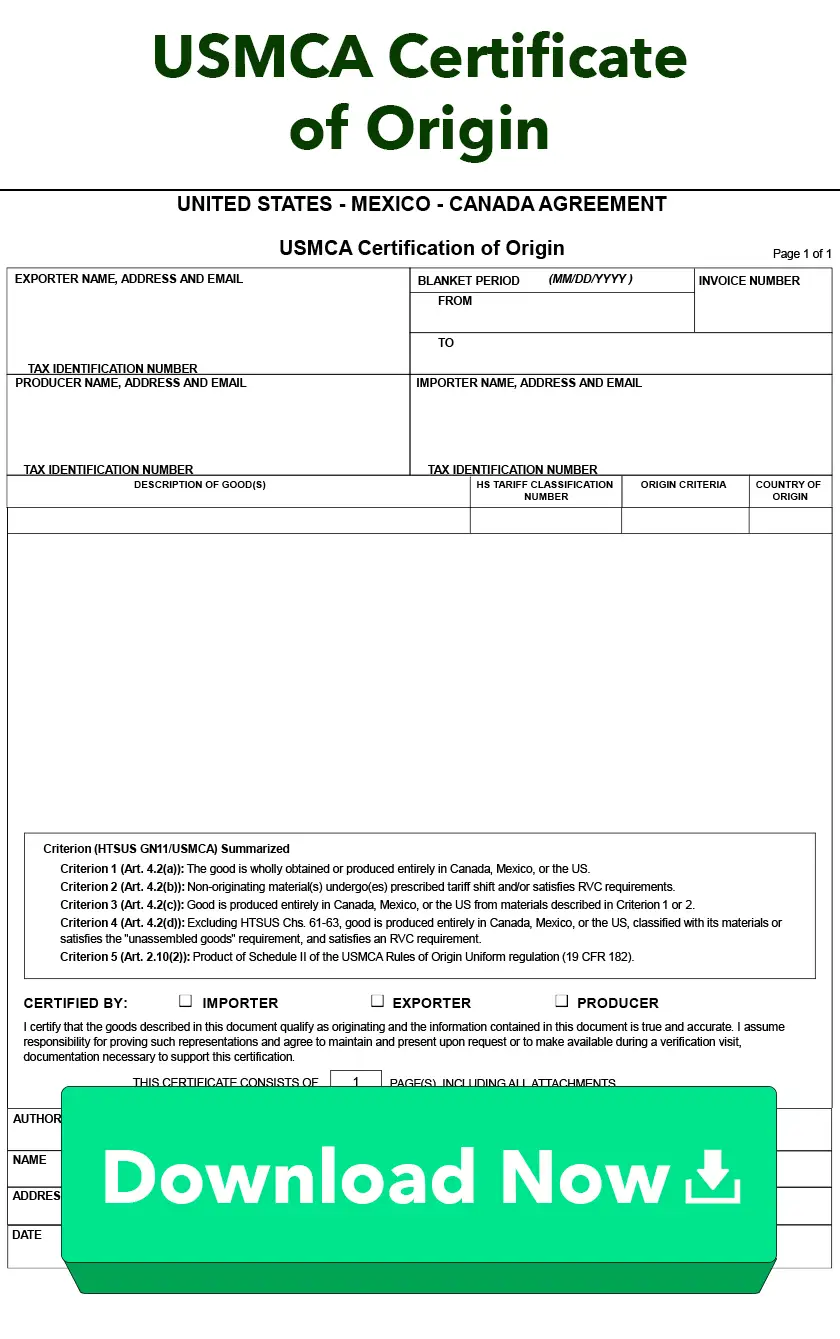

Free Download:

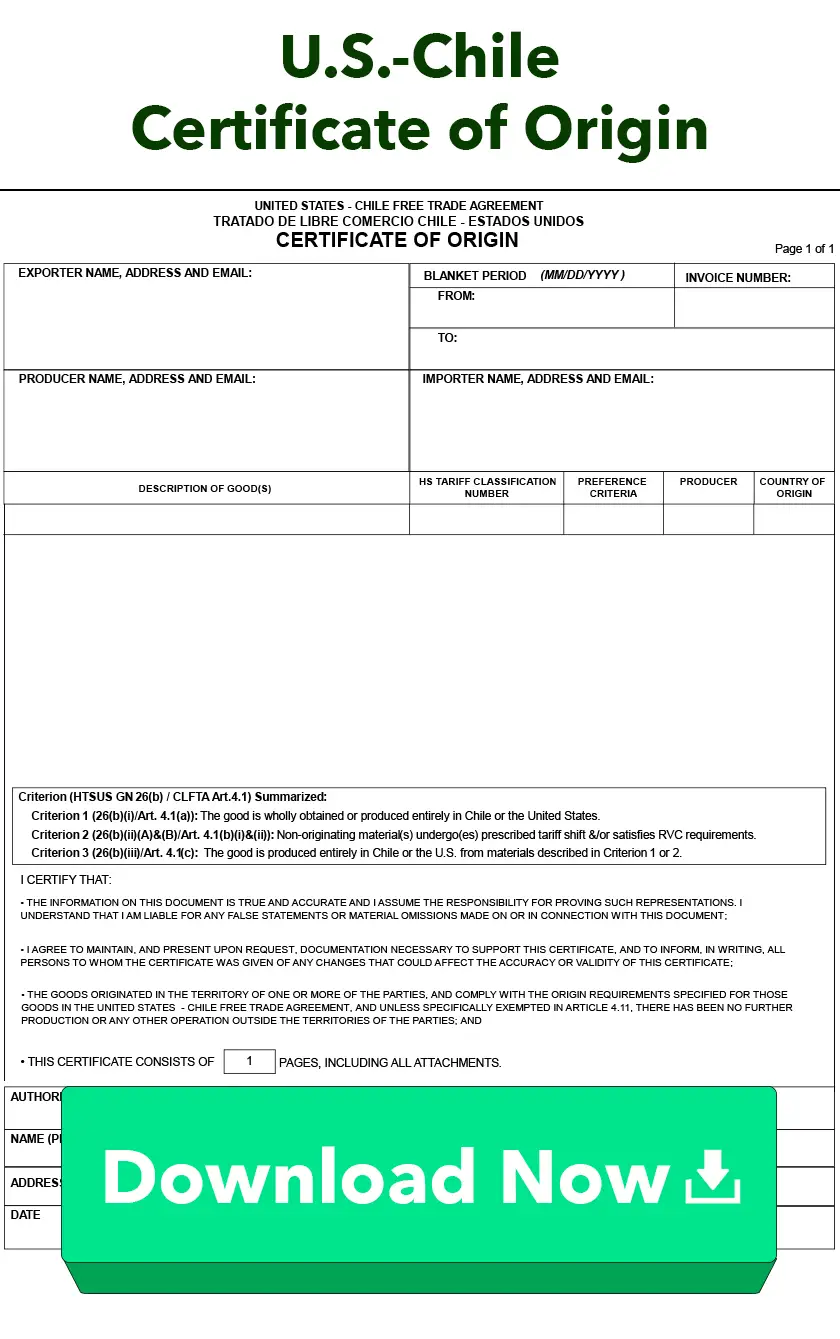

U.S.-Chile Certificate of Origin

Download and print this PDF of the U.S.-Chile Certificate of Origin and help your importer claim preferential duty rates.

What is a U.S.–Chile Certificate of Origin?

The U.S.–Chile Free Trade Agreement went into force in 2004 with 100 percent of products becoming duty free in 2015. Like all of the free trade agreements the U.S. has entered into with other countries, the responsibility for claiming preferential treatment lies with the importer. However, more often than not, the information needed to support the claim will have to be provided by the producer or exporter of the goods.

A certificate of origin can take many forms, such as a statement on company letterhead, a statement on a commercial invoice or a formal certificate of origin. Shipments valued under $2,500 do not require a certificate of origin or other supporting information of a preferential claim unless the customs authority suspects a claim is fraudulent.

If you generate a certificate of origin for the importer, you should maintain it for a period of at least five years after the date the certificate was issued along with all records and supporting documents related to the origin of the goods.

A Chile Certificate of Origin Should Include:

- The name and contact information for the exporter, importer and producer of the goods.

- A description of the goods, including the six-digit Harmonized System or Schedule B code.

- The preference criteria used to qualify goods under the FTA.

- If you are the producer of the goods.

- If you used the Net Cost accounting method to determine the origin of the goods.

- The country of origin of the goods.

- The signature and contact information of the person certifying that the goods qualify under the Chile FTA.

Create Accurate Export Forms

Reduce the time it takes to complete the U.S. - Chile Certificate of Origin by up to 80%. Shipping Solutions export documentation software makes it easy to create more than two dozen standard export forms. Register now for a free demo. There's absolutely no obligation.

U.S.-Chile Certificate of Origin FAQs

-

Is a certificate of origin required for Chile?

Shipments valued at more than $2,500 require a certificate of origin or other supporting information to claim preferential treatment. The certificate available to download on this page includes all of the required information.

-

Does the U.S. have a trade agreement with Chile?

Yes, the U.S.-Chile Free Trade Agreement went into force in 2004 with 100% of products becoming duty free in 2015.

-

How do I obtain a U.S.-Chile certificate of origin?

The responsibility for claiming preferential treatment lies with the importer. But often the information needed to support the claim will have to be provided by the producer or exporter of the goods. Download the certificate of origin on this page to ensure the required information has been provided.

Download Now

Today is your lucky day. Shipping Solutions® makes completing export forms simple, accurate and five-times faster than the tedious way you’re doing it now.

Get it done easily.

Eliminate the hassle of manually completing your export forms. Our EZ Start Screen helps you automatically complete more than a dozen export forms.

Get it done fast.

With Shipping Solutions automation, you can complete your export documents up to five-times faster than your traditional manual process.

Get it done right.

Instead of entering the same information over and over again, you enter information in only one place. That makes you less likely to make costly mistakes.

Export Form Templates

Popular

Our most frequently requested export forms.

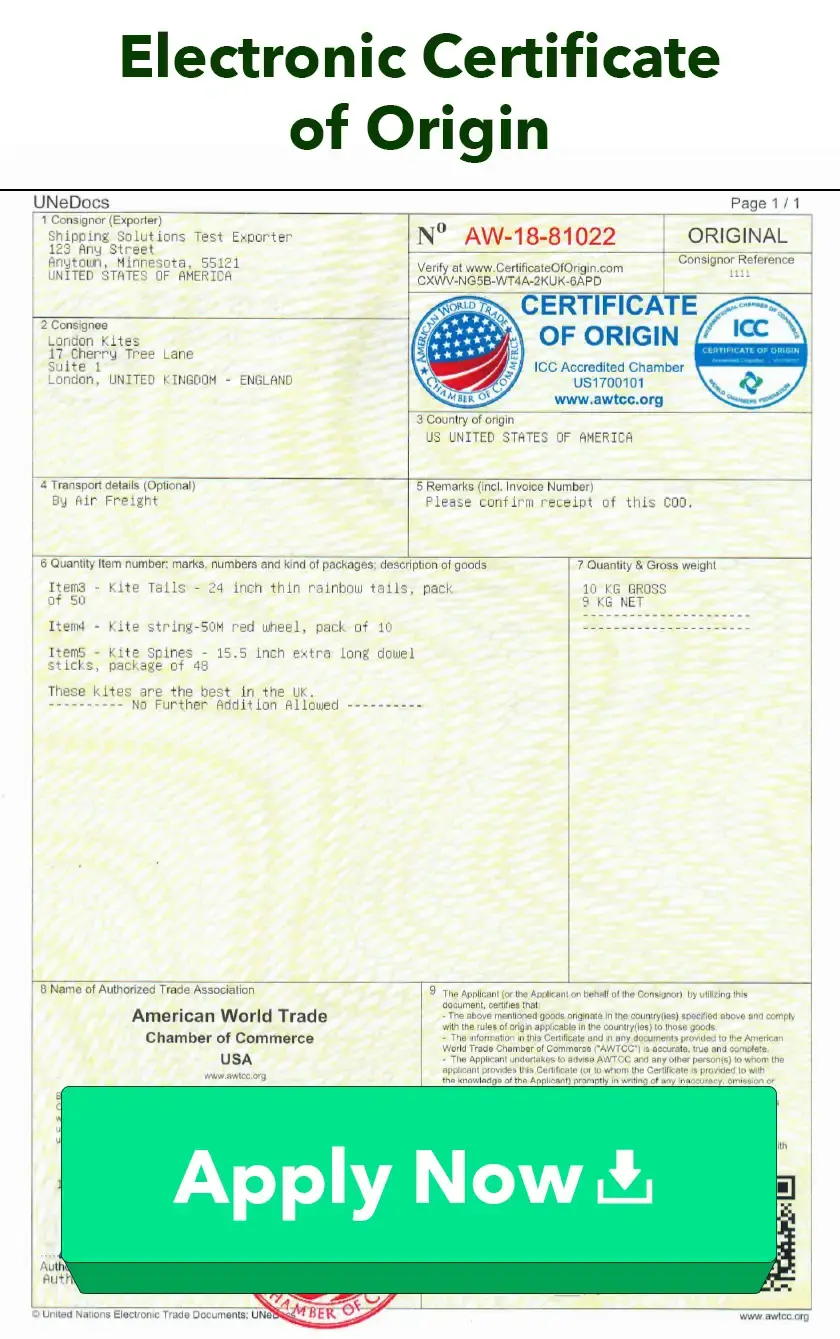

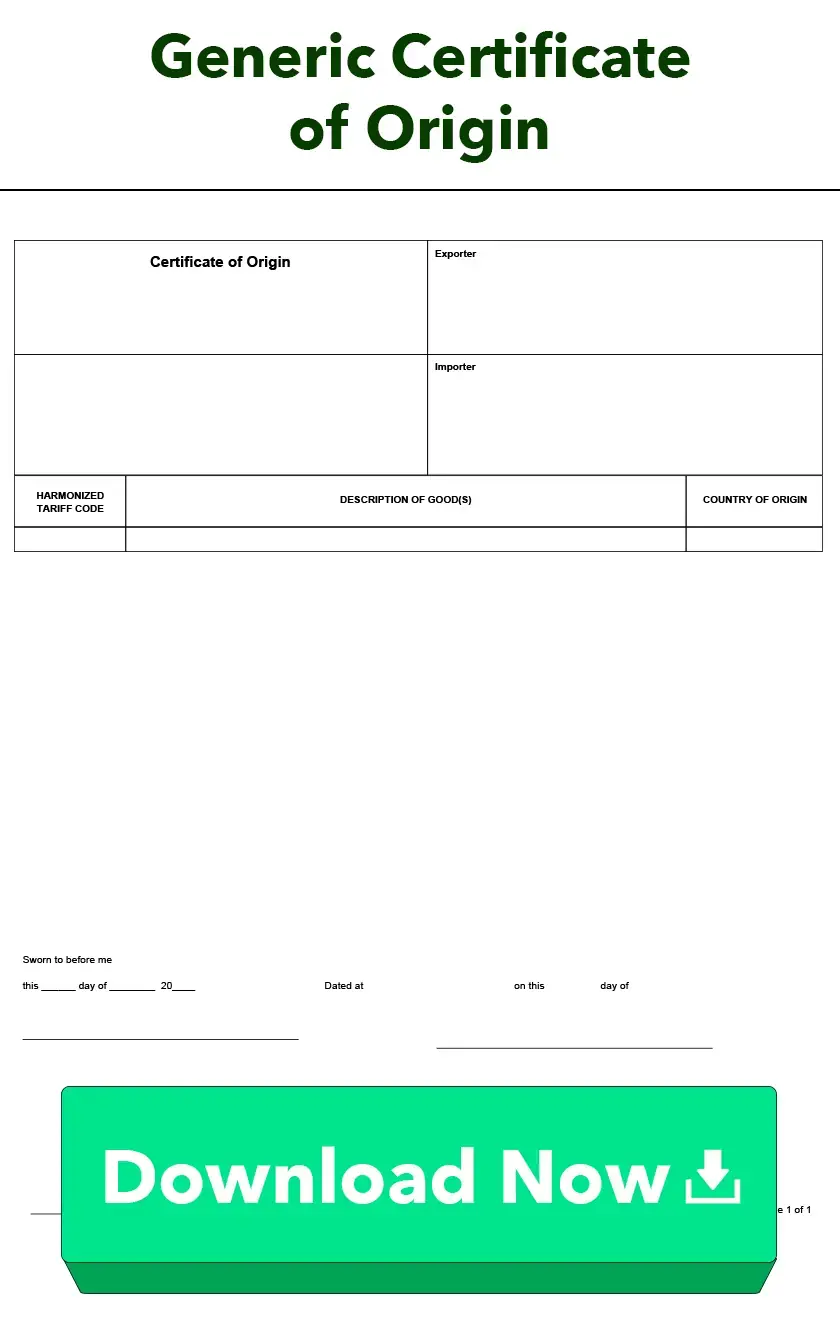

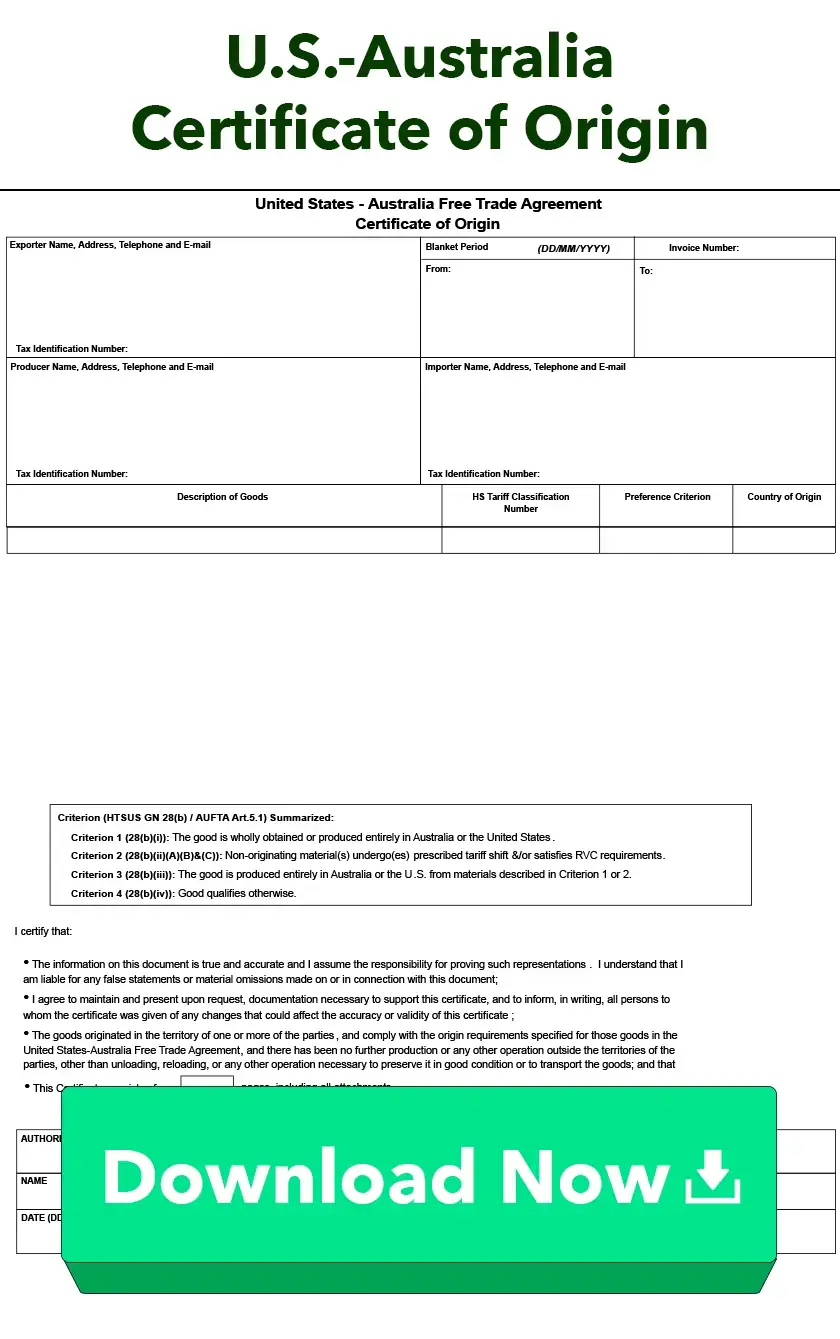

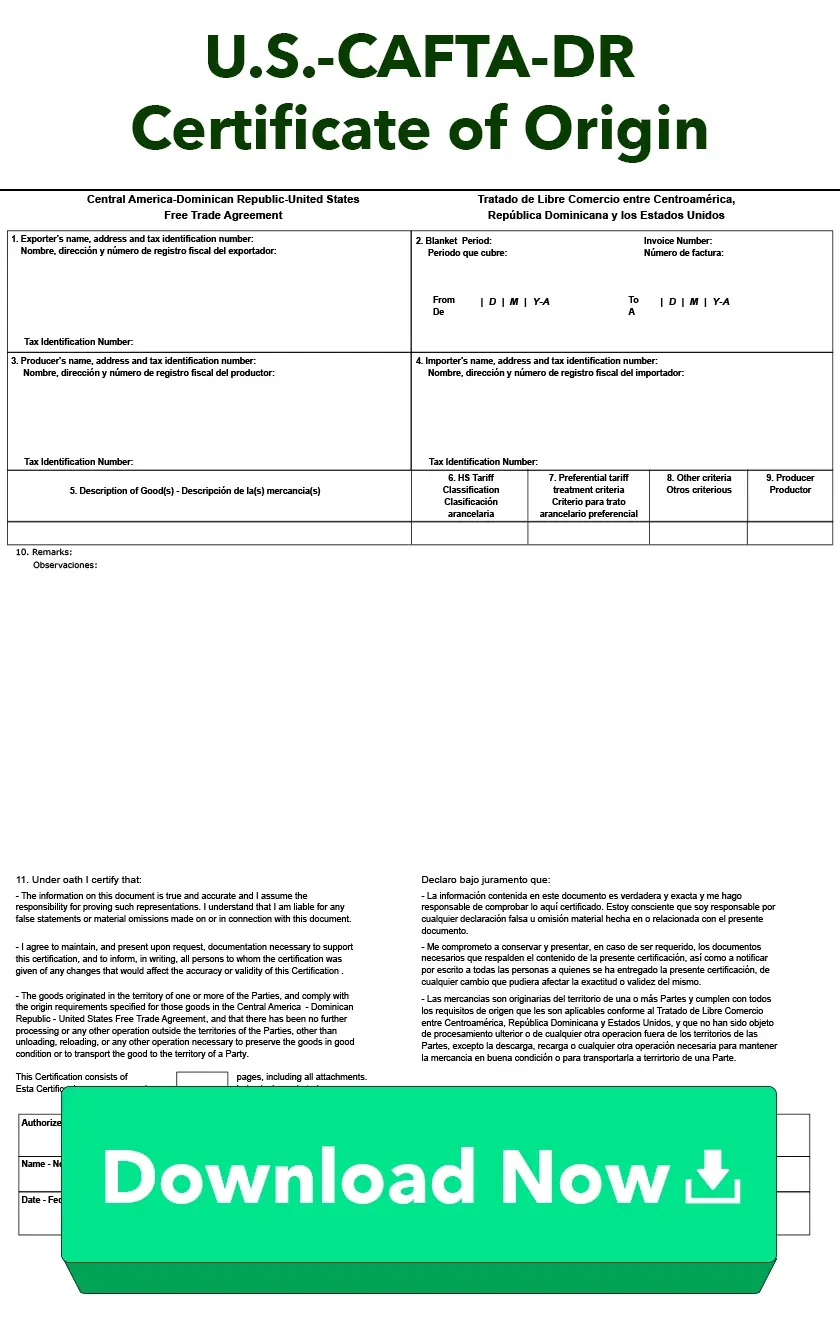

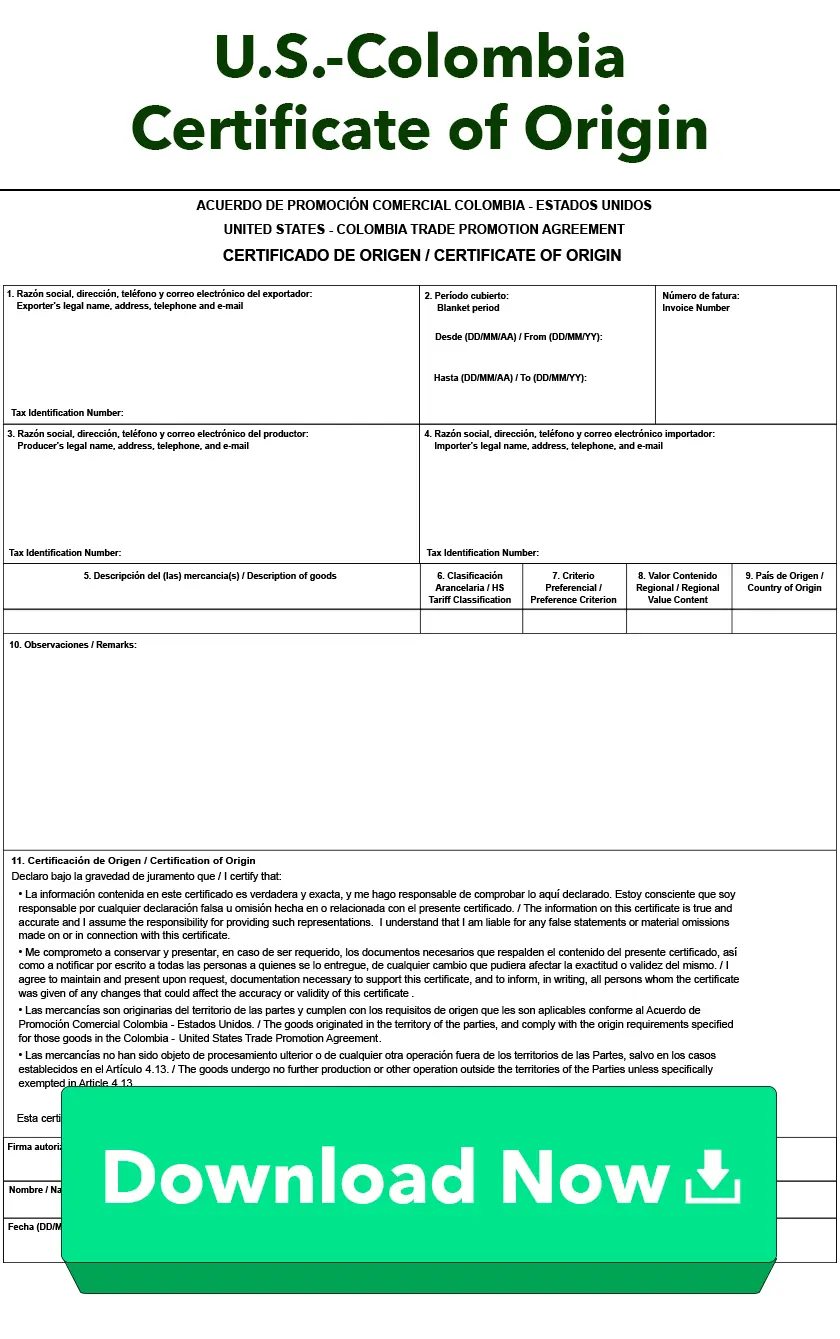

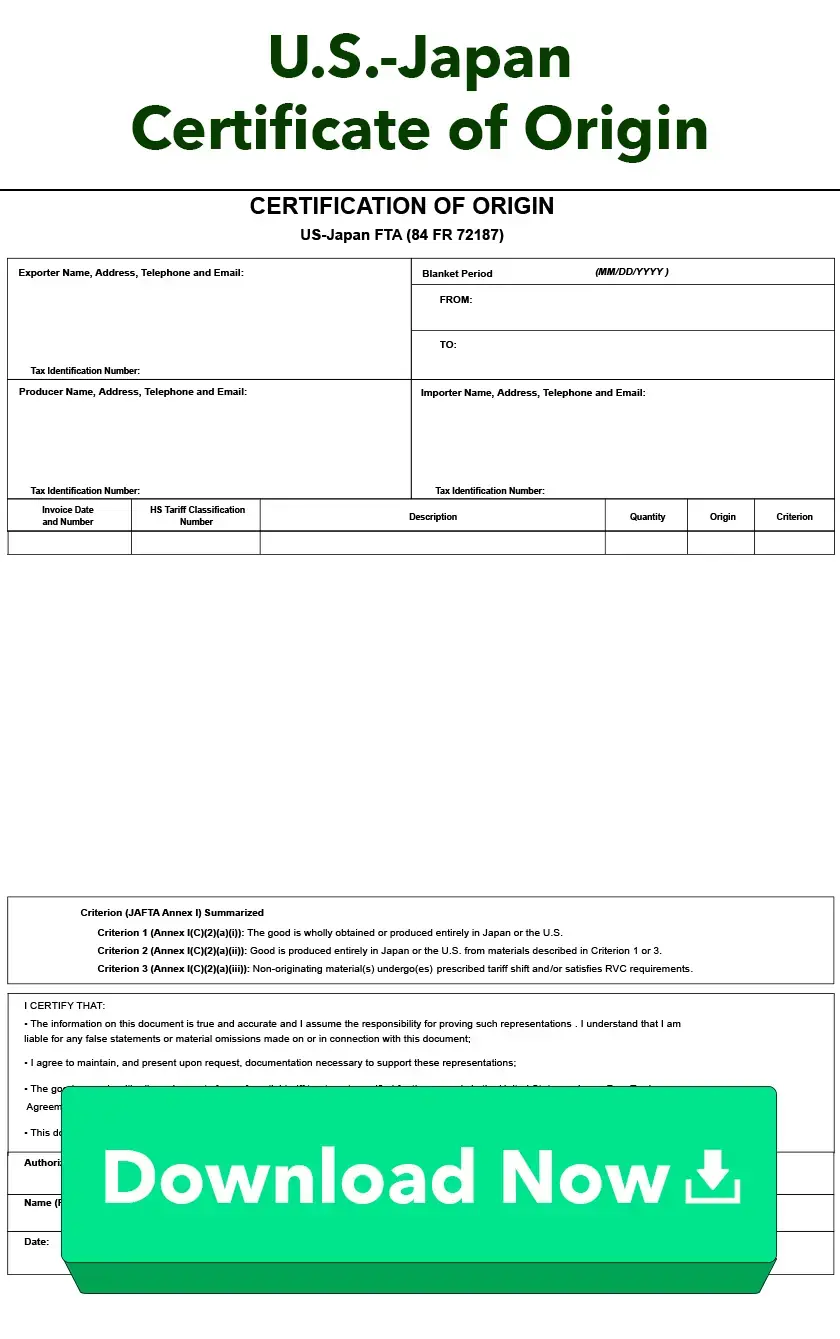

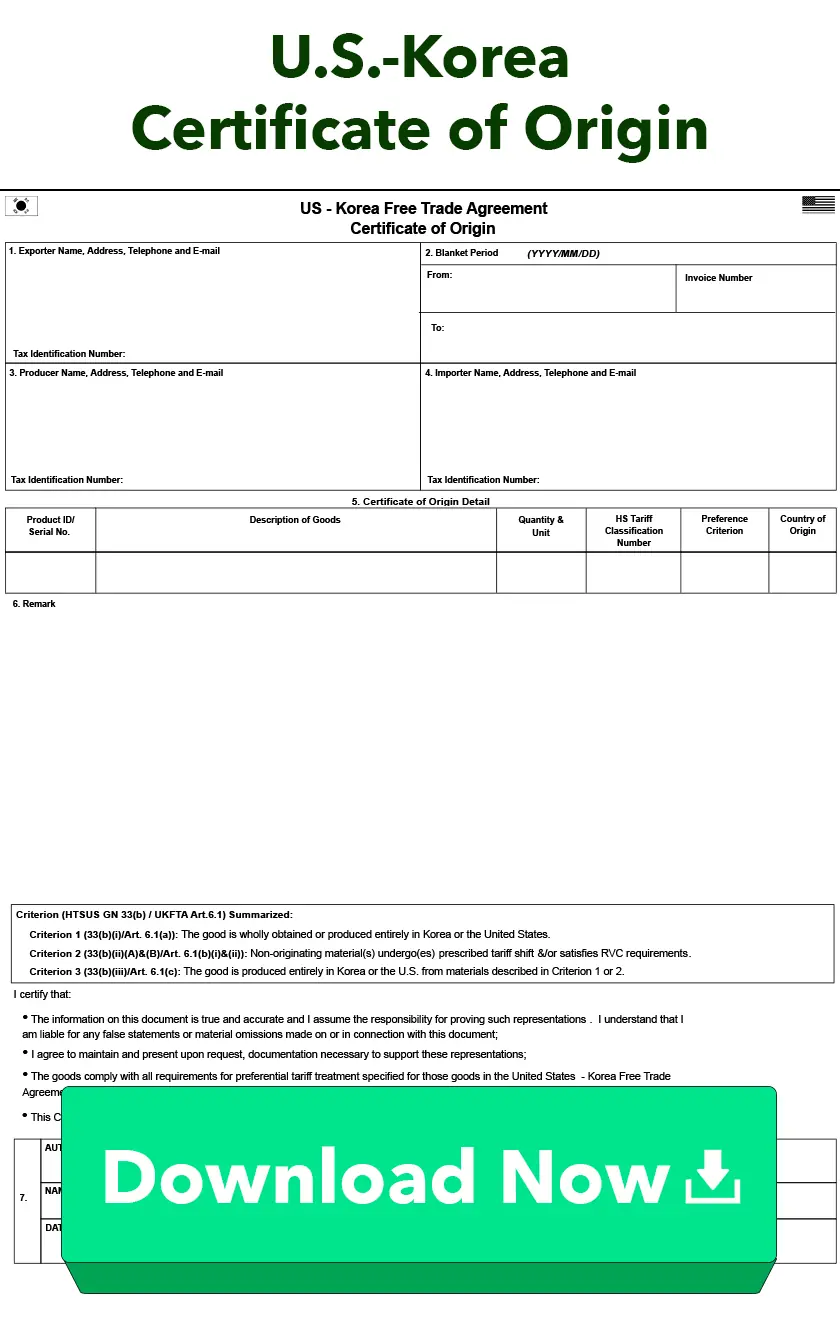

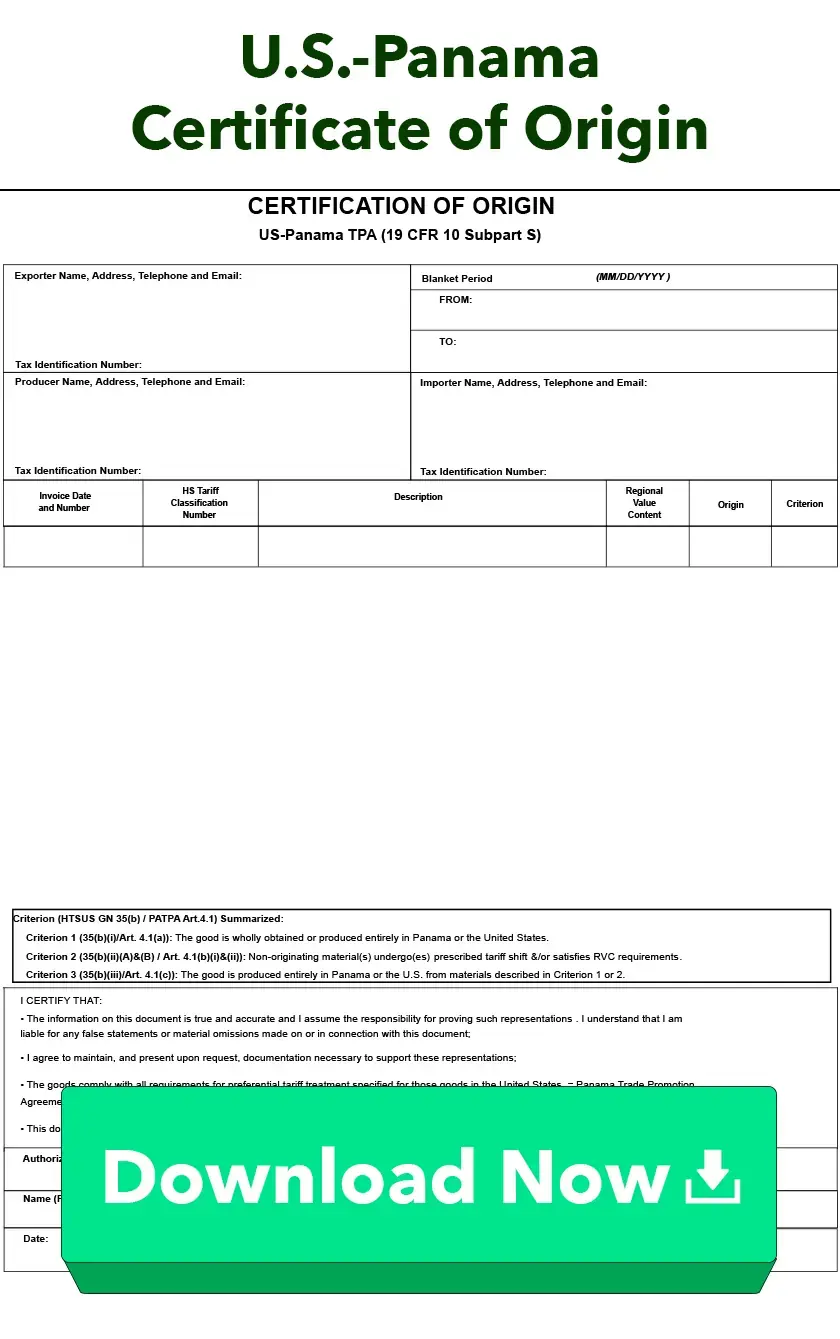

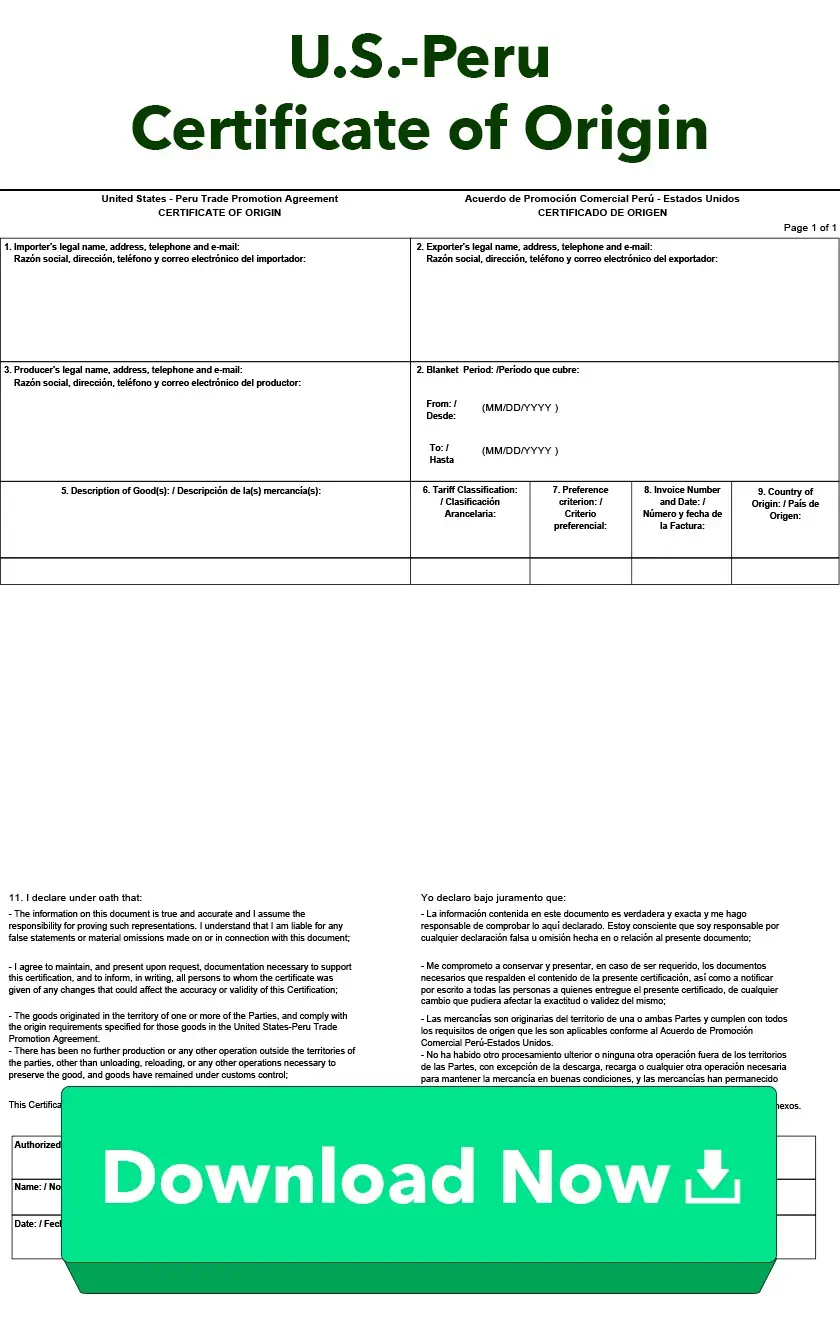

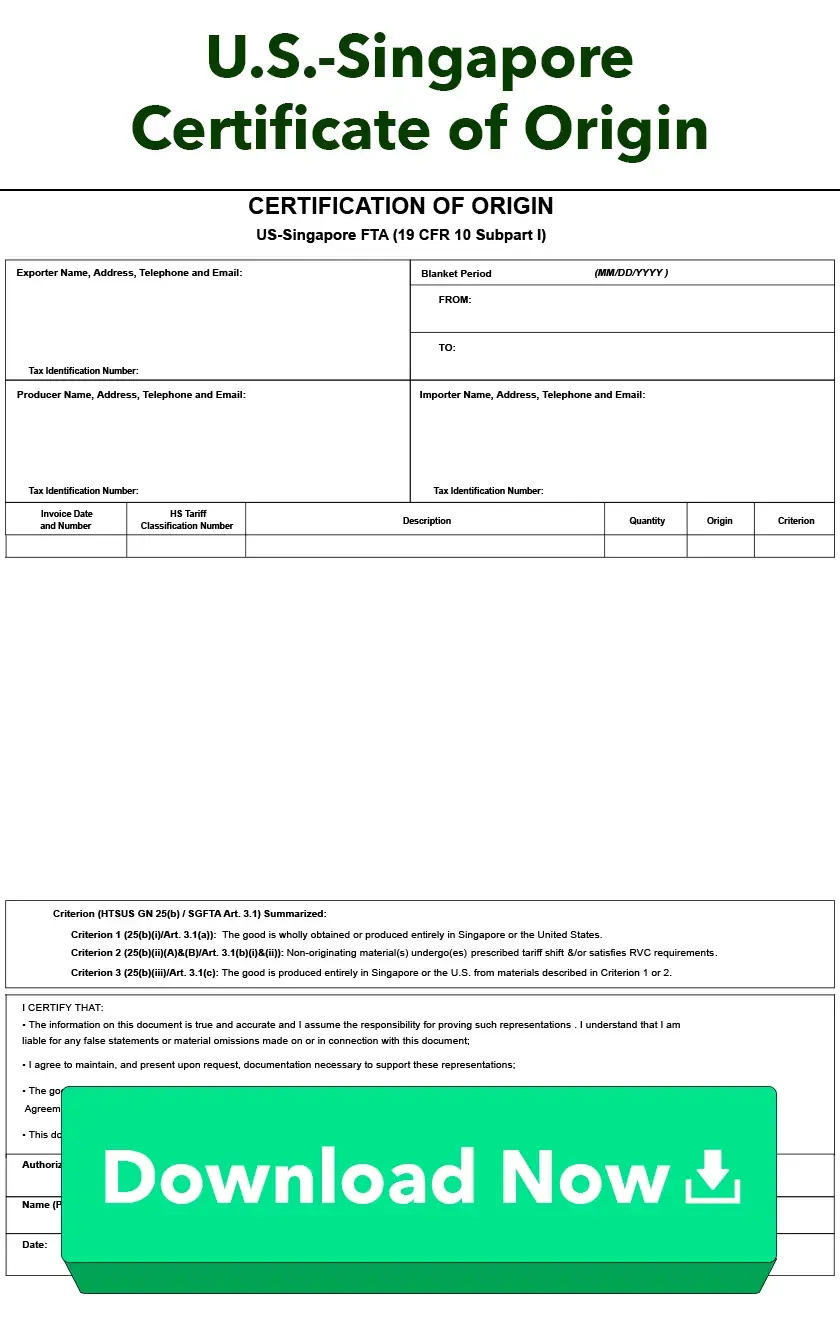

U.S. Certificates of Origin

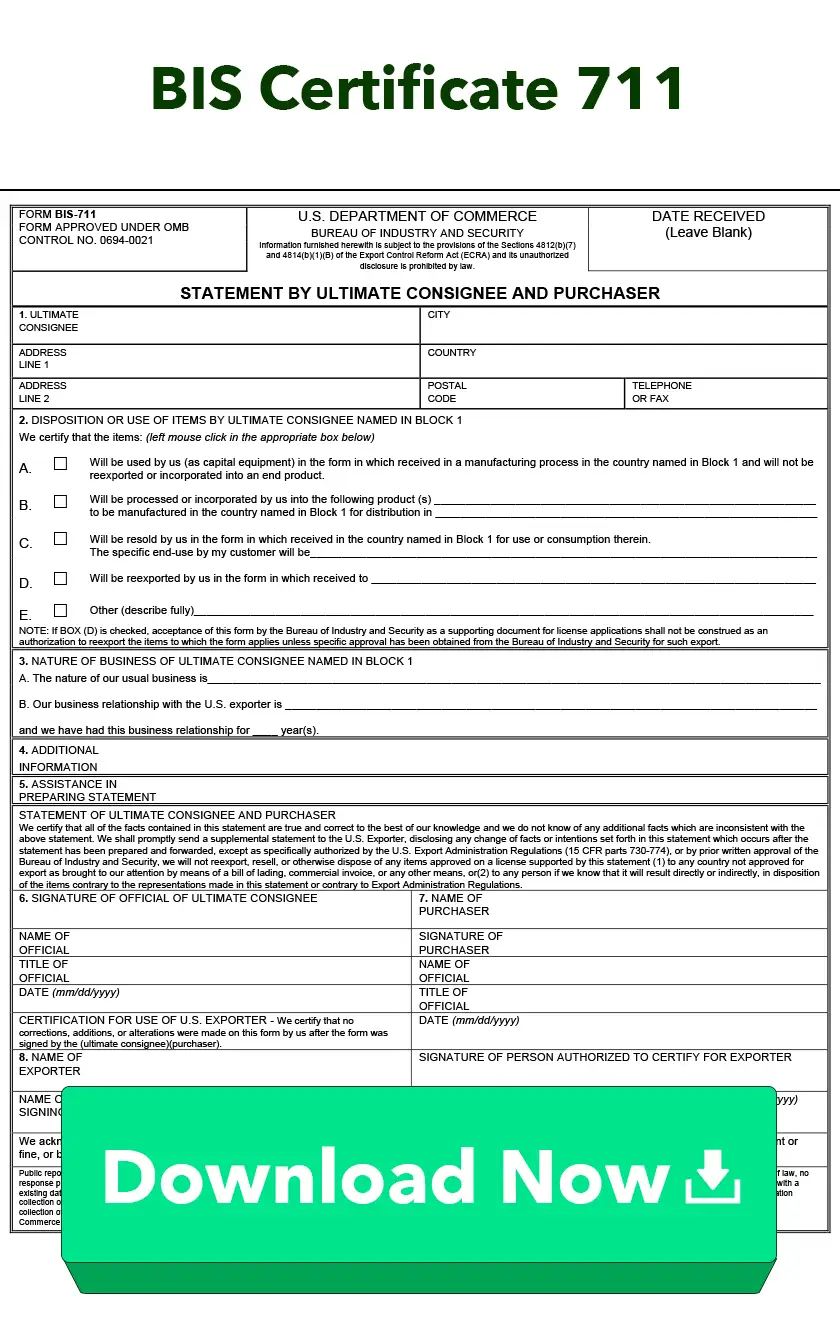

Learn More About U.S. Certificates of OriginThese forms certify the origin of the goods, which may determine the amount of duty to be paid.

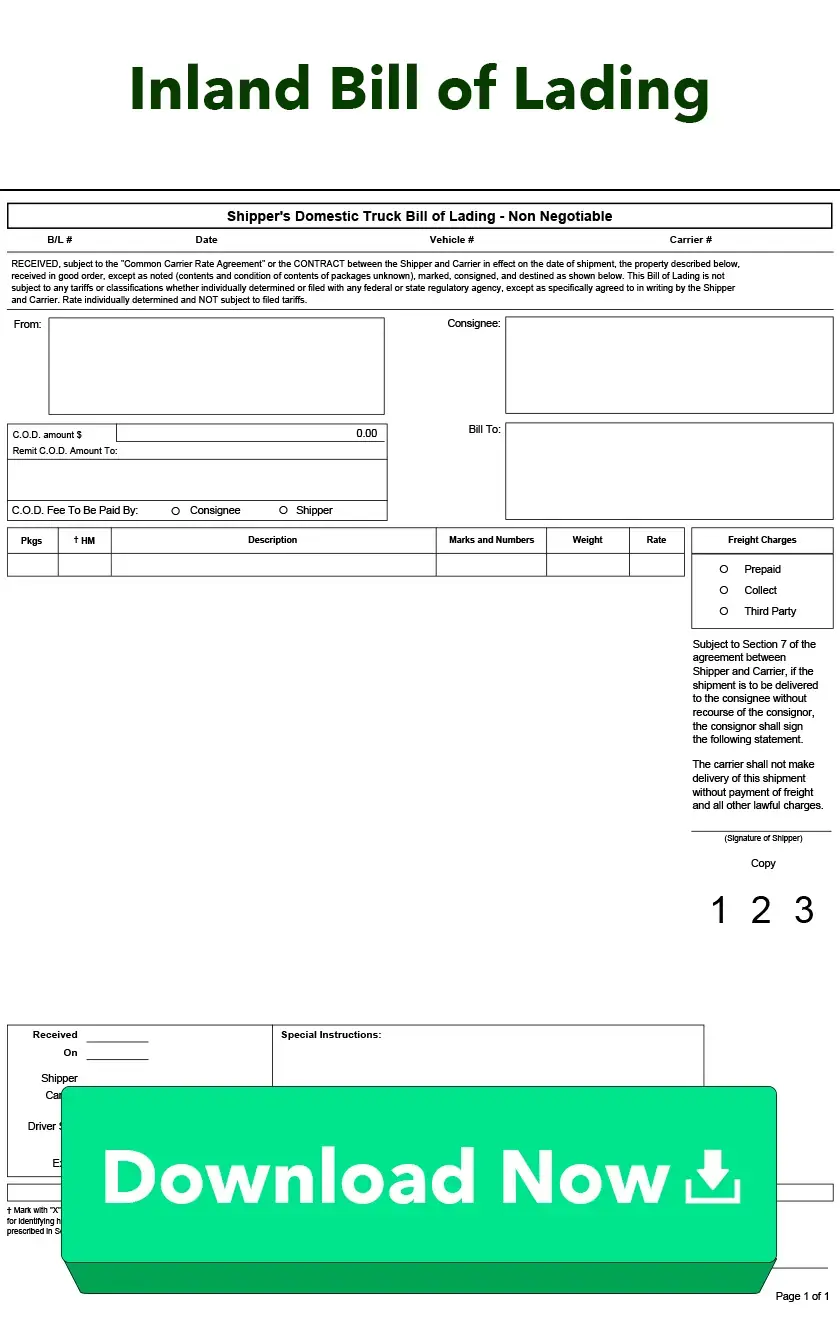

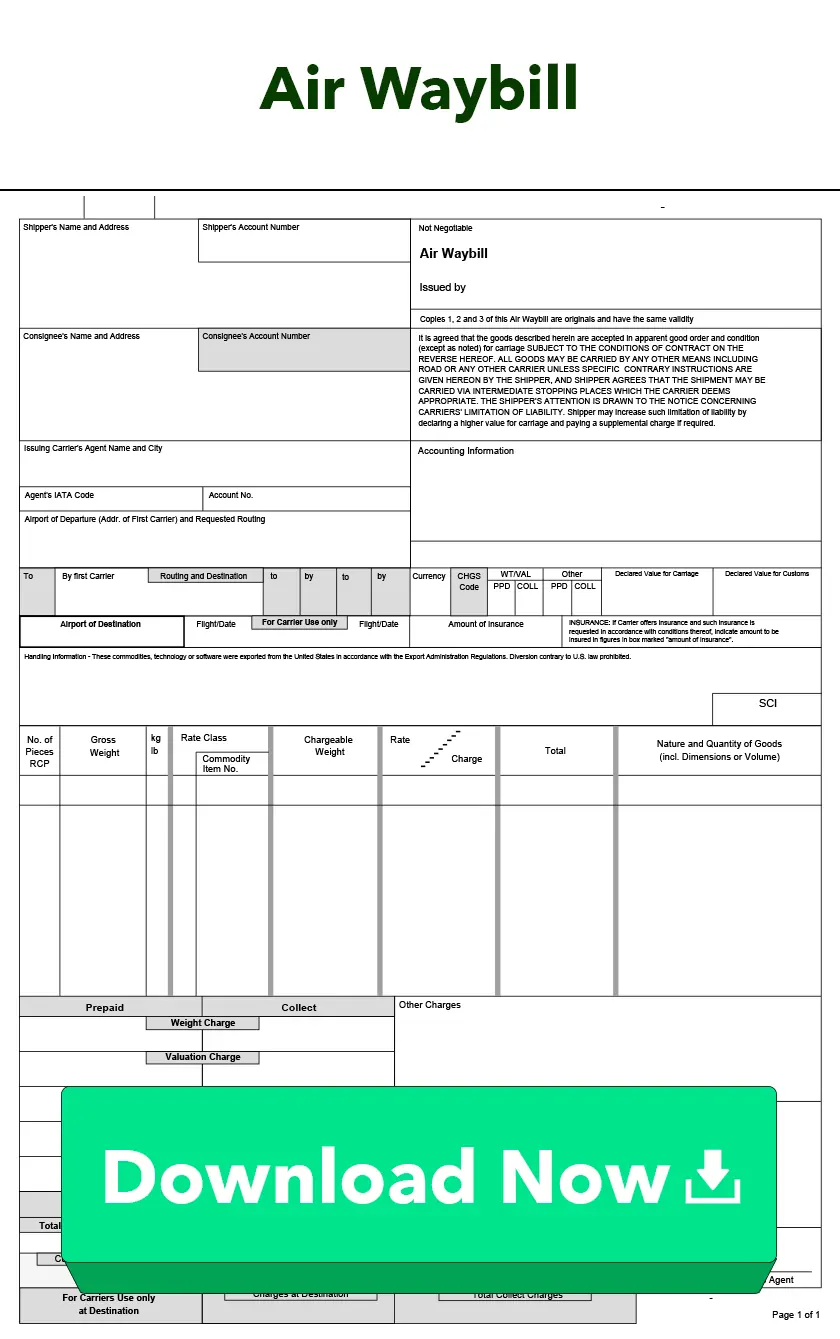

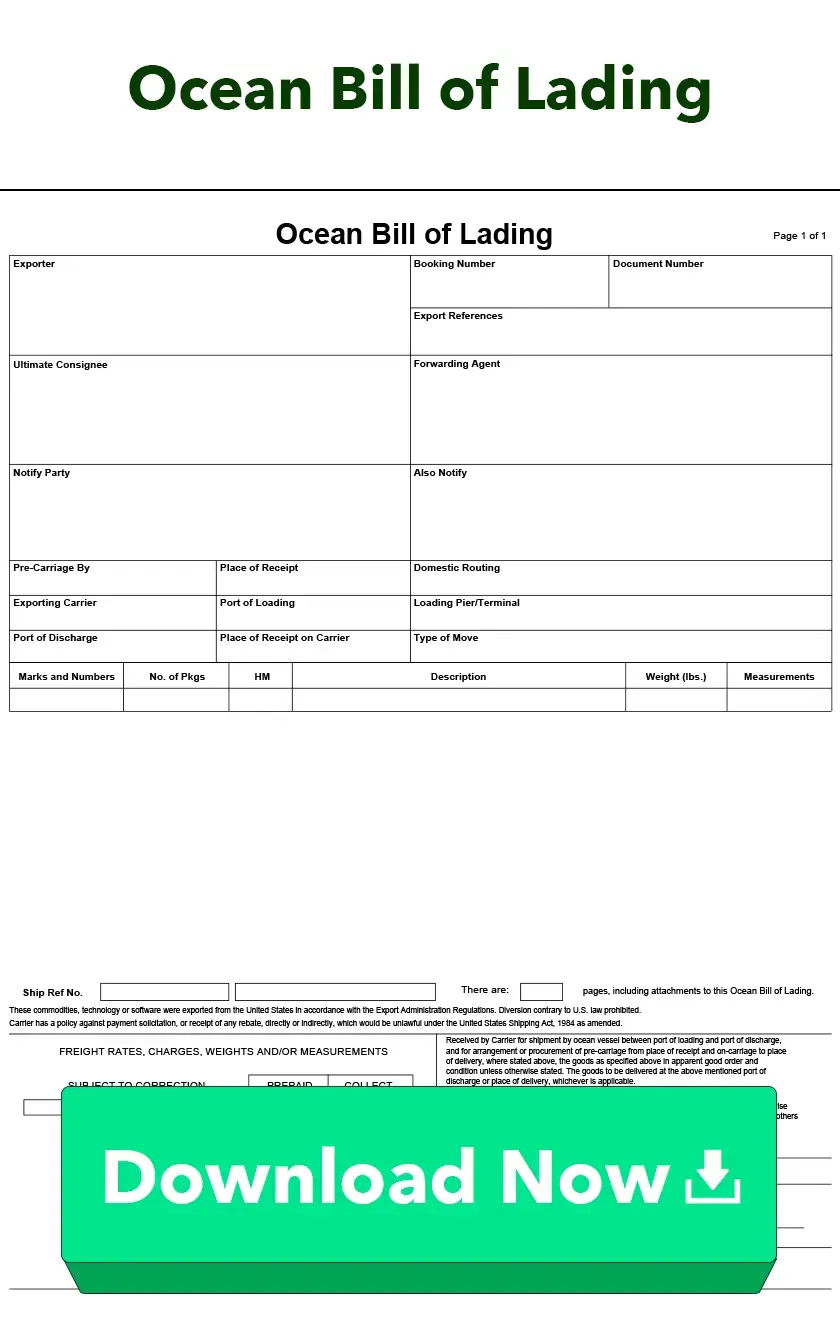

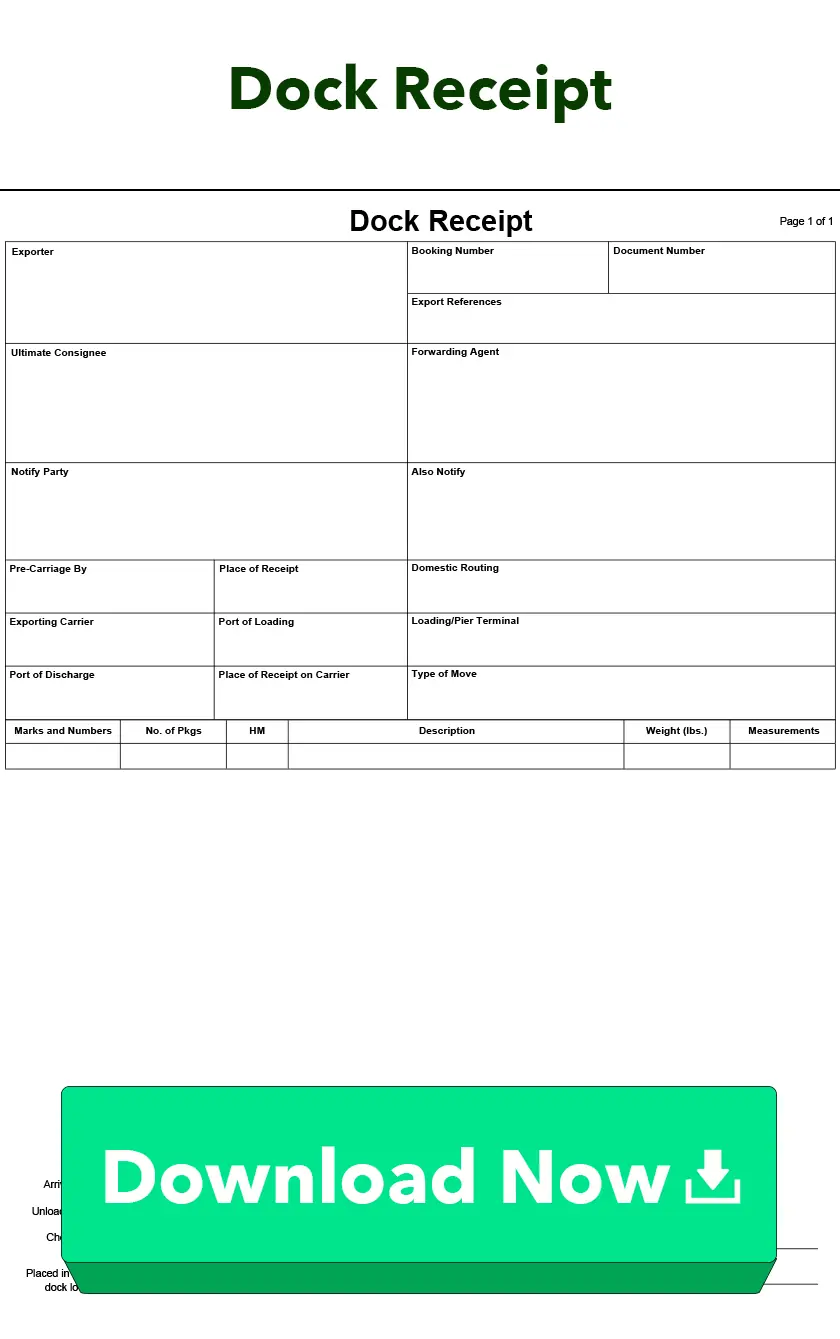

Bills of Lading

Learn More About Bills of LadingA bill of lading is a contract of carriage, a receipt from the carrier, and may be a document of title.

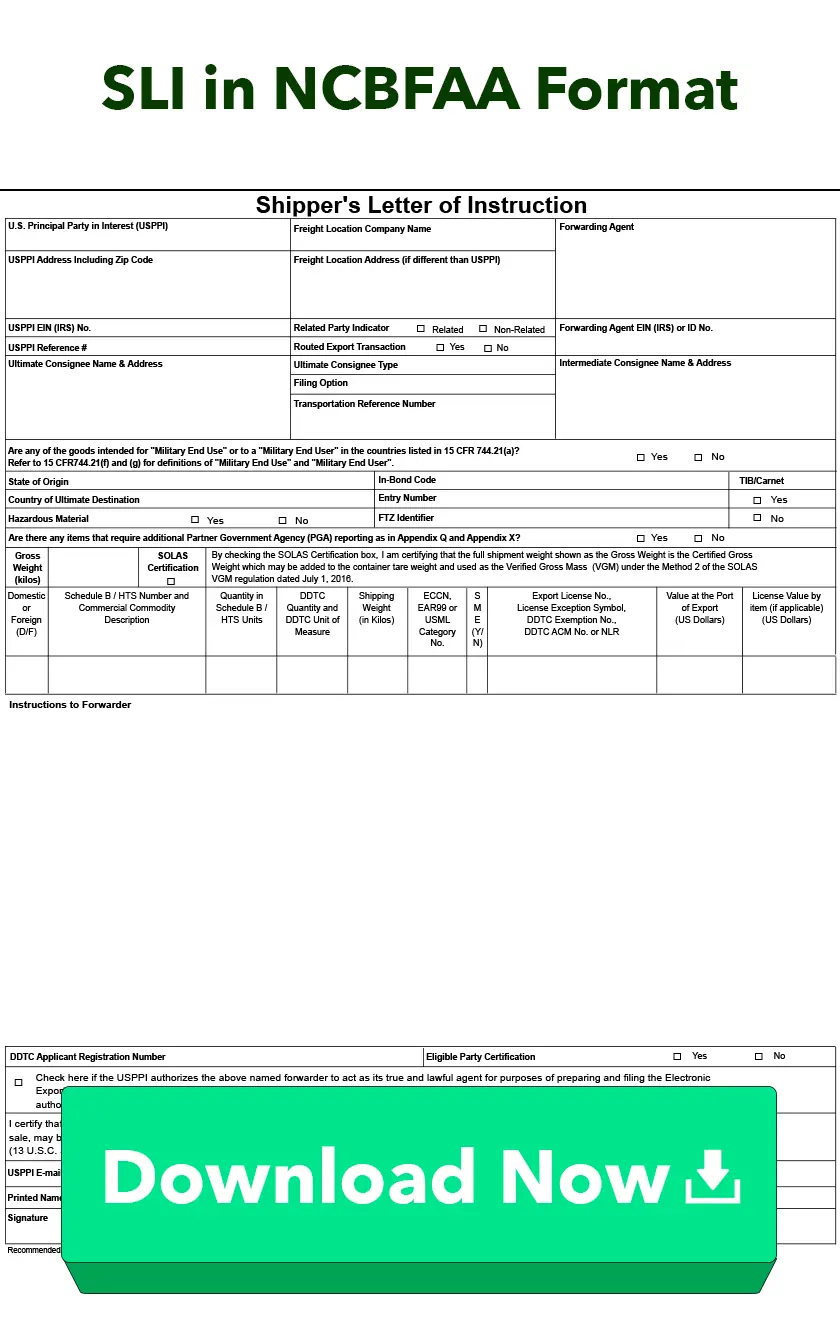

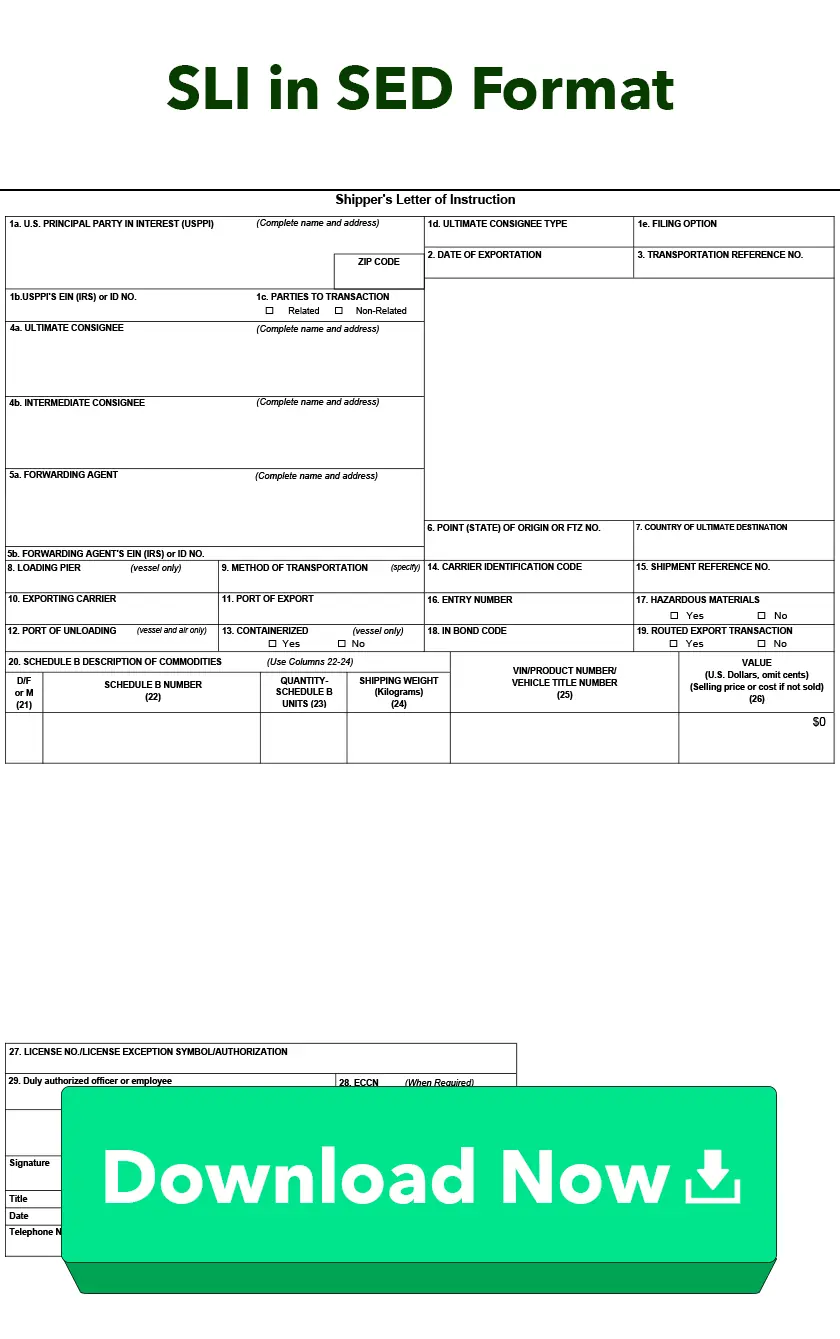

Shipper's Letter of Instruction (SLI)

Learn More About Shipper's Letter of Instruction (SLI)The Shipper's Letter of Instruction (SLI) conveys instructions from the exporter to the carrier or forwarder.

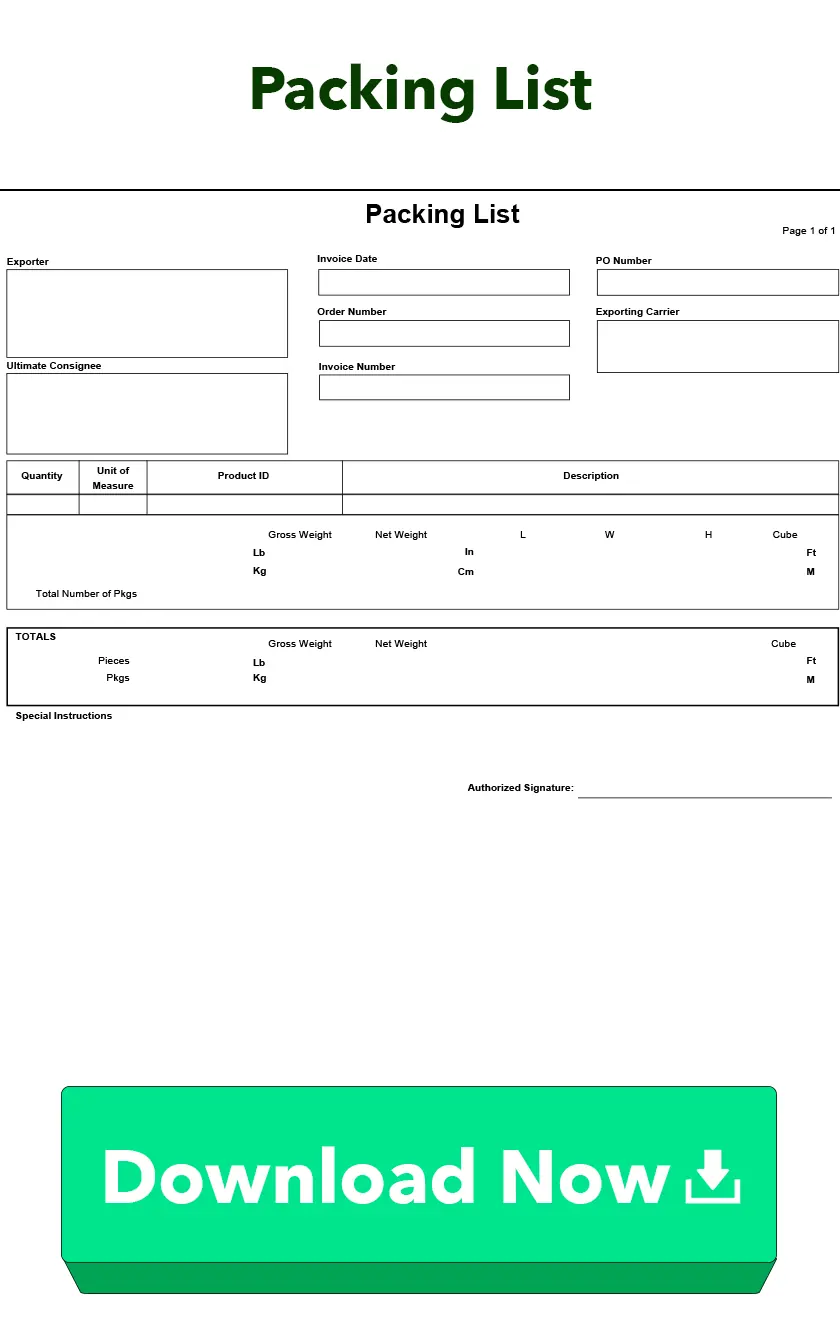

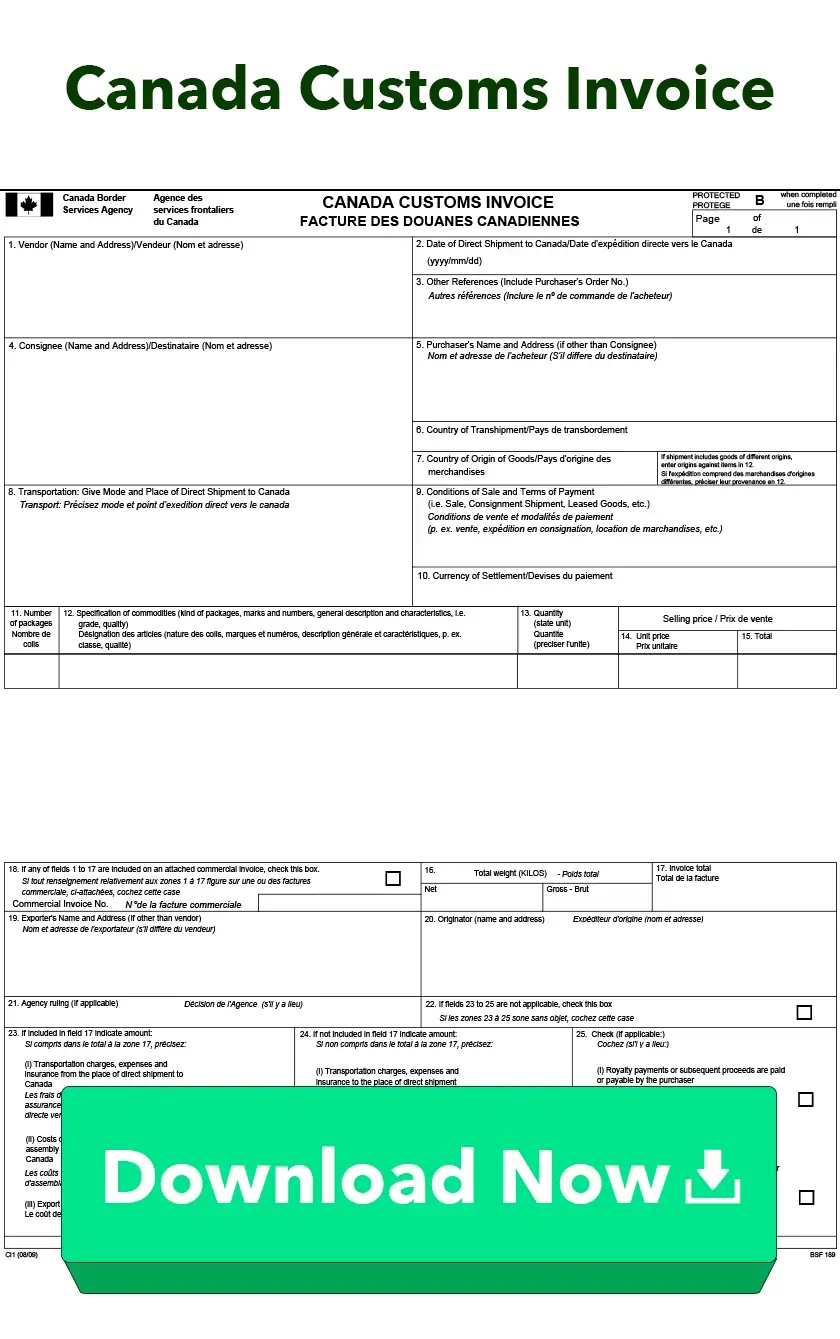

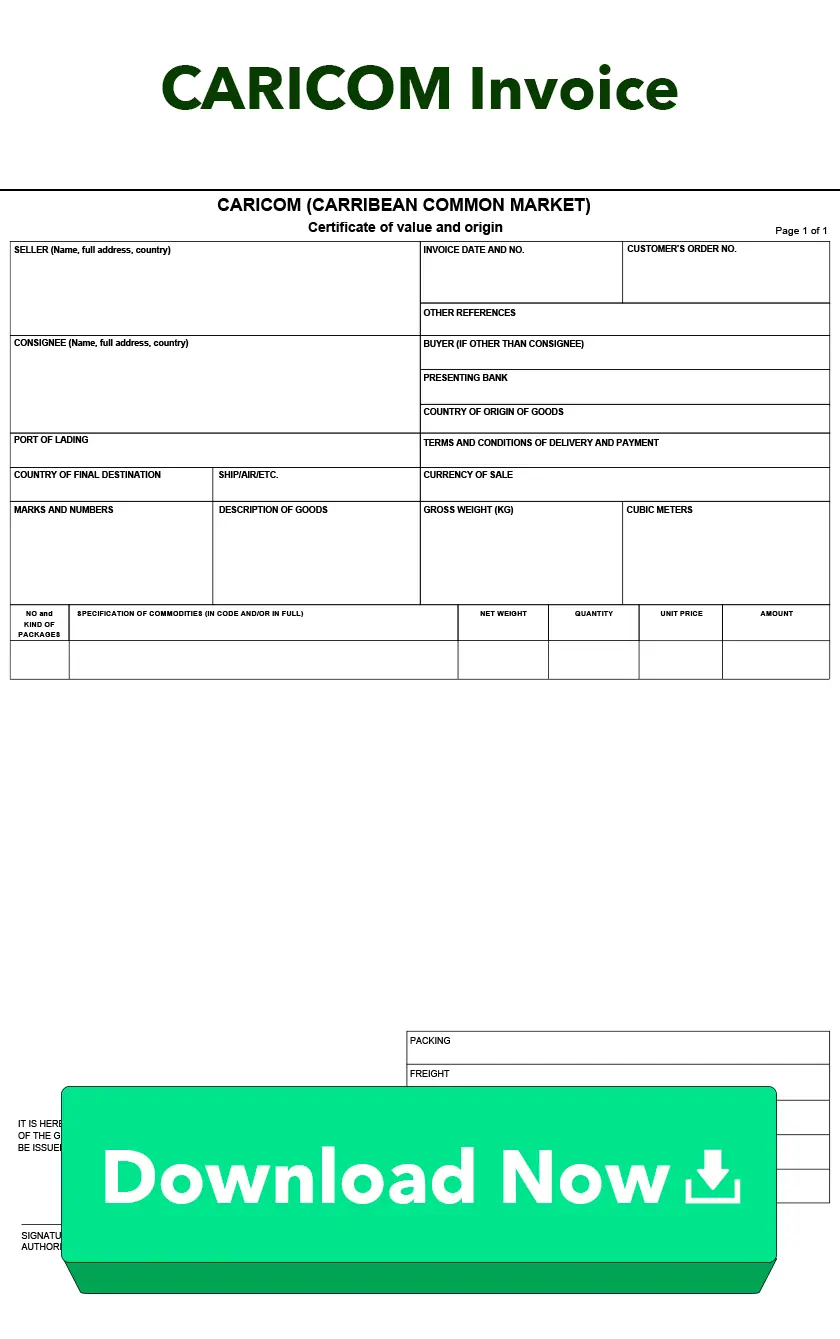

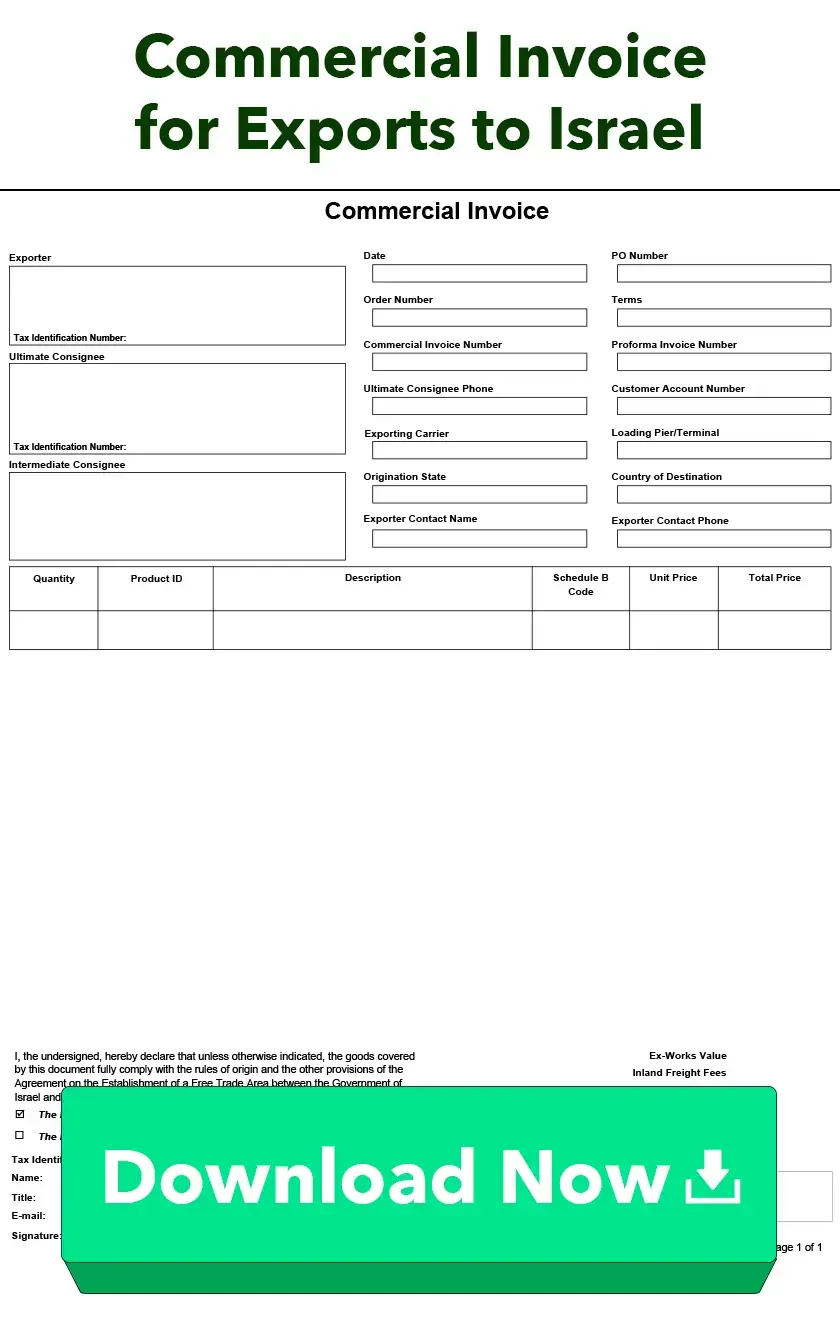

Invoices

Learn More About InvoicesInvoices are one of the most important export documents describing everything included in the shipment and its cost.

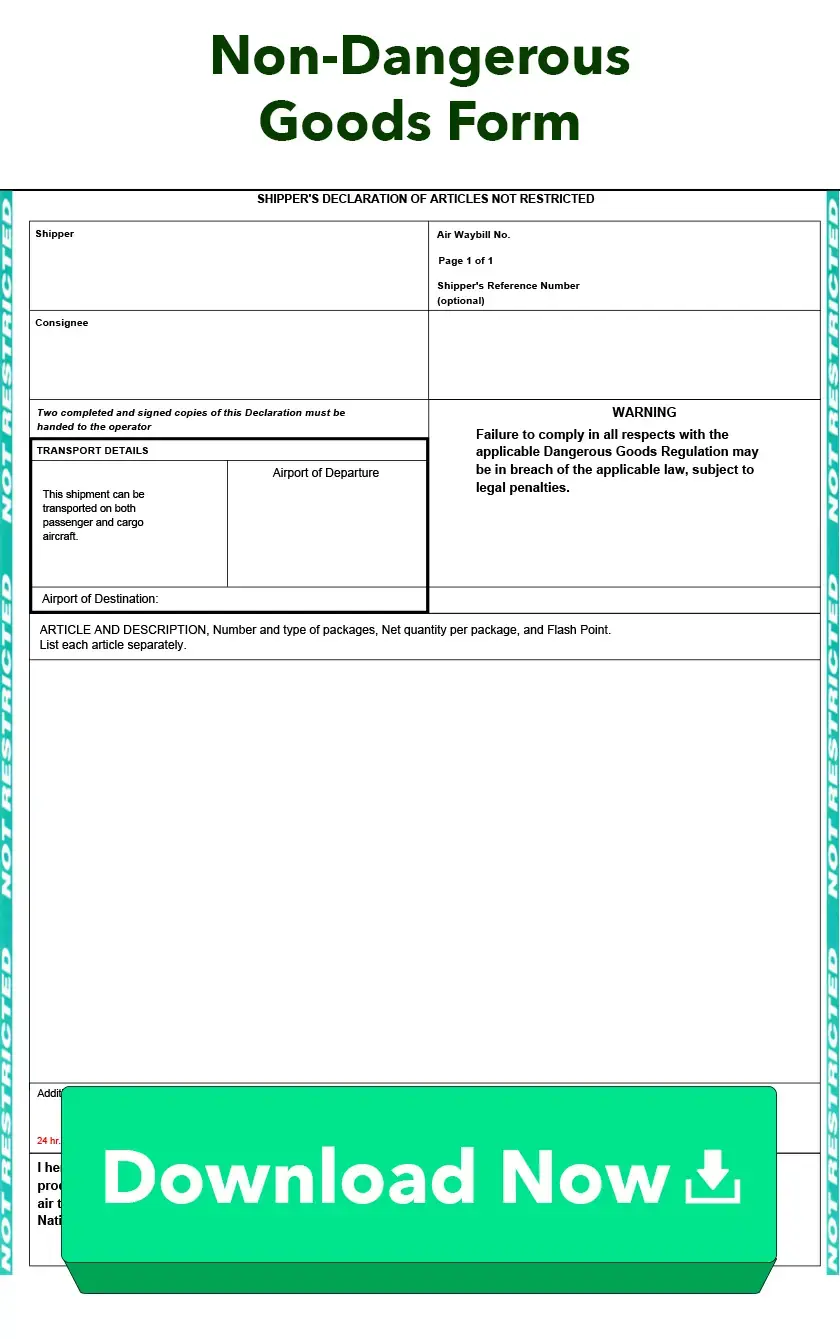

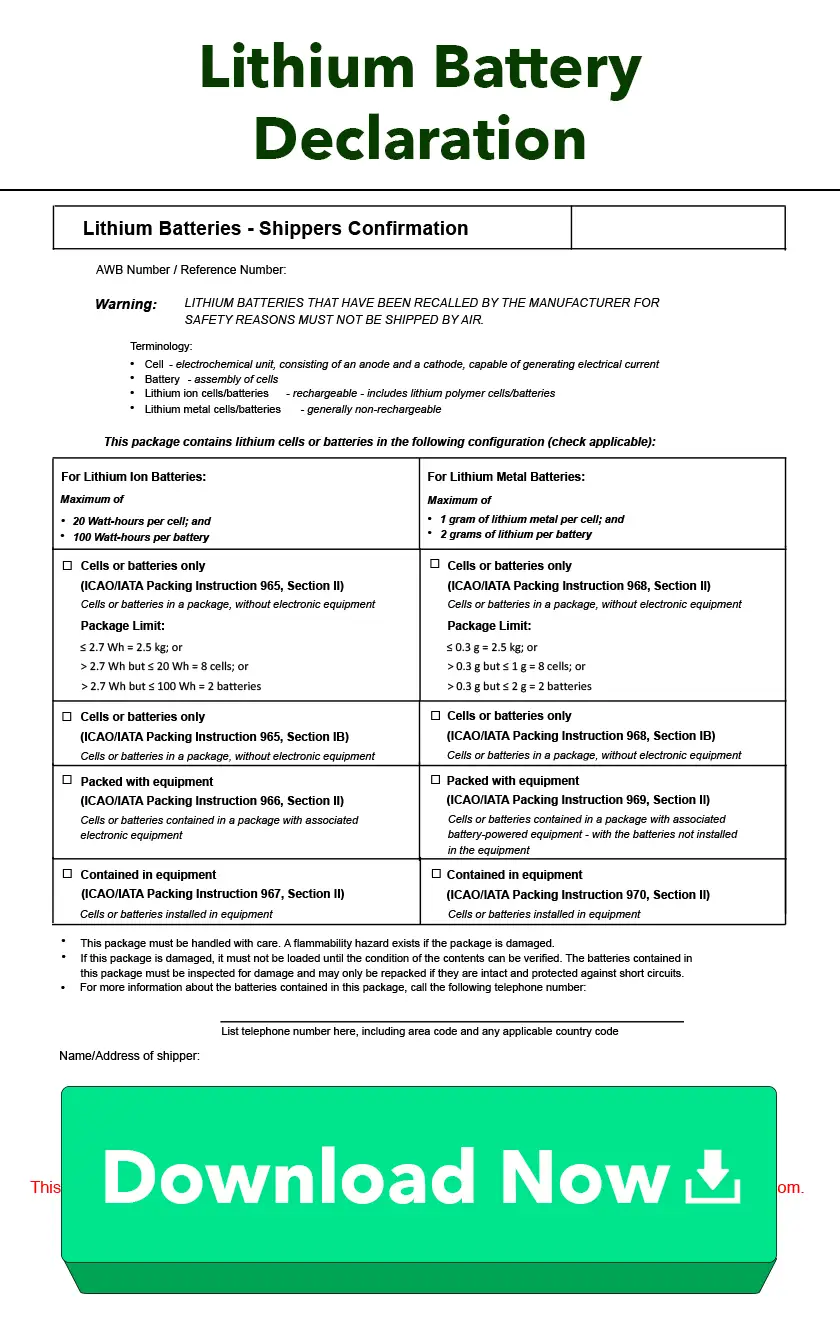

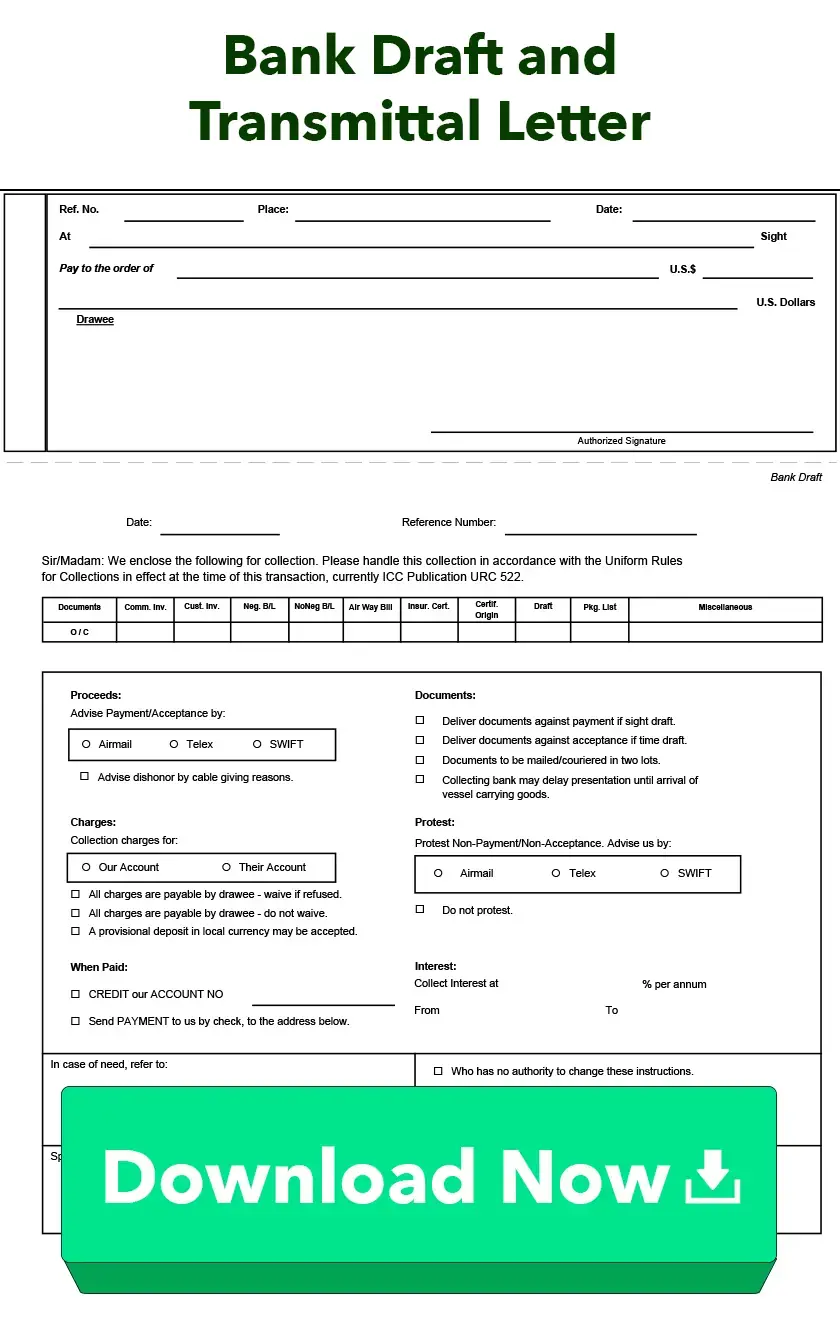

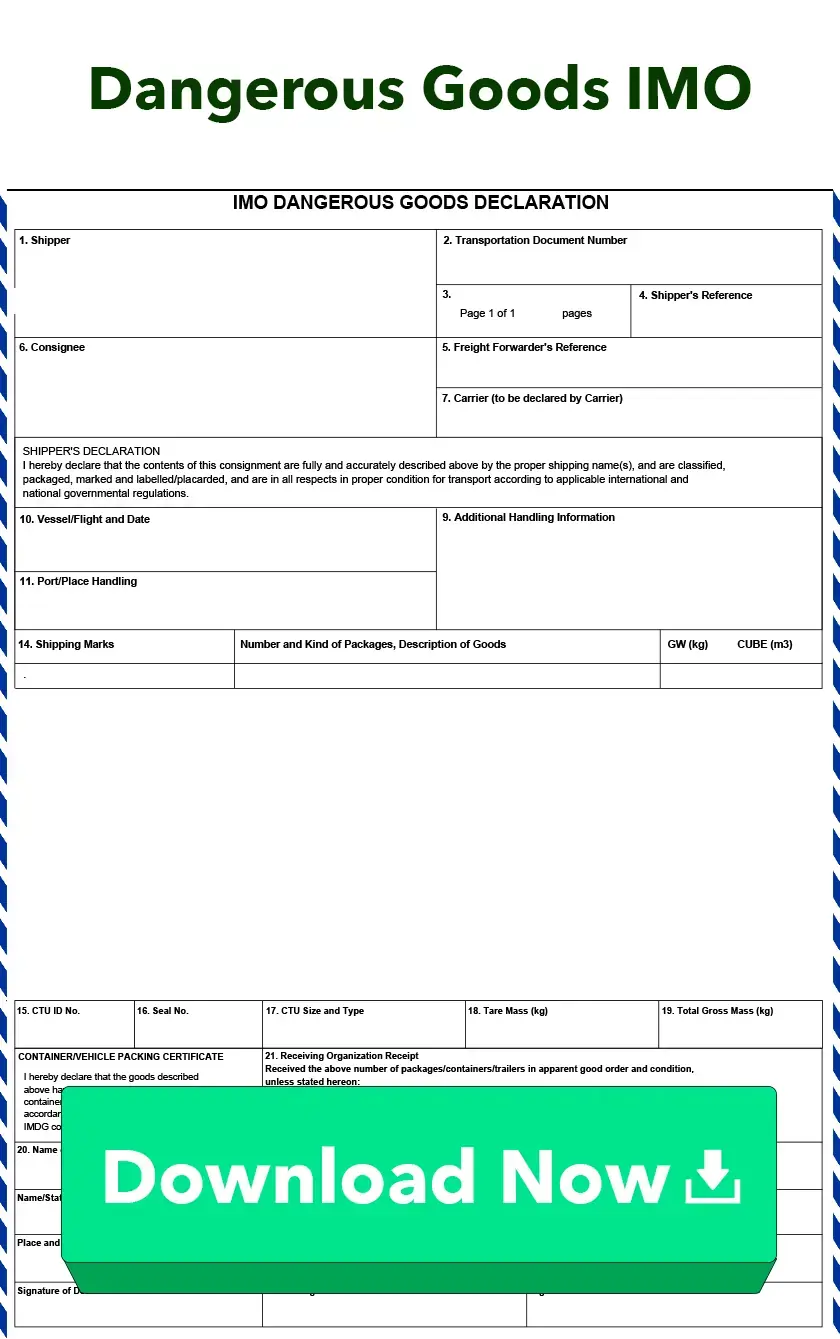

Dangerous Goods Forms

Learn More About Dangerous Goods FormsDangerous Goods (DG) forms are required for transporting dangerous or hazardous items.

Other

Additional forms required for exporting.

-23_101024.webp)

-26_101024.webp)

-13_101024.webp)

-14_101024.webp)

-20_101024.webp)

-24_101024.webp)

-25_101024.webp)

-27_101024.webp)

-28_101024.webp)

-32_101024.webp)

-33_101024.webp)