The International Trade Blog Export Compliance

Uyghur Forced Labor Prevention Act (UFLPA) Places the Burden on Importers

On: July 11, 2022 | By:  Leslie Glick |

4 min. read

Leslie Glick |

4 min. read

A new law was signed into law on Dec. 23, 2021, to supplement existing laws contained in Section 307 of the Tariff Act 1930, as amended (19 U.S.C. § 1307), which prohibit the importation of all “...goods, wares, articles, and merchandise mined, produced, or manufactured wholly or in part in any foreign country by convict labor or/and forced labor or/and indentured labor under penal sanctions.”

A new law was signed into law on Dec. 23, 2021, to supplement existing laws contained in Section 307 of the Tariff Act 1930, as amended (19 U.S.C. § 1307), which prohibit the importation of all “...goods, wares, articles, and merchandise mined, produced, or manufactured wholly or in part in any foreign country by convict labor or/and forced labor or/and indentured labor under penal sanctions.”

The new law—the Uyghur Forced Labor Prevention Act (UFLPA)—took effect on June 21 and is designed to reinforce United States prohibition of the importation of goods made with forced labor. On June 13, U.S. Customs and Border Protection (CBP) issued a guidance document, Uyghur Forced Labor Prevention Act: U.S. Customs and Border Protection Operational Guidance for Importers, to prepare importers to comply with this new law.

Of interest to the automotive industry is the fact that “the global auto industry could face its own disruptions given Xinjiang’s deep ties to raw materials needed for next-generation technology,” wrote The New York Times. Many of the products produced in the Xinjiang region are agricultural, but solar panels and materials for car batteries are also produced in the region and of wide interest.

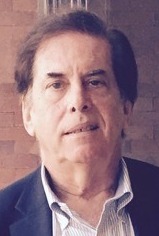

The new law is focused on claims that China is using the minority Muslim Uyghur population in the Xinjiang region for forced labor, including prison labor and indentured servants. China has denied allegations. This new initiative is part of the Biden administration’s efforts to expand enforcement of forced labor provisions that have already been in existence for many years. It is part of the Biden administration’s newly developed trade policy that future decisions would take into account non-trade related objectives linked to social agendas including human rights, enhancement of workers’ rights and participation, and benefits to minority communities. Now these broad policy guidelines are taking effect in the form of clear mandates that will impact the import community, with the UFLPA being only the most recent example.

The wording of the UFLPA has created concerns because CBP is required to apply a presumption that imports of all “goods, wares, articles, and merchandise mined, produced, or manufactured wholly or in part in the Xinjiang Uyghur Autonomous Region (Xinjiang) of the People’s Republic of China (PRC), or by entities identified by the U.S. government on the UFLPA Entity List, are presumed to be made with forced labor and are prohibited from entry into the United States. The presumption also applies to goods made in, or shipped through, the PRC and other countries that include inputs made in Xinjiang.”

The new operational guidance provided by CBP summarizes procedures involved in enforcing UFLPA. Much of it is consistent with already existing CBP regulations and procedures dealing with seizure and detention of goods. There is reference in the guidance to another document that importers must comply with. It states:

Importers must consult the Strategy to Prevent the Importation of Goods Mined, Produced, or Manufactured with Forced Labor in the People’s Republic of China (UFLPA Strategy), to be published by the Department of Homeland Security (DHS), in its role as the chair of the Forced Labor Enforcement Task Force (FLETF), on June 21, 2022, for specific importer guidance as required by the UFLPA. Section 2(d)(6) of the UFLPA requires the FLETF to develop guidance to importers on due diligence, supply chain tracing and management, and evidence to demonstrate goods were not mined, produced, or manufactured wholly or in part in the Xinjiang region of China or by forced labor. Importers must comply with the importer guidance in the UFLPA Strategy in order to be eligible for an exception to the rebuttable presumption.

Some in the trade community find this a disturbing approach to shift the burden to importers with a rebuttable presumption that they must overcome, and it could be a dangerous precedent. In most CBP investigations involving seizures and detentions, it is CBP that conducts its own investigation that leads to a seizure. CBP and related Homeland Security personnel have great resources and experience in this area with a CBP attaché in most embassies and foreign and U.S. personnel in many countries tracking shipments for possible illegality.

For example, there are numerous prosecutions each year for companies that export a product legally to countries like the United Arab Emirates or Turkey, and then it is illegally reshipped to sanctioned countries such as Iran or Sudan. With its huge international reach, it is clear that CBP, more so than an importer in Michigan, is in a better position to determine if a material produced in the Xinjiang region is using Uyghur workers who are not paid, and if those goods are being shipped to plants in other areas of China or other countries prior to exportation to the U.S. It is likely this approach will be subject to court challenges once importers start receiving seizure and detention notices.

Like what you read? Subscribe today to the International Trade Blog to get the latest news and tips for exporters and importers delivered to your inbox.

About the Author: Leslie Glick

Leslie Glick is a shareholder and co-chair of the International Trade and Customs Specialty Team in the Washington, D.C. office of the Michigan-based law firm of Butzel Long P.C. He has practiced in the international trade and customs law area for over 40 years and served as counsel to a Congressional subcommittee.

As an adjunct to his work in these areas he has developed subspecialties in various regulatory areas, particularly Food and Drug Administration regulation of imports and exports of foods, drugs, cosmetics, medical devices, and tobacco and cannabis products. He has also handled issues with the National Highway Transportation Safety Administration (NHTSA) of the Department of Transportation dealing with imports of automobiles and auto parts. Mr. Glick has been a frequent speaker at seminars sponsored by the National Association of Customs Brokers and Forwarders Association of America, Practicing Law Institute, and foreign chambers of commerce such as the CONFINDUSTRIA VICENZA in Italy.

He is a graduate of Cornell University and Cornell Law School and is conversant in Spanish.