Certificate of Origin Forms

Download the certificate of origin form you need for your export shipment.

What Is a Certificate of Origin?

A certificate of origin is a document that certifies the country where the goods originated. A certificate of origin may be required by the customs authority of the country where the goods are being imported. It’s also frequently used to determine how much duty the importer will pay to bring in the goods.

There are two types of certificates of origin you may need to create: a Generic Certificate of Origin or a Free Trade Agreement Certificate of Origin.

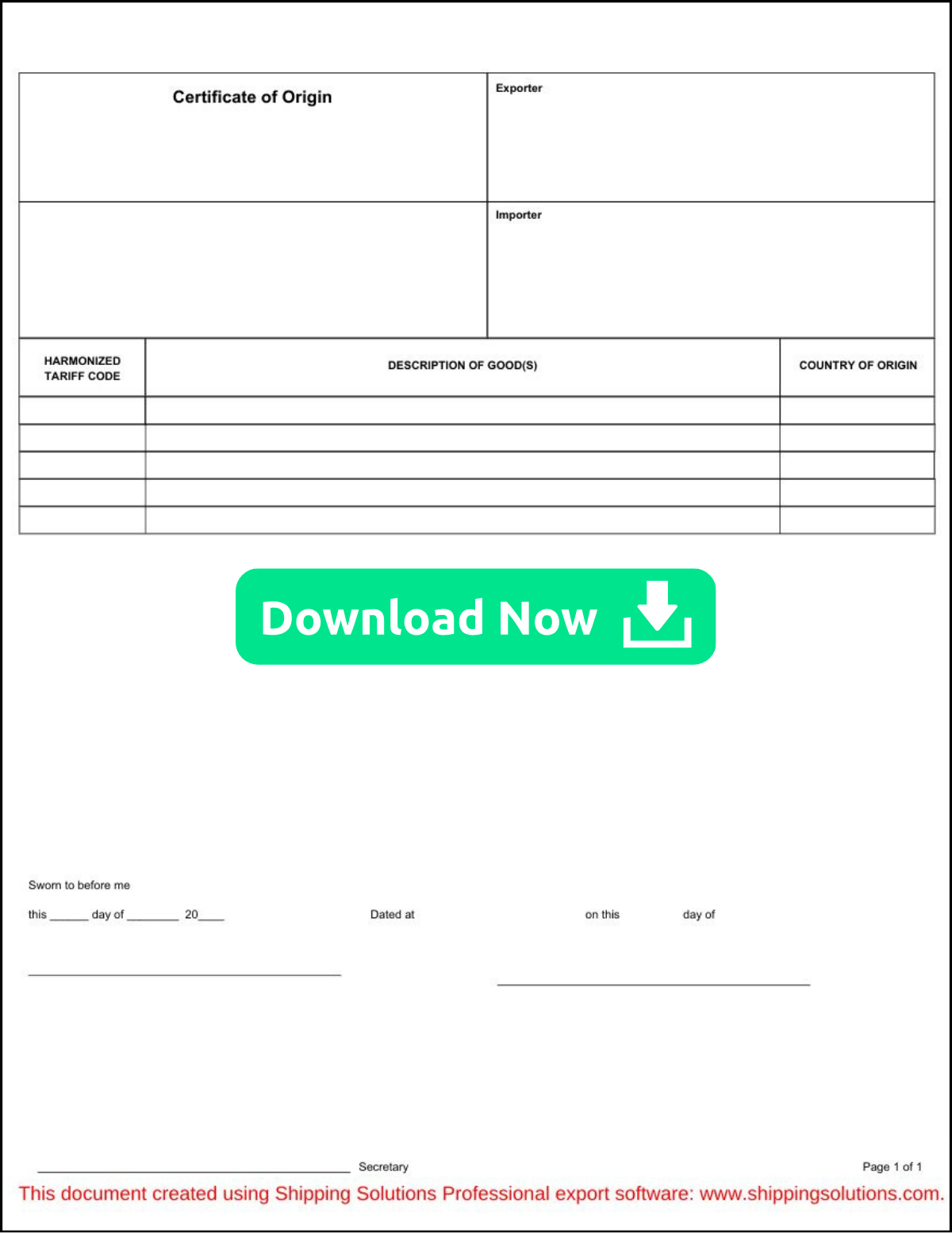

Generic Certificate of Origin

Most countries accept a generic certificate of origin form that includes information about the exporter and importer, the description and harmonized tariff code of the goods, and the country of origin. These certificates are usually prepared by the exporter and certified by the local chamber of commerce.

The importer is heavily dependent upon the assistance and cooperation of its U.S. suppliers in producing accurate and well-documented declarations of origin.

Electronic Certificate of Origin

Previously, companies were required to download a certificate of origin form, manually enter the information, print the form, sign it, deliver it or courier it to a chamber of commerce office, wait to get it reviewed and signed by the appropriate chamber employee, return it or courier it back to the company office, and courier the signed and certified documents to the importer.

Today, companies can enter their shipment information online, transmit it to a chamber, and get a certified certificate of origin in less than a day and at a fraction of the cost. Online certification saves on couriers, travel time, postage, and parking fees.

Free Trade Agreement Certificates of Origin

Free trade agreements (FTA) between the United States and other countries utilize a certificate of origin to document that the goods listed on the form qualify for special tariff treatment under the terms of the free trade agreement.

The U.S. currently has 14 FTAs in force with 20 countries:

- U.S.-Mexico-Canada Agreement (USMCA) Certificate of Origin

- U.S.-Australia Certificate of Origin

- U.S.-CAFTA-DR Certificate of Origin

- U.S.-Chile Certificate of Origin

- U.S.-Colombia Certificate of Origin

- U.S.-Japan Certificate of Origin

- U.S.-Korea Certificate of Origin

- U.S.-Panama Certificate of Origin

- U.S.-Peru Certificate of Origin

- U.S.-Singapore Certificate of Origin

- NAFTA Certificate of Origin (expired)

- Commercial Invoice for Exports to Israel

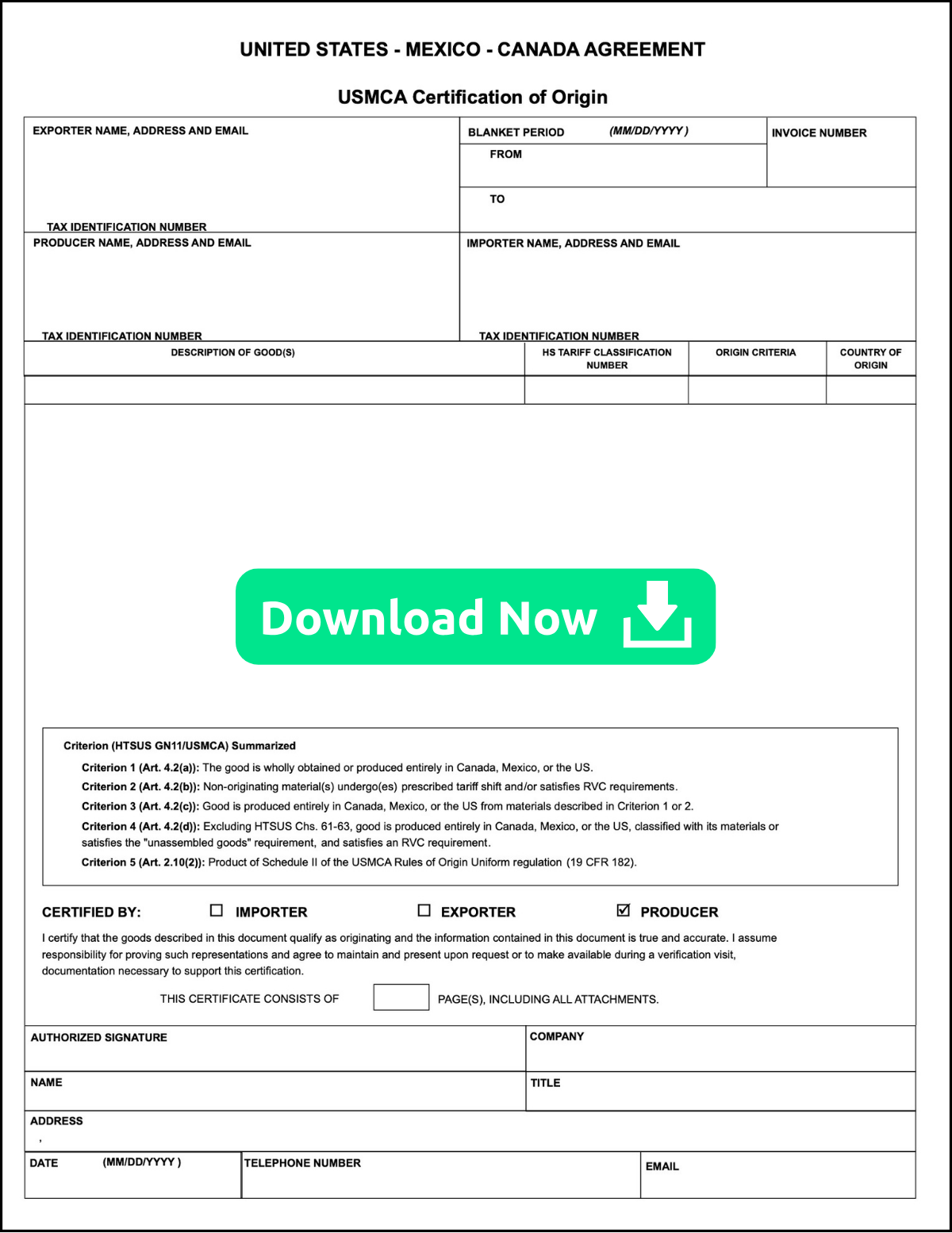

USMCA Certificate of Origin

The United States-Mexico-Canada Agreement (USMCA) officially replaced NAFTA on July 1, 2020. At that point NAFTA and the NAFTA Certificate of Origin became invalid.

Unlike NAFTA, the USMCA does not have a specific form that must be used to make a claim for preferential duty rates under the agreement. Instead, whichever party is certifying that the goods meet the rules of origin, must provide, at minimum, certain data elements as outlined in the agreement to support the claim.

That information can be provided on the invoice or on a separate attached document—a certificate of origin like the one available here. The document can be provided in a hard copy or digital format.

Importers must have the certificate in their possession at the time they make this claim. If they don't have it at the time of importation, they can make their claim up to one year later.

International protocol dictates that a free trade agreement be referred to using the country in which a person resides first. Therefore, in the United States, it is called USMCA. In Canada, it is officially known as the Canada–United States–Mexico Agreement (CUSMA) in English and the Accord Canada–États-Unis–Mexique (ACEUM) in French. In Mexico, it is called the Tratado entre México, Estados Unidos y Canadá (T-MEC).

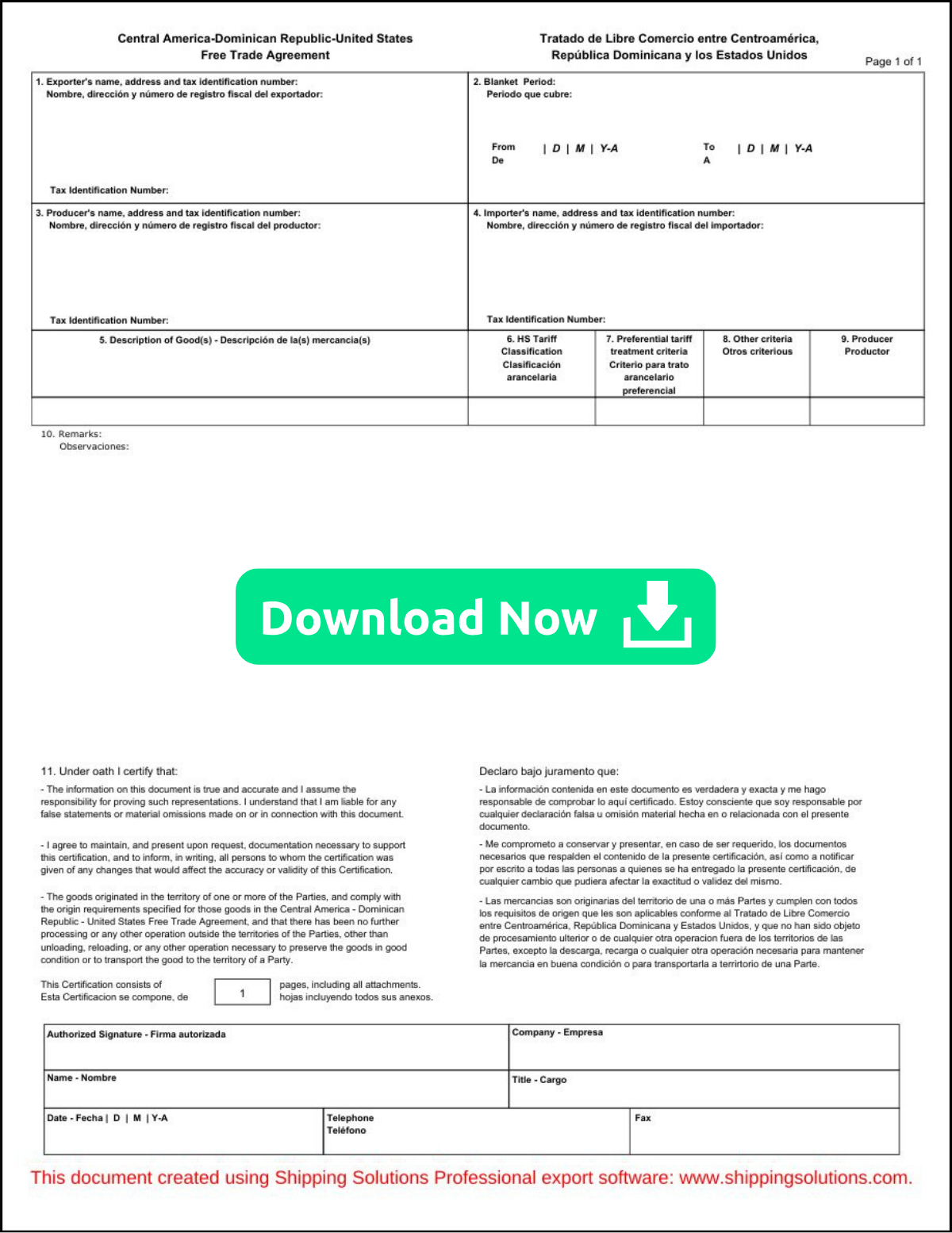

U.S.-CAFTA-DR Certificate of Origin

The Central America and Dominican Republic Free Trade Agreement (CAFTA-DR) designates the importer with the responsibility of claiming preferential tariff treatment under the Agreement. The importer should work with the U.S. exporter to ensure that a U.S. good meets the relevant rule of origin under the CAFTA-DR prior to making a claim.

In general, a product's eligibility for preferential tariff treatment may be demonstrated in a variety of ways provided it is in written or electronic form, for instance: a statement on company letterhead, a statement on a commercial invoice, or a certification. While no official form is required in order to demonstrate eligibility for preferential tariff treatment under the CAFTA-DR, there is a required list of elements that need to be included.

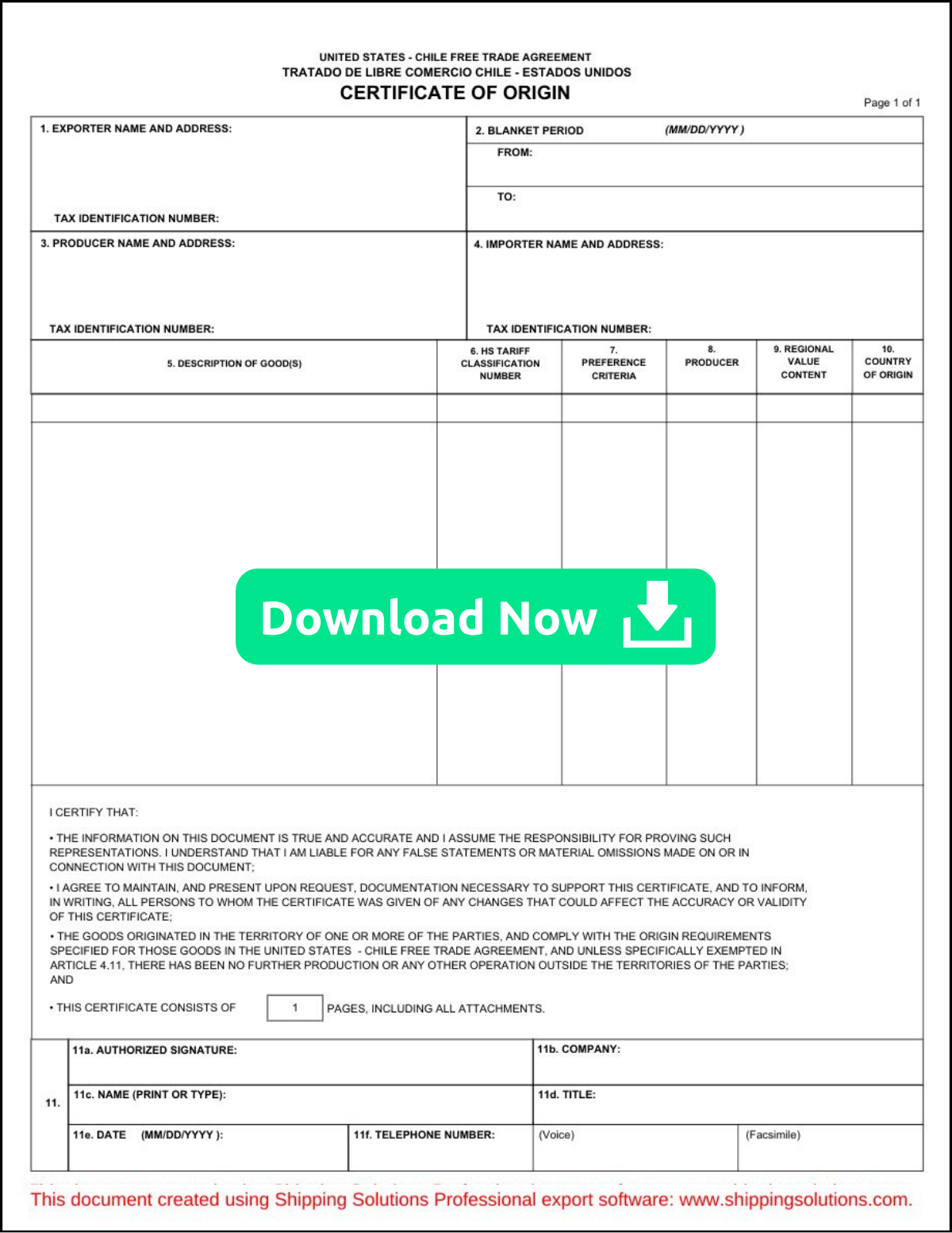

U.S.-Chile Certificate of Origin

The U.S.-Chile Free Trade Agreement (FTA) provides lower duties on certain goods originating in and traded between the United States and Chile. The Chilean importer is responsible for claiming preferential treatment for a given shipment at the time the goods are cleared through Customs. In order to claim the preferential duty rate, the importer must provide to Chilean Customs a written declaration, which may or may not be in the form of a certificate of origin.

Despite the fact that the ultimate responsibility for making the declaration lies with the importer, the information needed to support the declaration will have to be provided by the producer. The written declaration that the goods are originating may be produced by the exporter, importer or producer of the goods.

If someone other than the producer (i.e., the exporter or importer) issues the declaration, it must be based upon either:

- A written declaration of origin issued by the producer, or

- The issuer's intimate knowledge of the product, its manufacture, and its components.

The importer is heavily dependent upon the assistance and cooperation of its U.S. suppliers in producing accurate and well-documented declarations of origin.

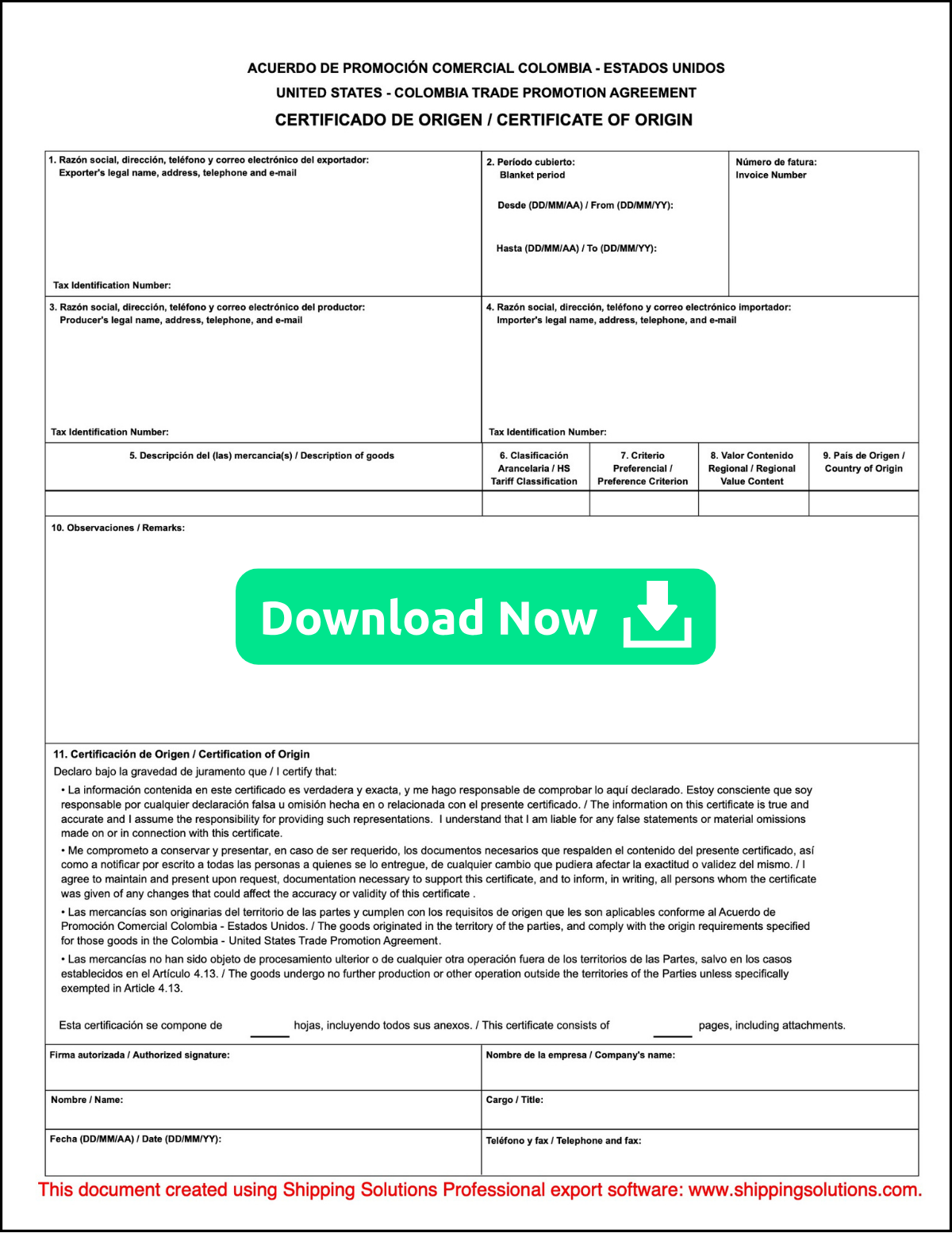

U.S.-Colombia Certificate of Origin

The United States-Colombia Free Trade Agreement (FTA) entered into force on May 15, 2012. On the day of implementation, more than 80% of U.S. industrial goods exports to Colombia became duty-free including agricultural and construction equipment, building products, aircraft and parts, fertilizers, information technology equipment, medical and scientific equipment, and wood.

It is the responsibility of the importer in Colombia to make a claim for the FTA-negotiated preferential tariff rate for qualifying products. However, the exporter or producer may be asked by the importer, customs broker, or the Colombia Customs Service to provide a written or electronic certification or other information to support the importer’s claim. While there is no required form for certifying origin, this is form that is commonly used by many exporters and importers.

The importer is heavily dependent upon the assistance and cooperation of its U.S. suppliers in producing accurate and well-documented declarations of origin.

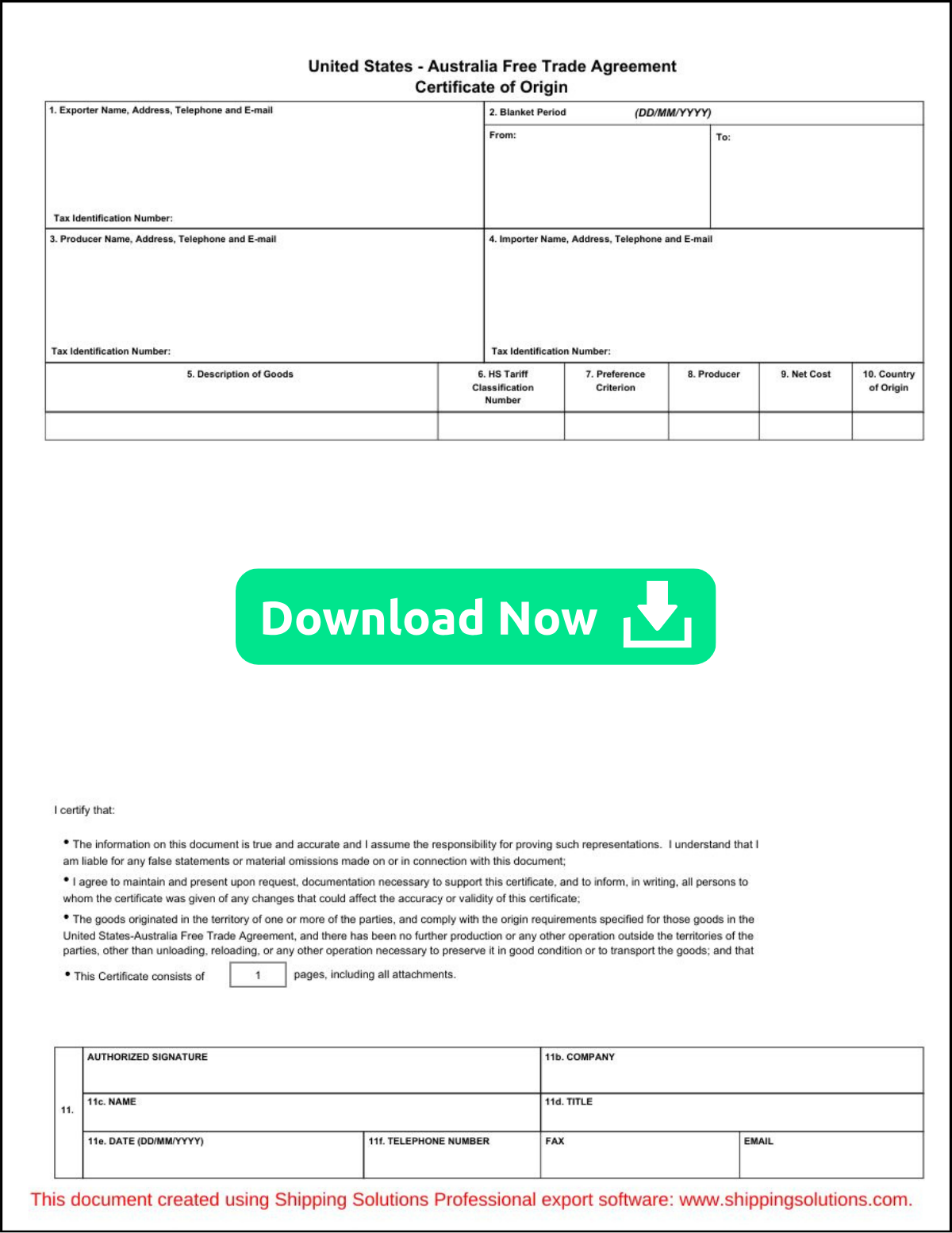

U.S.-Australia Certificate of Origin

The U.S.-Australia Free Trade Agreement (FTA) is an agreement between the United States and Australia that allows both nations to establish free trade between the two nations through the reduction and elimination of barriers to trade in goods and services.

In order to qualify, a product must qualify as "originating" under the terms of the Agreement. This means that the product must have sufficient U.S. or Australian content or processing to meet the criteria of the Agreement. If goods contain only U.S. or Australian inputs, they qualify. If they contain some inputs from other countries, they still might qualify if they meet specific criteria set out in the Rules of Origin of the Agreement.

The U.S.-Australia FTA calls for the importer to make a claim of preference. The importer may therefore ask the exporter for this information. The exporter (seller) may give confirmation, in an un-prescribed format, of why the goods qualify as "originating," which the importer may use to validate its claim. It is advisable to work with your importer and provide your importer with a written statement of origin upon request.

Customs officials can require importers to maintain documents relating to purchases and costs for up to five years after importation, should investigation and verification of claims be required. Customs officials can also seek information from exporters in verifying claims.

U.S.- Israel Certificate of Origin

Prior to April 1, 2018, U.S. exporters who wished to qualify for preferential access to the Israeli market needed to use a special green certificate of origin form. That form has now been replaced by a U.S. Origin Invoice Declaration that needs to appear on a commercial document, which would typically be the commercial invoice.

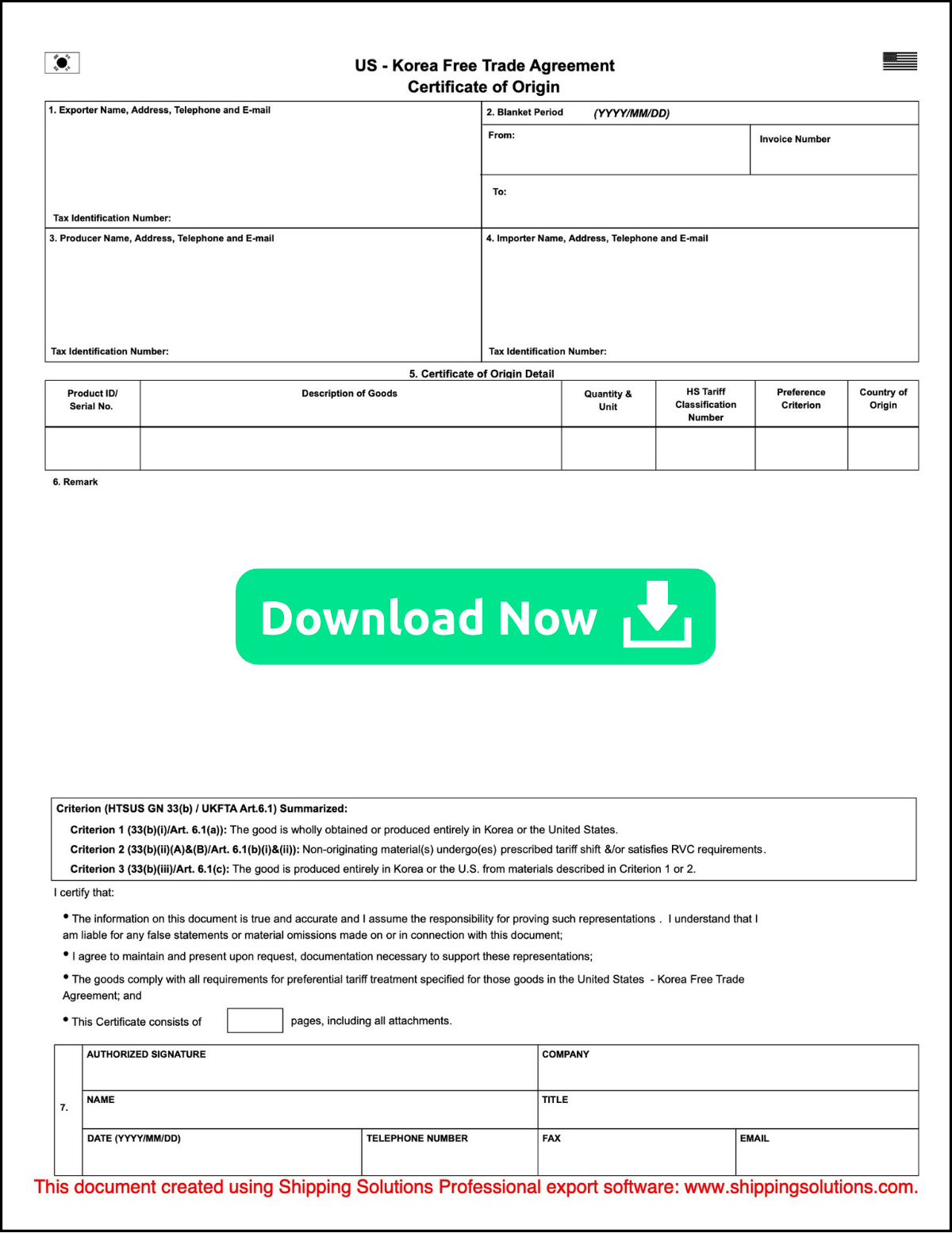

U.S.-Korea Certificate of Origin

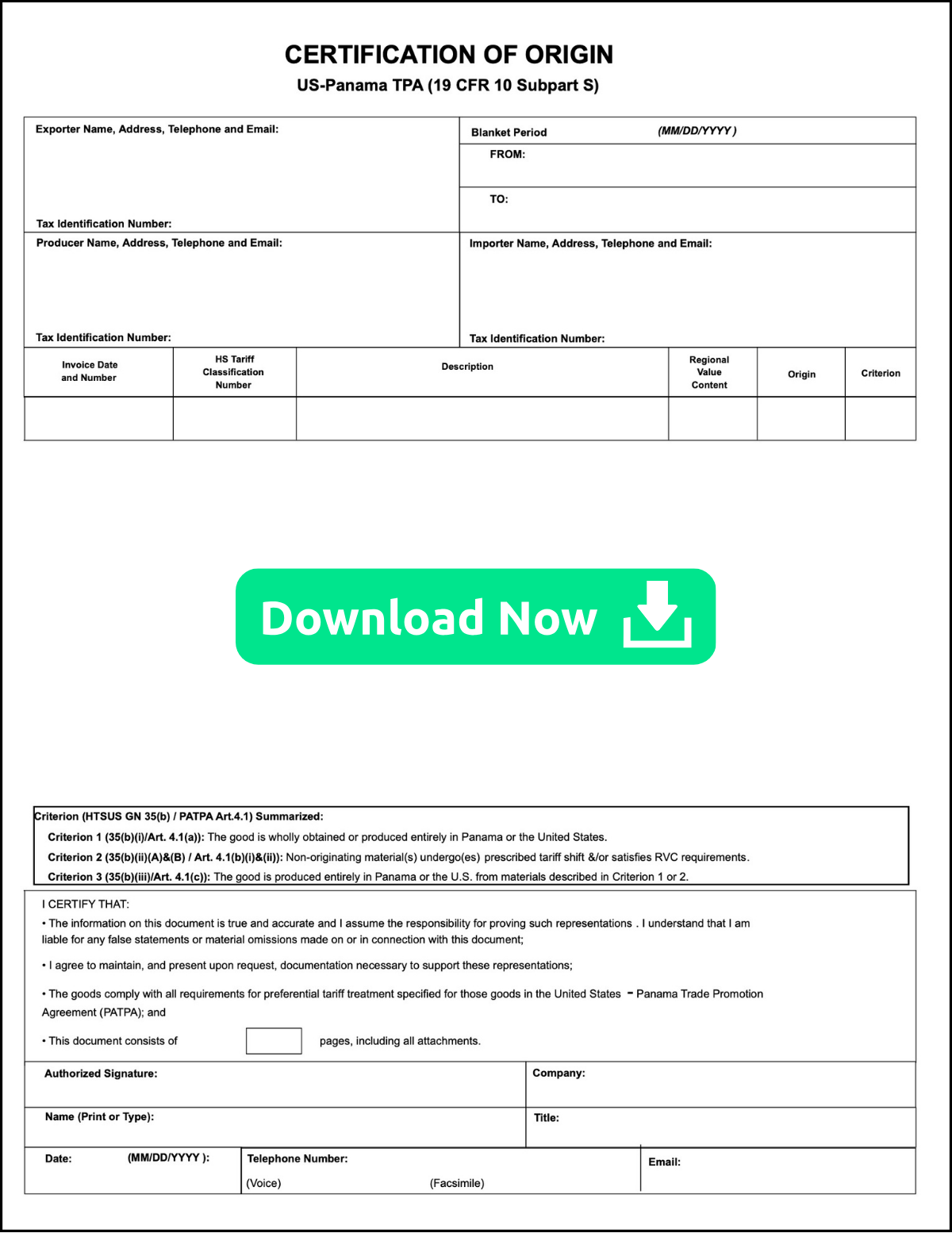

U.S.–Panama Certificate of Origin

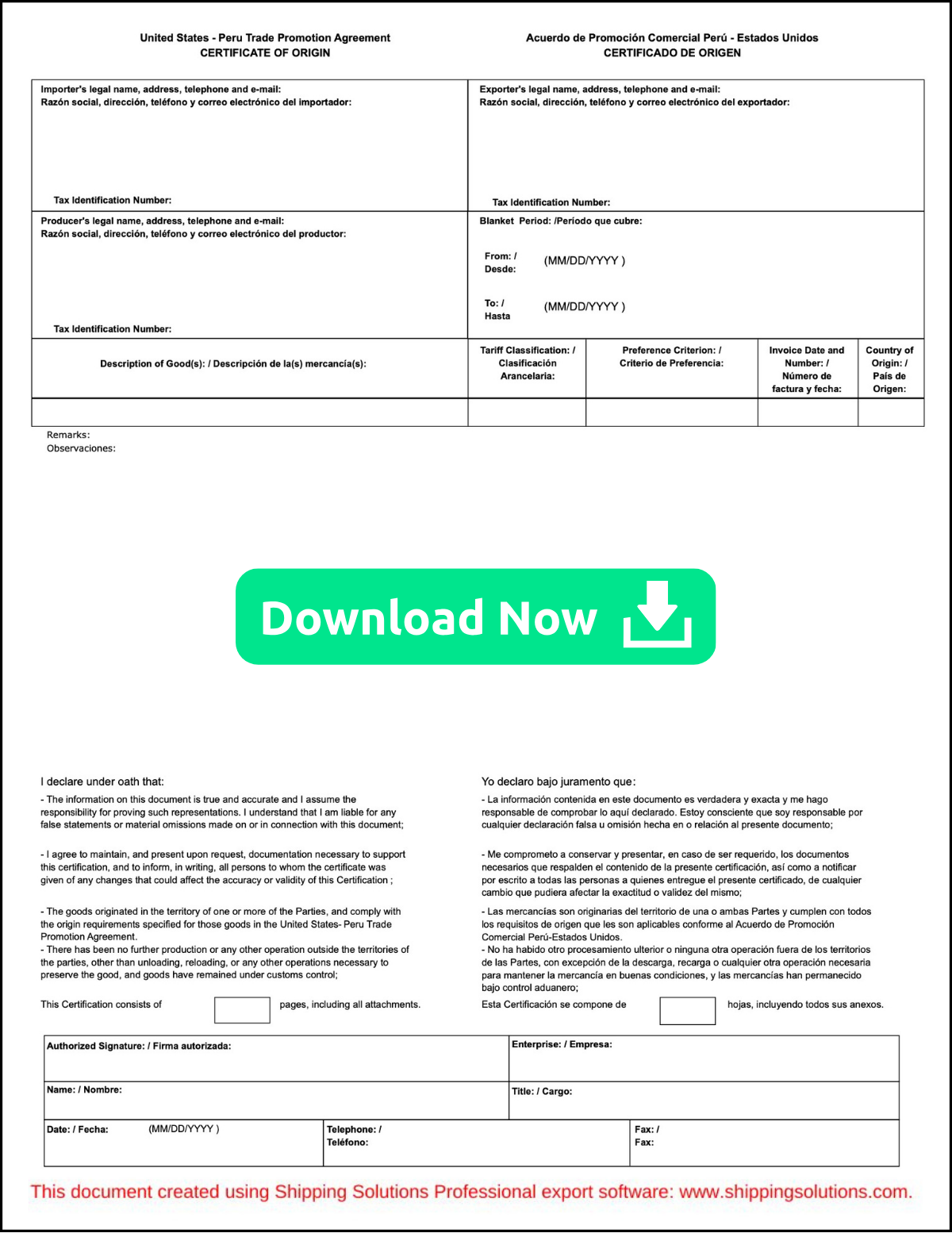

U.S.–Peru Certificate of Origin

The United States–Peru Trade Promotion Agreement (PETPA) eliminates tariffs and removes barriers to U.S. services; provides a secure, predictable legal framework for investors; and strengthens protection for intellectual property, workers, and the environment.

It is the responsibility of the importer in Peru to make a claim for the preferential tariff rate for qualifying products. However, the exporter or producer may be asked by the importer, customs broker, or Peru Customs Service to provide a written or electronic certification or other information to support the importer’s claim. While there is no required form for certifying origin, this form is commonly used by many exporters and importers.

The importer is heavily dependent upon the assistance and cooperation of its U.S. suppliers in producing accurate and well-documented declarations of origin.

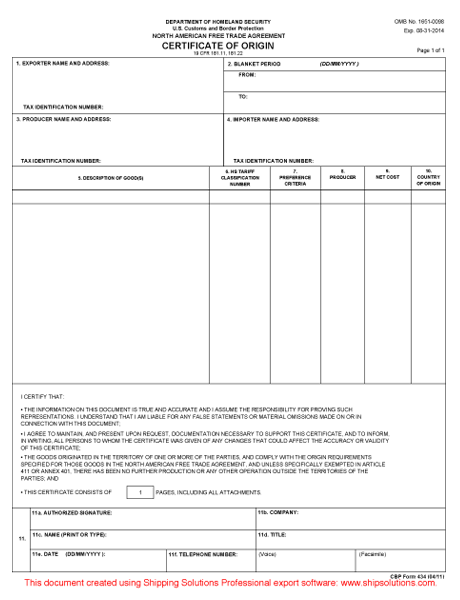

NAFTA Certificate of Origin (expired)

For 25 years, the North American Free Trade Agreement (NAFTA) provided substantial benefits for importers and exporters in Mexico, Canada, and the United States for goods originating in the three nations. It was replaced on July 1, 2020, with the U.S.-Mexico-Canada Agreement (USMCA), which revises and updates the agreement. The NAFTA Certificate of Origin is no longer valid.

What our customers say about us

I have about 272 team members using Shipping Solutions, mostly in the U.S., but also at a plant in Mexico, [and I] have visualization of every shipment that goes out of every location… The system is very easy to use. Our employees love using it. It makes life a lot easier for a lot of us.

Sandy Schultz

Quad

Shipping Solutions has been the best thing to happen to our exporting program. We are able to store unique customer data in a uniform way. No more trying to remember how to fill out every carrier's forms. No more entering and reentering information into multiple locations. Enter it once and be done. The restricted party screening is a great tool. One click and you're done. Shipping Solutions has saved us time, money and aggravation. I would recommend Shipping Solutions to anyone who exports.

Carol L. Wilson

Frontline

I just love this program! It makes my job fast and efficient. Customers and freight forwarders love my paperwork.

Ana Zax

Diamon-Fusion International

We are a small, but rapidly expanding company. Without Shipping Solutions Professional, we'd be lost in a sea of export orders. It helps us process and track our orders so quickly and efficiently, we don't want to be without it! Before we tried to do it all by hand, which cost us a lot of time and errors. Thanks for creating such an essential product!

Dacia Lindner

Diamon - Fusion International

Restricted party screening and filing through AES are my two favorite Shipping Solutions features!

Carol Bubbico

Cornelis Networks

Shipping Solutions is an excellent software package especially for the smaller exporter. The software is user friendly and easily adapted to individual company requirements. The online User Guide is easy to use with step-by-step illustrations of each screen. The Annual Maintenance Program provides users with the latest updates as they become available. The Customer Service Support Team is very responsive in addressing any technical questions.

Leah Kieffer

Brooks Instrument

We purchased your Shipping Solutions and are extremely happy with its capabilities. It's fast and easy to use.

Linda J. Weller

Production Control Units, Inc.