The International Trade Blog Import Procedures

HS Codes 2022: What Every Exporter Needs to Know

On: January 5, 2022 | By:  David Noah |

5 min. read

David Noah |

5 min. read

As new products come on the market and existing products change, the harmonized system numbers used to classify them need to be updated. To make these changes, the World Customs Organization (WCO) undertakes a formal process.

As new products come on the market and existing products change, the harmonized system numbers used to classify them need to be updated. To make these changes, the World Customs Organization (WCO) undertakes a formal process.

On Jan. 1, 2022, a new version of HS numbers, called HS 2022, went into effect. In this article, we’ll discuss the changes to HS classification and how exporters can stay up-to-date when classifying products.

Changing HS Numbers: A Background

Every five years, the World Customs Organization, the governing body of customs administrations representing more than 180 countries, reviews the Harmonized Commodity Description and Coding System, also known as the Harmonized System (HS). HS codes are the foundation of tariffs for more than 200 economies and countries worldwide.

The WCO reviews HS numbers to ensure they reflect changes and updates in technology and that they provide visibility into new product streams and emerging global issues. The seventh edition of the HS, called HS 2022, entered into force on Jan. 1, 2022. HS 2022 is the result of a review cycle that began in 2017 and concluded on June 28, 2019. During the cycle, the WCO adopted 351 sets of amendments relating to a wide variety of products and product groups.

HS Code Changes in 2022

According to the World Customs Organization, HS 2022 makes major changes to the Harmonized System, with the 351 sets of amendments covering a wide range of goods moving across borders. The primary focus of the HS 2022 amendments is to adapt to current trade by recognizing new product streams and addressing environmental and social issues of global concern.

Highlights of the changes include the following:

- New product streams (drones, tobacco products)

- Technological advances (glass fiber, metal forming machines)

- Health and safety (diagnostic kits, placebos, clinical trials)

- Human security (toxins, lab equipment)

- Protection of society (radioactive materials, detonators)

How to Review and Update Your Harmonized Tariff Schedule or Schedule B Numbers

HS numbers are the same in every country, so exporters should include the six-digit HS code on any export documents that are used by both the exporter and the importer. That typically includes the proforma and commercial invoices and certificates of origin.

Harmonized Tariff Schedule (HTS) and Schedule B codes take the same form as HS codes for the first six digits and include four additional digits for a total of 10 numbers. These additional numbers help further identify and classify products.

- The HTS code is a 10-digit classification system that is specific to the United States and exclusively for imports.

- The Schedule B Code is a 10-digit classification system that is specific to the United States and exclusively for exports.

So when an HS code changes, the U.S.-specific components of the HTS and Schedule B codes also change. Using an old HTS or Schedule B code is introducing incorrect information into your documentation.

On December 28, 2021, the White House published a Presidential Proclamation in the Federal Register implementing the 2022 HS changes into the Harmonized Tariff Schedule of the United States. Those changes went into effect on January 27, 2022.

As part of your company’s year-end checklist as well as your Export Compliance Program (ECP), you should take the opportunity to review your products and classification numbers to see if they are subject to any newly announced changes. It's very important you revied your product classification numbers this year (thanks to the substantial changes in HS 2022), but this practice is one you should do every year. Some years, none of your product codes will change; other years, one or more codes will be different.

It usually works best if you put together a team to select and update your product classification codes. This team might include your international legal counsel, international customer service and an in-house product engineer or technical expert on your team. And don't forget to keep your freight forwarders in the loop whenever you make changes!

Updated HTS Numbers

You'll find the current list of HTS numbers at the U.S. International Trade Commission (ITC) website, which includes a helpful tool for searching the list. Keep in mind that you cannot use certain HTS codes for filing your electronic export information through the Automated Export System (AES). The Census Bureau publishes a list of these numbers.

Updated Schedule B Codes

The U.S. Census Bureau publishes the Schedule B codes and has made those numbers available on its website. You'll also find a list of current Schedule B codes here. Census includes a list of obsolete Schedule B codes at the bottom of the web page.

In addition to HTS and Schedule B changes inspired by these HS changes, the International Trade Commission (ITC) and Census Bureau typically publish annual editions of the codes at the beginning of every year, as well as supplements or revisions as required throughout the year.

Why You Need to Understand Product Classification

If you’re misclassifying your products, you may be committing fraud, and you could face fines and other penalties. Fortunately, there are plenty of excellent classification resources available to exporters to help you avoid that fate.

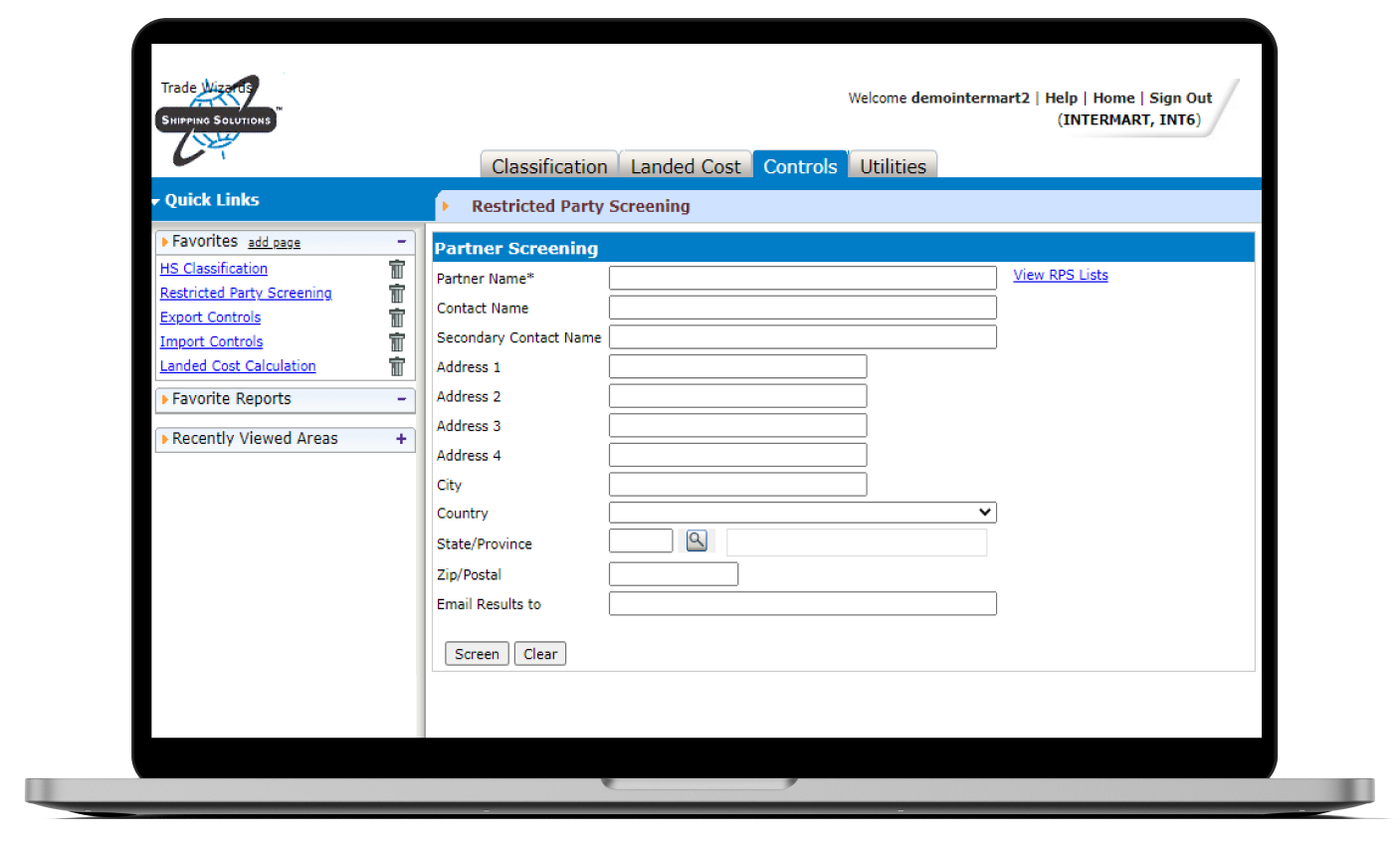

In addition to the Schedule B and HTS search tools above, Shipping Solutions Product Classification Software includes a more sophisticated search tool to find HTS and Schedule B codes for the United States, as well as HS codes for most every country in the world. It also includes an HS mapping tool that lets you enter the 10-digit code for one country and find the corresponding code for another.

The Product Classification Software also helps you search for the Export Commodity Control Number (ECCN) or United States Munitions List category to determine if any export controls may apply that require an export license. Click here to learn more and to register for a free trial subscription of the Product Classification Software.

Regardless of the tool you’re using, if you have difficulties determining the correct classification of your goods, contact the Trade Information Center at 1-800-USA-TRAD[E] (1-800-872-8723) or contact your local Export Assistance Center, which offers a variety of great trade resources for U.S. exporters.

Like what you read? Subscribe today to the International Trade Blog to get the latest news and tips for exporters and importers delivered to your inbox.

About the Author: David Noah

As president of Shipping Solutions, I've helped thousands of exporters more efficiently create accurate export documents and stay compliant with import-export regulations. Our Shipping Solutions software eliminates redundant data entry, which allows you to create your export paperwork up to five-times faster than using templates and reduces the chances of making the types of errors that could slow down your shipments and make it more difficult to get paid. I frequently write and speak on export documentation, regulations and compliance issues.