The International Trade Blog Export Compliance

Who Is the FPPI and Why Are They Important?

On: September 23, 2024 | By:  David Noah |

4 min. read

David Noah |

4 min. read

.webp?width=560&height=315&name=1200%20x%20675%20hubspot%20Who%20Is%20the%20FPPI%20and%20Why%20Are%20They%20Important%20(1).webp) USPPI. FPPI. EEI. POA…

USPPI. FPPI. EEI. POA…

OMG.

All the acronyms we use in exporting can make you feel a little overwhelmed. If you’re a little unsure how the FPPI fits into this alphabet soup, you’re not alone. Here’s what you need to know about the Foreign Principal Party in Interest (FPPI) in plain English.

Setting the Scene

When most people talk about exporting, they use simple terms to define the various parties in the transaction. The exporter is the person or organization that is selling the goods to a foreign buyer. That foreign buyer is the ultimate consignee, the person who ultimately receives the goods. It all seems simple and straightforward.

But as we know, export transactions aren’t always that simple. What if the seller is sending the goods to an agent of the buyer who is located in the United States who will then forward it to the ultimate consignee? Who is the exporter? Who is the ultimate consignee?

The U.S. Foreign Trade Regulations (FTR) detail when electronic export information (EEI) must be filed through the Automated Export System (AES), and it outlines the specific responsibilities of each of the parties in that transaction. Because of that, the definition of each party needs to be precise.

The FTR defines a U.S. Principal Party in Interest (USPPI), which may or may not be the same entity as the U.S. person or organization selling the goods. (See my blog post explaining who is the USPPI.) And the FTR defines the FPPI, who is the foreign buyer of the goods and may be the ultimate consignee.

For purposes of this article, we are concerned about the responsibilities the FTR assigns an FPPI who requests to have their merchandise delivered by the U.S. seller to another location within the United States. This is called a routed export transaction, which you can learn more about in the article Standard vs. Routed Export Shipment: What's the Difference?

Who Is the FPPI?

Here’s the official definition outlined on the U.S. Census Bureau website:

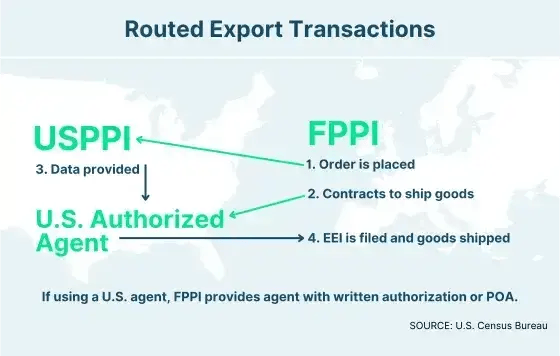

The FPPI is the party shown on the transportation document to whom final delivery or end-use of the goods will be made. This party may be the ultimate consignee. Generally, the FPPI is the foreign buyer of the goods that are purchased or obtained for export. In a routed export transaction, the FPPI is responsible for facilitating the movement of the cargo and authorizing a U.S. agent (freight forwarder) or the U.S. Principal Party in Interest to file the export information.

What Are the FPPI Responsibilities?

In a routed export transaction the FPPI is responsible for these things:

- The FPPI is responsible for controlling the movement of the goods out of the U.S.

- The FPPI is responsible for designating and hiring a forwarder (also known as a U.S. agent) to facilitate the movement of the cargo and file the AES.

- The FPPI is responsible for providing the power of attorney or written authorization to the forwarder or the USPPI in order to file through AES.

Meanwhile, it’s the responsibility of the USPPI to provide the buyer's forwarder with the necessary export information, including their EIN, in order to file through AES. The forwarder will supply the transportation information.

Why Is the FPPI Important?

In one word: compliance.

A routed export transaction requires that the person who files through AES resides in the U.S., which obviously excludes the FPPI. The FPPI must give their U.S. agent (typically their freight forwarder) or the USPPI authorization to prepare and file the EEI through AESDirect on their behalf.

In the Census Bureau’s Global Reach blog, they recommend that the USPPI request the POA to file through AES on behalf of the FPPI. I wholeheartedly agree. By filing through AES even in a routed export transaction, the USPPI can be assured that the EEI is filed accurately and reduce their risk.

Shipping Solutions export software makes filing through AES simple. With just a few clicks, you can quickly file through AES while also producing all the required export forms and staying compliant with U.S. export regulations.

Let us show you how. Sign up for a free online demo of the software.

Like what you read? Subscribe today to the International Trade Blog to get the latest news and tips for exporters and importers delivered to your inbox.

This article was first published in February 2015 and has been updated to include current information, links and formatting.

About the Author: David Noah

As president of Shipping Solutions, I've helped thousands of exporters more efficiently create accurate export documents and stay compliant with import-export regulations. Our Shipping Solutions software eliminates redundant data entry, which allows you to create your export paperwork up to five-times faster than using templates and reduces the chances of making the types of errors that could slow down your shipments and make it more difficult to get paid. I frequently write and speak on export documentation, regulations and compliance issues.