The International Trade Blog Export Compliance

HS Codes, HTS Codes and Schedule B Codes: What's the Difference?

On: January 17, 2024 | By:  David Noah |

8 min. read

David Noah |

8 min. read

Do you know the difference between HS codes, HTS codes and Schedule B codes? In casual conversation, exporters tend to use these terms interchangeably; they, for the most part, understand that these are codes representing classifications of products.

Do you know the difference between HS codes, HTS codes and Schedule B codes? In casual conversation, exporters tend to use these terms interchangeably; they, for the most part, understand that these are codes representing classifications of products.

While it’s not wrong to use them interchangeably in casual conversation, it is important to understand the differences—if not, you could get into trouble, and your shipment could, too!

.png?width=800&name=HS%20Codes%2c%20HTS%20Codes%20and%20Schedule%20B%20Codes%20Whats%20the%20Difference%20(1).png)

Here are definitions of the terms and examples of use cases when it is appropriate to use each term:

Harmonized System (HS) Code

The Harmonized System classification is a six-digit standard, called a subheading, for classifying globally traded products. HS codes, also called HS numbers, are used by customs authorities around the world to identify the duty and tax rates for specific types of products. You can learn more about these codes in our comprehensive resource for all exporters—Classifying Your Products for International Trade.

- HS codes are administered by the World Customs Organization. HS codes are recognized in 98% of world trade.

- There are six digits in an HS code. You use an HS code because it is a universal classification tool. Many governments add additional digits to the HS number to further distinguish products in certain categories. These additional digits are typically different in every country.

- HS codes are used in most international export documentation and commercial invoices.

Use Case: You’ll use an HS number when you are referencing the classification with your customers, vendors and anyone outside of the U.S.

When you’re completing export documentation, any documents that are used internationally, such as the commercial invoice, should display the six-digit HS code instead of a longer code. If you use a 10-digit code, the numbers may not be accurate for the country of import.

Example: HS Codes

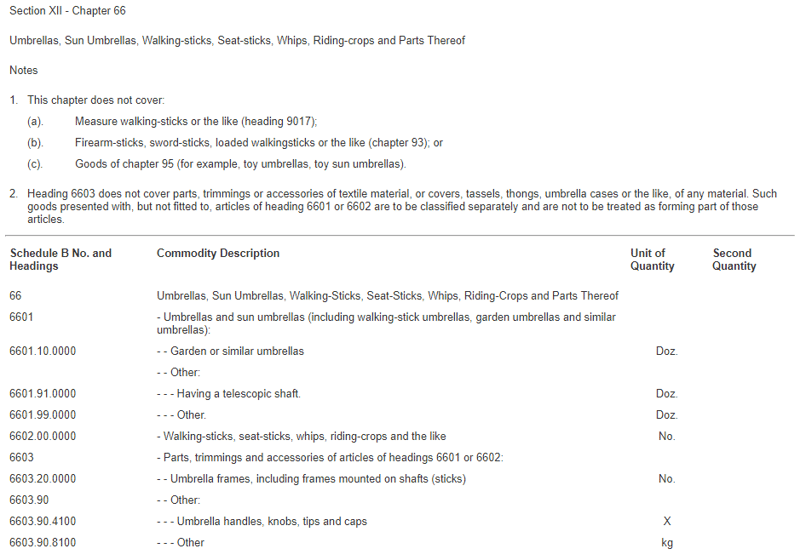

Chapter 66 of the Harmonized System includes the following products: "Umbrellas, sun umbrellas, walking-sticks, seat-sticks, whips, riding-crops and parts thereof." If your company is importing or exporting "umbrella frames, including frames mounted on shafts (sticks)," as defined by the World Customs Organization, the correct six-digit HS number is 6603.20. That is the number you would want to use on your international paperwork, because the last four digits of the 10-digit number may be different in every country.

Harmonized Tariff Schedule of the United States (HTSUS) Code

The Harmonized Tariff Schedule code is a 10-digit import classification system that is specific to the United States. HTS codes, also called HTS numbers, are administered by the U.S. International Trade Commission (ITC). It’s very important that all U.S. importers know and use the correct HTSUS codes because commodity duties are assessed based on this classification. An HTS code takes the same form as an HS code for the first six digits and then has four differing last digits.

Use Case: If you are a U.S. importer, this is the code you must use. The comprehensive classification list is available for free on the ITC website.

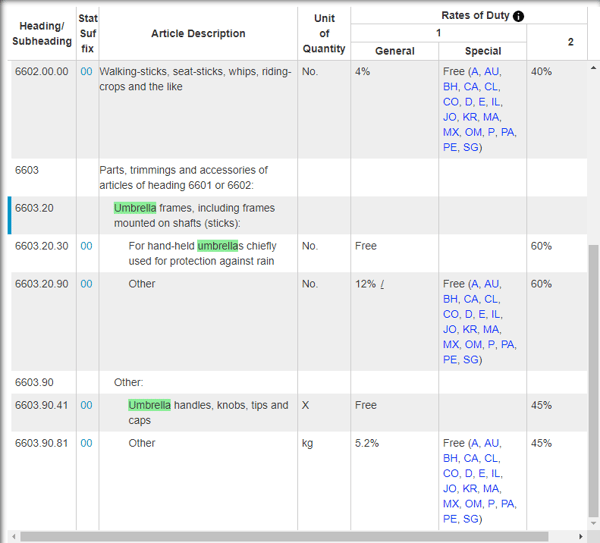

Example: HTS Codes

Let’s look again at the example for umbrella frames. According to the HTSUS, the correct classification "For hand-held umbrellas chiefly used for protection against rain" is 6603.20.3000 or 6603.20.9000 for all other umbrella frames. That designation is important. The umbrella frames with the first HTS code can enter the U.S. duty-free; the umbrella frames for the latter have a 12% general duty rate.

.webp?width=600&height=170&name=HTS%20Code%20for%20Umbrellas%20(1).webp)

Global and U.S. HS codes have four components, which are identified by the green numerals beneath the digits:

1. Chapter: In this example, 66 is the chapter.

2. Heading: In this example, 6603 is the heading. The heading dictates the specific category within any particular chapter.

3. Subheading: 6603.20 is the subheading. The last two digits of the international Harmonized Code are more specific, defining subcategories of products.

4. Extra digits: 6603.20.3000 is the suffix or extra digits. Countries can use an additional two to four digits for country-specific categorizations. For example, the United States relies on 10-digit codes called HTSUS numbers.

You can learn more about HTS codes in our two-part series, The Harmonized Tariff Schedule: General Rules of Interpretation Never Written (But Used Daily) and The Harmonized Tariff Schedule: Beyond the General Rules of Interpretation.

You can look up HTS codes here using the ITC's free search tool:

Why Is the Difference Important?

It’s important to understand the variations in HS numbers versus HTS and Schedule B codes because the four-digit difference could change the classification of your international export. For exports, you can’t simply use an HTS or Schedule B number in place of an HS number.

Consider the above example of umbrellas: Imagine you’re exporting parts for umbrellas. In the United States, they are identified by the HTS code 6603.20.3000. If you’re exporting these to Germany, and you complete the commercial invoice using all 10 digits of that code, the German importer’s paperwork will be rejected—in Germany, the correct number is 6603.20.0000.

As you can see, the first six digits (the HS numbers) are identical. The difference comes in the last four digits. Though the HS code subheading is the same, the HTUSUS for umbrellas is one digit different than the German code, making it incorrect.

Schedule B Code

The Schedule B code is a 10-digit subset of HTS codes for U.S. exporters. Schedule B codes are used for statistical purposes by the U.S. government to monitor U.S. exports.

- Schedule B codes are maintained by the U.S. Census Bureau instead of the ITC.

- As with HTS codes, the first six digits of a Schedule B code should be the same as an HS number; however, the last four digits may be different even than the HTS code.

Use Case: Companies that export will typically use the appropriate Schedule B codes for their products rather than HTS codes on their export paperwork and when filing their EEI through the Automated Export System (AES). Since the Schedule B codes are a subset of the HTS codes, it's usually quicker and easier to classify products under Schedule B than HTS.

Companies that are already classifying their products using the HTS codes for their imports may want to use HTS classification for all their products to eliminate the need to classify their products twice—once under HTS and once under Schedule B. That is perfectly acceptable, but do keep in mind that certain HTS codes can't be used for exporting.

Also, the reverse is not true. You cannot use Schedule B codes in place of HTS codes for import classifications.

Example: Schedule B Codes

You can look up Schedule B Codes here using the Census Bureau's search tool:

When Not to Use a Code

Some exporters prefer not to include an HS code on their commercial invoices. As a general rule, I think it's a good idea to include the proper code on the invoice, but I address some reasons why you might not in our article Why You Shouldn’t Include HS Numbers on a Commercial Invoice.

Changes to HS, HTS and Schedule B Codes

Like most things in life, the Harmonized System, Harmonized Tariff Schedule and Schedule B codes for your products can change. Every five years, the WCO reviews HS numbers to ensure they reflect changes and updates in technology and that they provide visibility into new product streams and emerging global issues. The seventh edition of the HS, called HS 2022, entered into force on January 1, 2022.

Since the HTS and Schedule B codes are based on the WCO's HS Codes, it's logical to assume that those codes are updated as well to reflect those changes. But that's not the only time those updates can occur. The U.S. International Trade Commission released 11 revisions to the HTSUS in 2023 and has published the 2024 Basic Edition. As you can see, you must regularly review the classifications for your products to ensure you're using the correct, current codes.

Why You Need to Understand These Terms

There are consequences if you misclassify your product. If you’re doing this wrong, you’re committing fraud—and you could face fines and other penalties. Fortunately, there are a ton of excellent resources available to exporters. Here are a few:

- Our Product Classification Trade Compliance Wizard, which can keep you on the right side of regulations by helping you properly classify all your products. You can give it a try for free!

- The U.S. Commercial Service office located near you. The Commercial Service is a great resource for companies that want to start or grow their exports. You'll find a directory of local offices on their website.

- The Trade Information Center, which you can contact at 1-800-USA-TRAD(E) (1-800-872-8723).

Like what you read? Subscribe today to the International Trade Blog to get the latest news and tips for exporters and importers delivered to your inbox.

This article was first published in November 2015 and has been updated to include current information, links and formatting.

About the Author: David Noah

David Noah is the founder and president of Shipping Solutions, a software company that develops and sells export documentation and compliance software targeted at U.S. companies that export. David is a frequent speaker on export documentation and compliance issues and has published several articles on the topic.