Free Download:

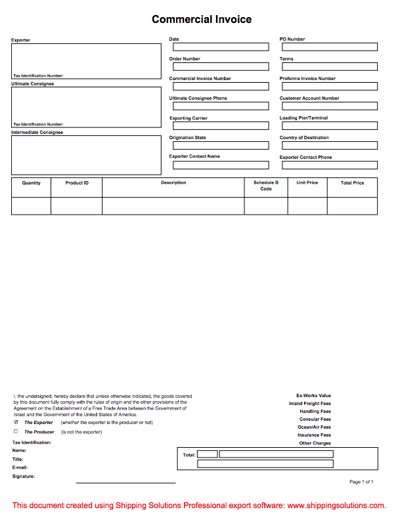

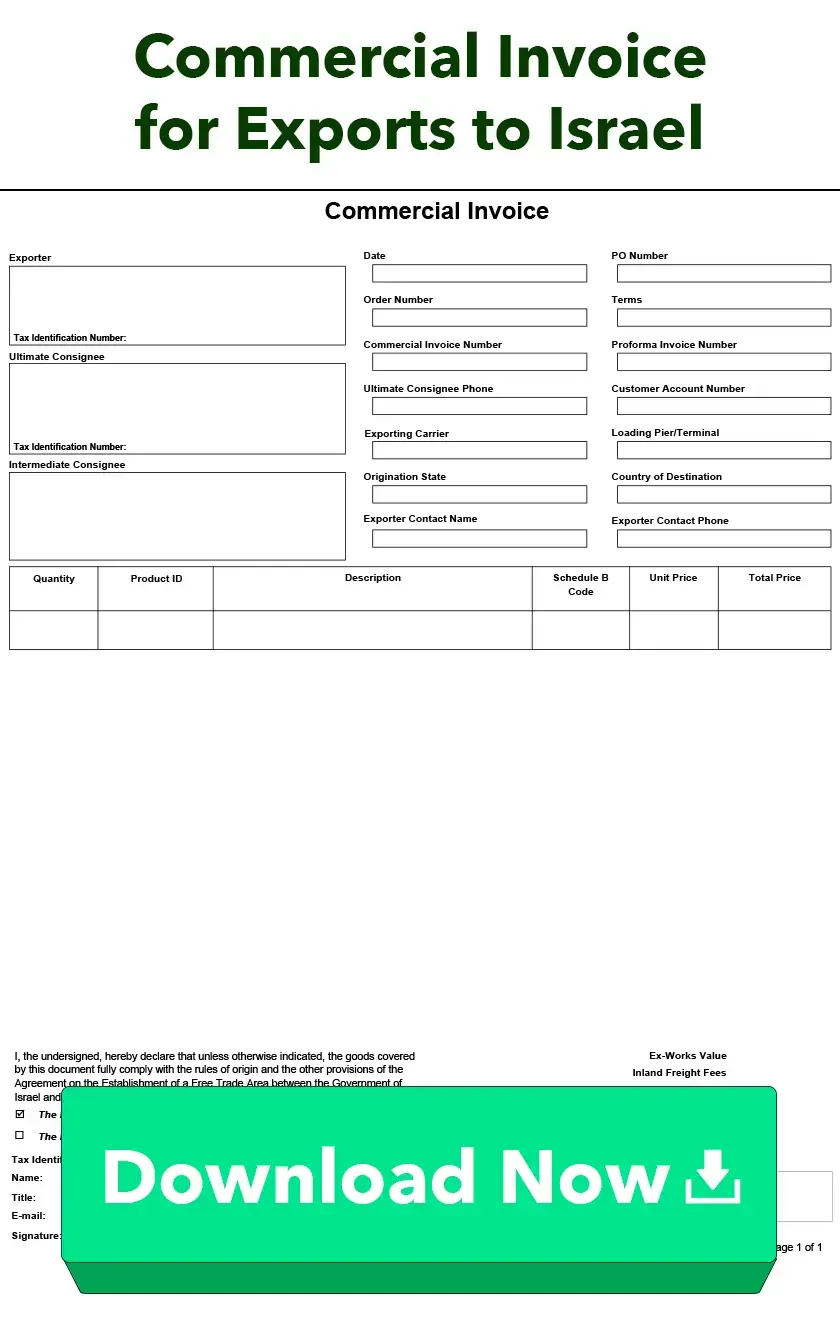

Commercial Invoice for Exports to Israel

Download and print this PDF of the Commercial Invoice form with the language you need for your exports to Israel.

What is a Commercial Invoice for Exports to Israel?

Prior to April 1, 2018, U.S. exporters who wished to qualify for preferential access to the Israeli market needed to use a special green certificate of origin form. That regulation has now changed and instead of providing the green certificate of origin, U.S. exporters must include a new statement that declares that their goods qualify under the U.S.-Israel Free Trade Agreement.

This version of the commercial invoice includes that statement as well as all the standard information that is typically required on a commercial invoice that must accompany an export shipment.

The commercial invoice is the single document that describes the entire export transaction from start to finish. When completed properly, it provides important instructions and information to the buyer, the freight forwarder, U.S. and foreign customs, the import broker, the marine insurance company, and both your bank and the buyer’s bank. Done improperly, it can cause confusion, delays and disagreements.

U.S. - Israel FTA Rules of Origin

Create Accurate Export Forms

Reduce the time it takes to complete the commercial invoice by up to 80%. Shipping Solutions export documentation software makes it easy to create more than two dozen standard export forms. Register now for a free demo. There's absolutely no obligation.

Commercial Invoice for Exports to Israel FAQs

-

Are there any specific requirements or regulations for commercial invoices when shipping to Israel?

U.S. exporters must include a statement that declares that their goods qualify under the U.S.-Israel Free Trade Agreement when shipping to Israel. The version of the commercial invoice that you can download on this page includes that statement as well as all the standard information that is typically required on a commercial invoice that must accompany an export shipment.

-

What is the U.S.-Israel Free Trade Agreement invoice declaration?

The commercial invoice for exports to Israel, available to download for free on this page, includes this statement, required under the U.S.-Israel FTA: “I, the undersigned, hereby declare that unless otherwise indicated, the goods covered by this document fully comply with the rules of origin and the other provisions of the Agreement on the Establishment of a Free Trade Area between the Government of Israel and the Government of the United States of America.”

-

What information should be included on a commercial invoice for exports to Israel?

A commercial invoice for exports to Israel should include essential information such as exporter and importer details, invoice number and date, detailed description and value of the goods, packaging information, country of origin, shipping details and relevant signatures and declarations. Download the sample template on this page to ensure you include all required details.

Download Now

Today is your lucky day. Shipping Solutions® makes completing export forms simple, accurate and five-times faster than the tedious way you’re doing it now.

Get it done easily.

Eliminate the hassle of manually completing your export forms. Our EZ Start Screen helps you automatically complete more than a dozen export forms.

Get it done fast.

With Shipping Solutions automation, you can complete your export documents up to five-times faster than your traditional manual process.

Get it done right.

Instead of entering the same information over and over again, you enter information in only one place. That makes you less likely to make costly mistakes.

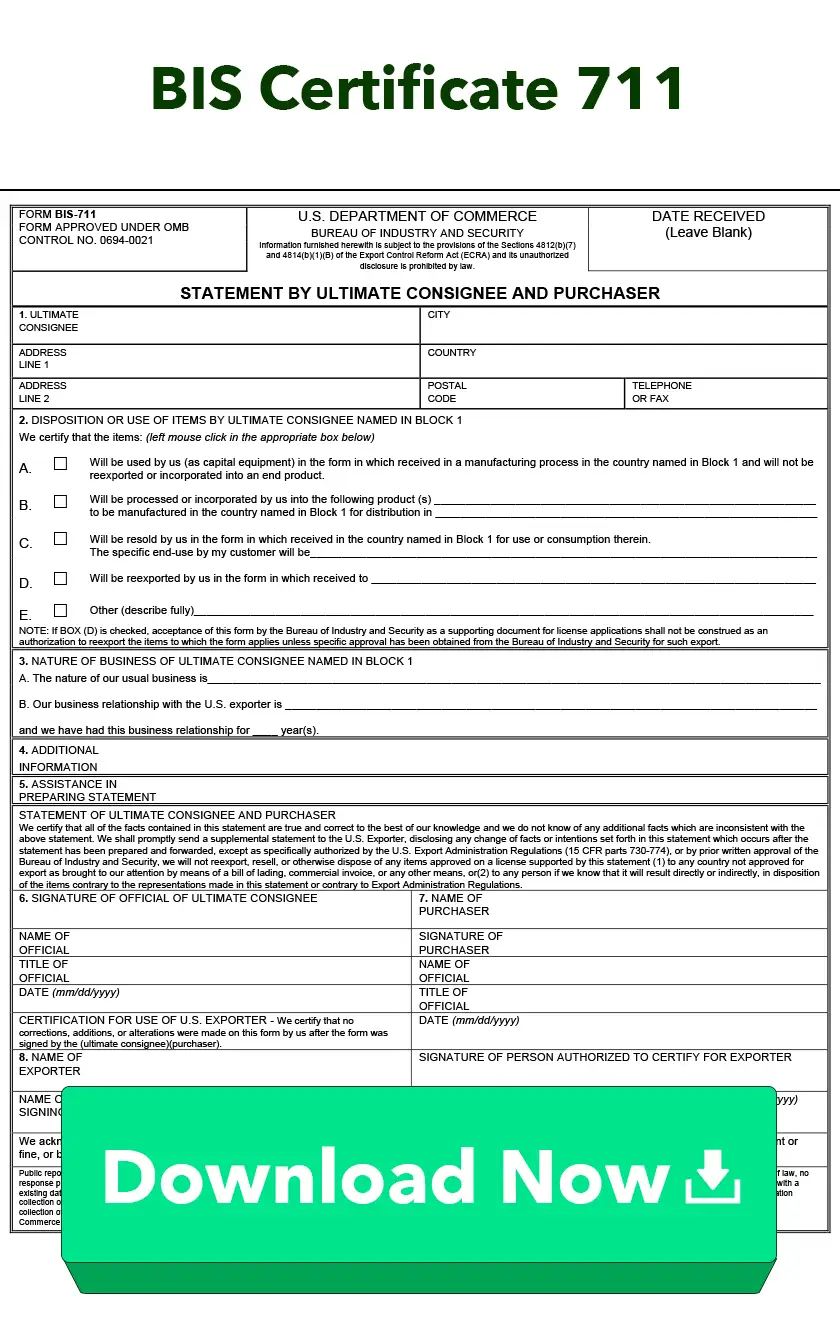

Export Form Templates

Popular

Our most frequently requested export forms.

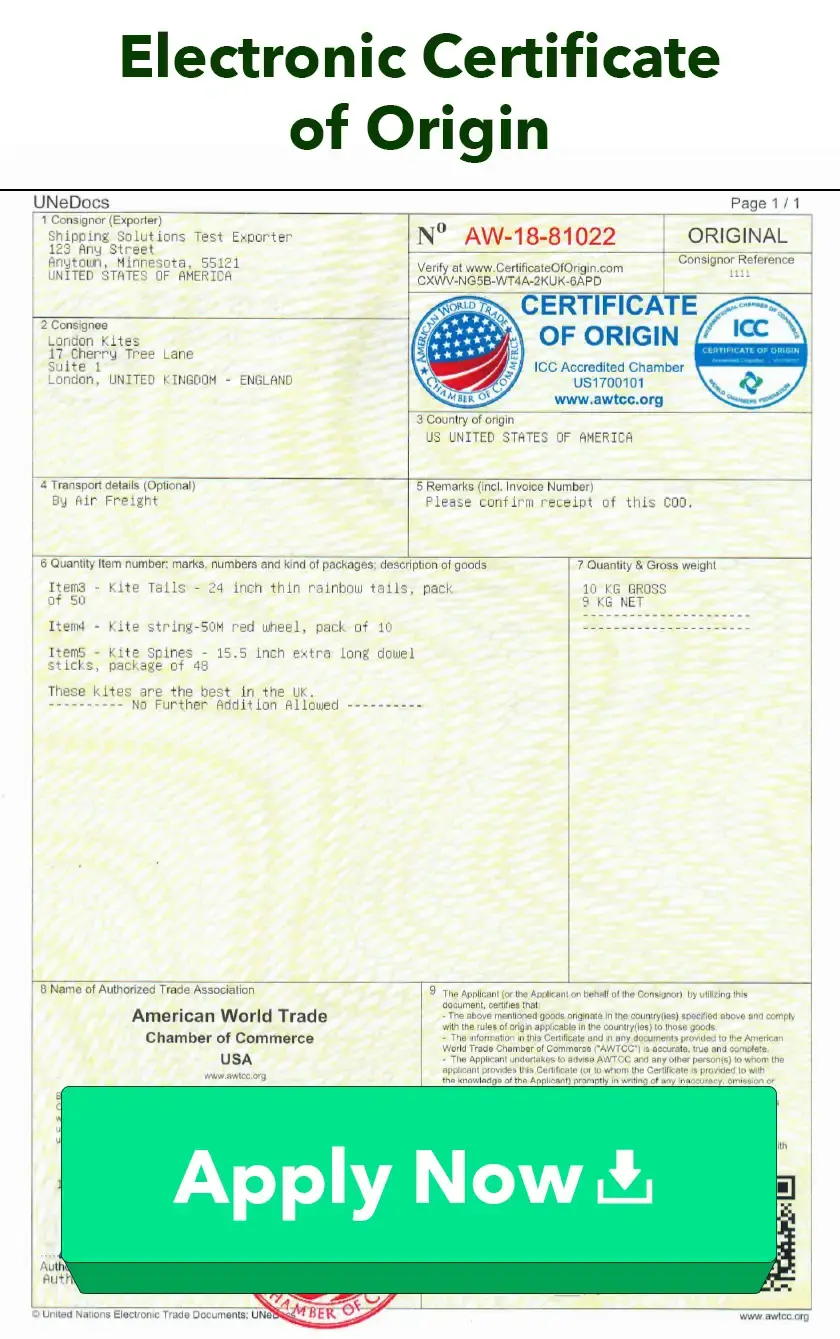

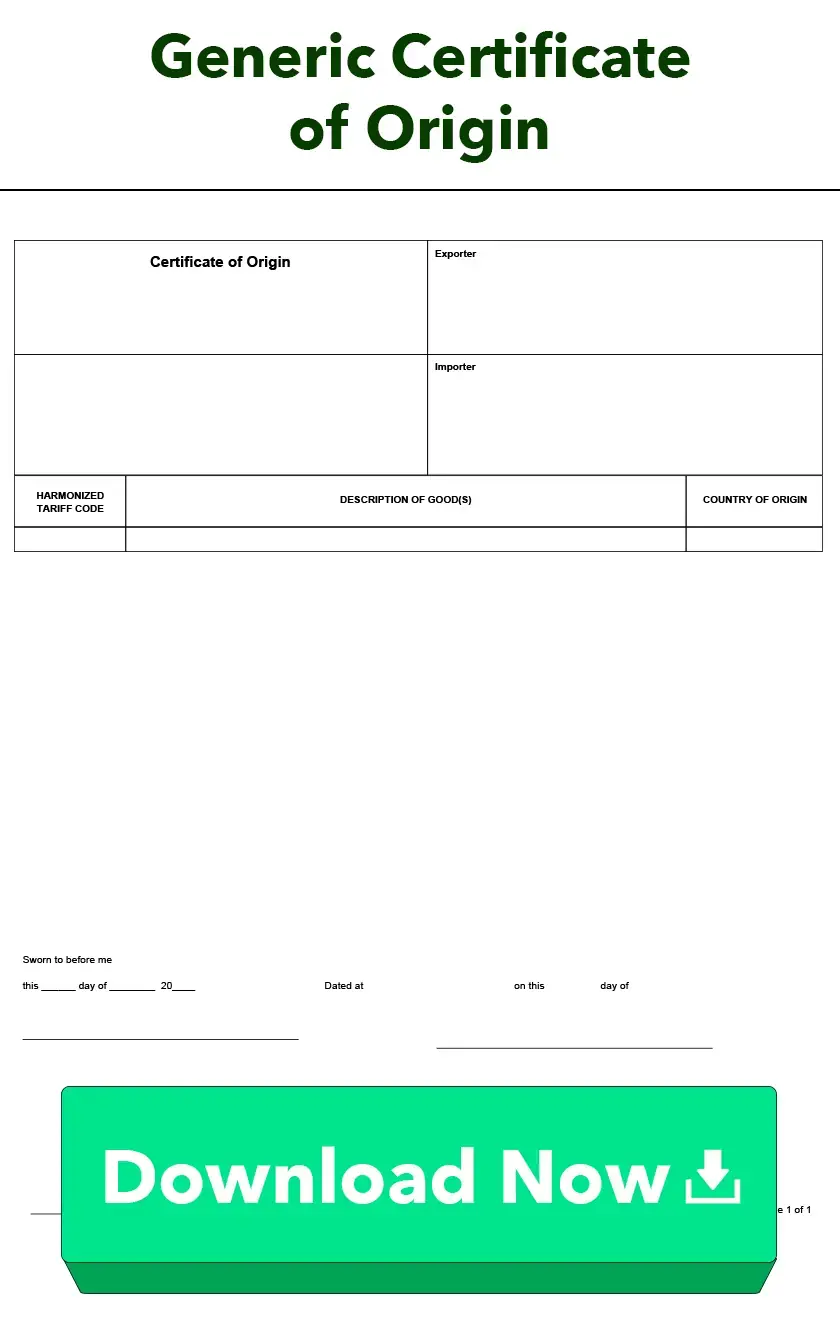

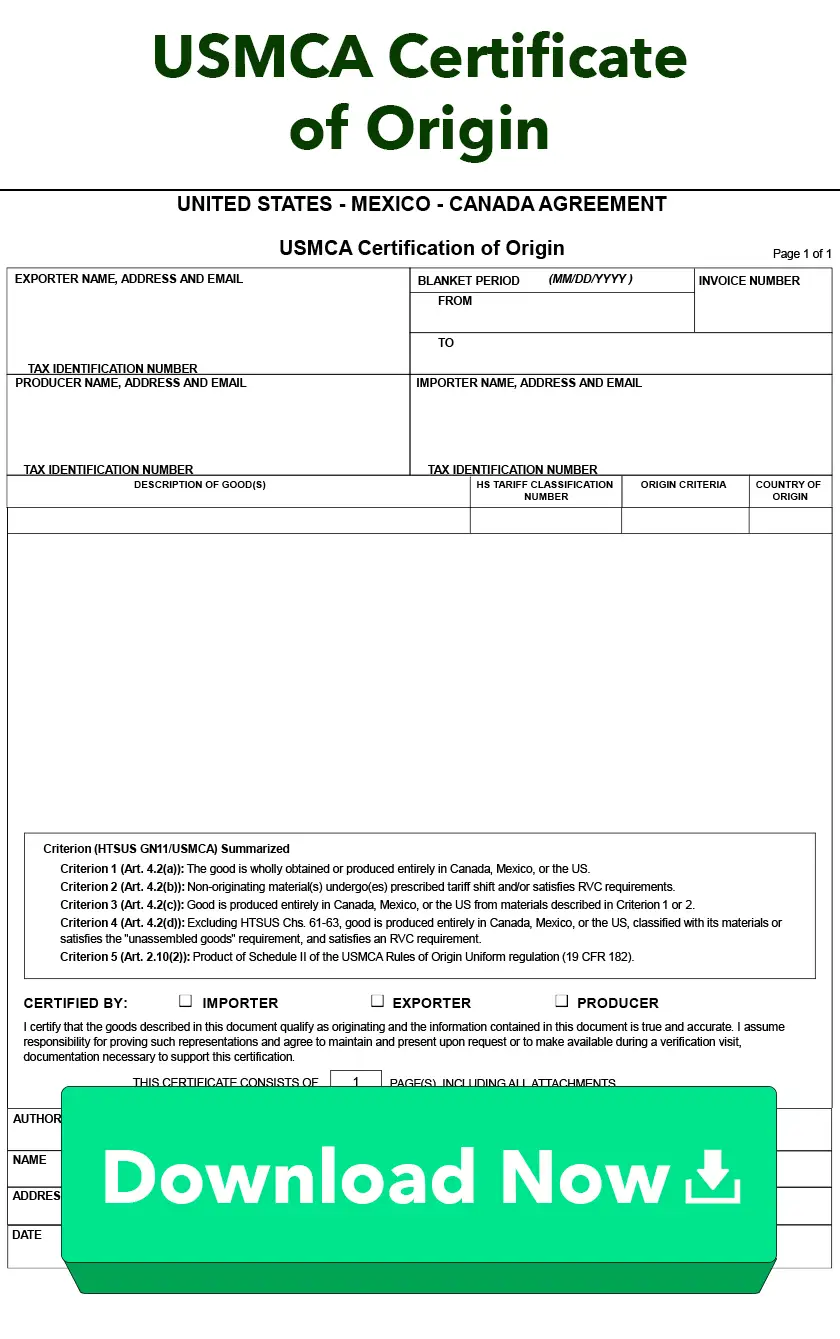

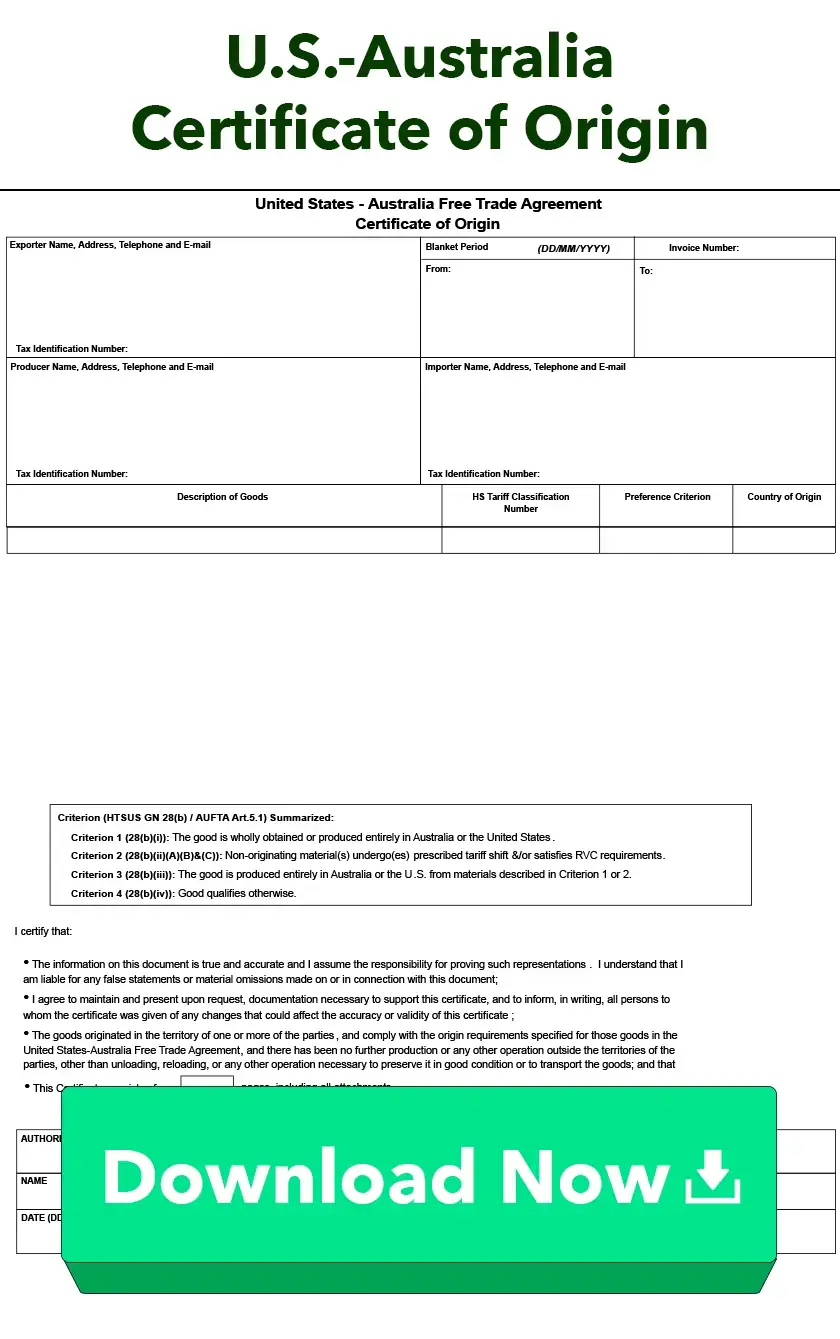

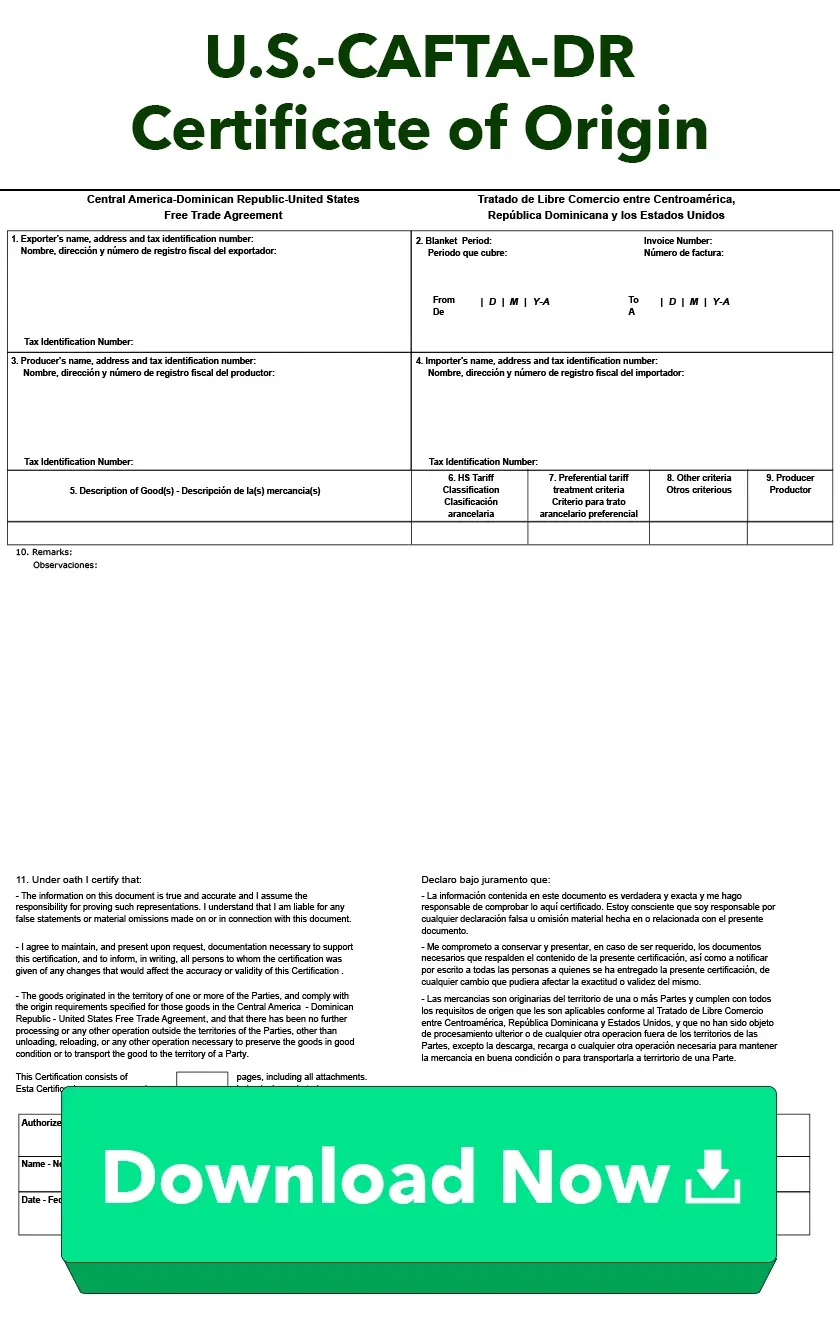

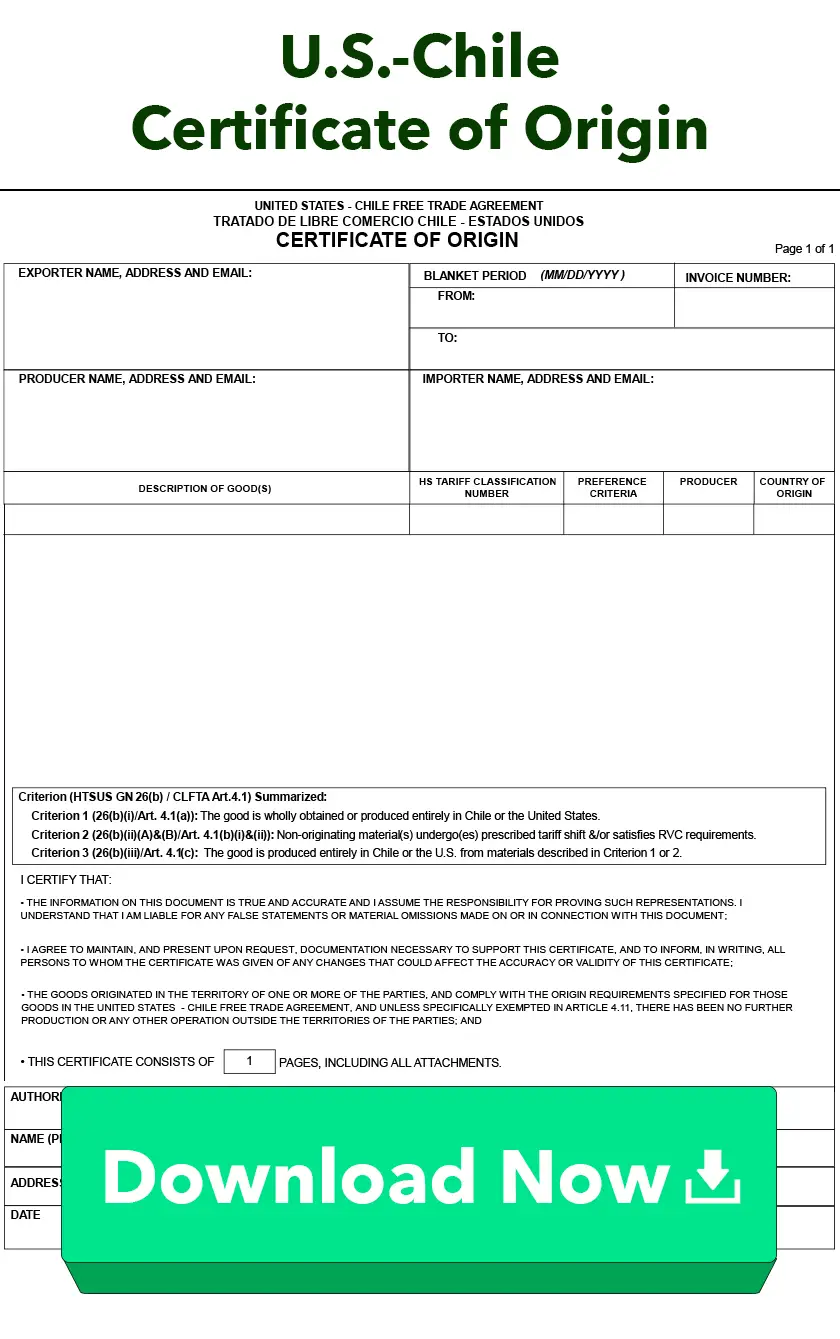

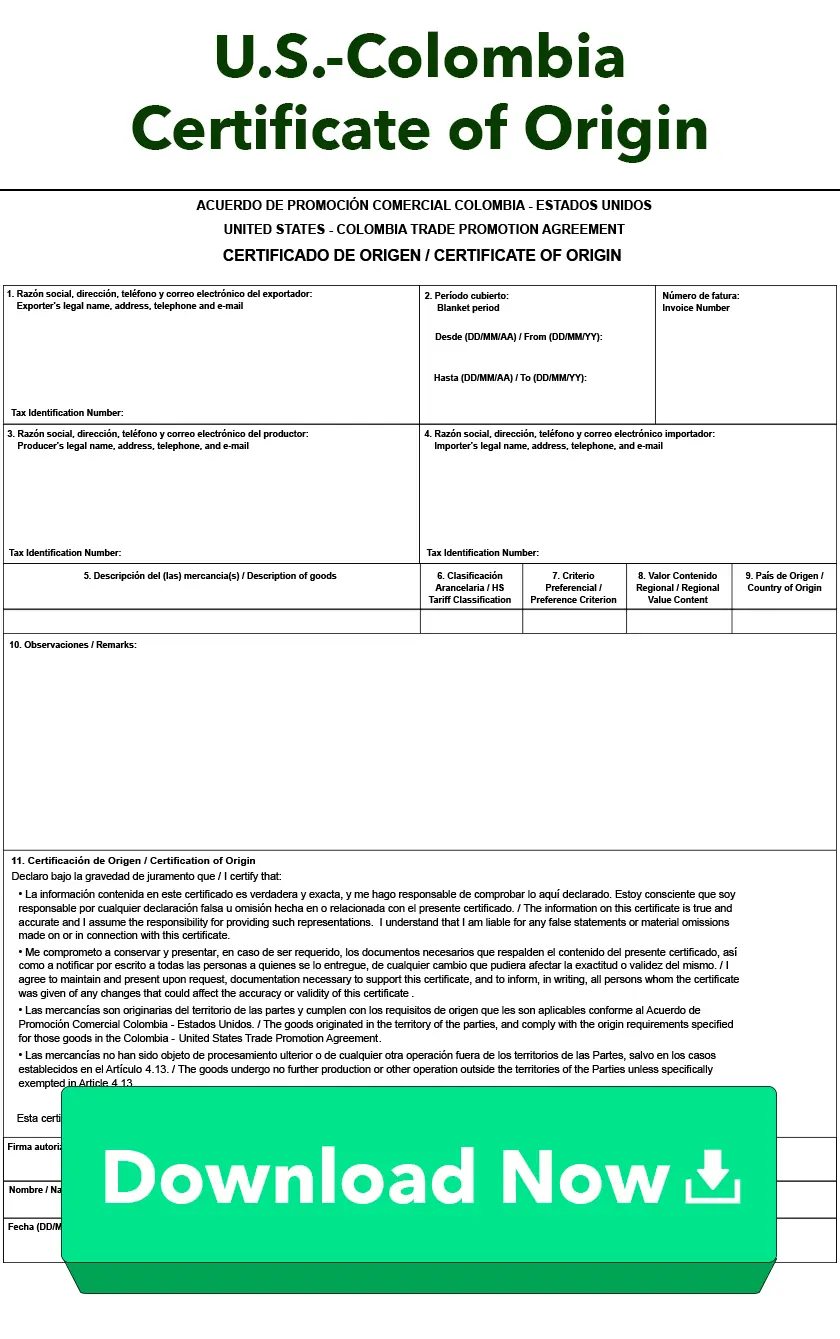

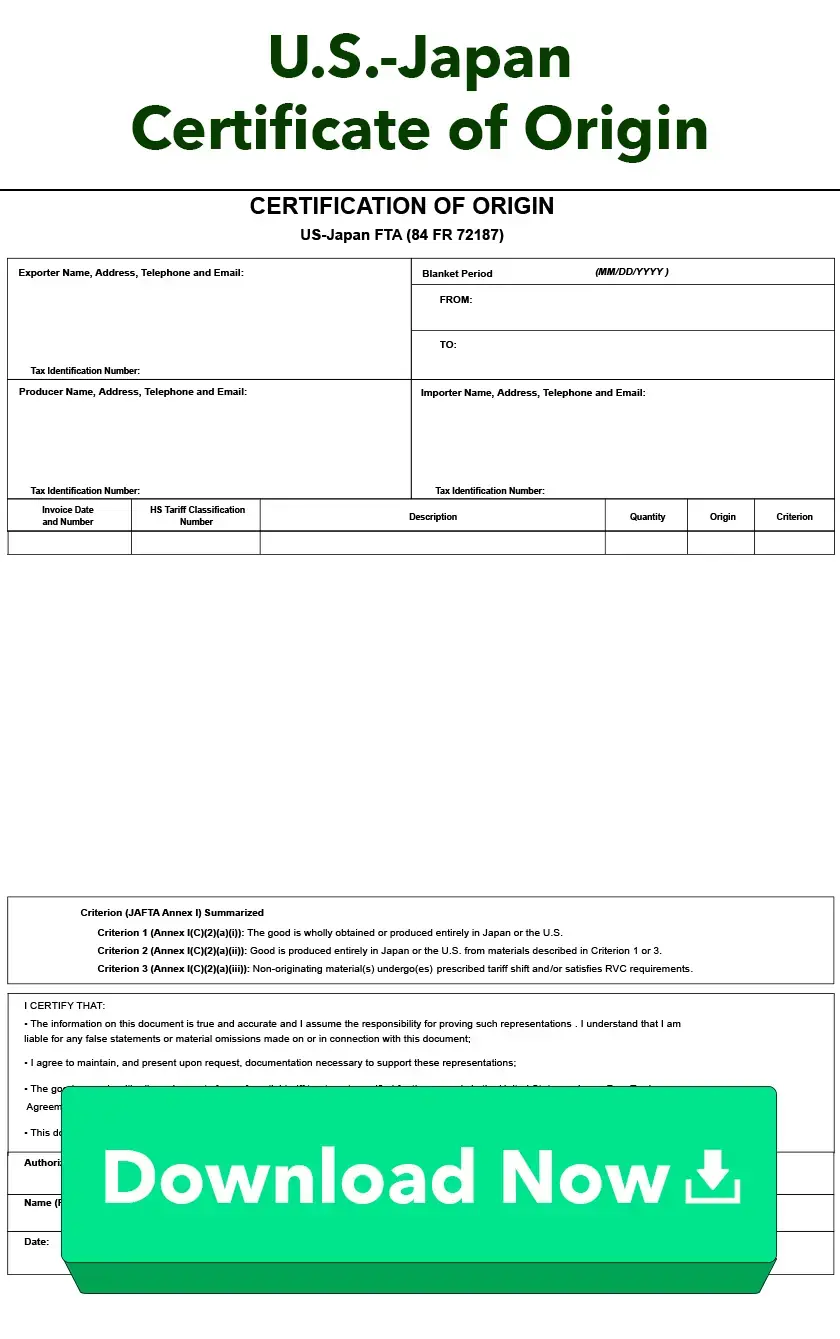

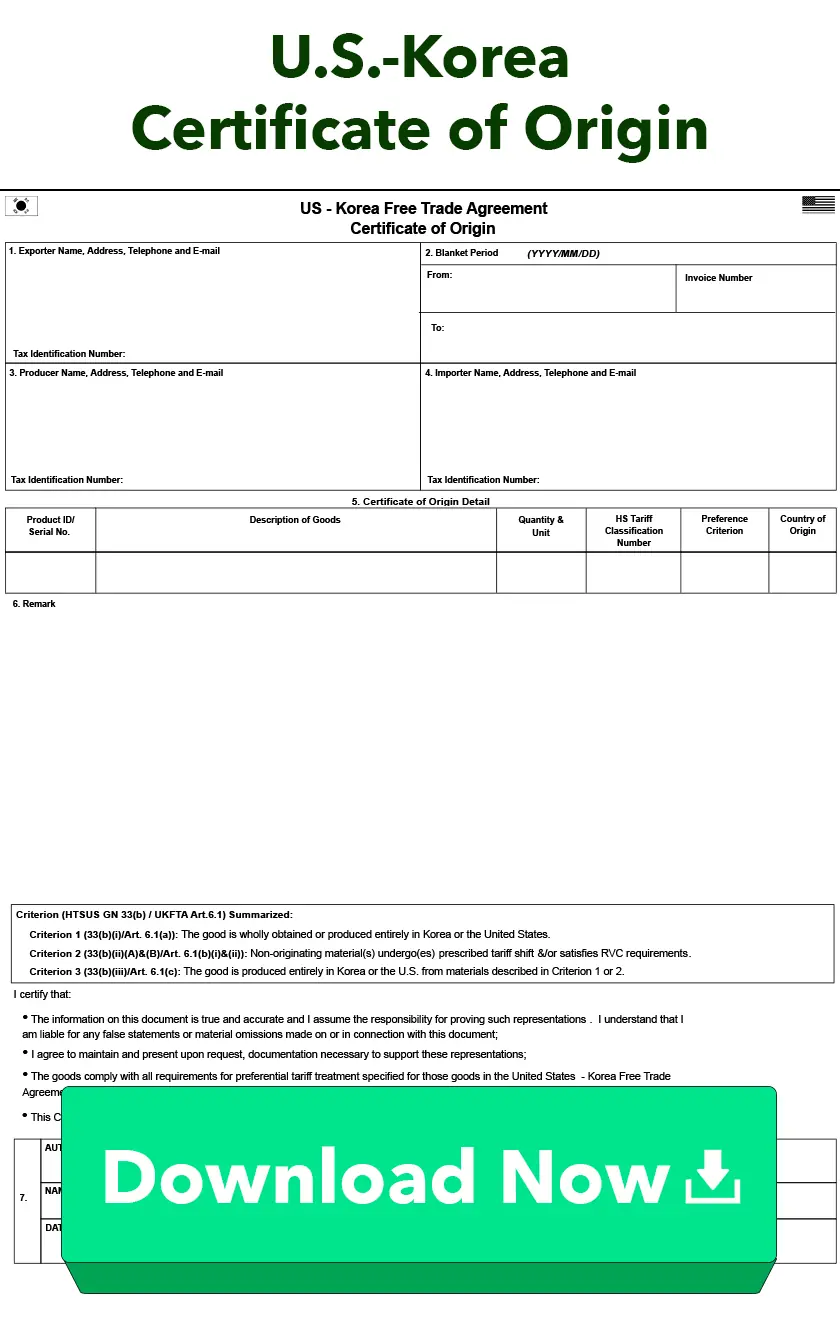

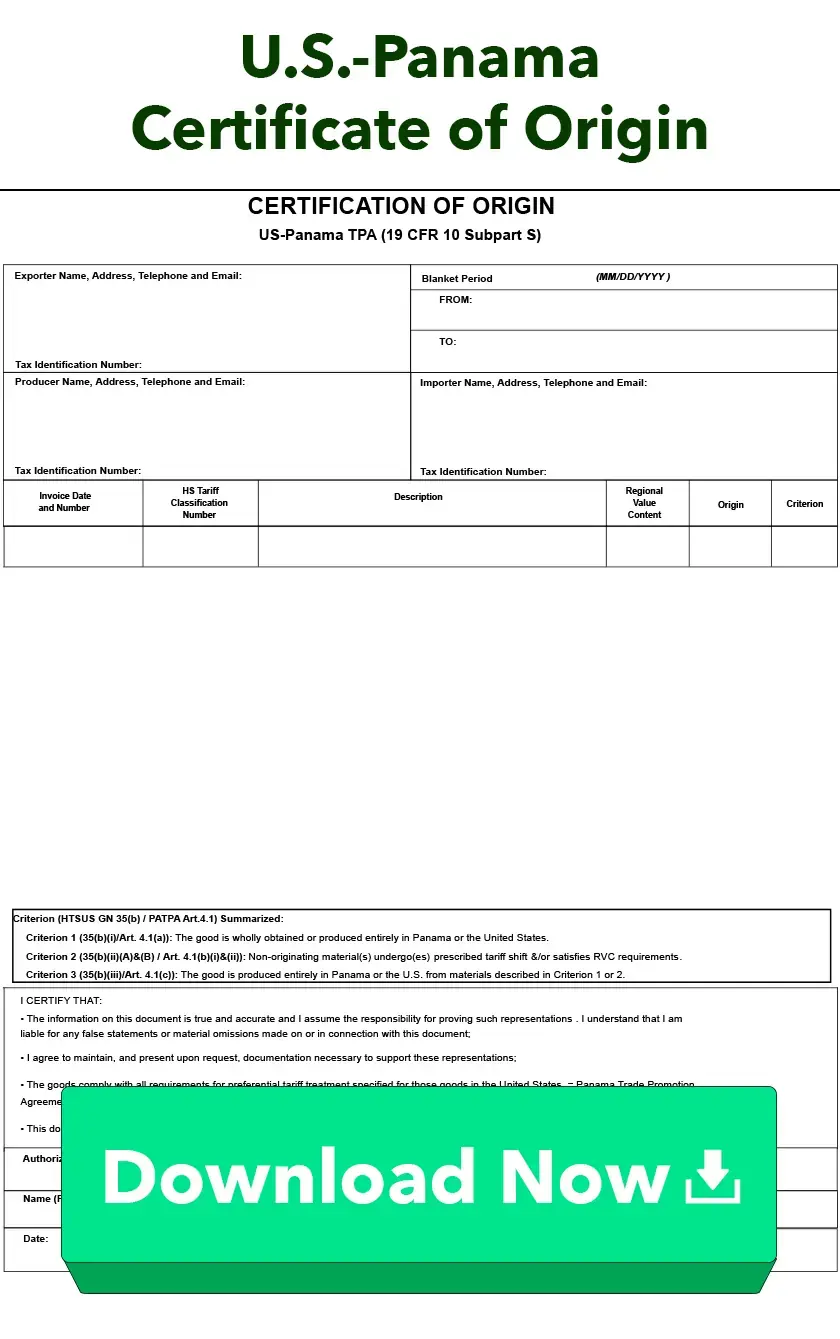

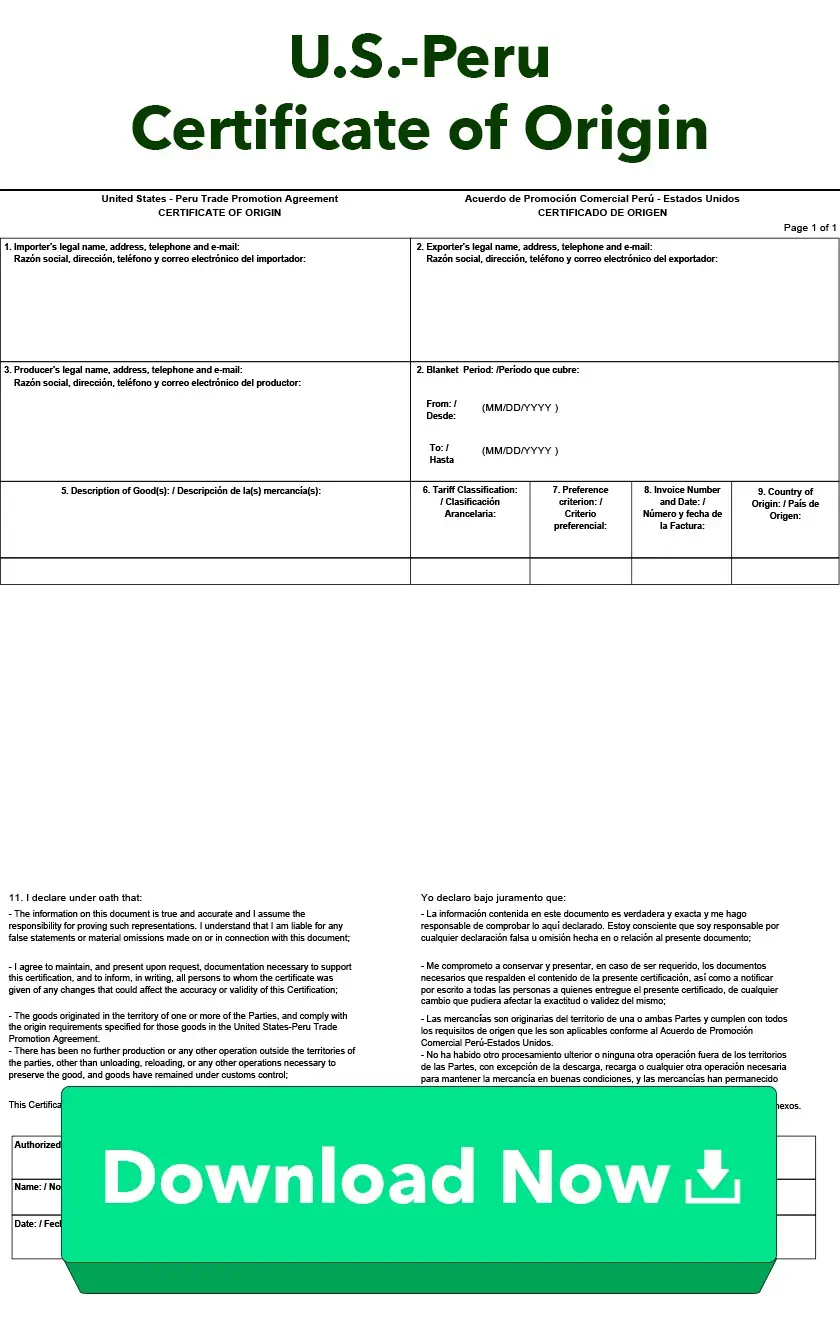

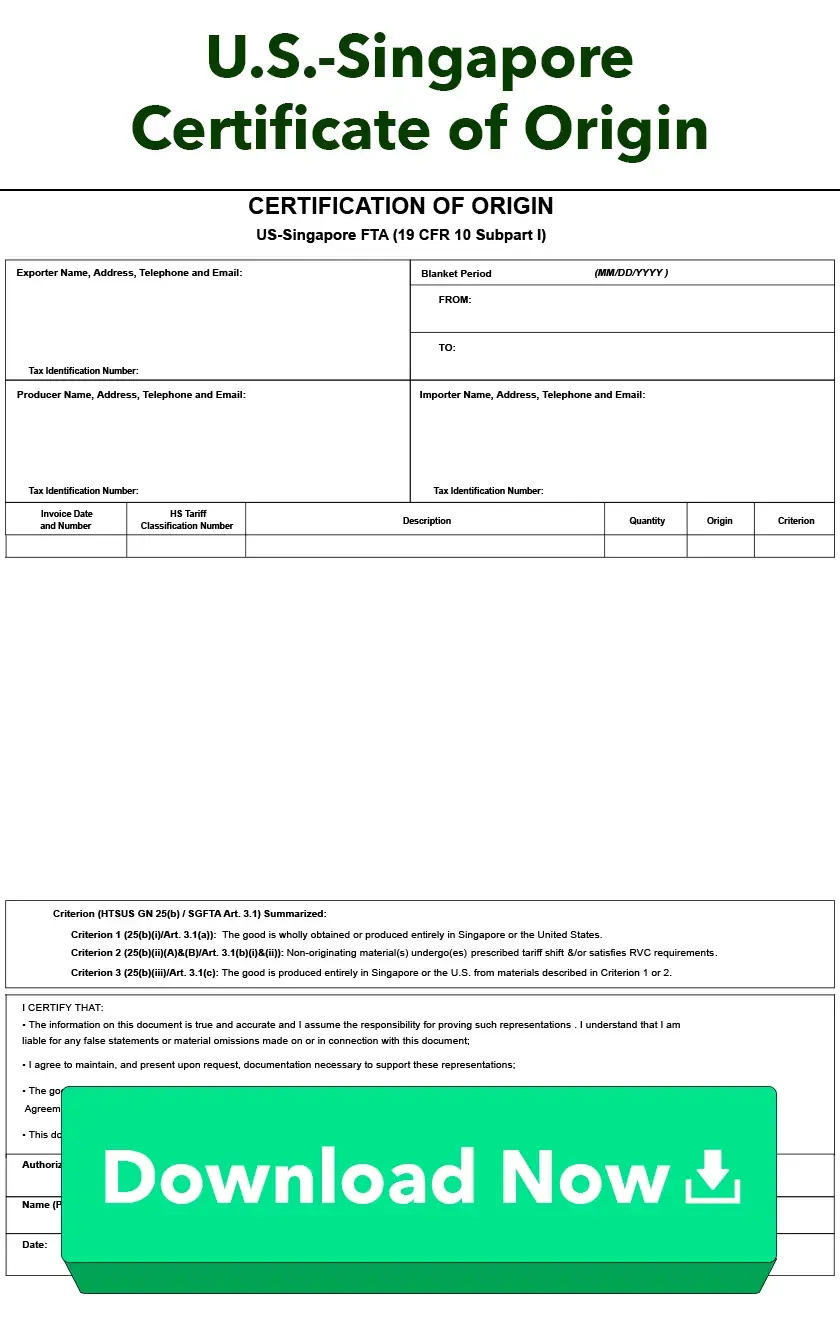

U.S. Certificates of Origin

Learn More About U.S. Certificates of OriginThese forms certify the origin of the goods, which may determine the amount of duty to be paid.

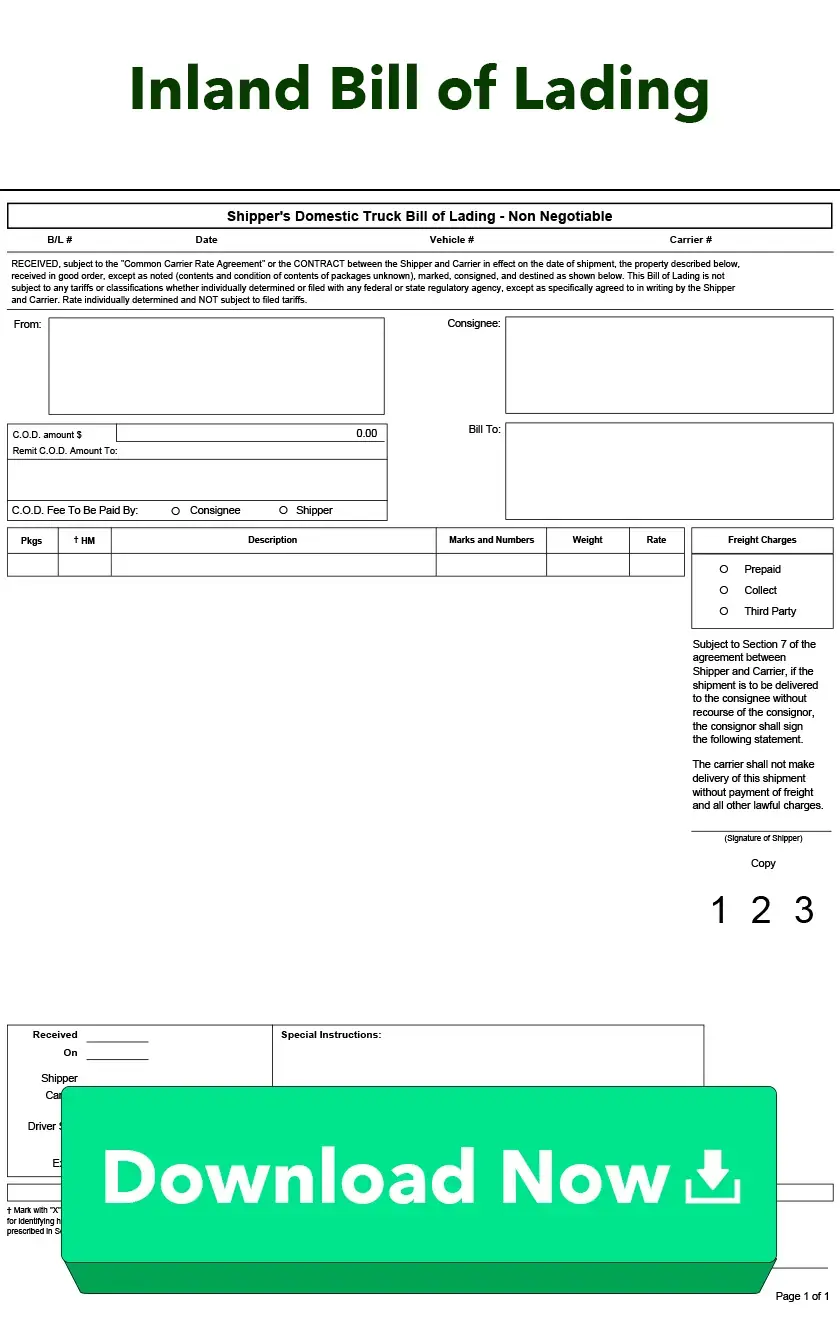

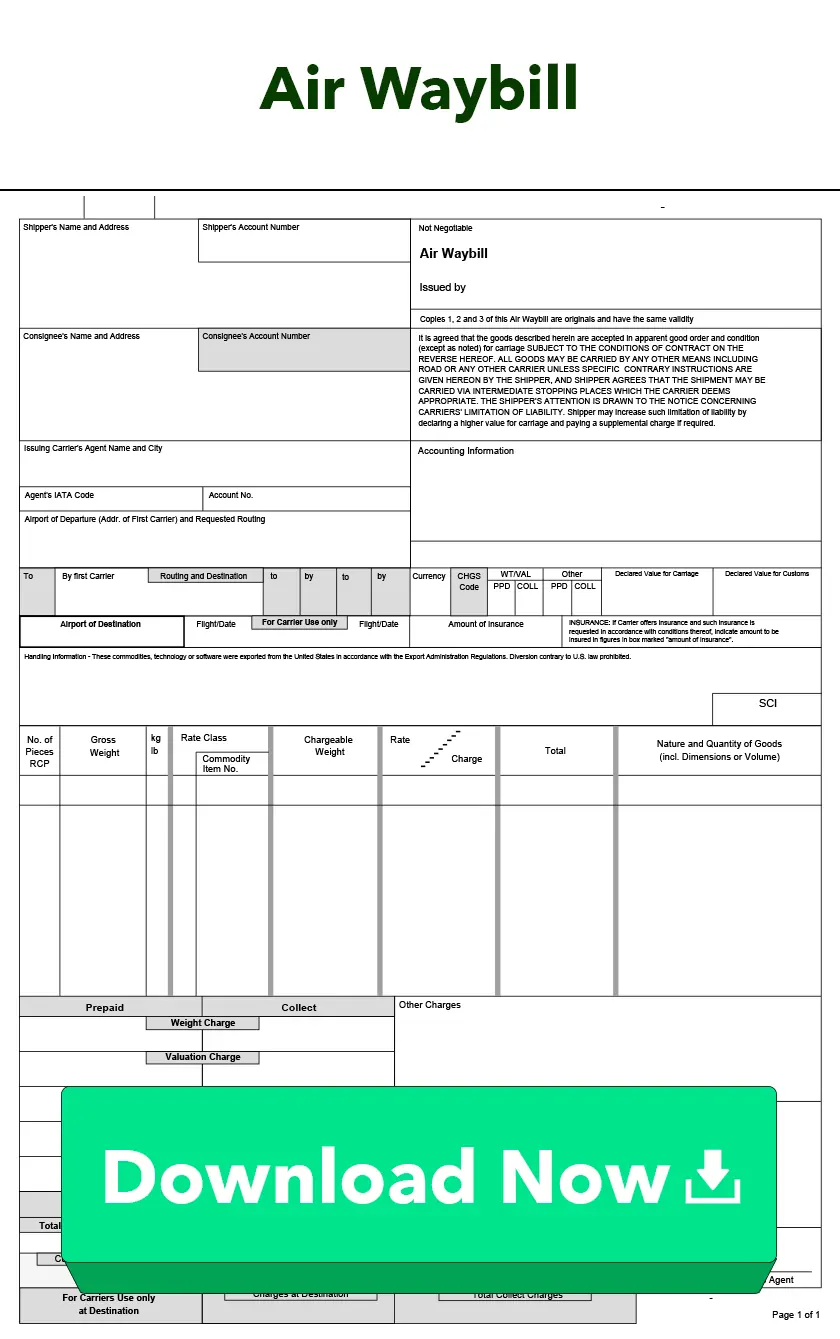

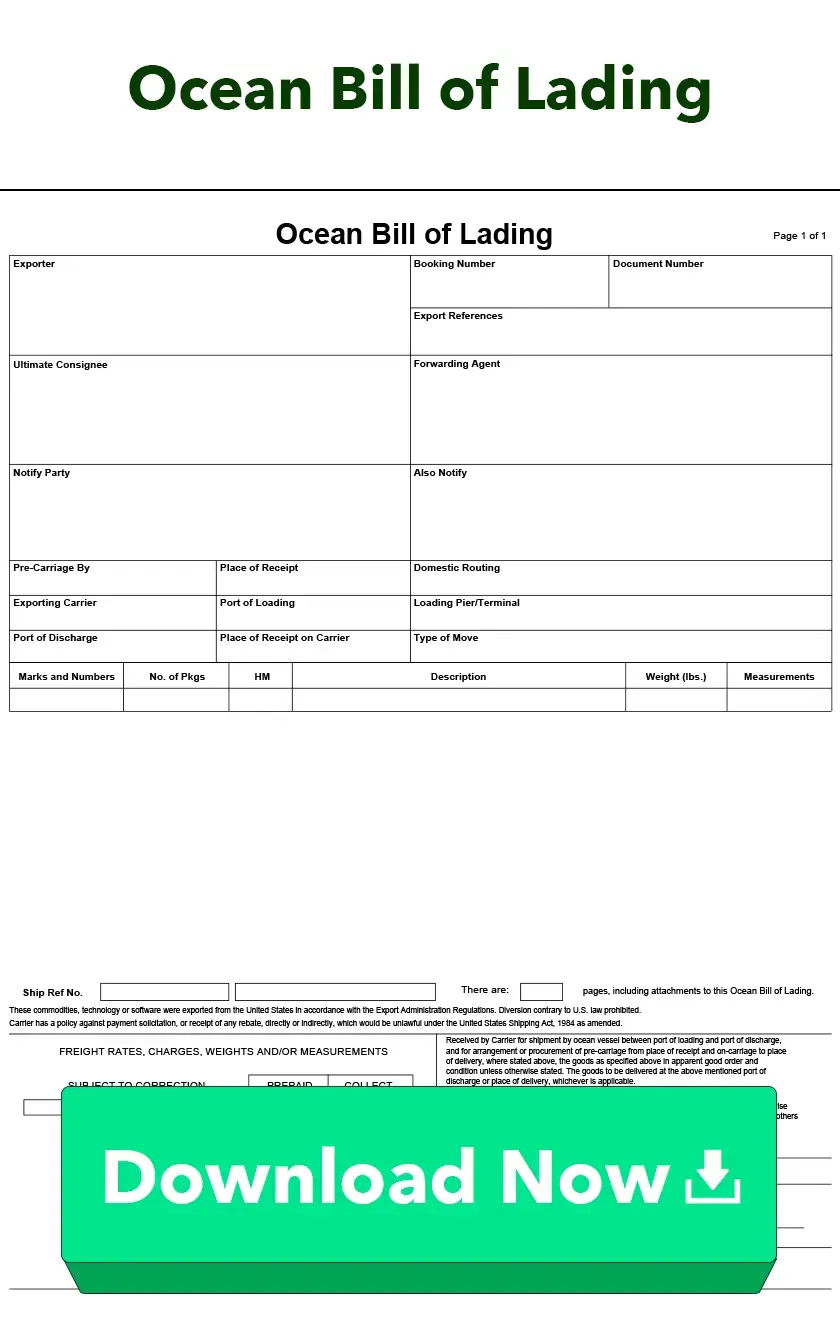

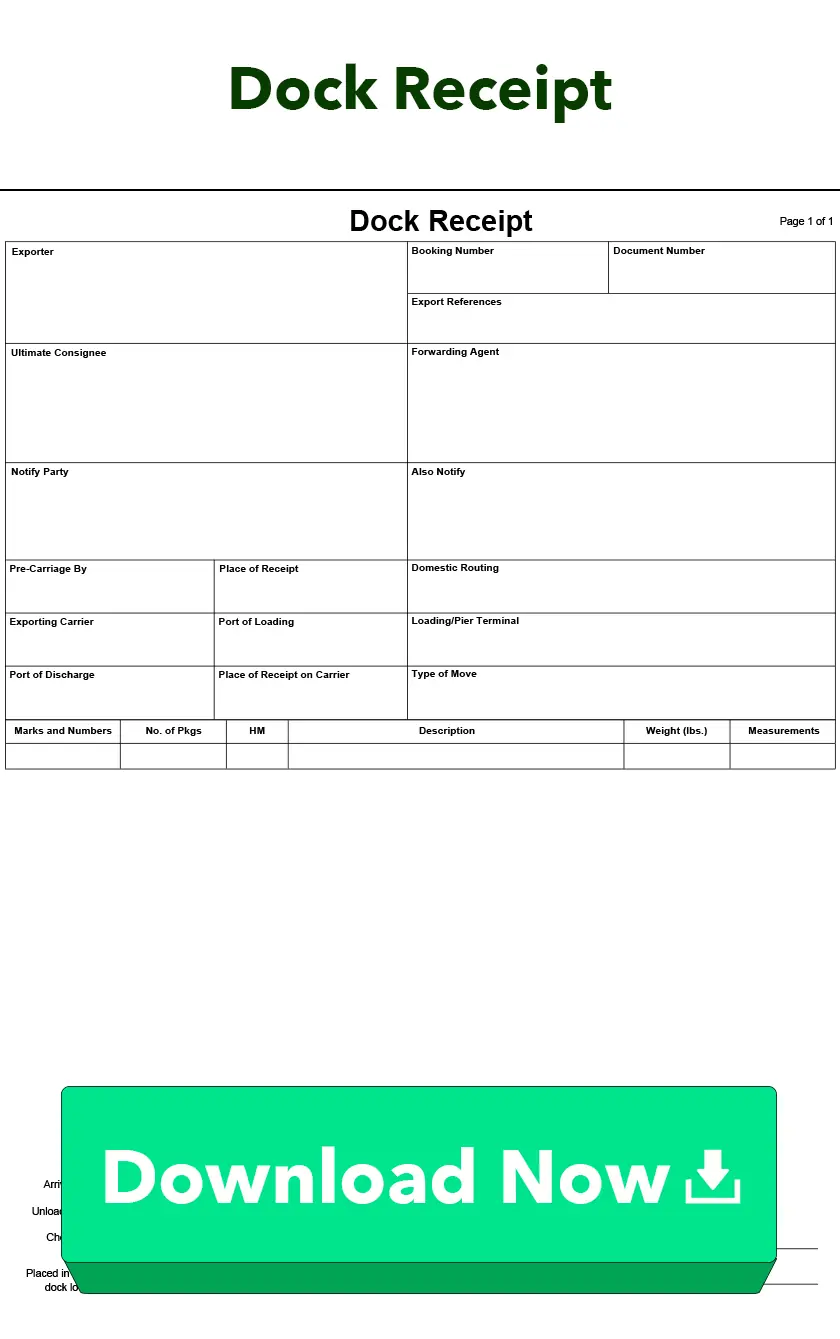

Bills of Lading

Learn More About Bills of LadingA bill of lading is a contract of carriage, a receipt from the carrier, and may be a document of title.

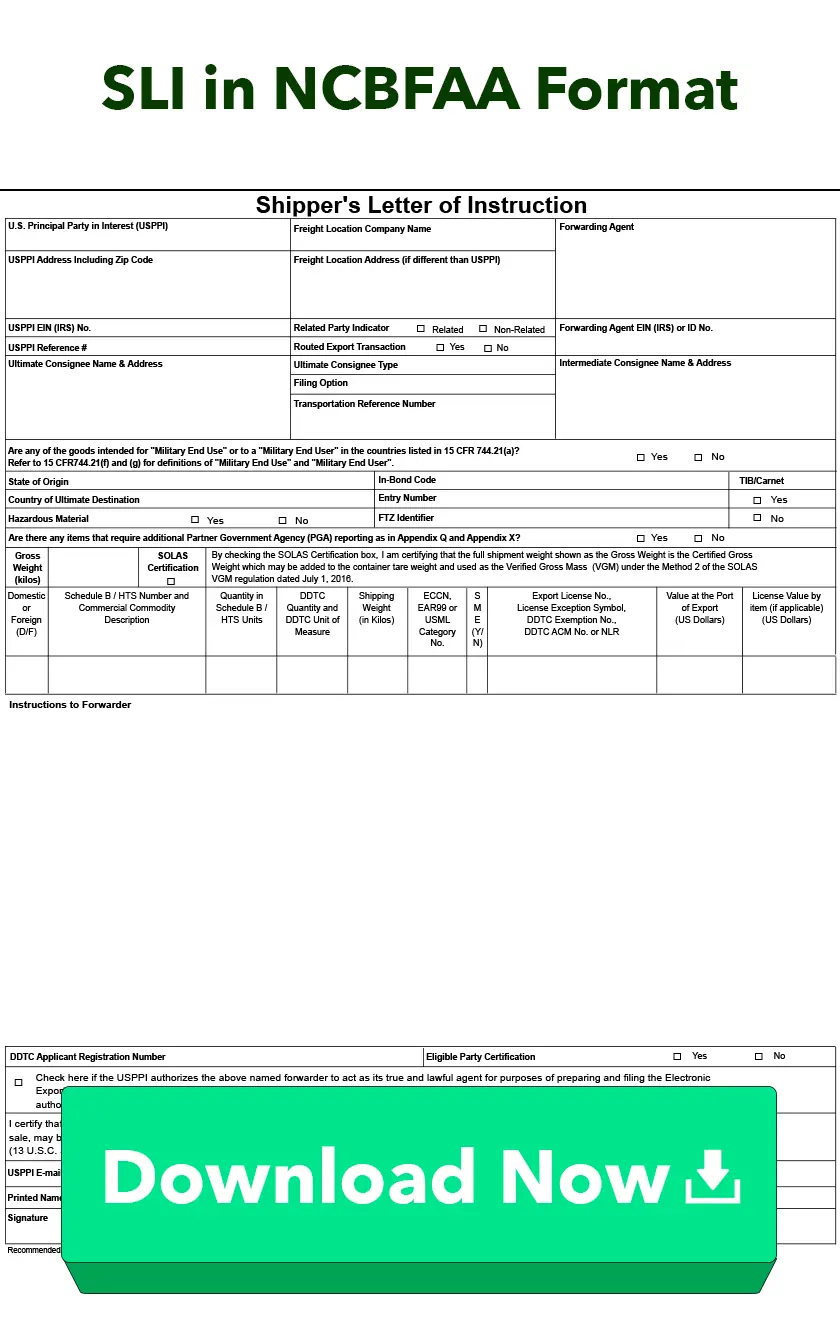

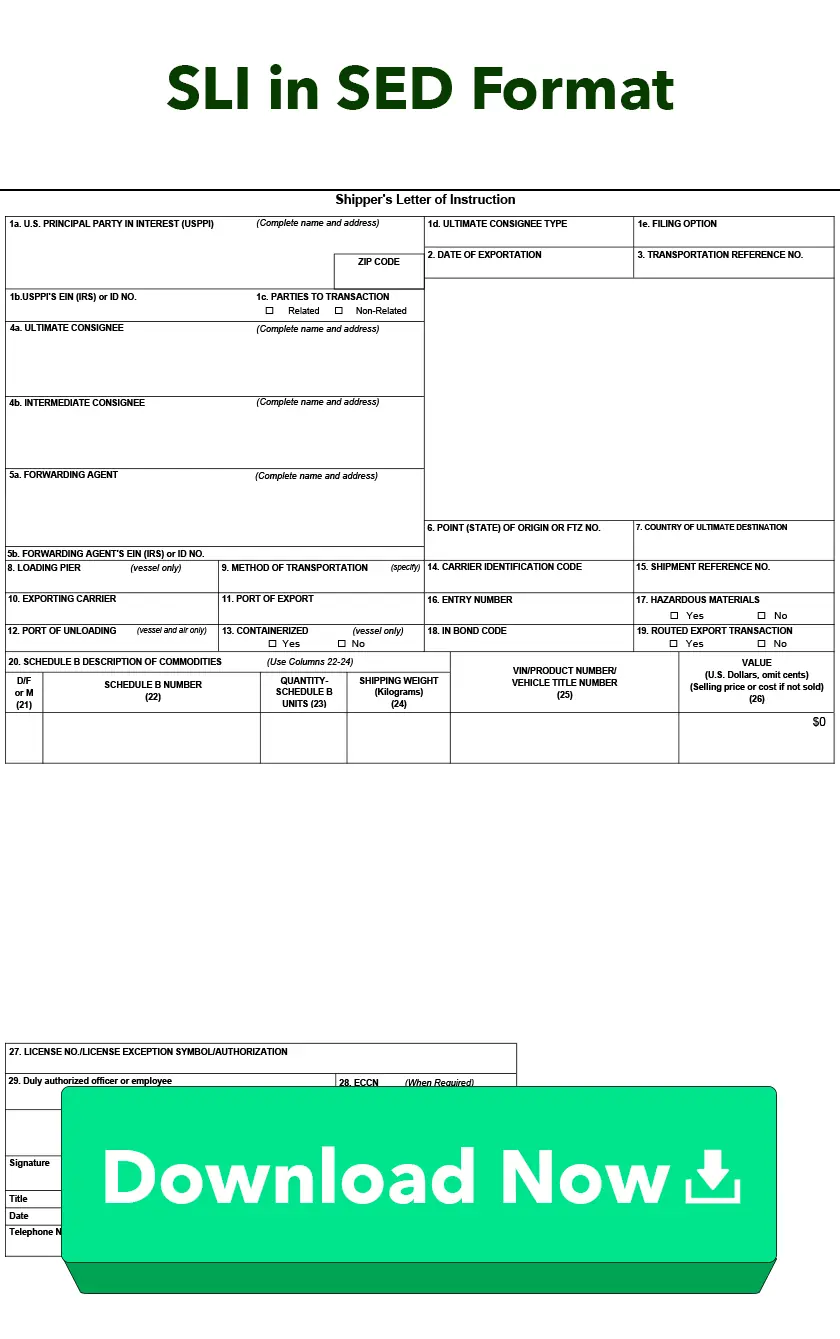

Shipper's Letter of Instruction (SLI)

Learn More About Shipper's Letter of Instruction (SLI)The Shipper's Letter of Instruction (SLI) conveys instructions from the exporter to the carrier or forwarder.

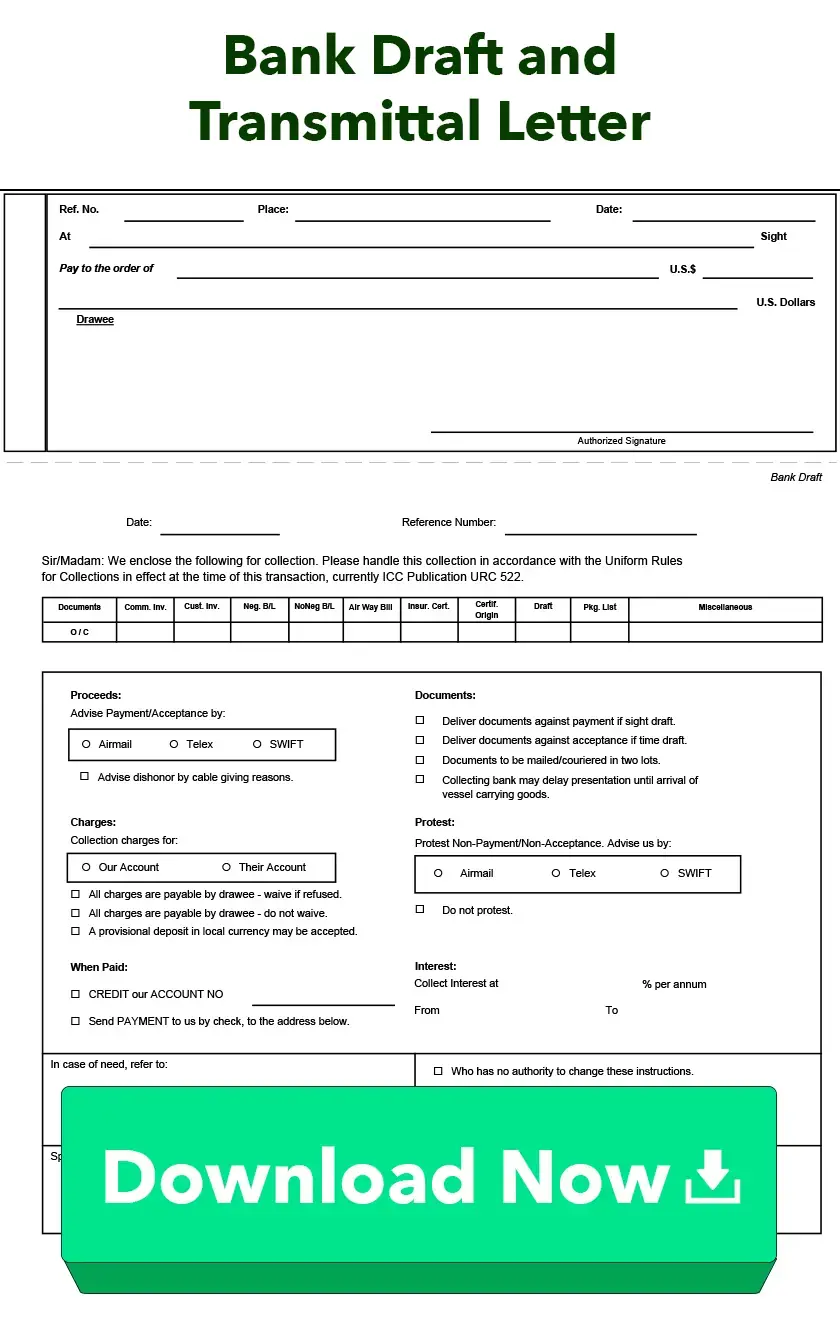

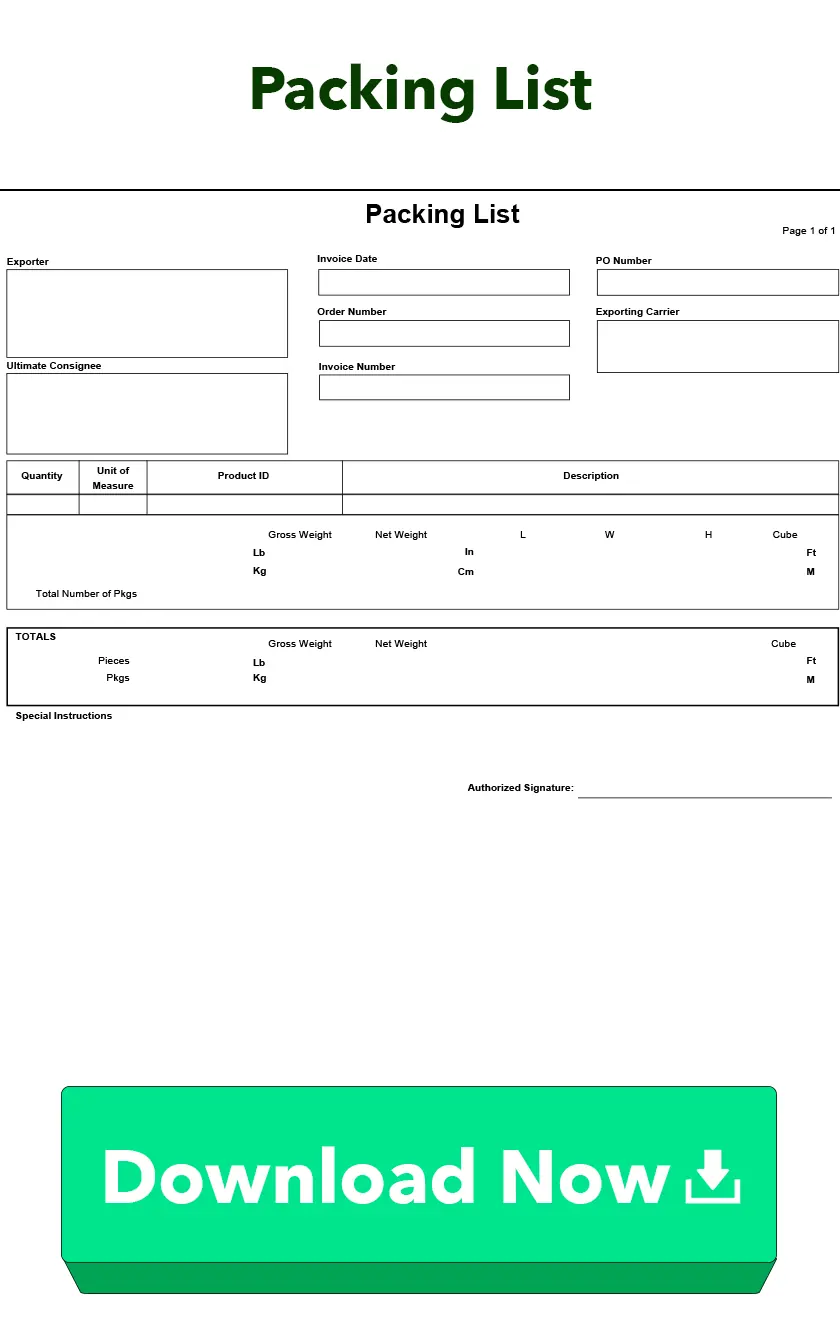

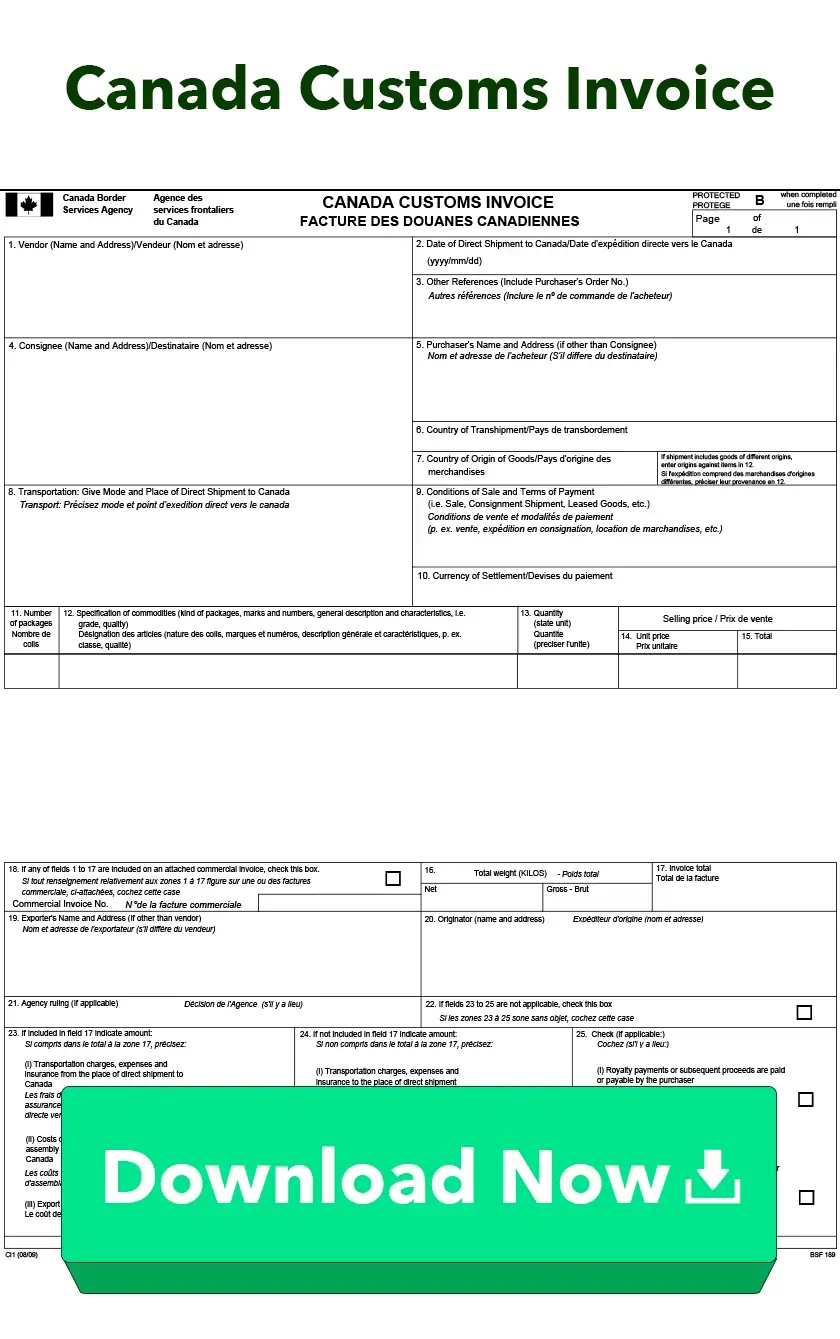

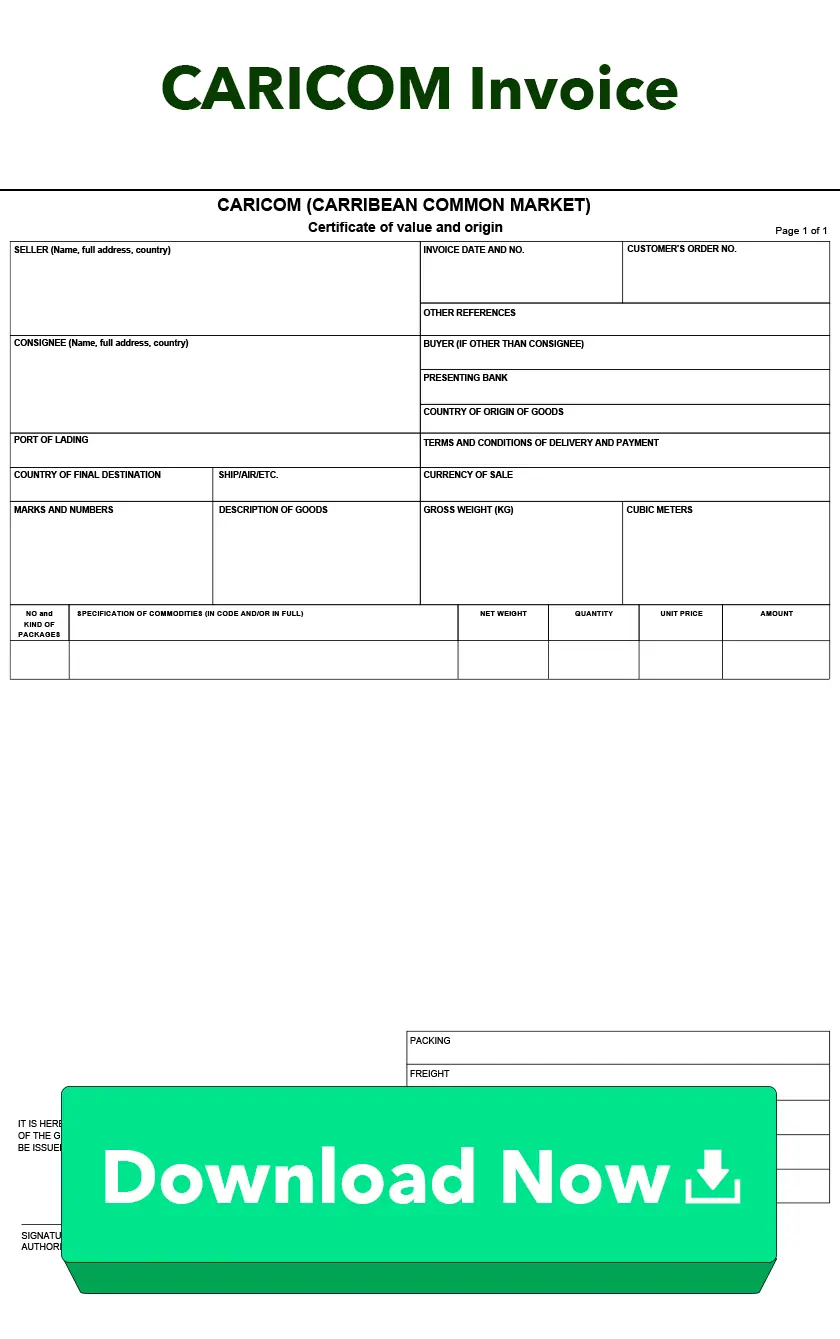

Invoices

Learn More About InvoicesInvoices are one of the most important export documents describing everything included in the shipment and its cost.

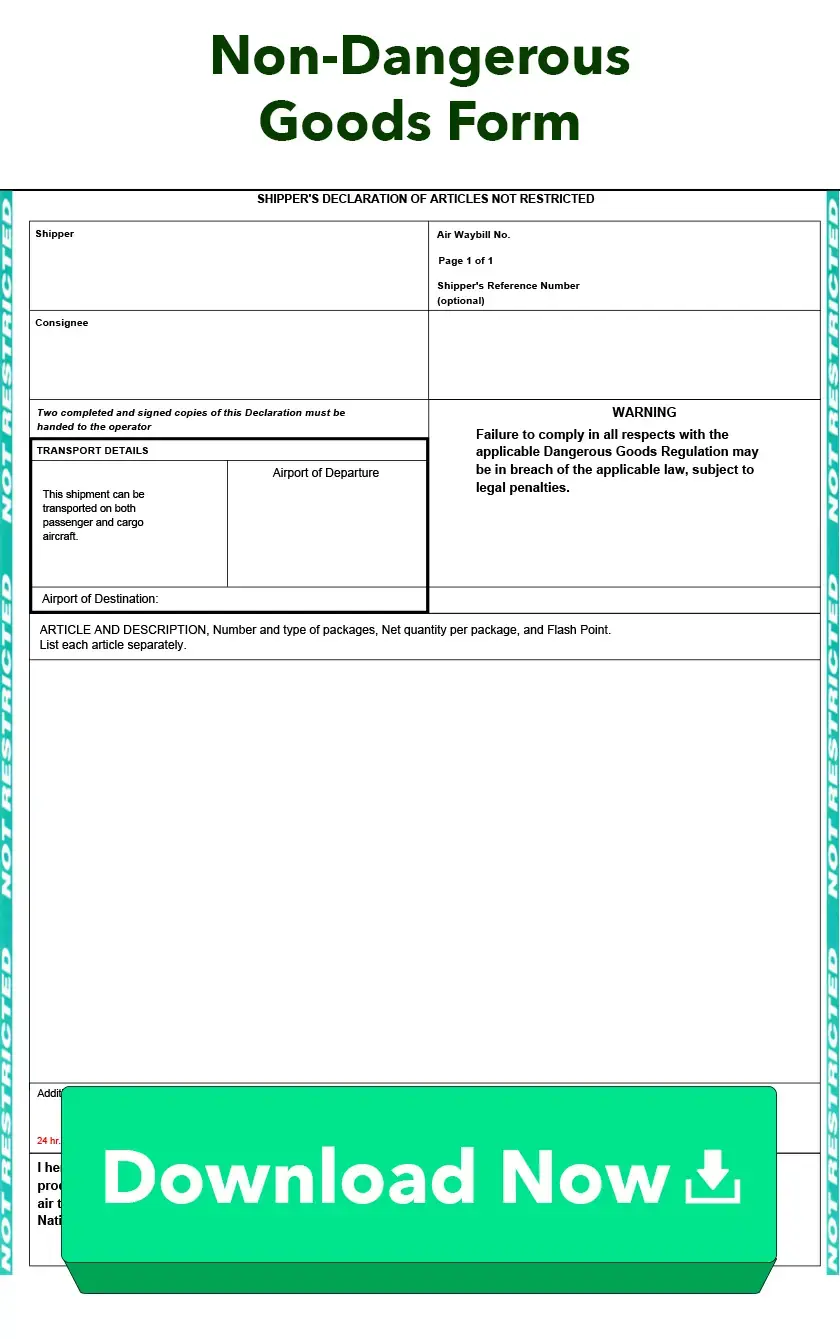

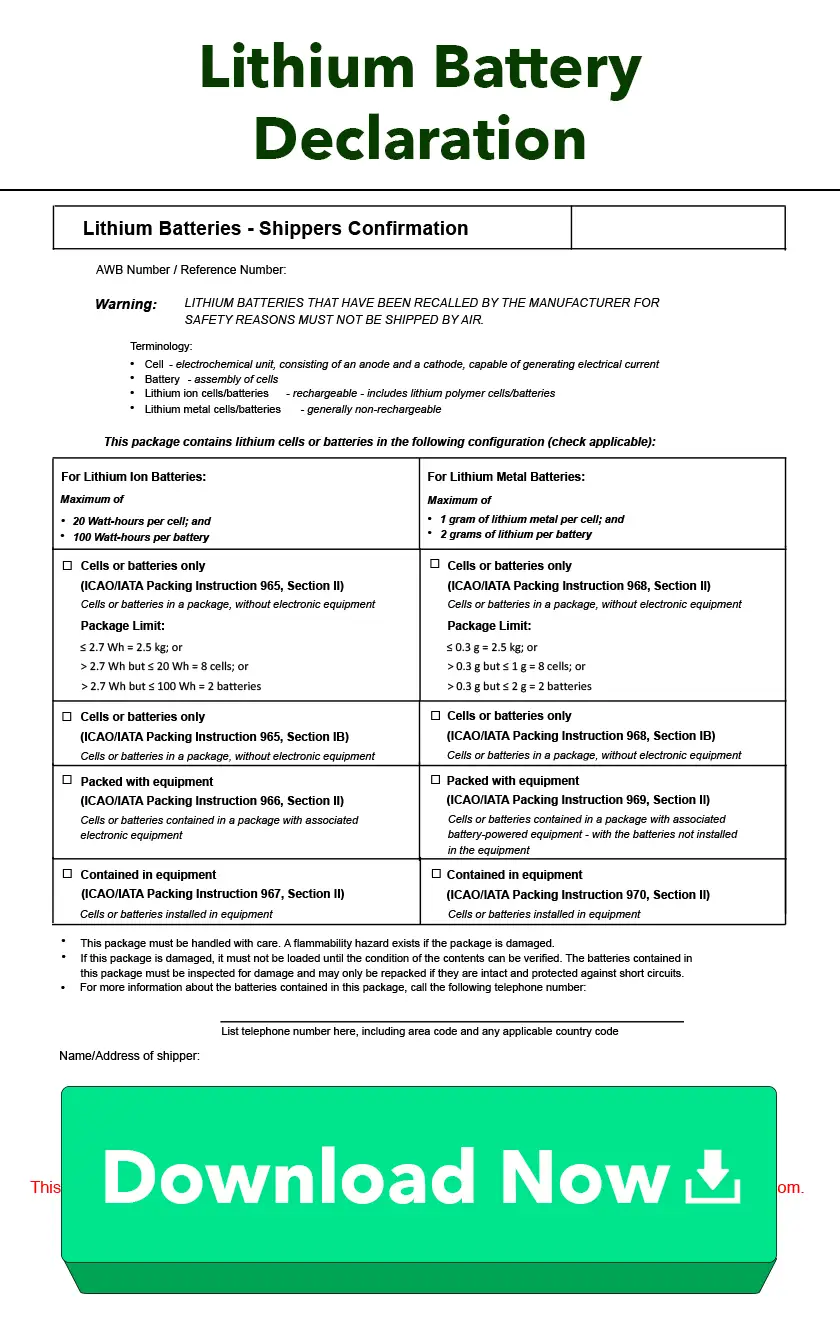

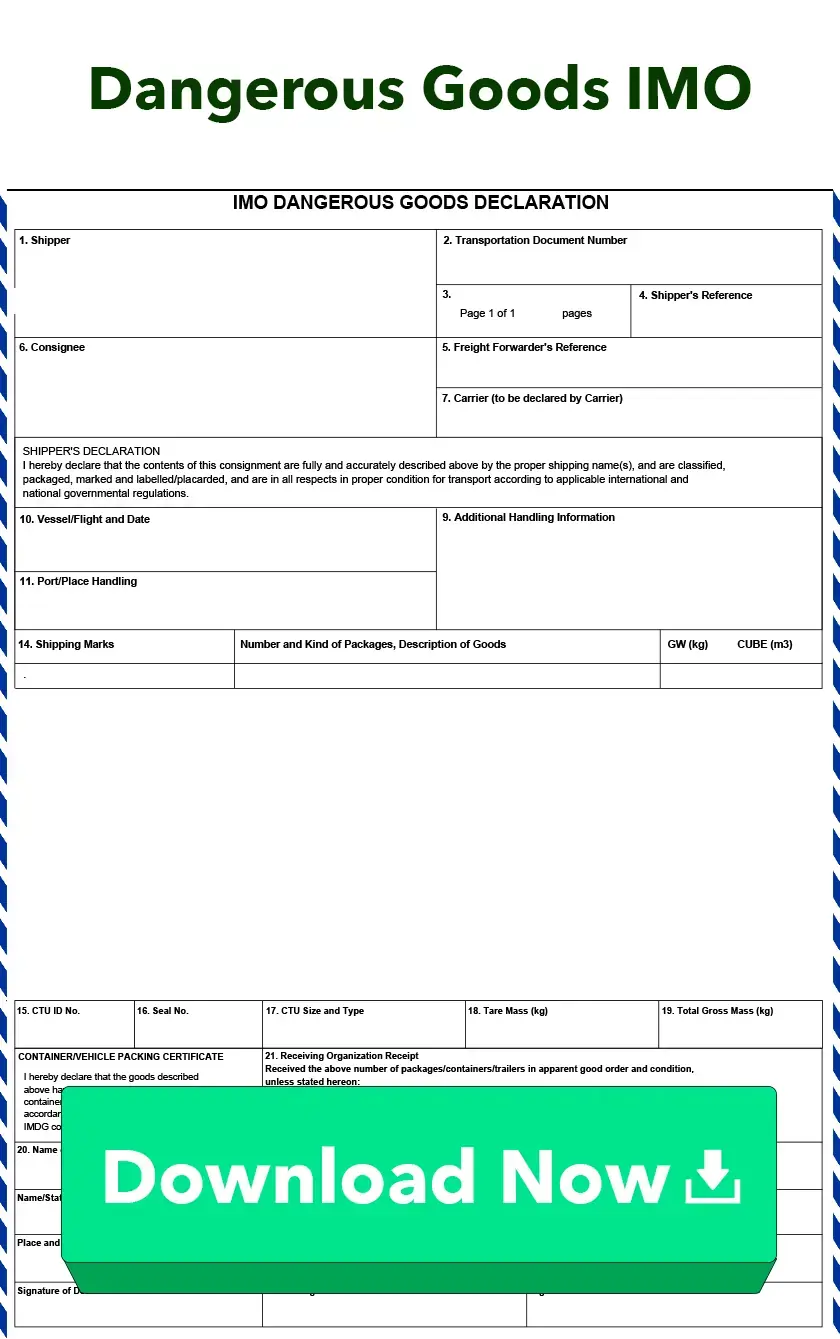

Dangerous Goods Forms

Learn More About Dangerous Goods FormsDangerous Goods (DG) forms are required for transporting dangerous or hazardous items.

Other

Additional forms required for exporting.

-23_101024.webp)

-26_101024.webp)

-13_101024.webp)

-14_101024.webp)

-20_101024.webp)

-24_101024.webp)

-25_101024.webp)

-27_101024.webp)

-28_101024.webp)

-32_101024.webp)

-33_101024.webp)