The International Trade Blog Free Trade Agreements

How to Determine Free Trade Agreement (FTA) Tariff Rates

On: February 5, 2024 | By:  Kari Crane |

5 min. read

Kari Crane |

5 min. read

If your business is involved in international trade and looking for a competitive edge, you cannot ignore free trade agreements (FTAs). Understanding and leveraging FTAs can improve your bottom line and open up market access. This article is one in a series explaining the steps you need to take to determine if your goods qualify for preferential treatment under an FTA. Today we’ll look at how to determine the tariff rate for your goods by using the U.S. Harmonized Tariff Schedule. Tariff rates significantly impact the cost and competitiveness of goods and are one of the primary reasons to qualify your goods under an FTA.

If your business is involved in international trade and looking for a competitive edge, you cannot ignore free trade agreements (FTAs). Understanding and leveraging FTAs can improve your bottom line and open up market access. This article is one in a series explaining the steps you need to take to determine if your goods qualify for preferential treatment under an FTA. Today we’ll look at how to determine the tariff rate for your goods by using the U.S. Harmonized Tariff Schedule. Tariff rates significantly impact the cost and competitiveness of goods and are one of the primary reasons to qualify your goods under an FTA.

The following information is part of our complete whitepaper on the topic, How to Qualify for a Free Trade Agreement (FTA).

Properly Classify Your Product with the Correct HS Code

Accurate classification of your products under the Harmonized System (HS) is the first step to determining the tariff rate for your goods. Each product in international trade is assigned a unique HS code, which is used by customs authorities around the world to identify the duty and tax rates for specific types of products.

The HS classification is a six-digit standard, called a subheading. While these numbers are uniform across the globe, many governments add additional digits to the HS number to further distinguish products in certain categories. These additional digits are typically different in every country.

The HS classification is a six-digit standard, called a subheading. While these numbers are uniform across the globe, many governments add additional digits to the HS number to further distinguish products in certain categories. These additional digits are typically different in every country.

Different FTAs may have specific criteria for particular HS codes, making it imperative to accurately determine the code for your product. Incorrect classification can result in denied preferential treatment or, worse, legal repercussions.

The Easiest Way to Classify Your Products: The Shipping Solutions Product Classification Software

The Product Classification Software allows you to search for the proper HS number for your product in several ways that are faster and easier than searching manually through codes and regulations.

- You can search on a partial HS number, you can search on words or phrases that describe your product or you can look at the entire tree of HS codes and drill down to specific numbers.

- There is also an HS Mapping tool that allows you to enter the 10-digit HTS number for one country (like the United States) and find the corresponding 10-digit number for another country. Because the 10-digit classification numbers are usually different in every country, the HS Mapping tool may display more than one potential corresponding HS number in the second country. You can then choose the number that best fits your product.

- Along with displaying HTS numbers, the HS Classification Software displays the default duty rate for the product—an important step, which we’ll discuss more below, in determining if it’s worth using an FTA for your shipment.

Click here to try the Product Classification Software for free.

How to Find Free Trade Agreement (FTA) Tariff Rates

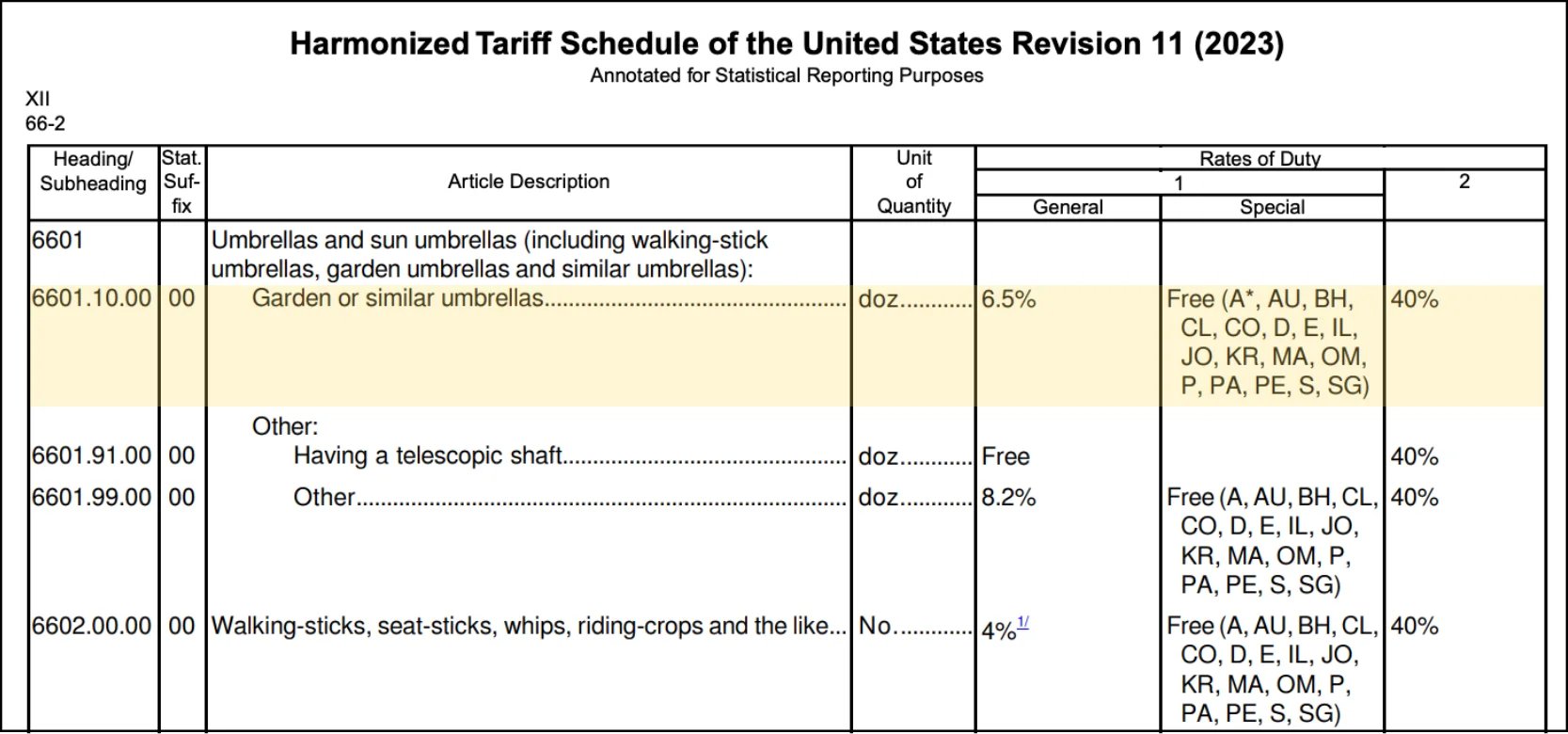

Once you’ve found the correct classification, you can determine the applicable tariff rate for your product under an FTA by using the U.S. Harmonized Tariff Schedule. Let’s look at an example for “garden or similar umbrellas:” 6601.10.0000. Here’s what the HTS shows us about those products:

Duty rates for trade with countries with which the U.S. has Normal Trade Relations (NTR) are listed in Column 1 under general. In this case, it would be 6.5% for garden umbrellas. Duty rates for countries not covered by NTR are listed in Column 2, a tariff rate of 40% in this case —significantly higher to discourage trade with certain countries. (At the time of publication, Cuba, North Korea, Russia and Belarus were Column 2 countries.) The duty rate for goods that qualify under an FTA is found in Column 1 under special. In this case, this product is duty-free for the agreements listed.

Using Landed Cost to Measure FTA Savings

Landed cost refers to the total cost of a product once it has been shipped and arrived at its destination, including the cost of the product itself, transportation fees, customs duties, taxes and any other charges incurred during the shipping process. It is a critical factor to consider when evaluating the costs and benefits of FTAs. You should calculate the landed cost of the product under the FTA versus the non-FTA scenario. This calculation can help companies understand the true cost savings of an FTA. Use the Shipping Solutions Landed Cost Calculator to accurately estimate this cost.

Understand the Rules to Receive FTA Benefits

In a globalized marketplace, FTAs are one important tool available to businesses looking to expand and stay competitive. The benefits—tariff elimination and increased market access, among others—can help propel companies to new heights. However, do remember that participation in FTAs is voluntary, and the decision to claim preferential treatment should only be made if you’re certain you can adhere to the rules of the FTA.

This is the first article in a series of four about qualifying for free trade agreements.

- Part 2: How to Identify and Apply FTA Rules of Origin

- Part 3: How to Determine Free Trade Agreement (FTA) Qualification

Like what you read? Join thousands of exporters and importers and subscribe to the International Trade Blog to get the latest news and tips delivered to your inbox.

About the Author: Kari Crane

Kari Crane is the editor of Passages: The International Trade Blog. Kari joined Shipping Solutions after working as an editor, writer and designer at a major market newspaper in Texas. Kari has spent her career finding different ways to tell stories and make complex topics easy-to-understand, so she loves helping importers and exporters understand how to navigate the complex world of international trade.

.webp?width=763&height=852&name=CTA%20-%20How%20to%20Qualify%20for%20a%20Free%20Trade%20Agreement%20(FTA).webp)