The International Trade Blog Import Procedures

What Is Country of Origin Labeling? An Overview

On: November 3, 2021 | By:  David Noah |

7 min. read

David Noah |

7 min. read

Country of origin is known as one of the last areas of definition under international trade, and it’s one that has no formal definition. (Even the World Trade Organization’s developed protocol has been interpreted differently.)

Country of origin is known as one of the last areas of definition under international trade, and it’s one that has no formal definition. (Even the World Trade Organization’s developed protocol has been interpreted differently.)

One subset of this incompletely defined area is marking and labeling. Despite the fact that 130 years have passed since the McKinley Tariff Act (also known as the Porcelain Marking Act), the way we label goods still isn’t standardized. In fact, we continue to legislate country of origin labeling today!

However, just because there’s no global standard doesn’t mean importers and exporters have license to act however they wish. Goods must always be properly labeled, and those that are not are considered non-conforming and out of compliance. Labeling is a regulatory imperative.

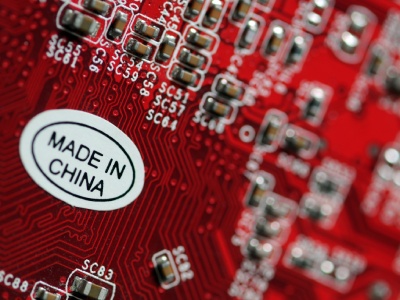

In addition, our global economy is making what was already a gray area even grayer: It’s becoming less and less clear what the country of origin for some goods actually is. Manufacturers are sourcing materials and components from around the world. It may be more difficult than you realize to determine the country of origin for customs purposes. In this article, we’ll look at the rules and requirements regarding country of origin labeling in the U.S., and how importers can make sure labeling is done correctly.

Country of Origin Labeling Requirements

Why is country of origin important?

In our article Importing Basics: Country of Origin, John Goodrich explains that duty rates, preferential trade agreements, trade sanctions and import quotas are regulated according to country of origin. Because of the revenue and admissibility issues involved, customs is vigilant about verifying country of origin. Furthermore, it is important for marking purposes. Import regulations put an emphasis on informing the end user of the country of origin of imported articles; not complying with these compliance regulations can lead to stiff fines and other penalties.

When is a country of origin label required?

According to U.S. Customs and Border Protection (CBP), every article of foreign origin entering the U.S. must be legibly marked with the English name of the country of origin, unless an exception from marking is provided in the law. The country of origin is defined as the country of manufacture, production or growth of an article. Colonies, possessions or protectorates outside the boundaries of the mother country may be considered separate countries.

Even the CBP website notes that this is general information—many complicated factors may be involved in origin issues (raw materials are from one country while the product is assembled in another), and certain products are subject to additional labeling requirements. For example, clothing must have labels indicating fabric content and washing instructions. Other products with special labeling requirements include tobacco (the Surgeon General’s Warning Statement), food and pharmaceuticals, and automobiles.

According to CBP, the rules of origin contained in 19 CFR Part 102 determine the country of origin for marking purposes of a good imported from Canada or Mexico in accordance with the requirements of 19 CFR Part 134. The product-specific rules of origin contained in GN 11(o) determine whether a good qualifies as originating under the USMCA. Except for certain agricultural goods, a good does not need to first qualify to be marked as a good of Canada or Mexico (as was the case in NAFTA) in order to receive preferential tariff treatment under USMCA. Therefore, section 19 CFR 102.19 (NAFTA preference override) provisions are no longer necessary and will not be applicable under the USMCA.

Exceptions to Country of Origin Labeling

According to the CBP, the following articles are excepted from marking by 19 U.S.C. 1304:

- An article that is incapable of being marked.

- An article that cannot be marked prior to shipment to the United States without injury to the article.

- An article that cannot be marked prior to shipment to the United States except at an economically prohibitive expense of its importation.

- When the container of an article reasonably indicates the article’s origin; that is, the marked container reaches the ultimate purchaser unopened.

- The article is a crude substance.

- The article is imported for use by the importer and is not intended for sale in its imported or any other form.

- The article is to be processed in the United States by the importer, or for his account, in such a manner that any marking would be permanently concealed, obliterated or destroyed.

- When the ultimate purchaser, by reason of the article’s character or by reason of the circumstances of its importation, necessarily must know, or in the case of a good from a NAFTA country, reasonably must know, the country of origin of such article even though it is not marked to indicate its origin.

- The article was produced more than 20 years prior to its importation into the United States.

- Articles of a class or kind (listed below) imported in substantial quantities for a five-year period immediately preceding Jan. 1, 1937, and which were not required to be marked.

Country of Origin Labeling FAQs

What is the purpose of marking?

To inform the ultimate purchaser in the United States of the country in which the imported article was made. The ultimate purchaser is generally the last person in the United States who will receive the article in the form in which it was imported.

Does altering the article in a second country change the country of origin?

The country of origin of an article may be changed in a secondary country if one of the following occurs:

- If the further work or material added to an article in the second country constitutes a substantial transformation. A substantial transformation occurs if a new article with a different name, character and use is created.

- For a good from a NAFTA country: If, under the NAFTA Marking Rules (19 CFR Part 102), the second country is determined to be the country of origin of the good.

- For an article considered to be a textile or apparel product (regardless of whether it is a good from a NAFTA country): If the country of origin is determined by the general rules set forth in 19 CFR Part 102.21 to be the second country. For purposes of determining whether a textile or apparel product is from Israel, the general rules in 19 CFR 12.130 apply.

What about USMCA? The USMCA does not contain country of origin marking rules. CBP continues to rely on the NAFTA rules of section 102 for goods of Canada or Mexico origin. They have updated the regulations but still refer to these as the NAFTA marking rules.

Is it necessary for the words “made in” or “product of” to precede the name of the country of origin?

The phrase “made in” is required only in the case where the name of any locality other than the country or locality in which the article was manufactured appears on the article or its container and may mislead or deceive the ultimate purchaser. The marking “made in (country)” or other words of similar meaning must appear in close proximity to, and in comparable size letters of, the other locality to avoid possible confusion.

Use of the words “assembled in” may be used to indicate the country of origin of an article where the country of origin of the article is the country in which the article was finally assembled. “Assembled in” may be followed by the statement “from components of (the name of the country or countries of origin of all the components).”

Where should the marking be located, and what size should it be?

The marking should be located in a conspicuous place. It need not be in the most conspicuous place, but it must be where it can be seen with a casual handling of the article. Markings must be in a position where they will not be covered or concealed by subsequent attachments or additions. The marking must be visible without disassembling the item or removing or changing the position of any parts.

The marking must be legible. This means it must be of an adequate size and clear enough to be read easily by a person of normal vision. The article should be marked as indelibly and permanently as the nature of the product will permit. Marking that will not remain on the article during handling or for any other reason except deliberate removal is not a proper marking.

Tips For Ensuring Proper Country of Origin Labeling

- Recognize that your products’ country of origin is just a matter of fact. If you are embarrassed, and don’t want to label with a certain country, then you need to reconsider where your goods are made or sourced.

- Get involved with your company’s marketing team from the beginning. The law is not specific about direct marketing, online or catalog marketing, but in practice, customs has said companies need to advertise if something is of foreign origin.

- Ensure your trade compliance team has full oversight of country of origin labeling from the beginning. If you have a product review process, trade compliance should be part of the process at every stage, not just for country of origin, but for Harmonized Code and other regulatory issues as well.

- Make sure you have a plan before, during and after import/export. If you’re called out for an issue with labeling, instead of exporting your goods, ship the goods to a bonded warehouse (if customs will allow you to) and fix the issue there.

- Seek customs broker advice and/or legal advice when in doubt. For compliance purposes, any time you look outside of your organization, you’re exercising reasonable care. This includes a consultant who’s a broker, a practicing broker or someone else in the trade.

- For labeling or duty purposes, you can submit to CBP for review.

Bottom line: There’s no excuse for not properly labeling/marking your items with country of origin. For additional help regarding marking of country of origin, contact the U.S. Customs and Border Protection Tariff Classification & Marking Branch, Office of Regulations and Rulings at (202) 325-0100.

Special thanks to John Goodrich of JD Goodrich & Associates for his assistance in this article.

Like what you read? Subscribe today to the International Trade Blog to get the latest news and tips for exporters and importers delivered to your inbox.

About the Author: David Noah

As president of Shipping Solutions, I've helped thousands of exporters more efficiently create accurate export documents and stay compliant with import-export regulations. Our Shipping Solutions software eliminates redundant data entry, which allows you to create your export paperwork up to five-times faster than using templates and reduces the chances of making the types of errors that could slow down your shipments and make it more difficult to get paid. I frequently write and speak on export documentation, regulations and compliance issues.