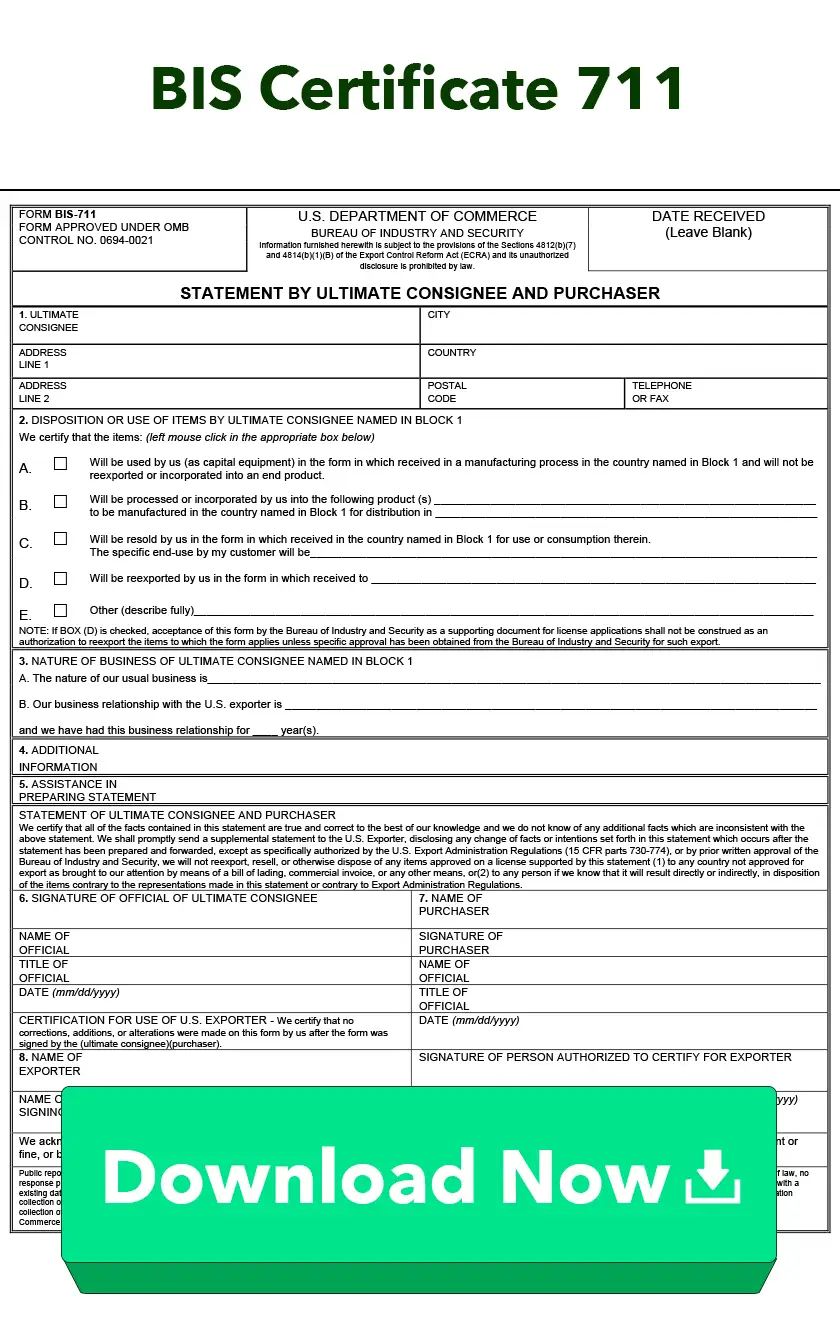

Free Download:

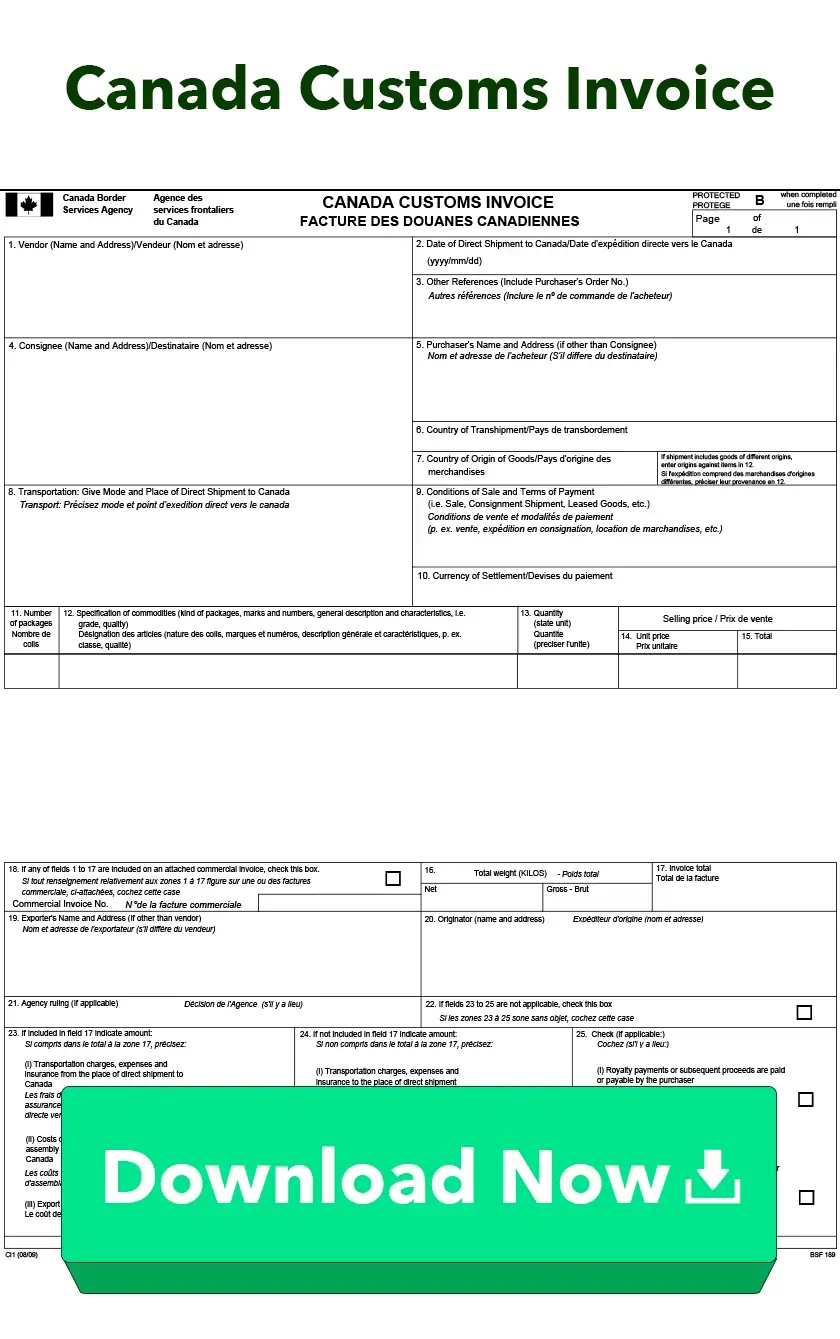

Canada Customs Invoice

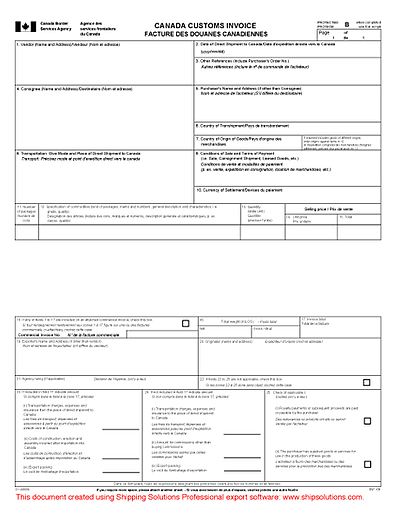

Download and print this PDF of this Canada Customs Invoice form for use with your exports to and imports into Canada.

What is a Canada Customs Invoice?

Commercial shipments to Canada, regardless of mode of transport, which are valued at over $2,500 (Canadian funds), are not classified under HTUSA Chapter 9810, and are subject to duties and sales taxes, should be accompanied by a Canada Customs Invoice. The invoice must contain all the information currently required by Canada Customs Regulations and can be prepared either by the exporter/importer or their agents.

The Canada Customs Invoice must be completed to show (a) the transferor as the exporter; (b) the transferee as the purchaser; and (c) the original vendor as the vendor. The exporter must specify, in addition to providing the general data regarding the transacting parties, the conditions of the sale, the terms of payment and complete details relative to packing, description of goods, unit price and total prices.

The Canada Customs Invoice must also document whether or not transportation and insurance charges, export packing and charges for construction or assembly in Canada are included in the selling price. Canada Customs is also very interested in whether or not commission or royalty payments are involved.

If you’re required to use the Canada Customs Invoice and don’t, or if the form is incomplete or inaccurate, you will delay your shipment at the border, which, ultimately, will delay your payday.

Create Accurate Export Forms

Reduce the time it takes to complete the Canada Customs Invoice by up to 80%. Shipping Solutions export documentation software makes it easy to create more than two dozen standard export forms. Register now for a free demo. There's absolutely no obligation.

Canada Customs Invoice FAQs

-

What is a Canadian Customs invoice?

A Canada Customs invoice is a document used to declare the value, quantity and nature of imported goods to Canadian Customs authorities and should be included with most shipments valued at over $2,500 (Canadian funds) unless the additional information found on a Canadian Customs invoice appears on the commercial invoice.

-

Is a Canadian Customs invoice required?

Commercial shipments to Canada, regardless of mode of transport, which are valued at over $2,500 (Canadian funds), are not classified under HTUSA Chapter 9810, and are subject to duties and sales taxes, should be accompanied by a Canada Customs invoice unless the additional information found on a Canadian Customs invoice appears on the commercial invoice.

-

How do I fill out a Canadian Customs invoice?

Download the template on this page for an easy guide to filling out the Canada Customs invoice. The form includes the exporter, purchaser and original vendor. In addition to providing general information about the parties involved, the exporter must specify the sale conditions, payment terms and provide detailed information about packaging, goods description, unit price and total prices. It is important to disclose any commission or royalty payments as Canada Customs has an interest in these details.

-

Who is responsible for a Canada Customs invoice?

The Canada Customs invoice can be prepared either by the exporter, the importer or their agents.

Download Now

Today is your lucky day. Shipping Solutions® makes completing export forms simple, accurate and five-times faster than the tedious way you’re doing it now.

Get it done easily.

Eliminate the hassle of manually completing your export forms. Our EZ Start Screen helps you automatically complete more than a dozen export forms.

Get it done fast.

With Shipping Solutions automation, you can complete your export documents up to five-times faster than your traditional manual process.

Get it done right.

Instead of entering the same information over and over again, you enter information in only one place. That makes you less likely to make costly mistakes.

Export Form Templates

Popular

Our most frequently requested export forms.

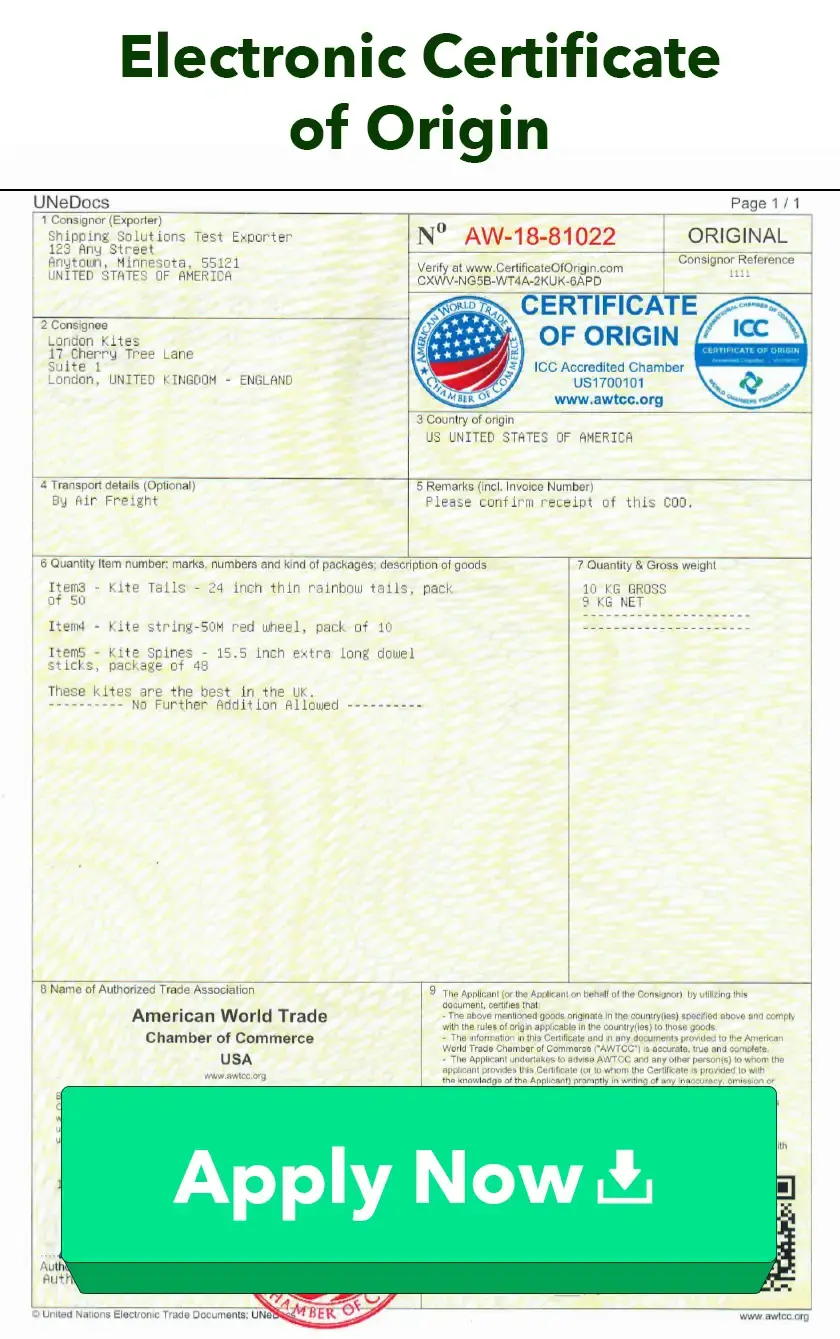

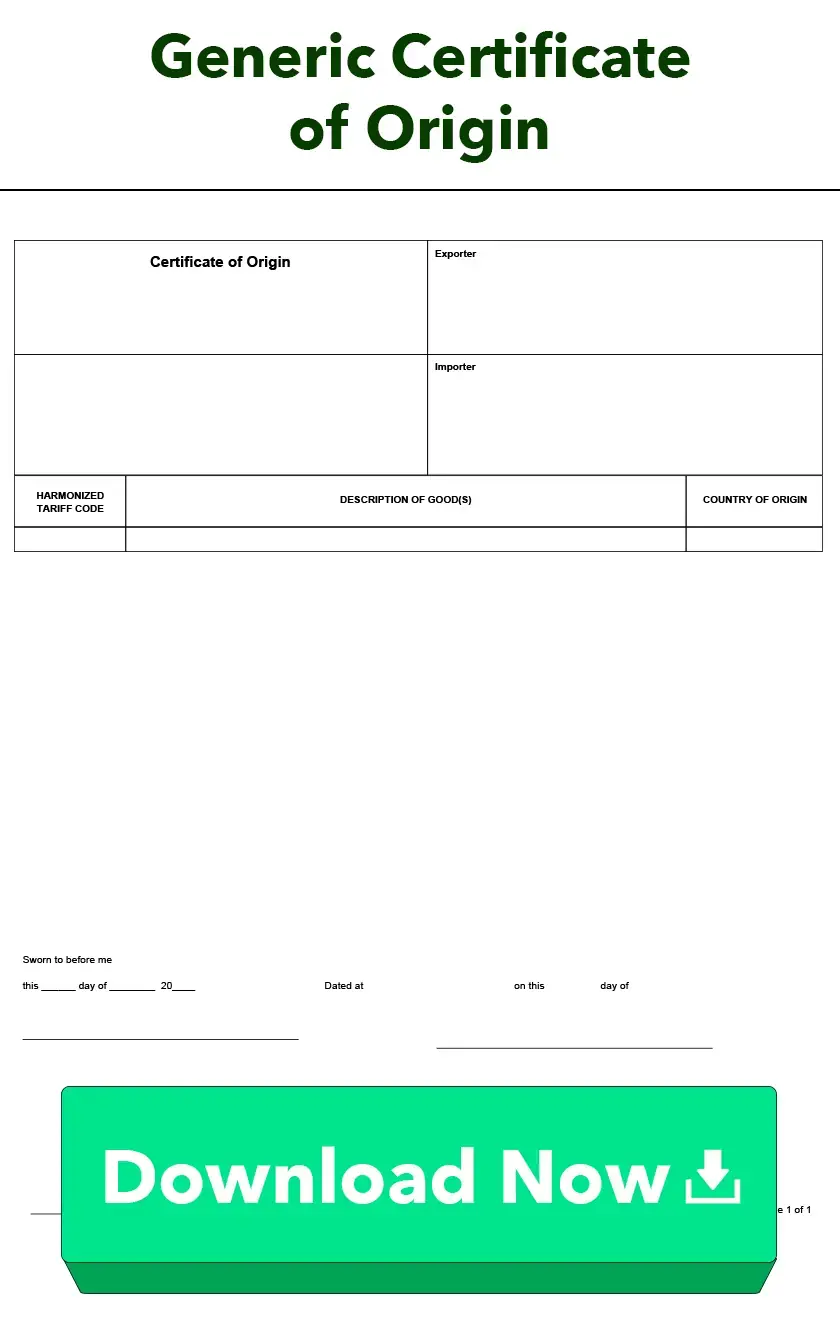

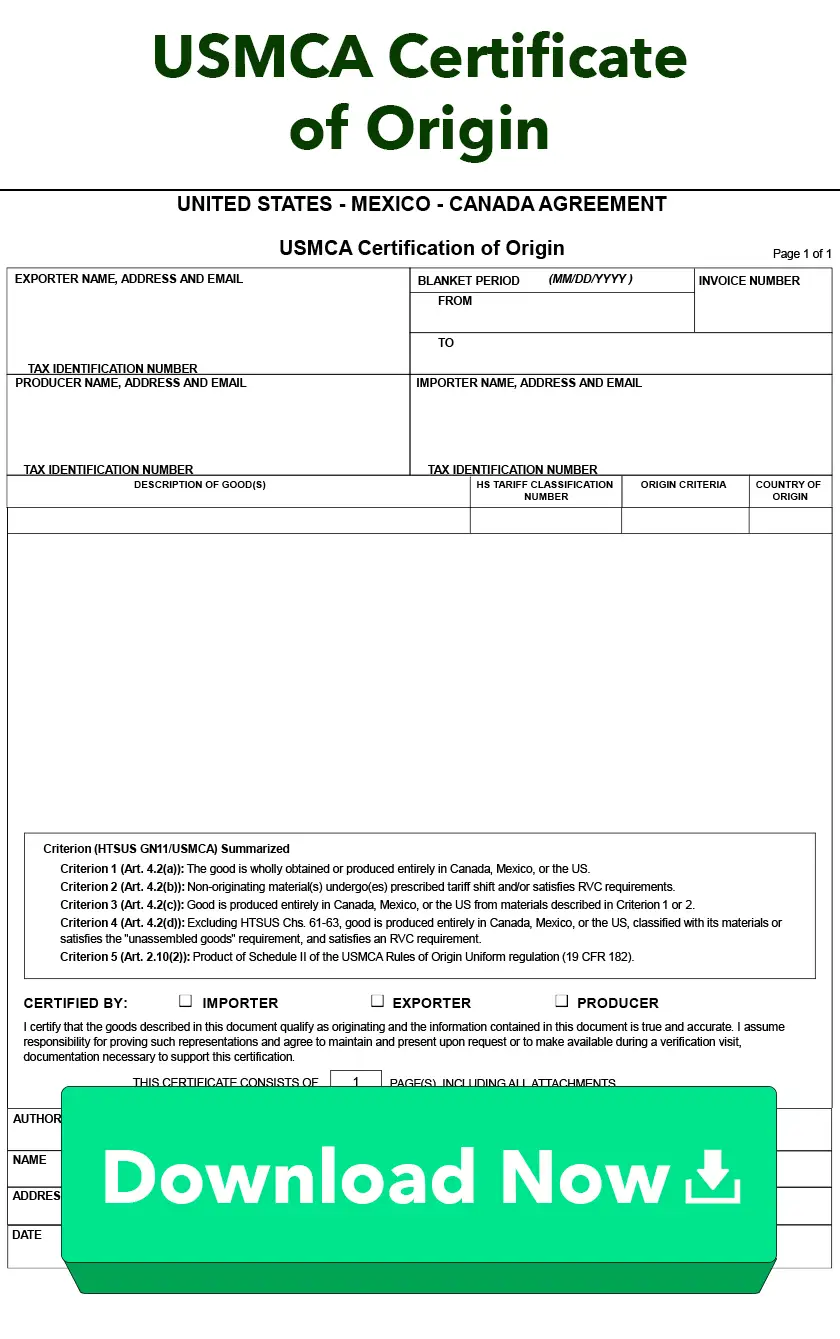

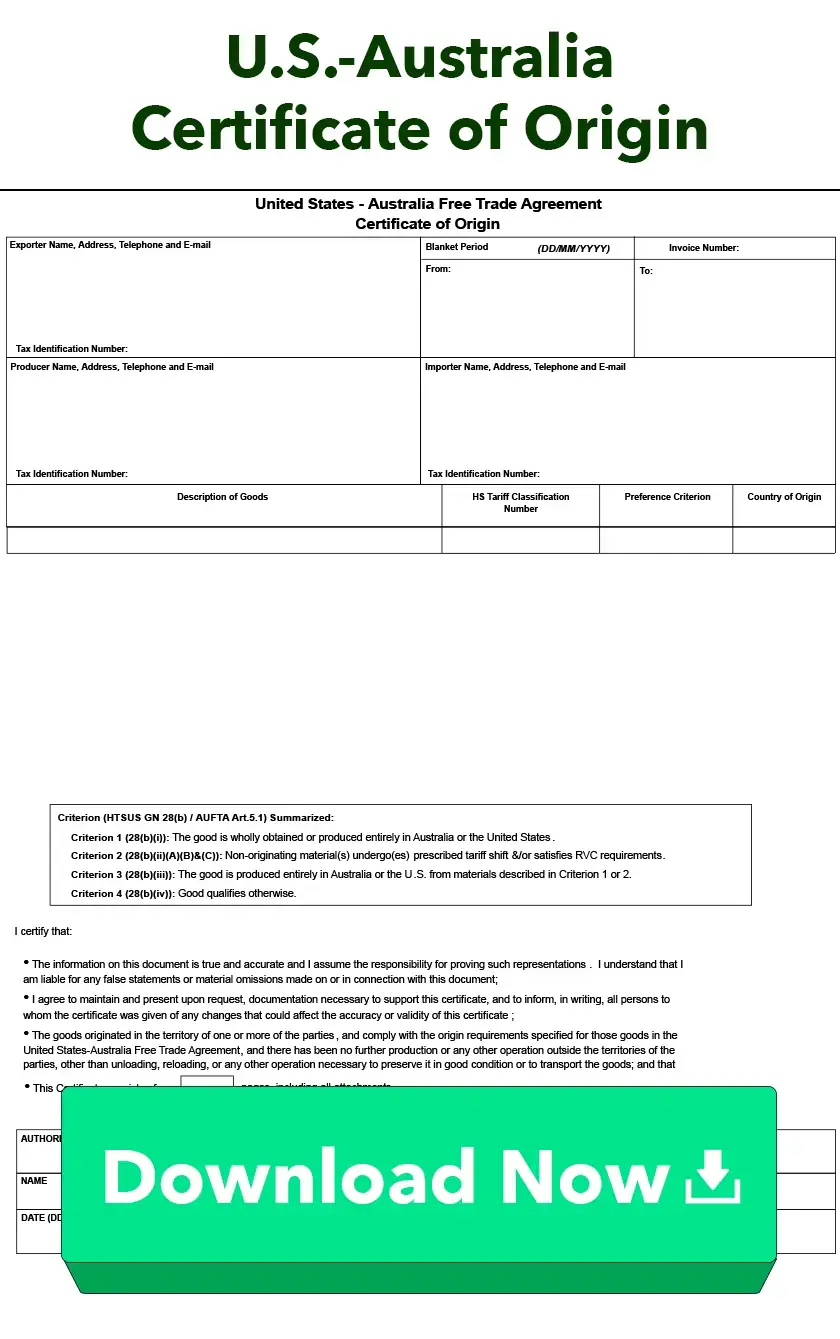

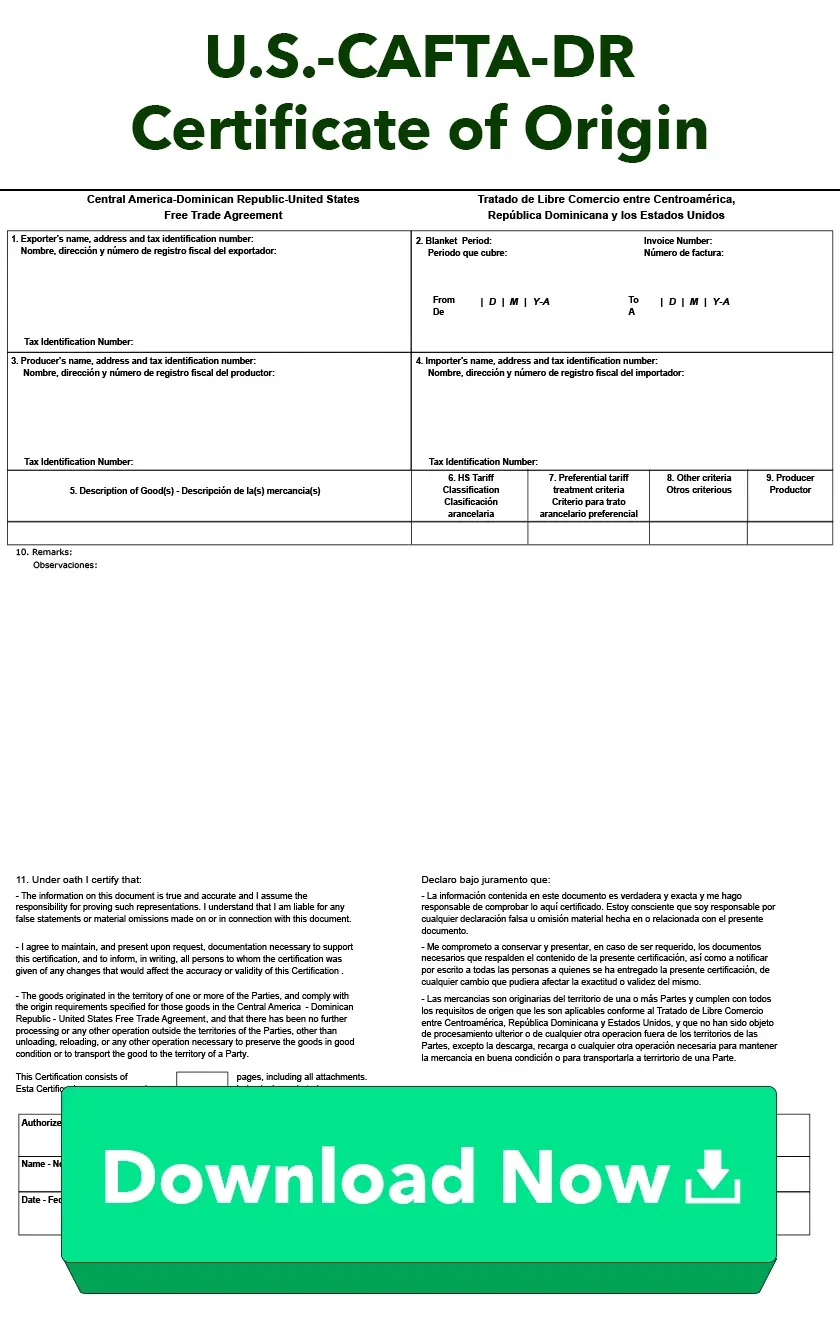

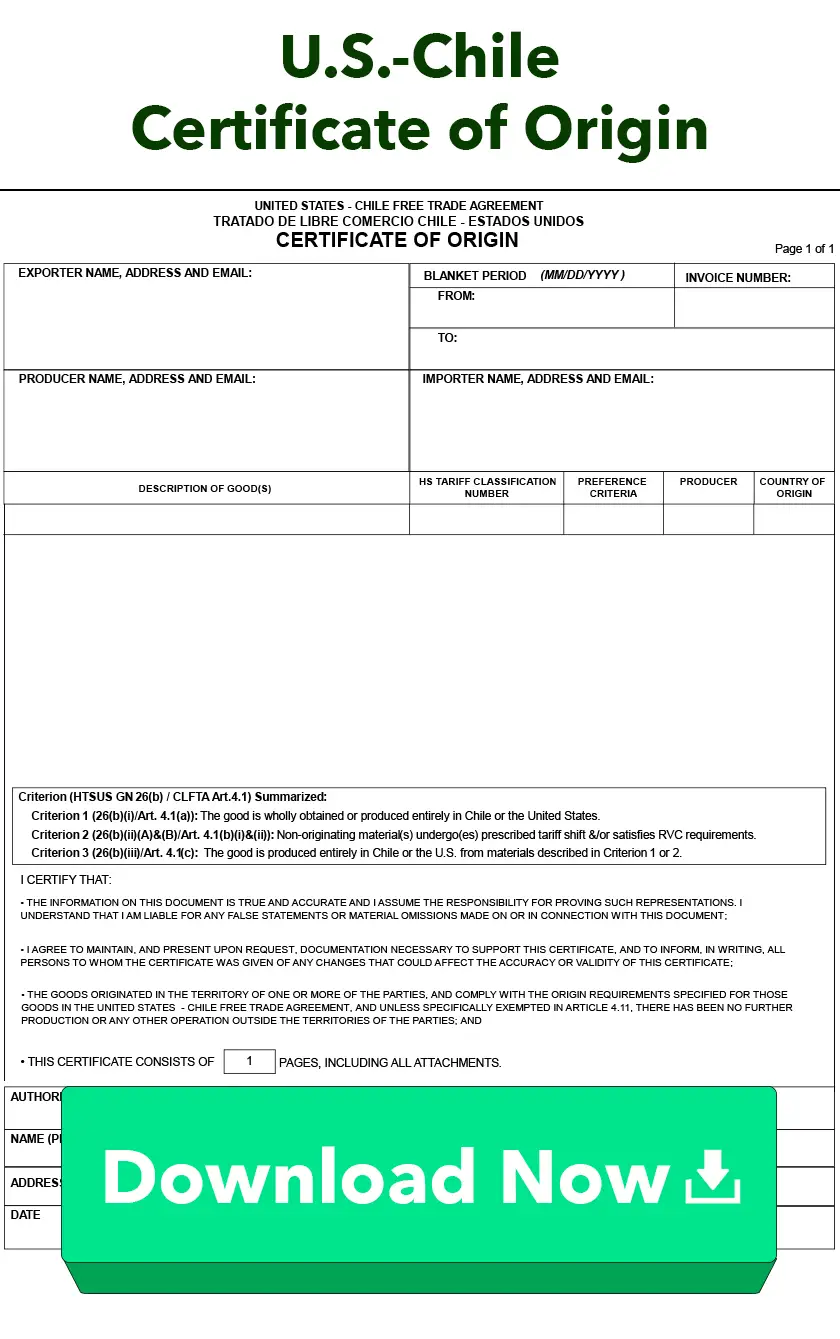

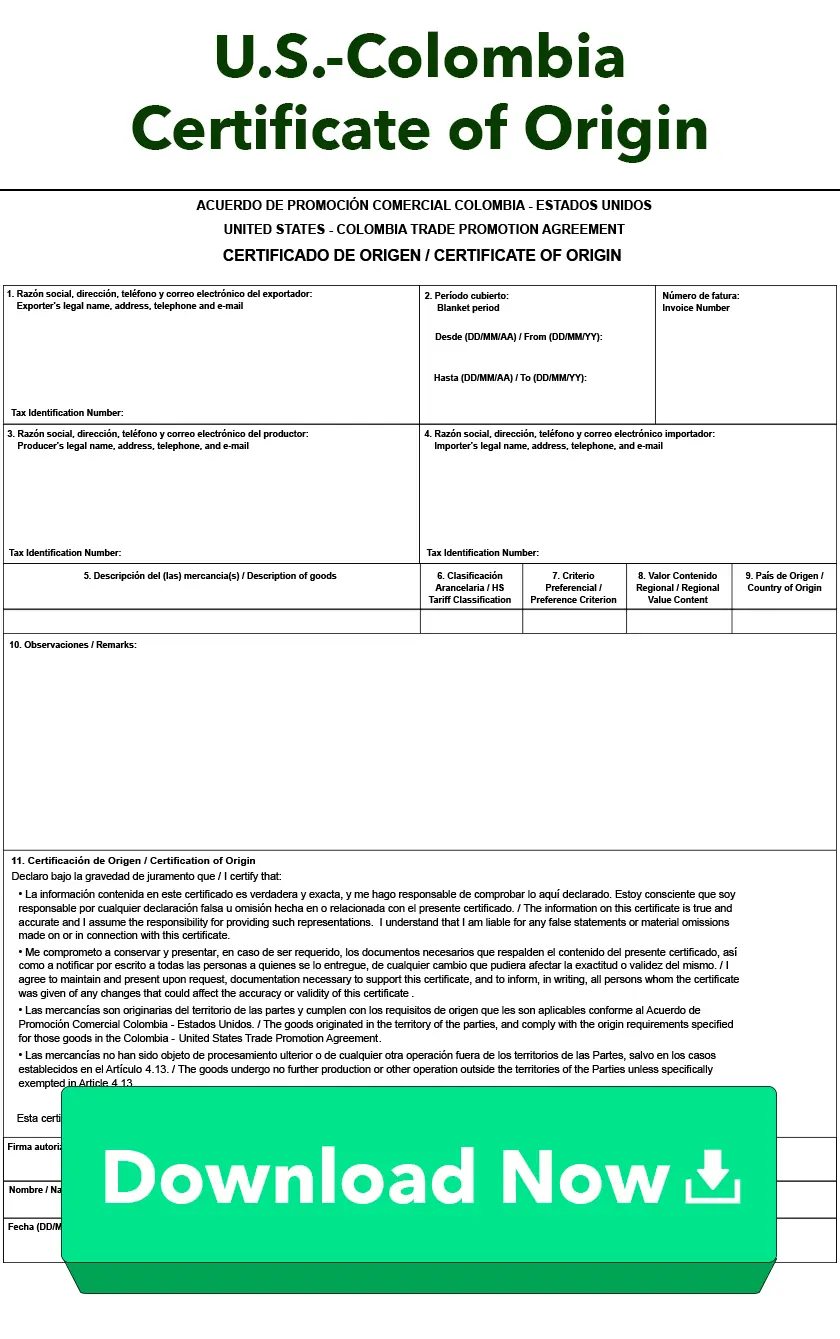

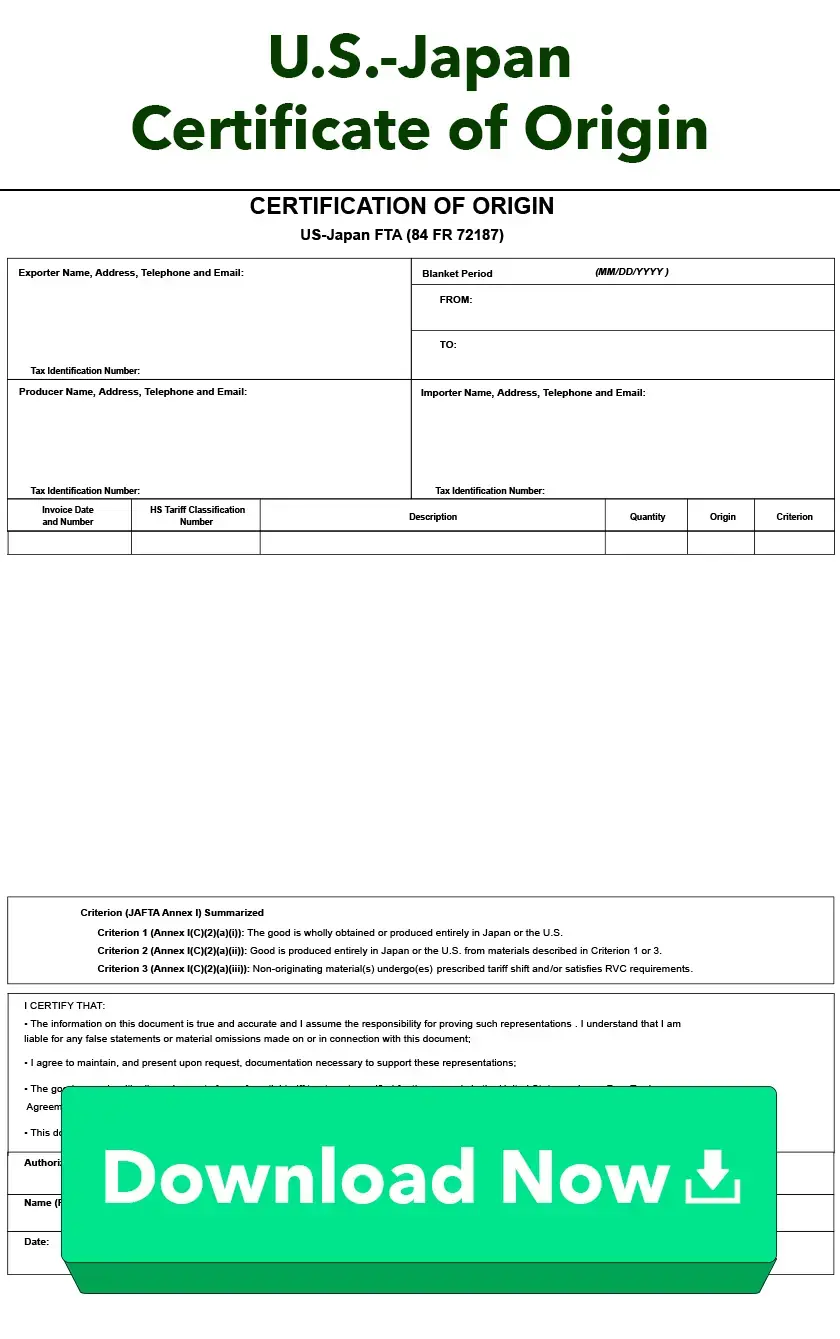

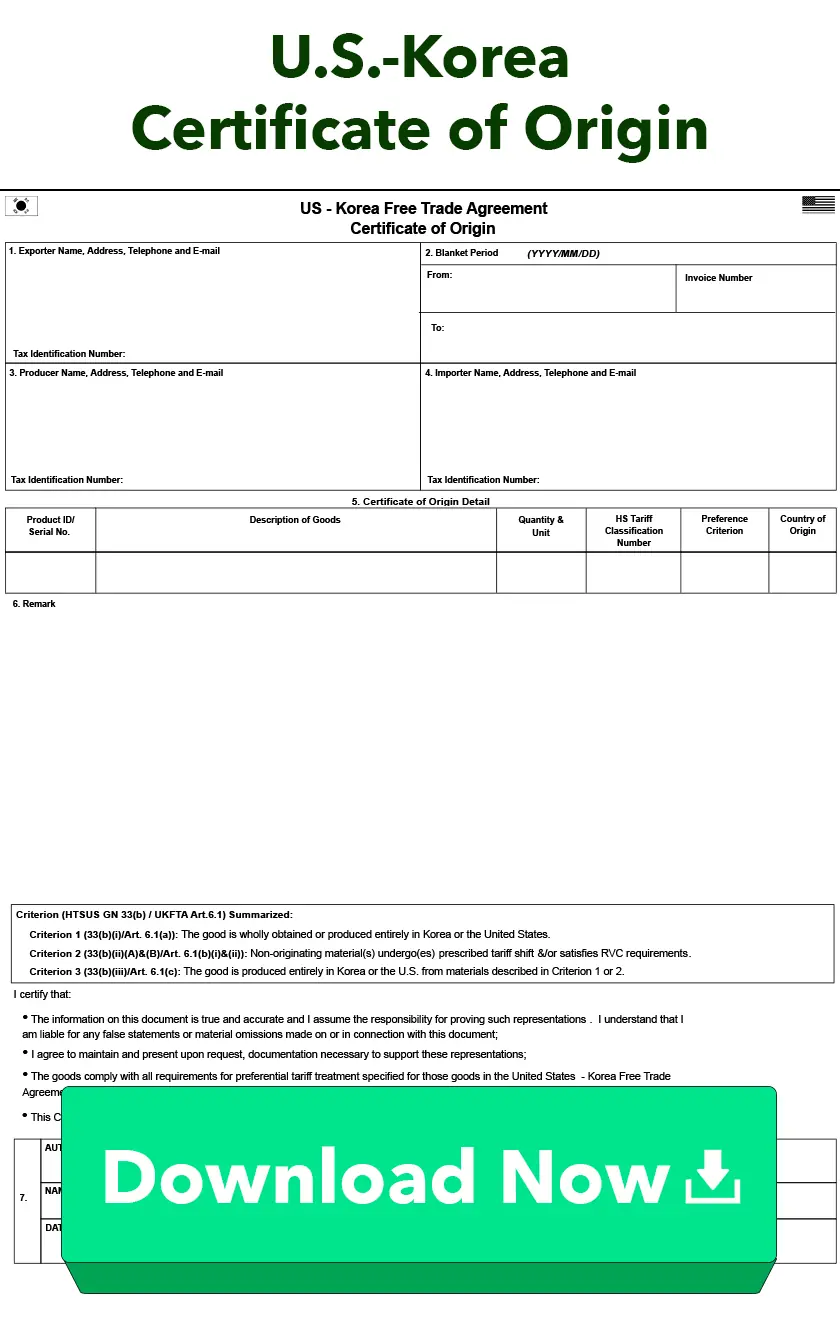

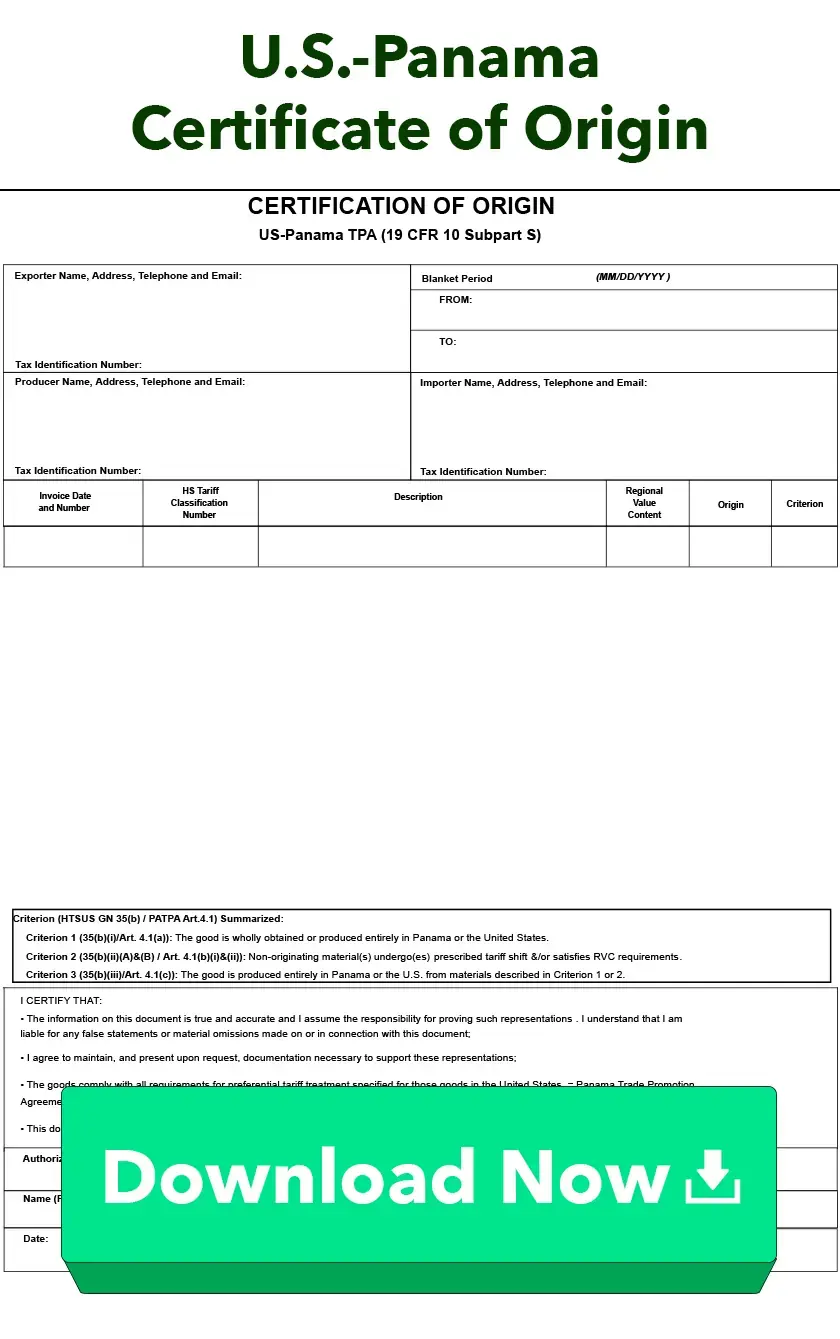

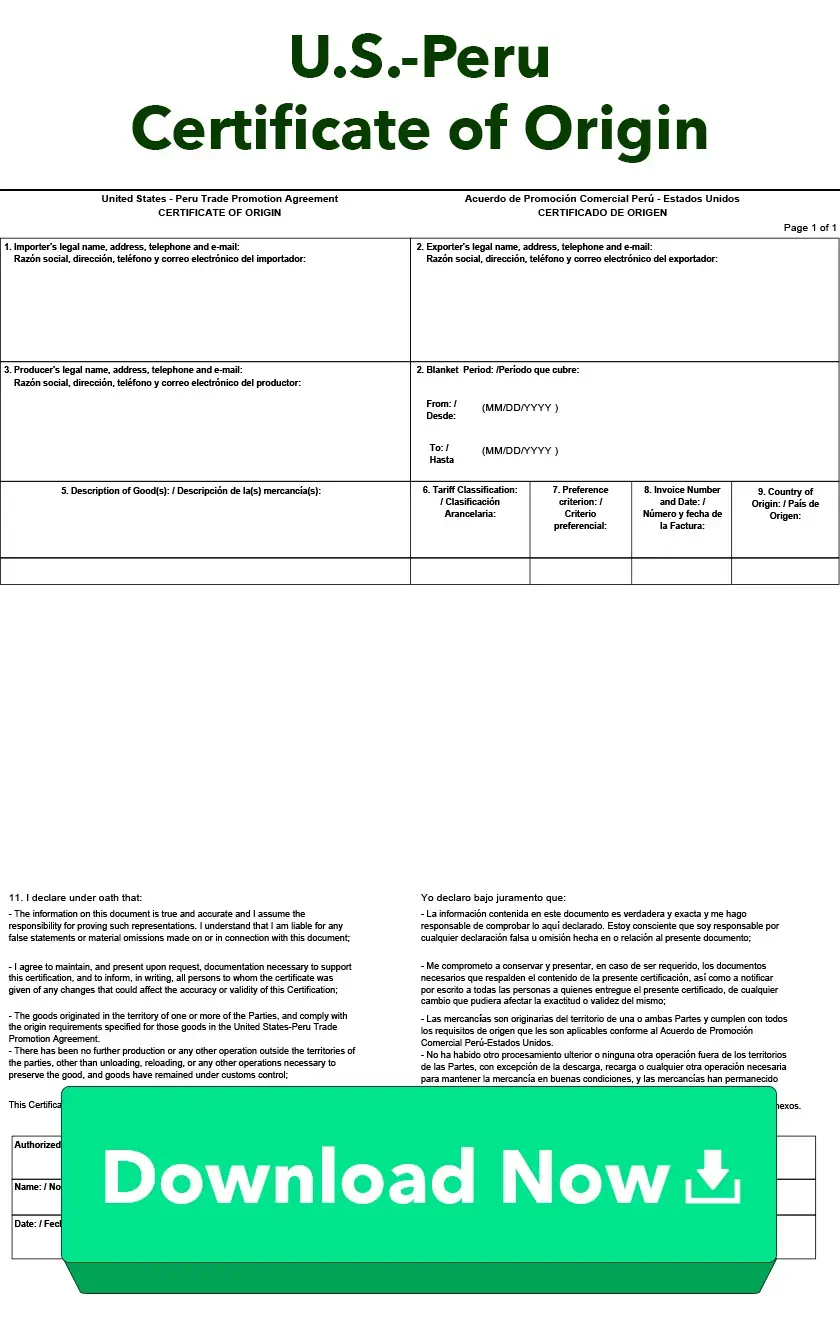

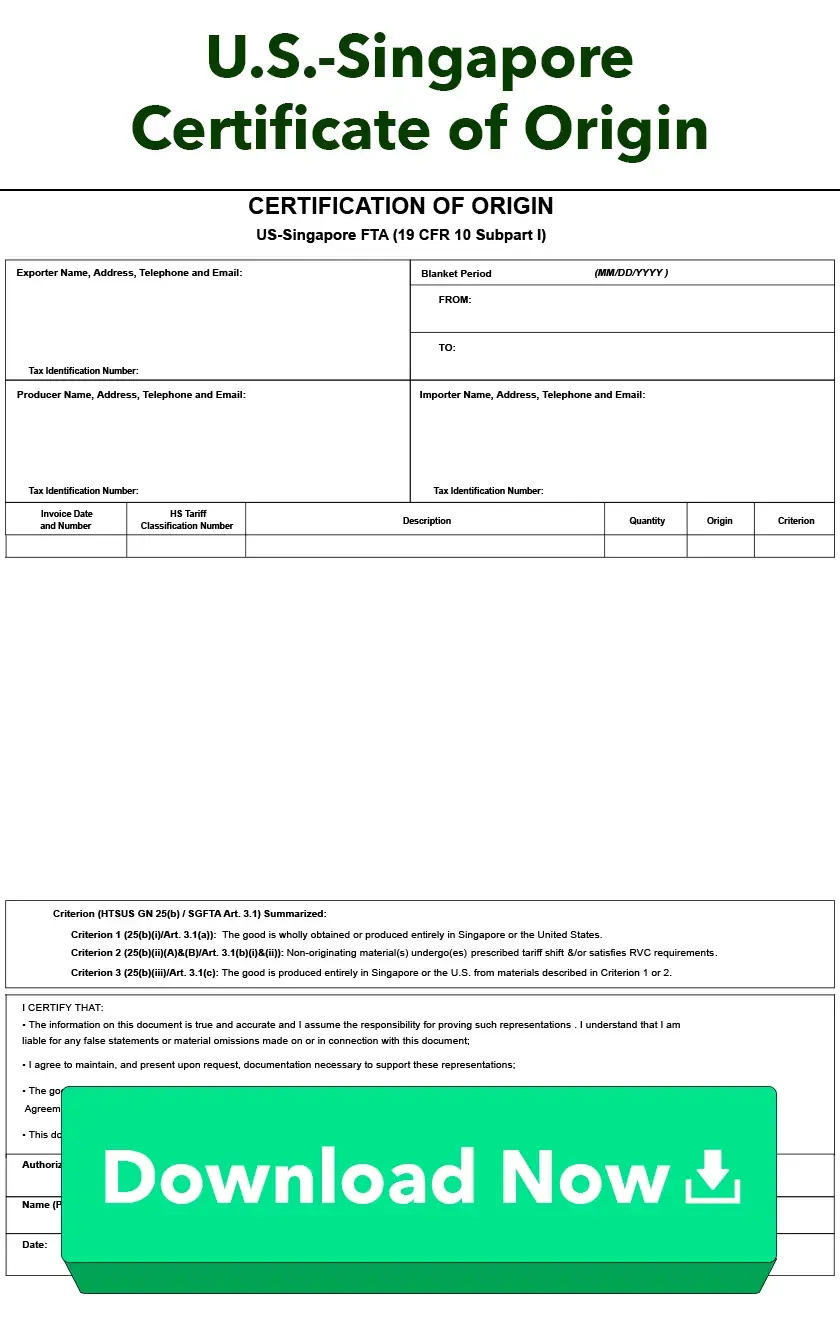

U.S. Certificates of Origin

Learn More About U.S. Certificates of OriginThese forms certify the origin of the goods, which may determine the amount of duty to be paid.

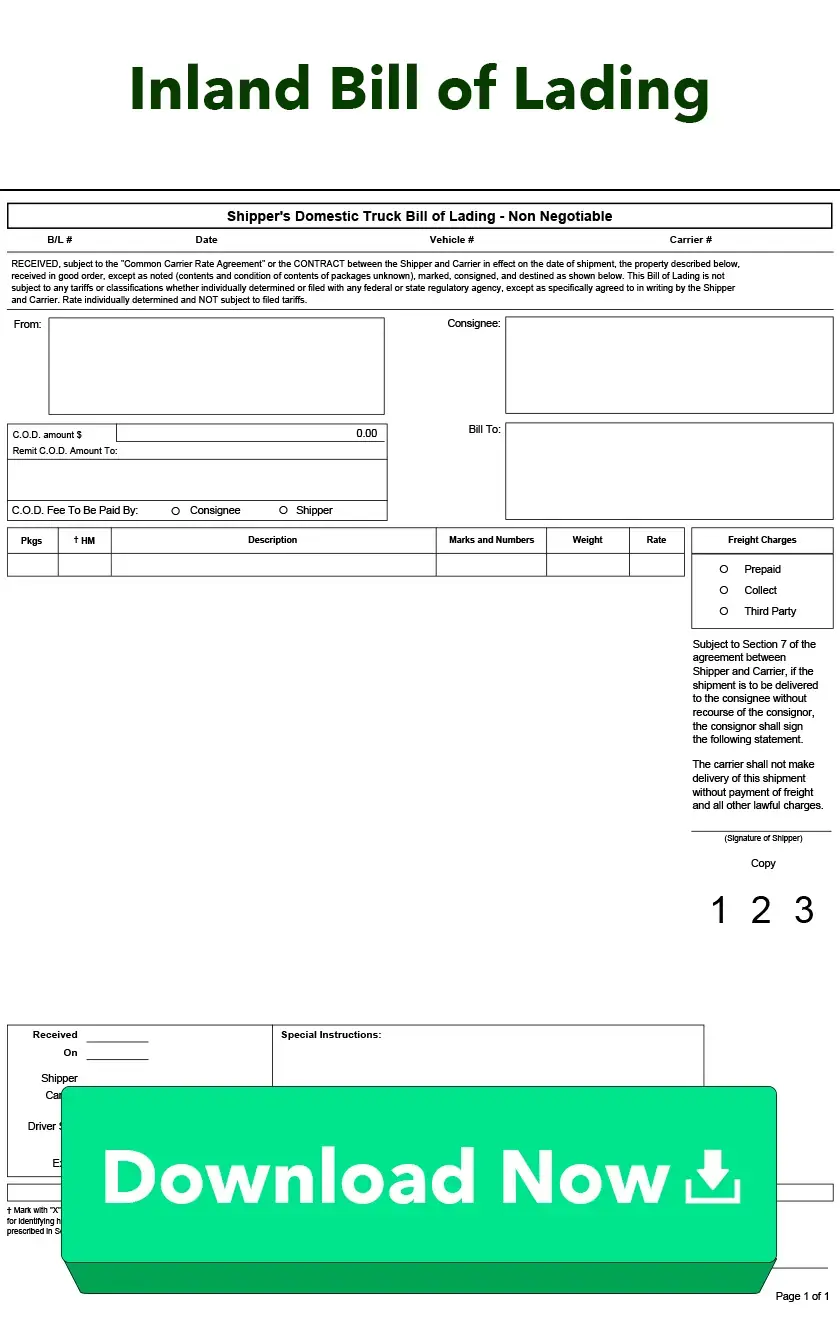

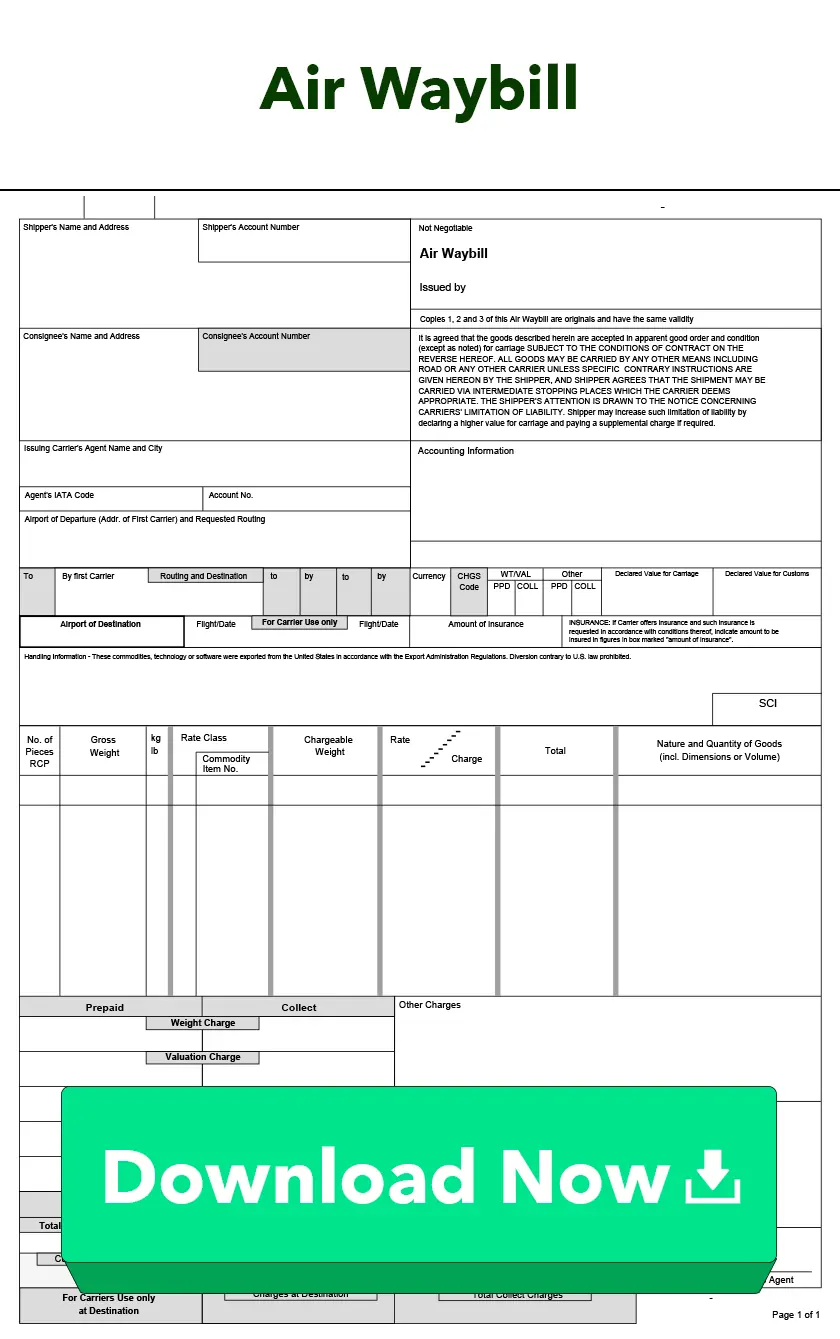

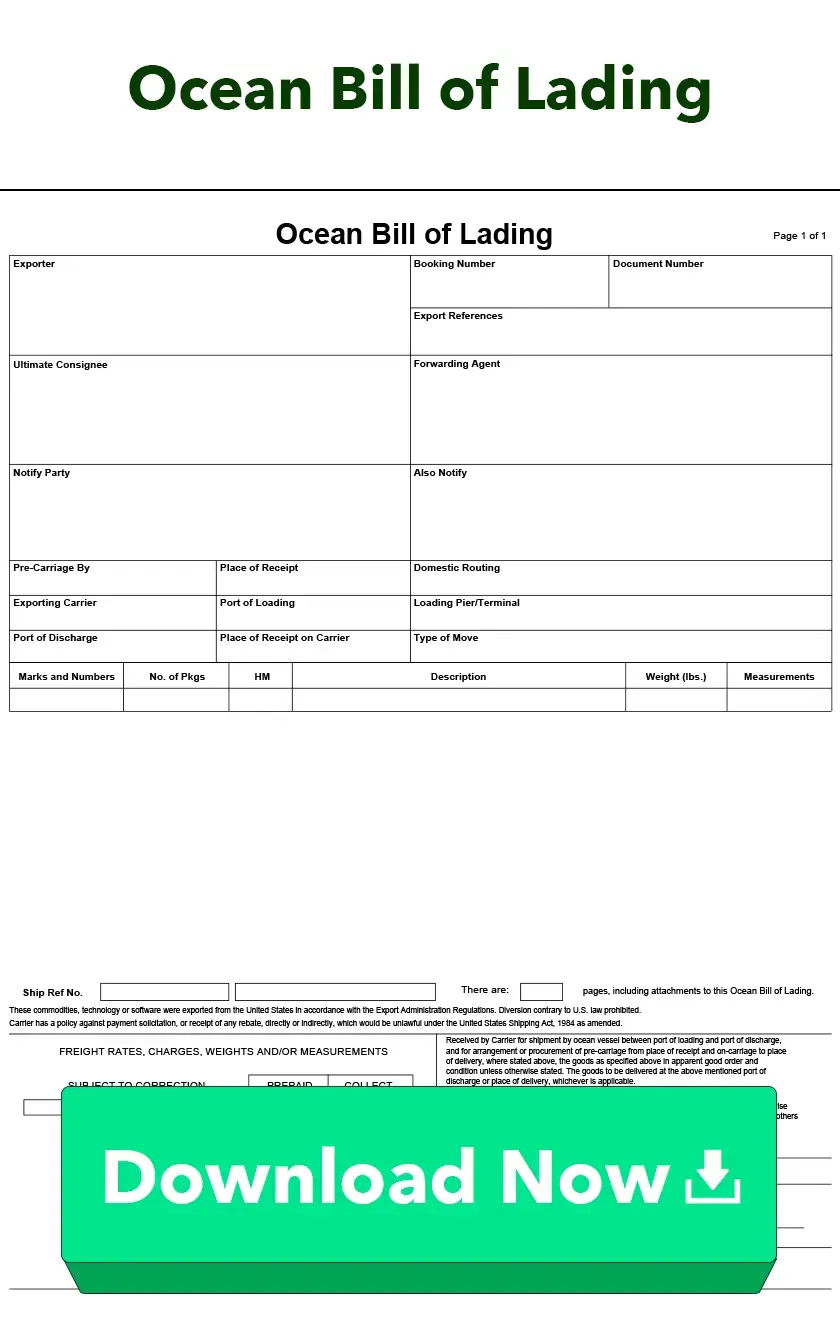

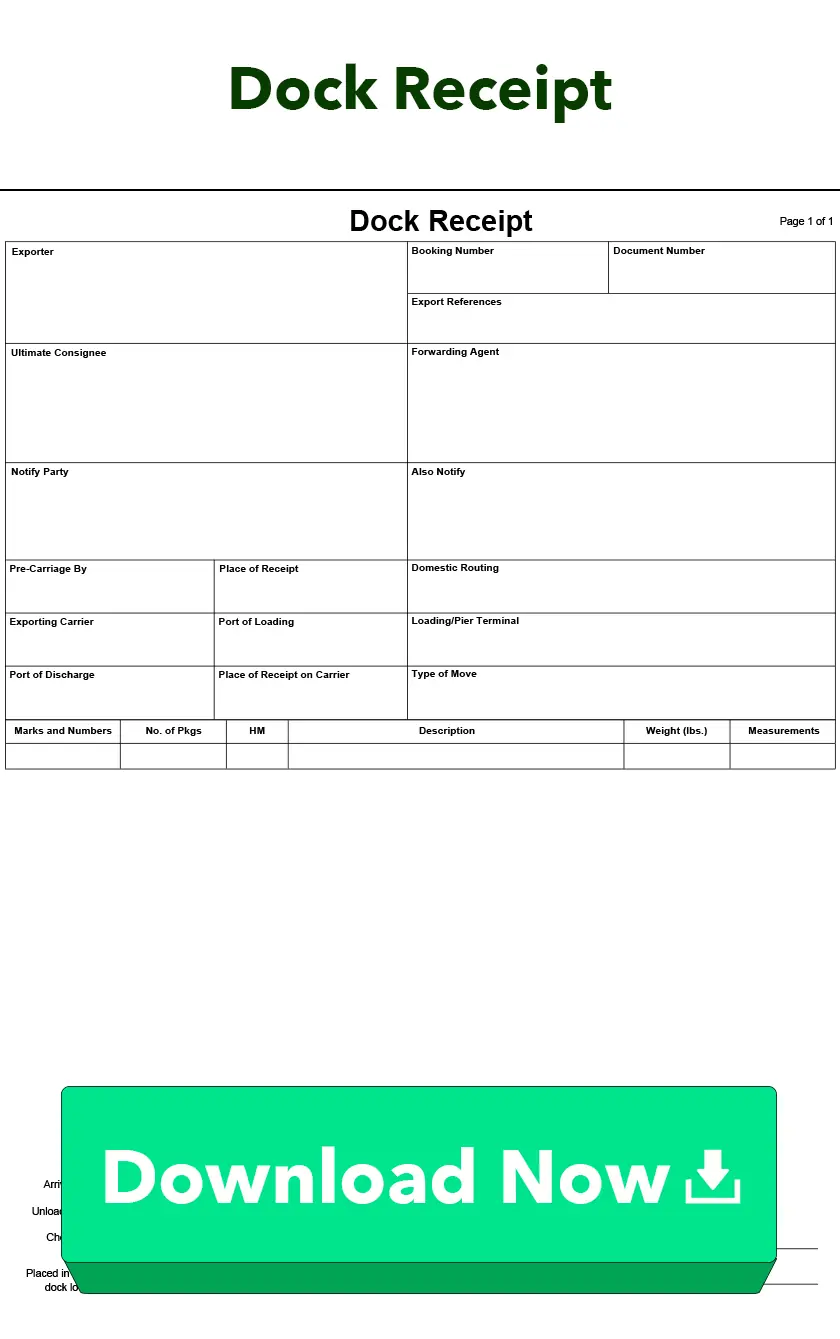

Bills of Lading

Learn More About Bills of LadingA bill of lading is a contract of carriage, a receipt from the carrier, and may be a document of title.

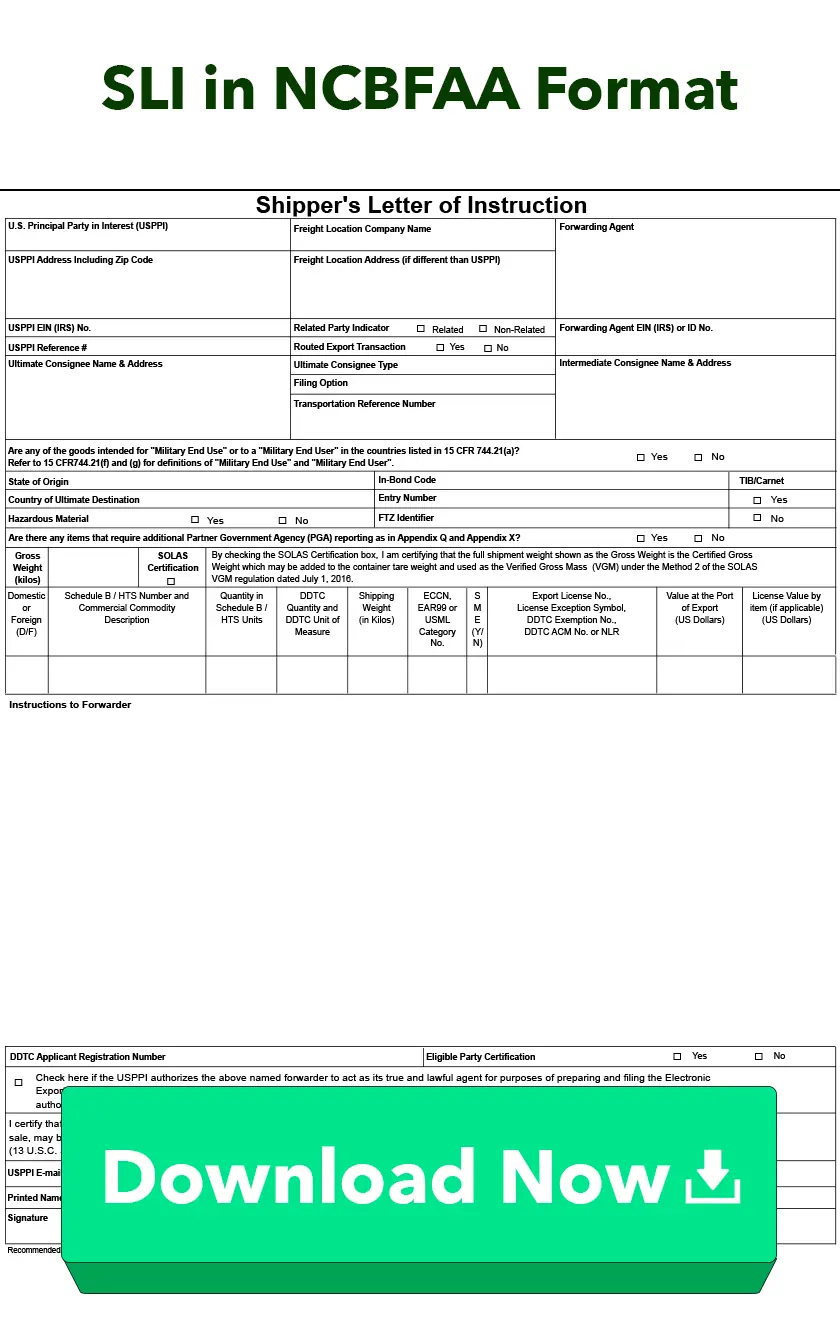

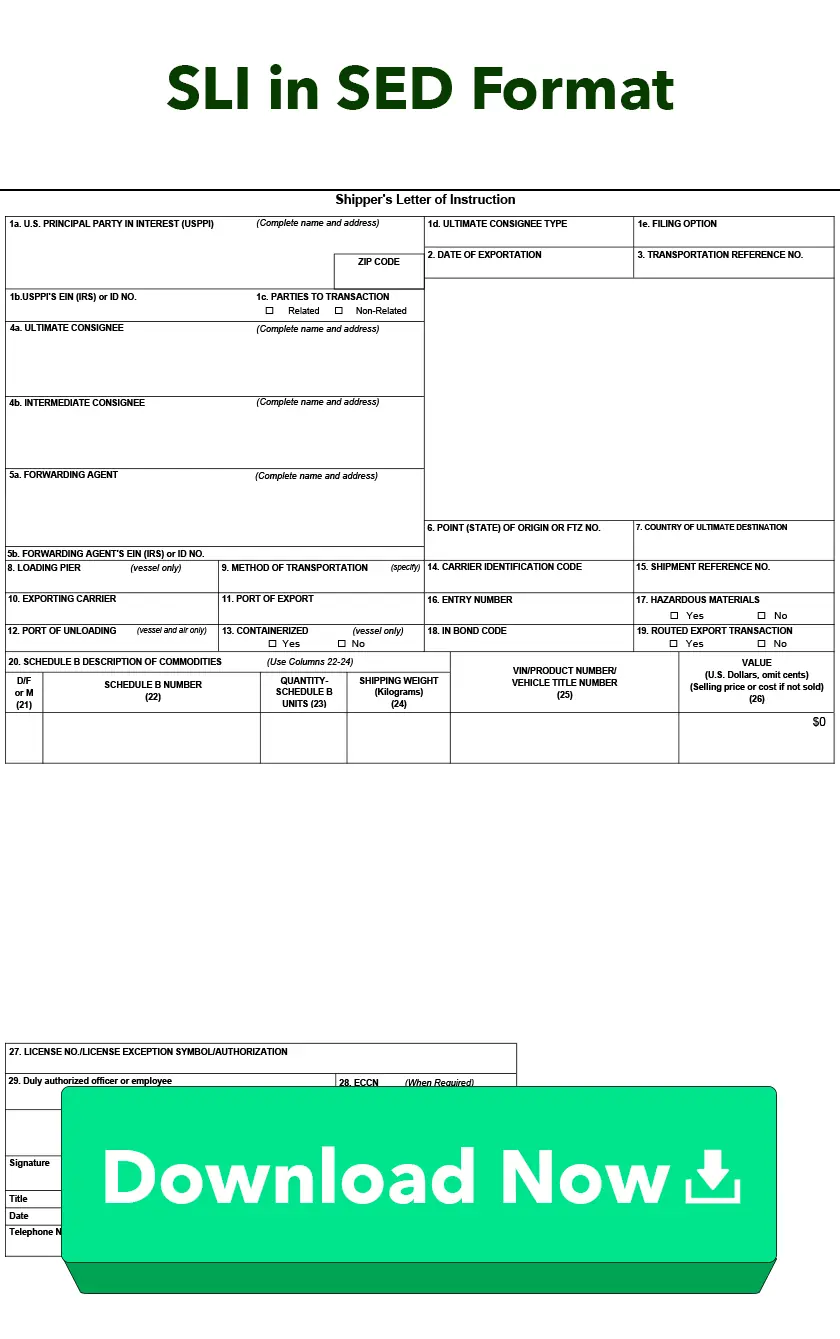

Shipper's Letter of Instruction (SLI)

Learn More About Shipper's Letter of Instruction (SLI)The Shipper's Letter of Instruction (SLI) conveys instructions from the exporter to the carrier or forwarder.

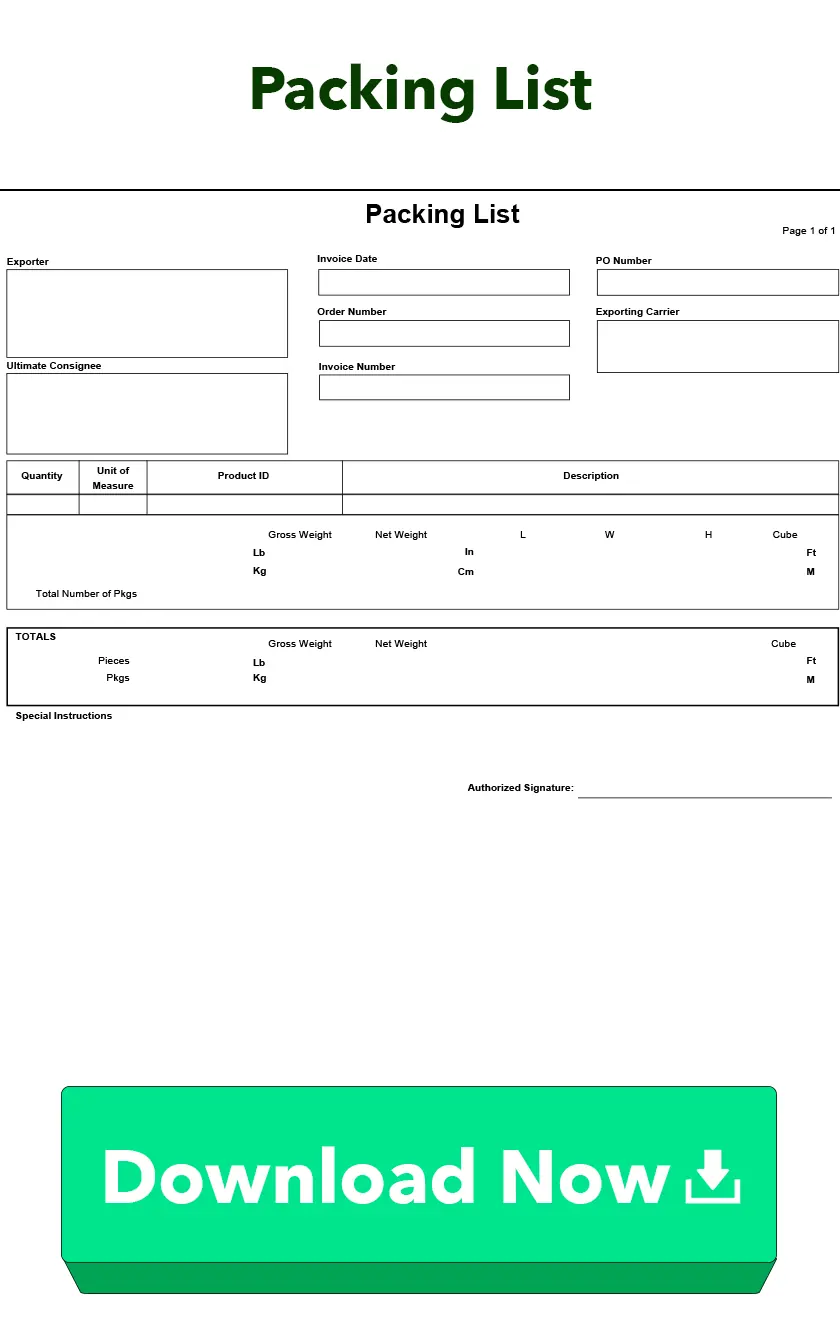

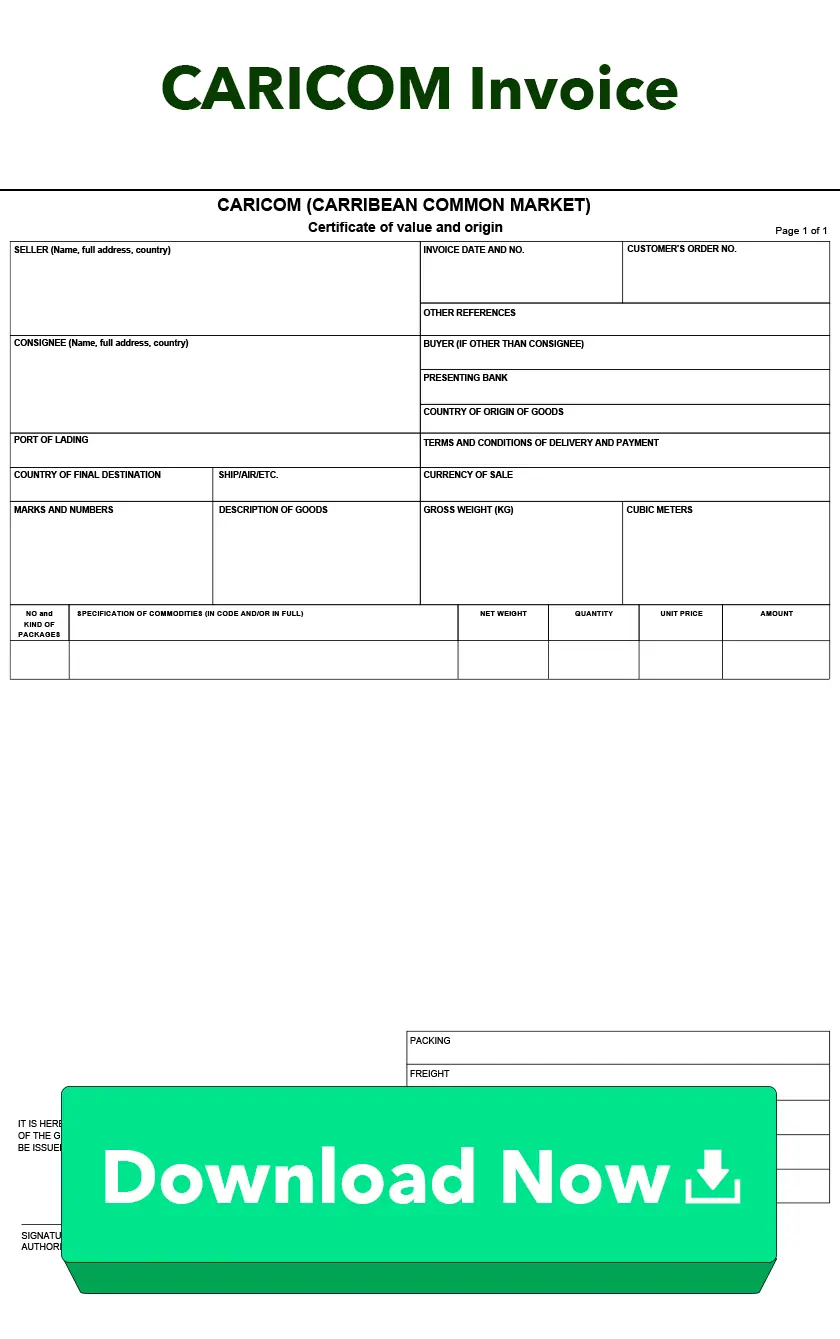

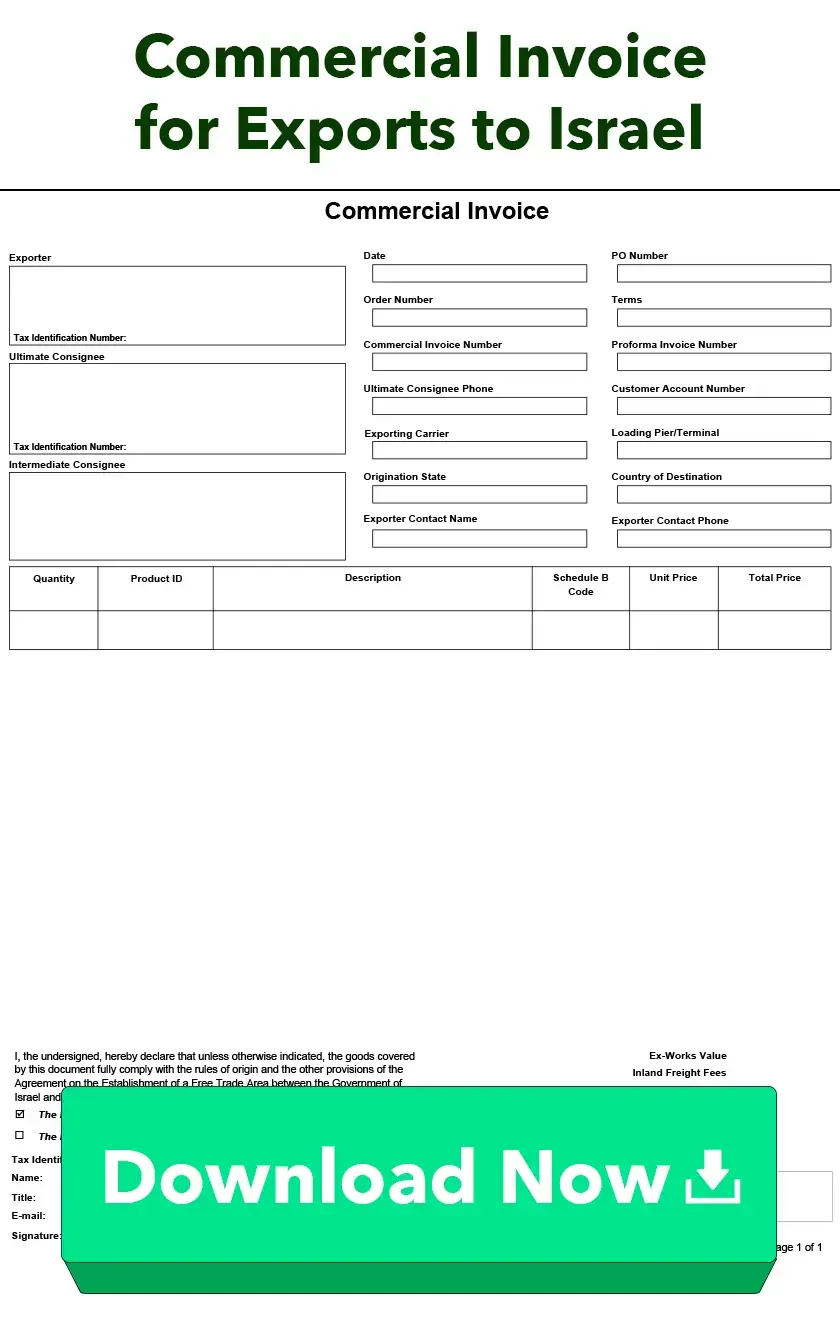

Invoices

Learn More About InvoicesInvoices are one of the most important export documents describing everything included in the shipment and its cost.

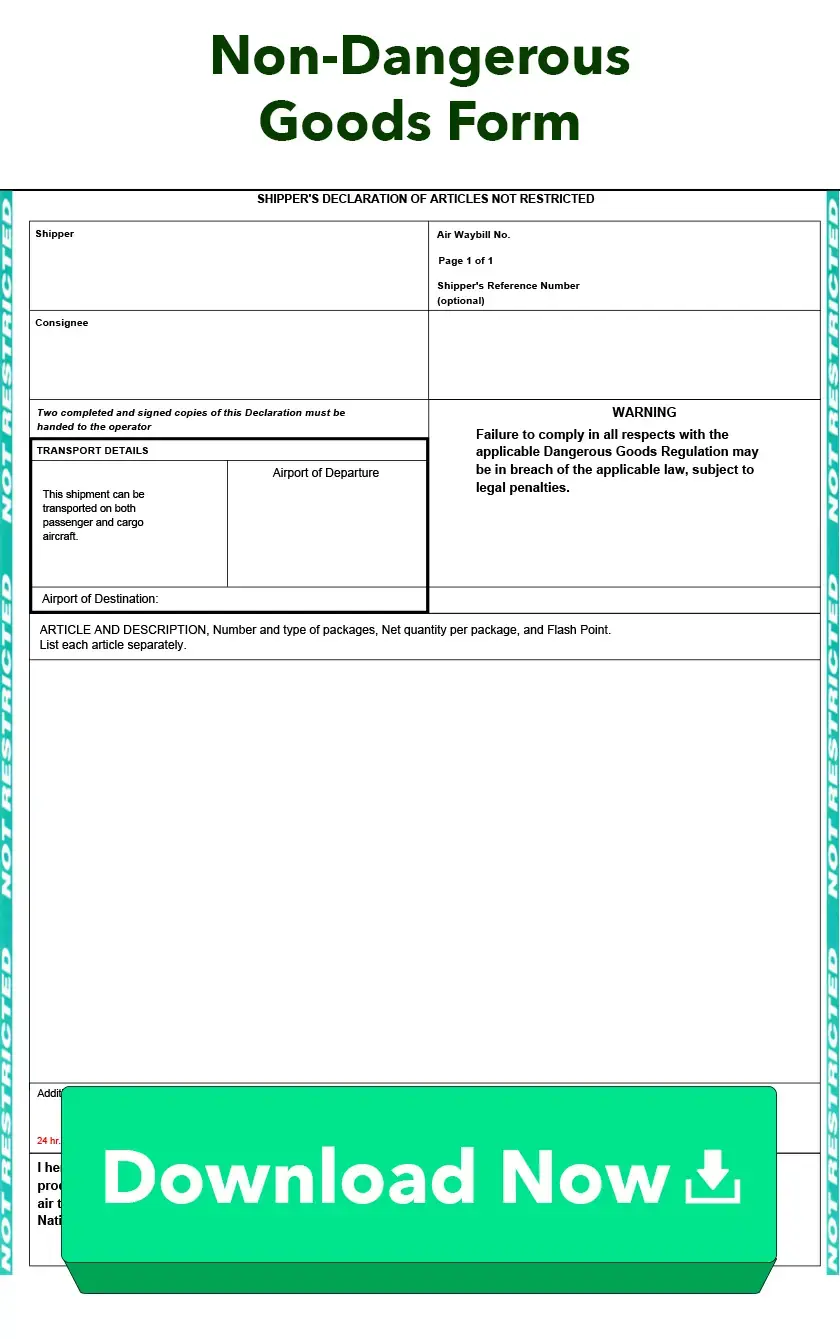

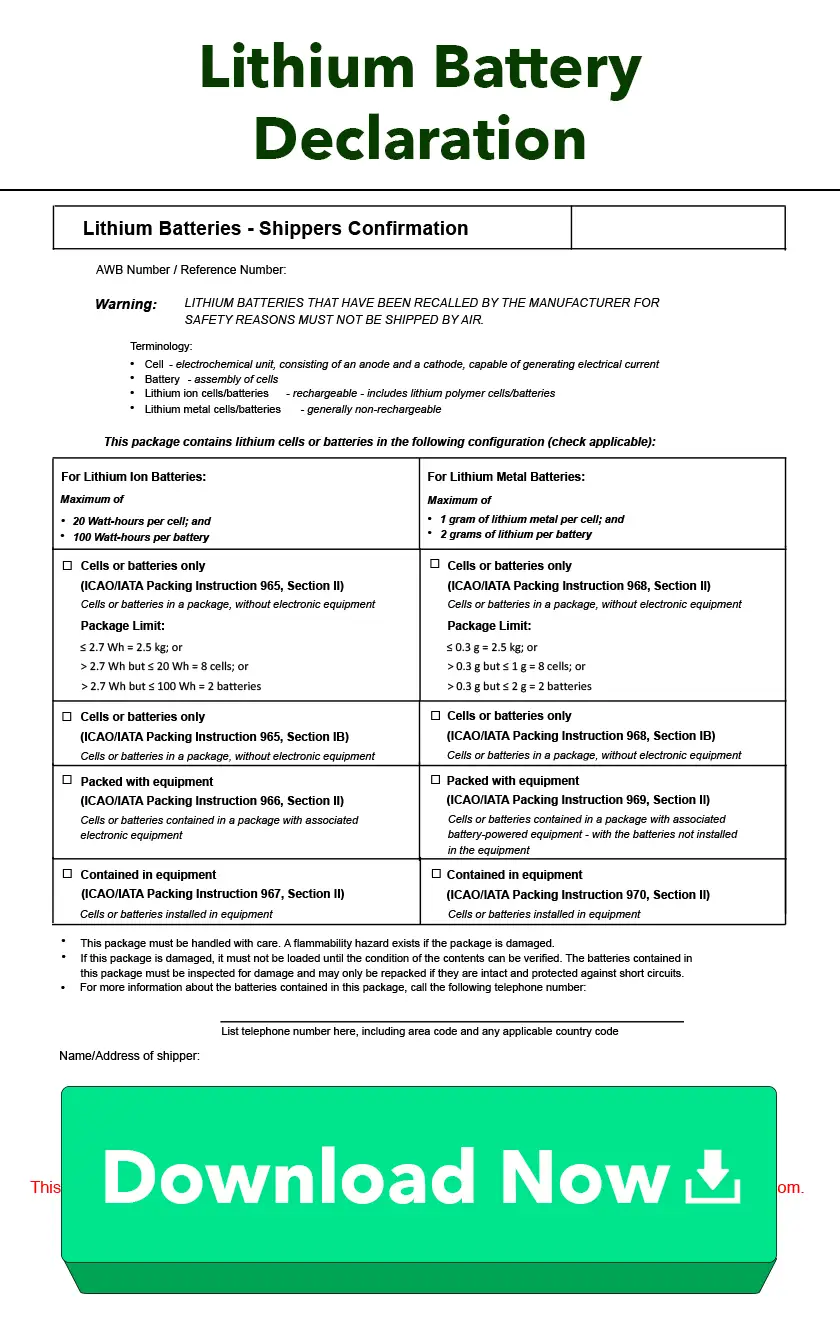

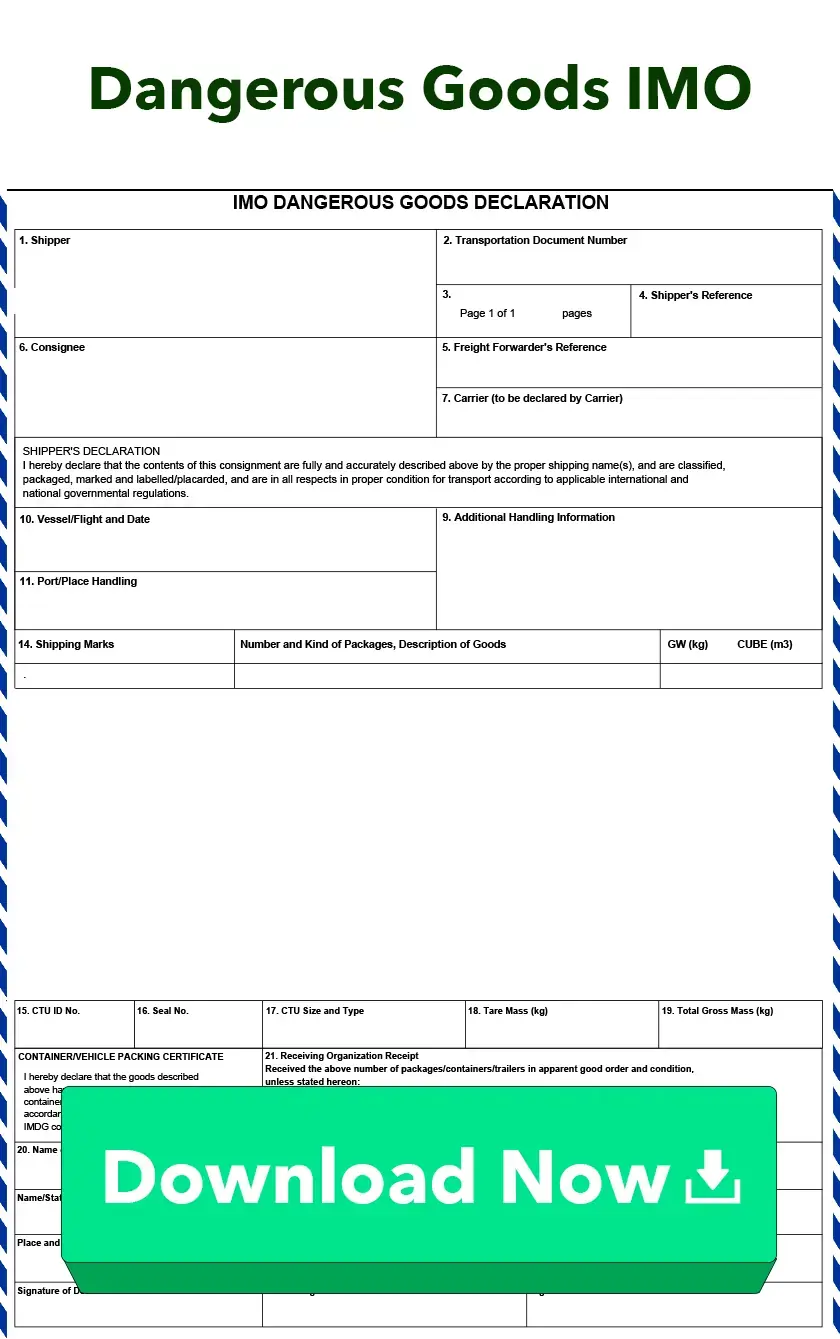

Dangerous Goods Forms

Learn More About Dangerous Goods FormsDangerous Goods (DG) forms are required for transporting dangerous or hazardous items.

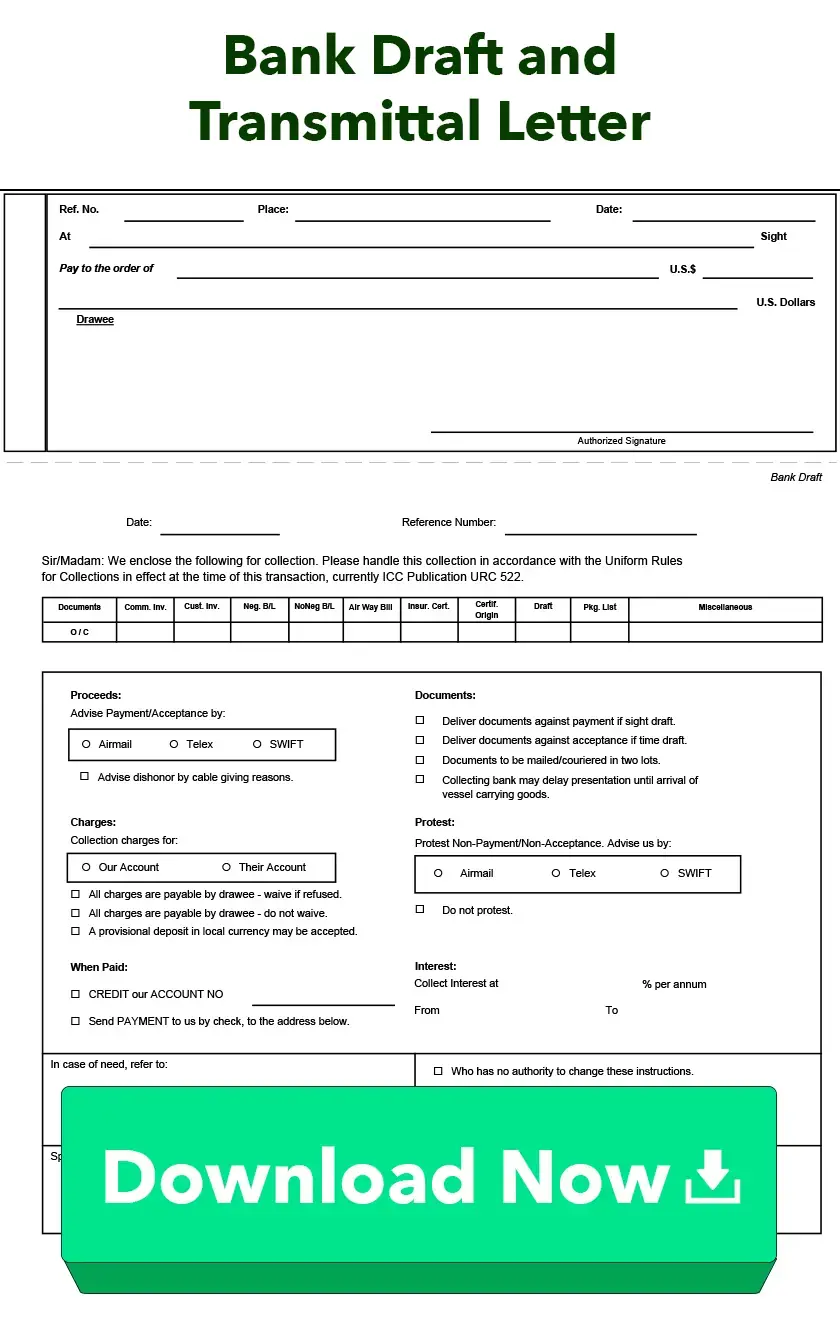

Other

Additional forms required for exporting.

-23_101024.webp)

-26_101024.webp)

-13_101024.webp)

-14_101024.webp)

-20_101024.webp)

-24_101024.webp)

-25_101024.webp)

-27_101024.webp)

-28_101024.webp)

-32_101024.webp)

-33_101024.webp)