The International Trade Blog Export Compliance

Why You Shouldn't Include HS Numbers on a Commercial Invoice

On: March 14, 2018 | By:  David Noah |

5 min. read

David Noah |

5 min. read

A commenter left this note on one of our recent articles, 10 Items That Belong on Your Commercial Invoices:

A commenter left this note on one of our recent articles, 10 Items That Belong on Your Commercial Invoices:

“Nice overview of elements of a commercial invoice. I was glad to see the interesting note on the whether or not to include HS numbers. This is coming up more and more with clients.”

Her comment gave me a thought: As a rule, I encourage exporters to include Harmonized System (HS) numbers on their commercial invoices.

Correctly applied, HS numbers can help ensure your exports make it through customs without delay and get delivered to their final destinations, which can help you get paid faster. However, as the reader noted, while most businesses consider it a best practice to include HS numbers on their commercial invoices, there are certain situations where including a HS number could actually backfire.

I've come up with two reasons why you might not want to include HS numbers on your invoices:

1. Your Importer Asks You to Use a 10-Digit Code

While your customers may ask you to specify a 10-digit HS number on the commercial invoice, the 10-digit number you use for U.S. export purposes may be different than the 10-digit number they need to use in their country for their import purposes. Why are they different?

The first six digits of the HS are called the international level and are uniform for all countries that agree to the Harmonized System. Individual countries have the authority to add to the HS system to create 10-digit codes based on their individual taxes and needs. (Some countries use eight-digit codes; others use 12-digit codes. For the sake of our example, we’ll assume a 10-digit code.) Any digits beyond those six are country specific and could be different for every country.

Check out my blog post, What's the Difference between HS Codes & HTS Codes?, for a more detailed explanation.

Let's say, for example, that I export parts for umbrellas. In the United States, they are identified by the HS number 6603.20.3000. If I’m exporting these to Germany, and I complete the commercial invoice using all 10 digits of that code, the German importer’s paperwork will be rejected—in Germany, the correct number is 6603.20.0000.

Let’s break this down further.

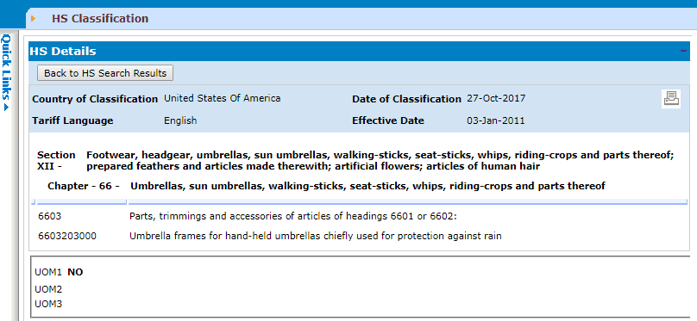

As you can see below, the 6603.20.3000 HS number in the U.S. is for parts, trimmings and accessories made for hand-held umbrellas chiefly used for protection against rain. The Shipping Solutions Product Classification Software shows the complete listing for this item including the Section XII description, Chapter 66 description, and the individual number description:

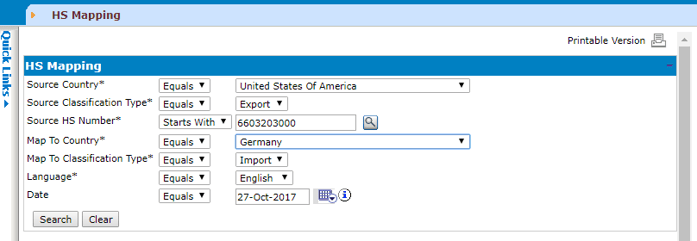

It also allows me to map the U.S. HS number against the HS database for any other country such as Germany. Here’s what the data input screen looks like:

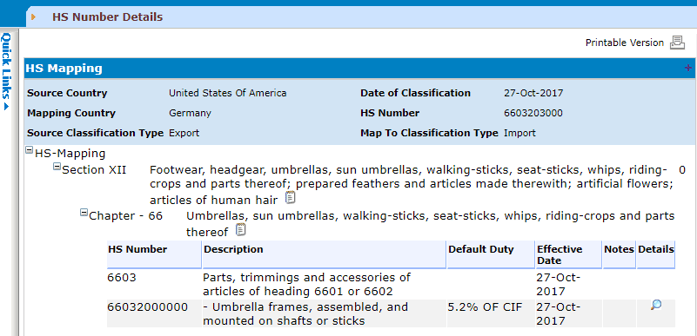

And here are the results I get, in this case, for Germany:

As you can see, the correct HS number for importing this product into Germany is 6603.20.0000.

While this umbrella frame simply has one choice, many products are complicated. In those cases, the Product Classification Software will give you multiple options to choose from since other countries’ customs agencies will use slightly different descriptions of the products. With a few clicks, the product classification tool can take the headache out of the confusing rules of trade compliance.

2. Your Importer Asks You to Use a Code You're Unsure Of

Finding an appropriate HS Number for your products is not always easy. As you review the Schedule B or Harmonized Tariff Schedule codes of the U.S., you'll sometimes find that more than one number is a potential match for one of your products. In addition to referring to the Section and Chapter and Classification notes, you may need to refer to Customs rulings related to your products or, if you're still unsure, ask Customs for a binding ruling. (Check out John Goodrich's great article on best practices for determining product classifications.)

Because classification isn't always easy, the process may result in some disagreement between you and your customer. They may have some very valid reasons why they think you should use a different HS number than the one you are using. Or they may simply want you to use a number that will provide a lower duty rate. If you know—or believe—an HS number is incorrect and proceed to use it anyway, you’re committing fraud. Ultimately, it is your responsibility to use the correct code no matter the circumstance.

Not including an HS number on your export invoice allows you to avoid this conflict. However, this doesn’t mean you can leave it off all your export paperwork. For example, you need to provide a 10-digit Schedule B or HTS code for your products in order to file your electronic export information (EEI) through the Automated Export System (AES). If you’re relying on a third party like your freight forwarder to file through AES, you must make sure you provide correct information on your Shipper’s Letter of Instruction so they can file correctly.

Using the Correct HS Number

As I mentioned earlier, it’s difficult to overstate the importance of HS numbers. Using the incorrect code could mean:

- The product will be classified incorrectly.

- The exporter’s certificate of origin will be prepared incorrectly.

- The goods will be entered into another country under an incorrect classification number.

- Border customs may dispute the number.

- Import clearance delays may occur.

- The buyer may incur additional costs.

- The importing country may begin an investigation.

- Goods may be denied preferential duty treatment.

- Penalty action may be taken.

Fortunately, software programs like Shipping Solutions automate the process of creating your export paperwork and use best practices when printing HS numbers and other important export data on the various export forms. Shipping Solutions knows which forms need six digits, which need 10, and which documents don't need any HS numbers at all.

Now you tell me. Are there any other situations when exporters shouldn’t include HS numbers on a commercial invoice?

This article was first published in November 2014 and has been updated to include current information, links and formatting.

About the Author: David Noah

As president of Shipping Solutions, I've helped thousands of exporters more efficiently create accurate export documents and stay compliant with import-export regulations. Our Shipping Solutions software eliminates redundant data entry, which allows you to create your export paperwork up to five-times faster than using templates and reduces the chances of making the types of errors that could slow down your shipments and make it more difficult to get paid. I frequently write and speak on export documentation, regulations and compliance issues.