The International Trade Blog Export Compliance

Export Codes: ECCN vs. HS, HTS and Schedule B

On: March 18, 2024 | By:  David Noah |

11 min. read

David Noah |

11 min. read

As an exporter, you must be concerned with the proper classification of your goods and products.

As an exporter, you must be concerned with the proper classification of your goods and products.

Shipping Solutions has been helping exporters with their documentation for more than 25 years, and we continue to hear from many who are confused about the Export Control Classification Number (ECCN) classification for their product and the Harmonized System (HS), Harmonized Tariff Schedule (HTS) and Schedule B numbers for their products.

First, it’s critical to understand that these classification systems have different purposes.

The ECCN is for export control purposes.

It is used to determine whether or not an item requires special controls before export. You may need to apply for an export license or use a license exception before you can export certain products to other countries.

HS, HTS and Schedule B numbers allow customs to assess proper duty and taxes on imported goods or to collect export statistics.

- HS codes, also called HS numbers, are a six-digit classification system used by customs authorities around the world to identify the duty and tax rates for specific types of products. You’ll use an HS number when you reference the classification with your customers, vendors and anyone outside the United States. Many countries, including the United States, add additional digits to the HS number to further distinguish products in certain categories. These additional digits are typically different in every country.

- The Harmonized Tariff Schedule of the United States is the 10-digit import classification system specific to the United States. HTS codes, also called HTS numbers, are administered by the U.S. International Trade Commission (ITC). Commodity duties are assessed based on this classification. An HTS code takes the same form as an HS code for the first six digits, then has four differing last digits. If you are a U.S. importer, this is the code you must use.

- The Schedule B code is a 10-digit subset of HTS codes for U.S. exporters. Schedule B codes are used for statistical purposes by the U.S. government to monitor U.S. exports. Companies that export typically use the appropriate Schedule B codes for their products rather than HTS codes on their export paperwork, and when filing their electronic export information (EEI) through the Automated Export System (AES). Since the Schedule B codes are a subset of HTS codes, it's usually quicker and easier for exporters to classify products under Schedule B than HTS.

Because these three codes are often confused, we’ve written about them extensively. You can learn more about these codes in our comprehensive resource for all exporters, Export Procedures and Documentation: An In-Depth Guide, and in our article HS Codes, HTS Codes and Schedule B Codes: What's the Difference?

Determining Jurisdiction of Your Export Products

There are multiple U.S. agencies that regulate exporting, and different agencies' regulations apply to different products. That means that the first step for classifying your goods for export control purposes is determining who has jurisdiction over your goods.

While most items are controlled by the U.S. Department of Commerce under the Export Administration Regulations (EAR), your items may not be, especially if they have a direct military application. In that case, they may fall under the jurisdiction of the State Department's Directorate of Defense Trade Controls (DDTC). You can learn more about this in our article USML vs. ECCN: What's the Difference?

In this article, we are going to talk specifically about products that are controlled by the Commerce Department and the EAR.

Export Control Classification Numbers

The Bureau of Industry and Security (BIS) is the agency within the Commerce Department whose primary mission is to protect the security of the United States and promote its continued strategic technology leadership with effective export controls and treaty compliance. BIS sums it up nicely:

If you ship a commercial item from the United States to a foreign destination, your transaction is likely to be subject to the jurisdiction of the U.S. Department of Commerce. The BIS within the U.S. Department of Commerce has jurisdiction over the export and reexport of “dual-use” items (i.e., commodities, technology and software that have both civilian and military or proliferation applications).

These controls are implemented through the EAR. If your item is subject to the jurisdiction of the U.S. Department of Commerce, you should first determine if your item is designated by an ECCN on the Commerce Control List (CCL). The ECCN is a key factor in determining whether you need a license to export dual-use items outside of the U.S.

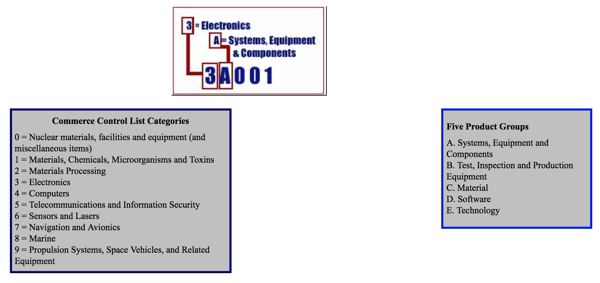

BIS defines an ECCN as a five-digit alphanumeric designation (i.e., 1A984 or 4A001) used in the CCL to identify items for export control purposes. An ECCN categorizes items based on the nature of the product, i.e., the type of commodity, technology or software and its respective technical parameters.

Determining the Correct ECCN Classification for Your Product

Finding the correct ECCN classification for your products can be challenging, especially if you don’t have a strong understanding of the technical specifications of the items. In addition, not all items have an ECCN. However, the only way to make that determination is to rule out any potential matches within the CCL.

Just because it may be difficult doesn’t mean you should avoid the responsibility. Since the ECCN is the key factor in determining whether your product needs an export license, finding the correct classification is an important part of complying with the law and avoiding penalties.

There are three ways to classify your products for export controls: you can self-classify your products, submit a SNAP-R request for a Commodity Classification (CCATS) ruling or rely on the product vendor.

1. Self-Classify Your Products

Self-classification is exactly what it sounds like: you are solely responsible for determining your product’s classification. This requires a technical understanding of your item and familiarity with the structure and format of the CCL. All ECCNs are listed in the CCL.

- The CCL is divided into 10 categories, each represented by the first digit of the ECCN.

- Each of the 10 categories is divided into five product groups, represented by the second digit of the ECCN.

- The first character of the ECCN identifies the broader category to which it belongs, and the second character identifies the product group (see example and boxes below).

- Once the appropriate category and product group are identified, match the particular characteristics and functions of your item to one of the specific ECCNs that follow.

You can also use the Commerce Control List Index to navigate the CCL.

- Begin by searching for your item on the CCL Index.

- When you find a potential ECCN, read through the ECCN entry on the CCL before determining if your item fits into the parameters of that ECCN.

- If the ECCN contains a list under the Items heading, broken down into subparagraph(s), read through these subparagraph(s) to determine that your item meets the technical specifications listed in the ECCN category.

- You may need to review more than one ECCN description before you find the correct ECCN entry.

Visit the BIS web page, About Export Administration Regulations (EAR), for an explanation of the BIS export licensing process. To simplify this process, you can use Shipping Solutions’ Product Classification Software. It allows you to search for the correct ECCN number for your product by entering either the first part of the ECCN number or a text description of your product.

2. Request an Official Classification from BIS

Your second option is to submit a commodity classification request online through the Simplified Network Application Process - Redesign (SNAP-R). You will need a Company Identification Number (CIN) before accessing the online SNAP-R system. For help applying for and answering questions about a CIN, visit the BIS’s SNAP-R video page.

3. Rely on the Product Vendor

The third way to classify your products for export controls is to go to the source. You can contact the manufacturer, producer or developer of the item you are exporting to see if they have classified their product and can provide you with the ECCN.

If they have exported the item in the past, it is likely they have the ECCN. However, it’s your responsibility to review the ECCN and make sure it’s up-to-date and correct. Make sure you’re in agreement with the vendor, because it will ultimately be your responsibility, not theirs.

Next Steps

Once the ECCN has been identified, you can determine the reasons for control of the item, which transactions may require an export license based on the country of destination, and which license exceptions, if any, may apply. Download the free How to Determine If You Need an Export License white paper for a detailed explanation of how to make these determinations.

If You Still Can’t Find Your Item on the CCL

If you’ve reviewed the CCL and are convinced your item doesn’t fit into the parameters of any ECCN classification, it doesn’t mean you’re off the hook for export control. End use and end user are other reasons controls exist; you may have an item that is designated as EAR99. (That is, of course, if it is also not controlled by another agency.)

If so, your item may be exported using the license exception NLR (no license is required) if all of the following criteria is met:

- The item is not being shipped to a sanctioned destination.

- The item is not being shipped to a denied person, sanctioned entity or prohibited end user.

- The item will not be used for a specific end use, subject to higher controls.

To find out more about these types of export restrictions, check out this free white paper: What You Need to Know about Export Compliance.

Additional Resources for Identifying the Correct Classifications

Every export item has an HTS/Schedule B code, but not every item has an ECCN. It’s important to check if your item has both. Shipping Solutions Product Classification Software can help. Enter a brief description of your product into the software, and then it will display potential matches along with notes about each option.

BIS conducts an excellent two-day seminar, Complying with U.S. Export Controls, that explains the export control requirements in more detail and walks you through the process of determining the correct ECCN classifications for your products. You'll find a complete list of seminar dates and locations on the BIS website.

Export Codes: Frequently Asked Questions (FAQs)

-

What are export codes?

Export codes are a set of identifiers used to classify goods for international trade. Different codes serve different purposes, aiding in export controls, customs duties and trade statistics.

-

What is an ECCN (Export Control Classification Number)?

An ECCN is used to determine whether an item requires export control, meaning special permission might be needed before it can be shipped to certain countries. ECCNs are listed in the Commerce Control List (CCL) and classify items based on their potential national security concerns.

-

What is the difference between ECCN and HS/HTS/Schedule B?

- ECCN: Used for export control. Focuses on security concerns.

- Harmonized System (HS) code: A global system for classifying goods with a 6-digit code. Used as a base for other classification systems.

- Harmonized Tariff Schedule (HTS ): The U.S.-specific version of the HS code. Adds four additional digits to the HS code for further detail, used to determine import duties.

- Schedule B: A U.S.-specific system based on the HTS code, but using only the first six digits. Used for collecting export statistics by the U.S. government.

-

Which export code do I need to use?

It depends on your specific purpose:

- Export control: Check the CCL using the ECCN to determine export restrictions.

- Import duties: Use the HTS code for customs clearance.

- Export statistics: Use the Schedule B code on export paperwork and filings.

Learn more about which code is best for you to use in HS Codes, HTS Codes and Schedule B Codes: What's the Difference?.

-

Where can I find export codes?

- ECCN: Search the Commerce Control List (CCL)—https://www.bis.doc.gov/

- HS/HTS: Search the U.S. International Trade Commission's Harmonized Tariff Schedule (HTS)—https://www.usitc.gov/

- Schedule B: Search the Schedule B Search Engine—https://www.census.gov/scheduleb

-

I'm unsure what export code my product falls under. What should I do?

Use our Product Classification Wizard or consult with a trade professional or freight forwarder experienced in classification.

-

Do export codes ever change?

Yes, export codes can change periodically due to various factors, such as updates to national security regulations, changes in product technology or international trade agreements. It's crucial to stay updated with the latest information to ensure accurate classification and compliance.

-

Can I use the same export code for different countries?

No, export control regulations can vary significantly between countries. An ECCN might allow unrestricted export to one country but require a license for another. It's vital to verify regulations for each destination country before exporting.

-

Are there any penalties for using the wrong export code?

Using an incorrect code can lead to serious consequences, including:

- Delays or seizure of your shipment

- Fines and penalties

- Denial of future export privileges

- Potential legal ramifications

-

Do I need a separate code for each product variation I export?

Generally, no. If product variations share the same core functionality and material composition, they might fall under the same code, even with slight differences in size, color or additional features. However, if the variations significantly alter the product's potential use or raise specific security concerns, separate codes might be necessary.

-

Is there a difference between export controls and customs duties?

Yes, export controls and customs duties serve distinct purposes:

- Export controls: Focus on national security and preventing the proliferation of sensitive technologies or goods. They might involve licensing requirements or restrictions on specific destinations based on potential misuse concerns.

- Customs duties: Are taxes levied on imported goods by the destination country. The amount of duty depends on the specific product and the importing country's tariff schedule.

Like what you read? Subscribe today to the International Trade Blog to get the latest news and tips for exporters and importers delivered to your inbox.

This post was originally published in July 2018 and has been updated to include current information, links and formatting.

About the Author: David Noah

As president of Shipping Solutions, I've helped thousands of exporters more efficiently create accurate export documents and stay compliant with import-export regulations. Our Shipping Solutions software eliminates redundant data entry, which allows you to create your export paperwork up to five-times faster than using templates and reduces the chances of making the types of errors that could slow down your shipments and make it more difficult to get paid. I frequently write and speak on export documentation, regulations and compliance issues.