Free Download:

CARICOM Invoice

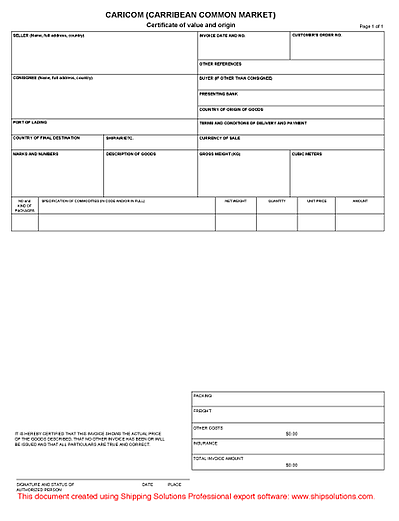

Download and print this PDF of the CARICOM Invoice form for use with your exports.

What is a CARICOM Invoice?

In the Caribbean region, a free trade zone called the Caribbean Common Market exists. This free trade zone essentially creates one common market for the 15 member states. Theoretically, all goods produced within the common market can move freely throughout the common market and should not be subject to any import duties, license restrictions, quotas or other barriers to entry.

With some exceptions, goods imported into the member countries from non-member countries are subject to import duties and other import restrictions. All exports to member countries from non-member countries must be accompanied by five copies of a properly completed CARICOM Invoice or a standard commercial invoice that includes all the data found on the CARICOM invoice. If the invoice is missing any of this information, the shipment may be delayed at customs.

The CARICOM member states include: Antigua and Barbuda; The Bahamas; Barbados; Belize; Dominica; Grenada; Guyana; Haiti; Jamaica; Montserrat; Saint Lucia; St. Kitts and Nevis; St. Vincent and the Grenadines; Suriname; and Trinidad and Tobago, as well as five associate member states: Anguilla; Bermuda; British Virgin Islands; Cayman Islands; and Turks and Caicos Islands.

Create Accurate Export Forms

Reduce the time it takes to complete the CARICOM Invoice by up to 80%. Shipping Solutions export documentation software makes it easy to create more than two dozen standard export forms. Register now for a free demo. There's absolutely no obligation.

CARICOM Invoice FAQs

-

What countries require a CARICOM invoice?

A CARICOM invoice should be included for these member states: Antigua and Barbuda; the Bahamas; Barbados; Belize; Dominica; Grenada; Guyana; Haiti; Jamaica; Montserrat; Saint Lucia; St. Kitts and Nevis; St. Vincent and the Grenadines; Suriname; and Trinidad and Tobago, as well as five associate member states: Anguilla; Bermuda; British Virgin Islands; Cayman Islands; and Turks and Caicos Islands.

-

What is the purpose of a CARICOM invoice?

The CARICOM invoice facilitates trade among Caribbean Common Market countries by providing a standardized document that contains essential information about the goods being traded. All exports to member countries from non-member countries must be accompanied by five copies of a properly completed CARICOM invoice or a standard commercial invoice including certain data elements.

-

What information should be included in a CARICOM invoice to ensure smooth customs clearance?

Download the template on this page to ensure you include all relevant information, including: the description of goods, quantity, value, country of origin, harmonized system (HS) code, packaging details and shipping terms.

Today is your lucky day. Shipping Solutions® makes completing export forms simple, accurate and five-times faster than the tedious way you’re doing it now.

Get it done easily.

Eliminate the hassle of manually completing your export forms. Our EZ Start Screen helps you automatically complete more than a dozen export forms.

Get it done fast.

With Shipping Solutions automation, you can complete your export documents up to five-times faster than your traditional manual process.

Get it done right.

Instead of entering the same information over and over again, you enter information in only one place. That makes you less likely to make costly mistakes.