The International Trade Blog Import Procedures

Exporters May Be Eligible for Import Tax Refunds

On: May 31, 2023 | By:  David Noah |

4 min. read

David Noah |

4 min. read

If you’re exporting to another country, there’s always a cost. In addition to paying fees for customs duties, you may also be paying Value Added Tax (VAT) if you’re selling goods to a country with a VAT regime. What many U.S. exporters don’t know is that they may be able to get some of this VAT refunded. In this article, we’ll look at where VATs exist and how to recover these costs.

If you’re exporting to another country, there’s always a cost. In addition to paying fees for customs duties, you may also be paying Value Added Tax (VAT) if you’re selling goods to a country with a VAT regime. What many U.S. exporters don’t know is that they may be able to get some of this VAT refunded. In this article, we’ll look at where VATs exist and how to recover these costs.

Movement of Goods and Import Taxes

When U.S. companies move goods throughout the world, they face customs when crossing borders. At this point, documentation is audited for compliance, the packing list is checked and goods may be reviewed. This is also when fees are assessed. Typically, these fees fall into two categories:

Customs Duties

A customs duty is a tariff or tax imposed on goods that are transported across international borders. The purpose of customs duties is to protect each country's economy, residents, jobs and environment by controlling the flow of goods, especially restricted and prohibited goods, into and out of the country.

“Dutiable” refers to articles on which customs duty may have to be paid. Each article has a specific duty rate, which is determined by a number of factors, including where you acquired the article, where it was made and what it is made of. Also, anything you bring back into the United States that you did not have when you left must be "declared."

The customs duty rate is a percentage. This percentage is determined by the total purchase value of the article(s) paid in a foreign country; it is not based on factors such as quality, size or weight. The Harmonized Tariff Schedule (HTS) provides duty rates for virtually every existing item.

- U.S. Customs & Border Protection uses the Harmonized Tariff Schedule of the United States Annotated (HTSUS), which is a reference manual that provides the applicable tariff rates and statistical categories for all merchandise imported into the U.S.

- The European Union has a unified duty rate for products; referred to as TARIC (Tarif Intégré de la Communauté), it's used to identify the various rules that apply to specific products being imported into the customs territory of the EU.

- Other countries’ customs duties can be found online through a variety of resources, including the Shipping Solutions Product Classification Software.

Value Added Tax (VAT)

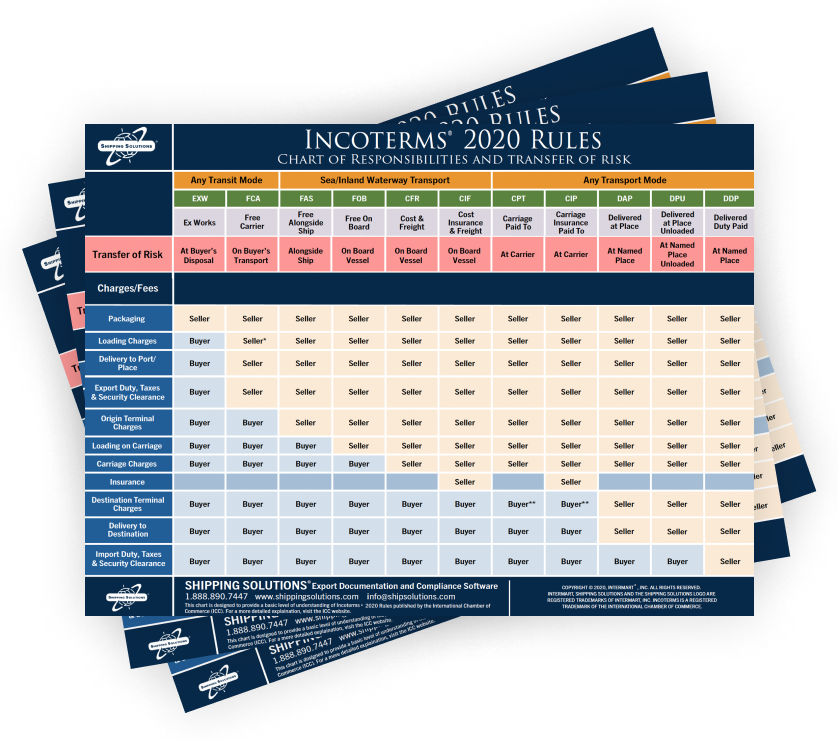

If a company ships goods internationally, typically using the Incoterms 2020 Rule Delivered Duty Paid (DDP), the seller bears all costs in the destination country. As a result, a significant foreign tax charge known as import VAT is charged. The cost of import VAT depends on the product, as different countries have different “VATable” items.

Import VAT leakage is common for exporting companies when the logistics department handles the shipping invoices instead of the finance department. Consequently, the import VAT goes unnoticed and, often, companies do not recover the money they are eligible to reclaim.

Typically, exporters see customs duties and VAT lumped together as one carriage cost. This makes it difficult to distinguish between customs duties, which are not recoverable, and VAT, which is recoverable.

Where do VATs exist?

Import VAT refunds are available only where a VAT regime exists. More than 140 countries worldwide—including all European countries—levy a VAT on goods and services.

Who Is Eligible for an Import Tax Refund?

Specific criteria need to be met to reclaim VAT. This includes:

- Legislative requirements (whether or not the country you’re exporting to wants to pay back taxes).

- Operational requirements for your company, including accurate documentation and compliance. Specifically, the Incoterm used for your exports affects whether or not the shipment is eligible for a refund. If your company is importing items into a foreign country at your own cost and for your own use (DDP shipments), you can claim back the import VAT.

Using Incoterms Other than Ex Works for Your Benefit

While the inclination of most U.S. exporters is to use the Incoterms 2020 rule Ex Works (EXW), this is not always the best tactic, especially if you are attempting to recover VAT. While using another Incoterm may seem at first to be an obstacle, it can be a good strategy and save you money in multiple ways. In addition to being able to reclaim VAT, you may also be able to better control the international transport of your goods and even reduce your shipping rates.

Attempting to navigate the import tax refund process can be confusing and frustrating for many U.S. exporters. However, you risk leaving tons of money on the table by sticking only with EXW. There are a number of companies, including VAT IT, who we spoke to for this article, that work with exporters to review their exports, determine if they may be eligible to reclaim VAT payments and implement a strategy to do so.

Like what you read? Join thousands of exporters and importers who subscribe to Passages: The International Trade Blog. You'll get the latest news and tips for exporters and importers delivered right to your inbox.

About the Author: David Noah

As president of Shipping Solutions, I've helped thousands of exporters more efficiently create accurate export documents and stay compliant with import-export regulations. Our Shipping Solutions software eliminates redundant data entry, which allows you to create your export paperwork up to five-times faster than using templates and reduces the chances of making the types of errors that could slow down your shipments and make it more difficult to get paid. I frequently write and speak on export documentation, regulations and compliance issues.