The International Trade Blog Free Trade Agreements

How to Identify and Apply FTA Rules of Origin

On: February 19, 2024 | By:  Kari Crane |

5 min. read

Kari Crane |

5 min. read

By reducing tariffs, streamlining customs procedures and increasing market access, free trade agreements (FTAs) pave the way for businesses to grow and thrive abroad. Yet the majority of companies don’t take advantage of the benefits. The reason many point to is the complexity of understanding the rules of origin.

By reducing tariffs, streamlining customs procedures and increasing market access, free trade agreements (FTAs) pave the way for businesses to grow and thrive abroad. Yet the majority of companies don’t take advantage of the benefits. The reason many point to is the complexity of understanding the rules of origin.

This article is one in a series explaining the steps you need to take to determine if your goods qualify for preferential treatment under an FTA. Today we’ll help explain one of the topics that leaves trade professionals most confused: the rules of origin—what they are, where to find them and how to apply them to your product.

For a more in-depth look into the entire process of claiming preferential treatment under an FTA, you’ll want to download our free whitepaper, How to Qualify for a Free Trade Agreement.

What Are Rules of Origin?

According to the International Trade Administration, rules of origin (ROOs) are used to determine if products are eligible for duty-free or reduced duties under the FTA rules even though they may contain non-originating (non-FTA) components. If your product is wholly grown or manufactured and assembled primarily in one country, the rules for determining country or origin will be simple. However, if the finished product includes components that originate in many countries, determining origin can be more complex.

Rules of origin vary from agreement to agreement and from product to product.

Where to Find the Rules of Origin for U.S. Free Trade Agreements (FTAs)

To apply the rules of origin, first you need to know where to find them. You have several options:

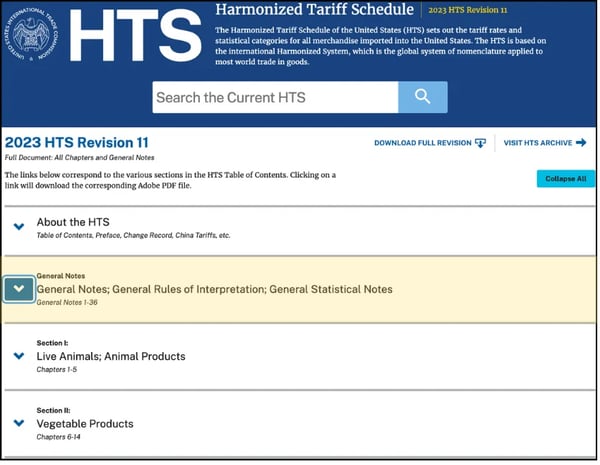

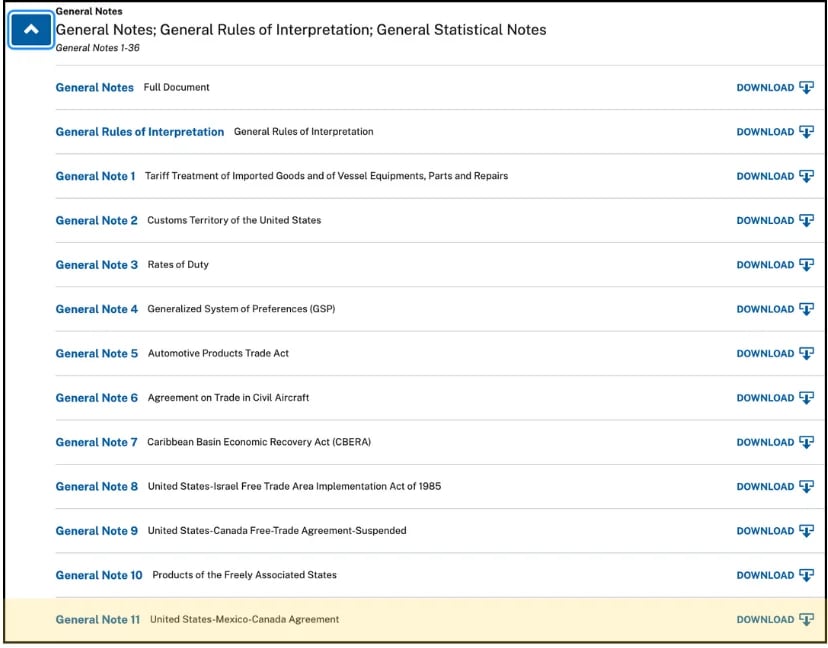

The U.S. Harmonized Tariff Schedule

Scroll down to the General Notes section of the HTS. Each U.S. FTA has a section of the general notes dedicated to it. For example, the United States-Mexico-Canada Agreement (USMCA) is General Note 11. Click download to get a PDF of the USMCA rules of origin.

Expand the General Notes section of the HTS.

Click the download button next to the FTA in which you’re interested.

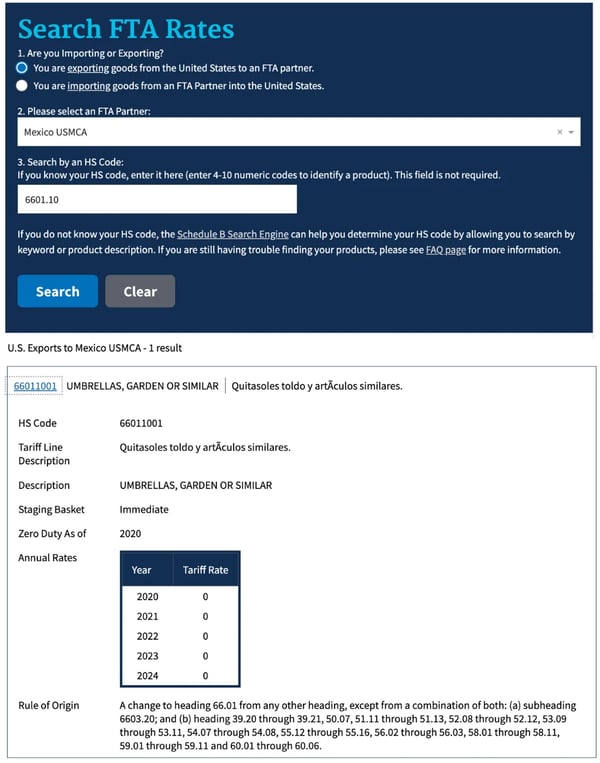

The International Trade Administration (ITA) FTA Tariff Tool

This tool allows you to search rules of origin and tariff data for U.S. FTAs by answering three questions:

- Are you importing or exporting the product?

- With which U.S. FTA partner are you trading?

- What is your product’s HS code?

Here is an example using the HS code for garden or similar umbrellas—6601.10—if you were exporting goods to Mexico using the USMCA:

Sample results using the FTA Tariff Tool.

Search results show the preferential tariff rate with the selected partner country, Mexico in this example, along with future tariff rates if they will be lower or eliminated in the future. The product-specific rule of origin is displayed under the tariff rate.

Other Resources

- Beyond the FTA Tariff Tool, the ITA has an FTA help center where you can find information and rules of origin for each U.S. agreement.

- The United States Trade Representative has the text of all U.S. trade agreements on their website.

How to Read and Apply Free Trade Agreement Rules of Origin

Rules of origin vary across the many U.S. FTAs, though many of the methods and formulas for qualification are repeated. There are typically three primary ways, laid out in the rules of origin, for goods to qualify:

- The goods are wholly obtained or produced in one of the FTA countries.

- The goods are made up of all components and materials that originated in one of the FTA countries.

- The goods meet other product-specific requirements, laid out in the FTA’s rules of origin. The tariff shift method and regional value content (RVC) method are commonly used here.

We will explain these three methods in more detail in an upcoming article and in our free guide, How to Qualify for a Free Trade Agreement (FTA).

Conclusion

Participation in FTAs is voluntary, and the decision to claim preferential treatment should only be made if you’re certain you can adhere to the rules of the FTA. In some cases, voluntary NON-participation might be the strategic choice—if, say, you can’t properly verify that your goods qualify or the costs of administering and training around FTAs become too expensive and burdensome. You’re never legally obligated to participate, so only do so if you can while fulfilling all of your compliance obligations. But for companies willing to invest the necessary effort and resources to navigate the complexities of FTAs, the benefits can be well worth the undertaking.

This is the second article in a series of four about qualifying for free trade agreements:

- Part 1: How to Determine Free Trade Agreement (FTA) Tariff Rates

- Part 3: How to Determine Free Trade Agreement (FTA) Qualification

To make sure you don't miss the others, subscribe to Passages: The International Trade Blog.

Like what you read? Join thousands of exporters and importers who subscribe to Passages: The International Trade Blog. You'll get the latest news and tips for exporters and importers delivered right to your inbox.

About the Author: Kari Crane

Kari Crane is the editor of Passages: The International Trade Blog. Kari joined Shipping Solutions after working as an editor, writer and designer at a major market newspaper in Texas. Kari has spent her career finding different ways to tell stories and make complex topics easy-to-understand, so she loves helping importers and exporters understand how to navigate the complex world of international trade.

.webp?width=763&height=852&name=CTA%20-%20How%20to%20Qualify%20for%20a%20Free%20Trade%20Agreement%20(FTA).webp)