Free Download:

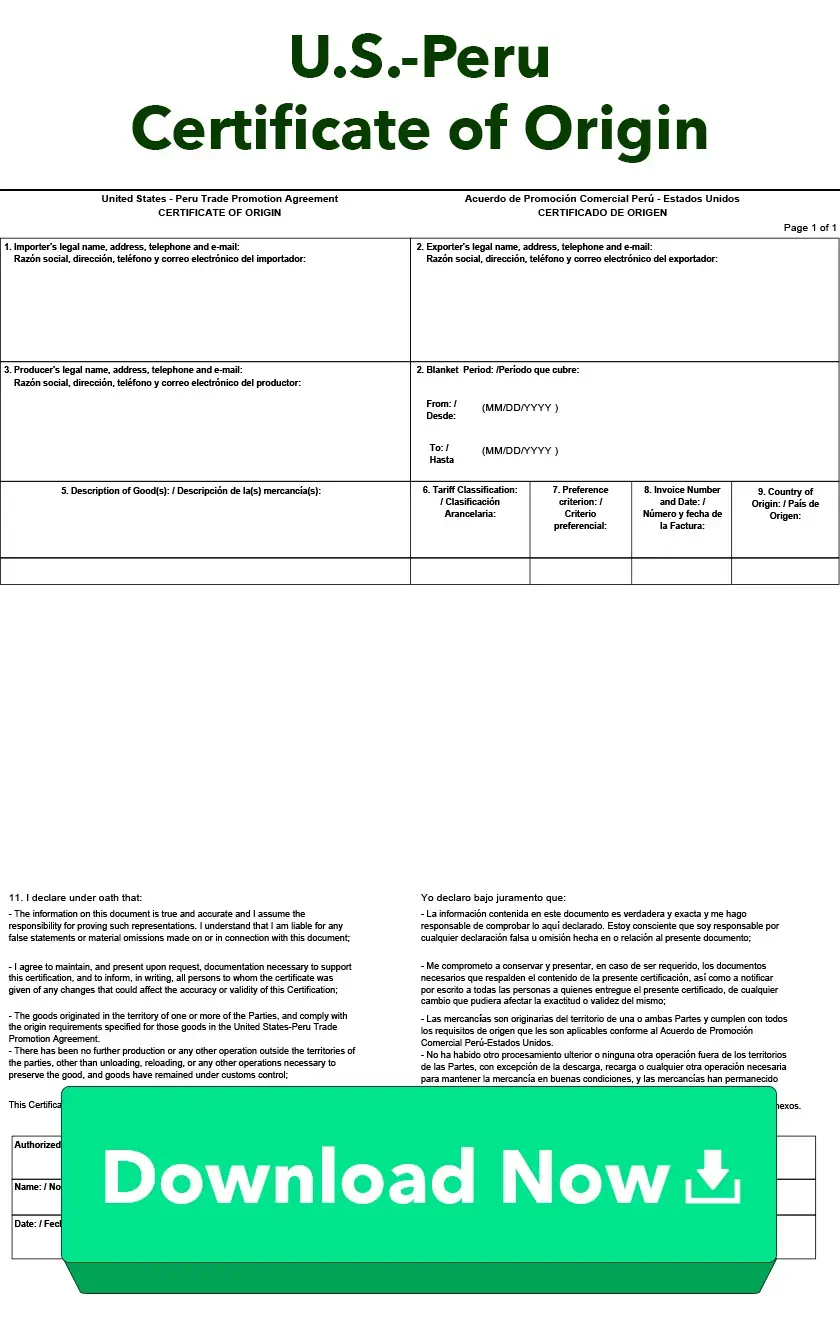

U.S.–Peru Certificate of Origin

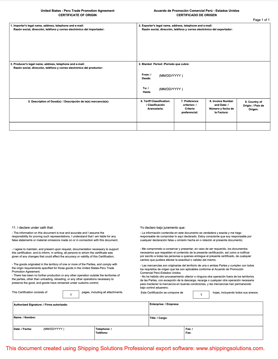

Download and print this PDF of the U.S. - Peru Certificate of Origin and help your importer claim preferential duty rates.

What is a U.S.–Peru Certificate of Origin?

The United States–Peru Trade Promotion Agreement (PETPA) entered into force on Feb. 1, 2009. The PETPA eliminates tariffs and removes barriers to U.S. services, provides a secure, predictable legal framework for investors, and strengthens protection for intellectual property, workers, and the environment.

The PETPA is the first agreement in force that incorporates groundbreaking provisions concerning the protection of the environment and labor rights that were included as part of the Bipartisan Agreement on Trade Policy developed by Congressional leaders on May 10, 2007. Since 2009, total trade between the United States and Peru has risen from close to $9 billion to $15.8 billion in 2019. Peru is currently our 35th largest goods trading partner.

It is the responsibility of the importer in Peru to make a claim for the preferential tariff rate for qualifying products. However, the exporter or producer may be asked by the importer, customs broker or Peru Customs Service to provide a written or electronic certification or other information to support the importer’s claim. While there is no required form for certifying origin, this form is commonly used by many exporters and importers.

The importer is heavily dependent upon the assistance and cooperation of its U.S. suppliers in producing accurate and well-documented declarations of origin.

Create Accurate Export Forms

Reduce the time it takes to complete the U.S. - Peru Certificate of Origin by up to 80%. Shipping Solutions export documentation software makes it easy to create more than two dozen standard export forms. Register now for a free demo. There's absolutely no obligation.

U.S.-Peru Certificate of Origin FAQs

-

Does Peru require a certificate of origin?

The United States-Peru Trade Promotion Agreement does not require a specific certificate of origin form to qualify for preferential treatment. However, there are specific data requirements to claim preference. Download the certificate of origin on this page to ensure you include all the required information.

-

Does Peru have a trade agreement with the U.S.?

The United States-Peru Trade Promotion Agreement (PETPA) entered into force on Feb. 1, 2009. The PETPA eliminates tariffs and removes barriers to U.S. services, provides a secure, predictable legal framework for investors, and strengthens protection for intellectual property, workers, and the environment.

-

Can I make my own U.S.-Peru certificate of origin?The responsibility for claiming preferential treatment lies with the importer. But often the information needed to support the claim will have to be provided by the producer or exporter of the goods. You can make your own certificate or origin. Download the template on this page to ensure the required information has been provided.

Download Now

Today is your lucky day. Shipping Solutions® makes completing export forms simple, accurate and five-times faster than the tedious way you’re doing it now.

Get it done easily.

Eliminate the hassle of manually completing your export forms. Our EZ Start Screen helps you automatically complete more than a dozen export forms.

Get it done fast.

With Shipping Solutions automation, you can complete your export documents up to five-times faster than your traditional manual process.

Get it done right.

Instead of entering the same information over and over again, you enter information in only one place. That makes you less likely to make costly mistakes.

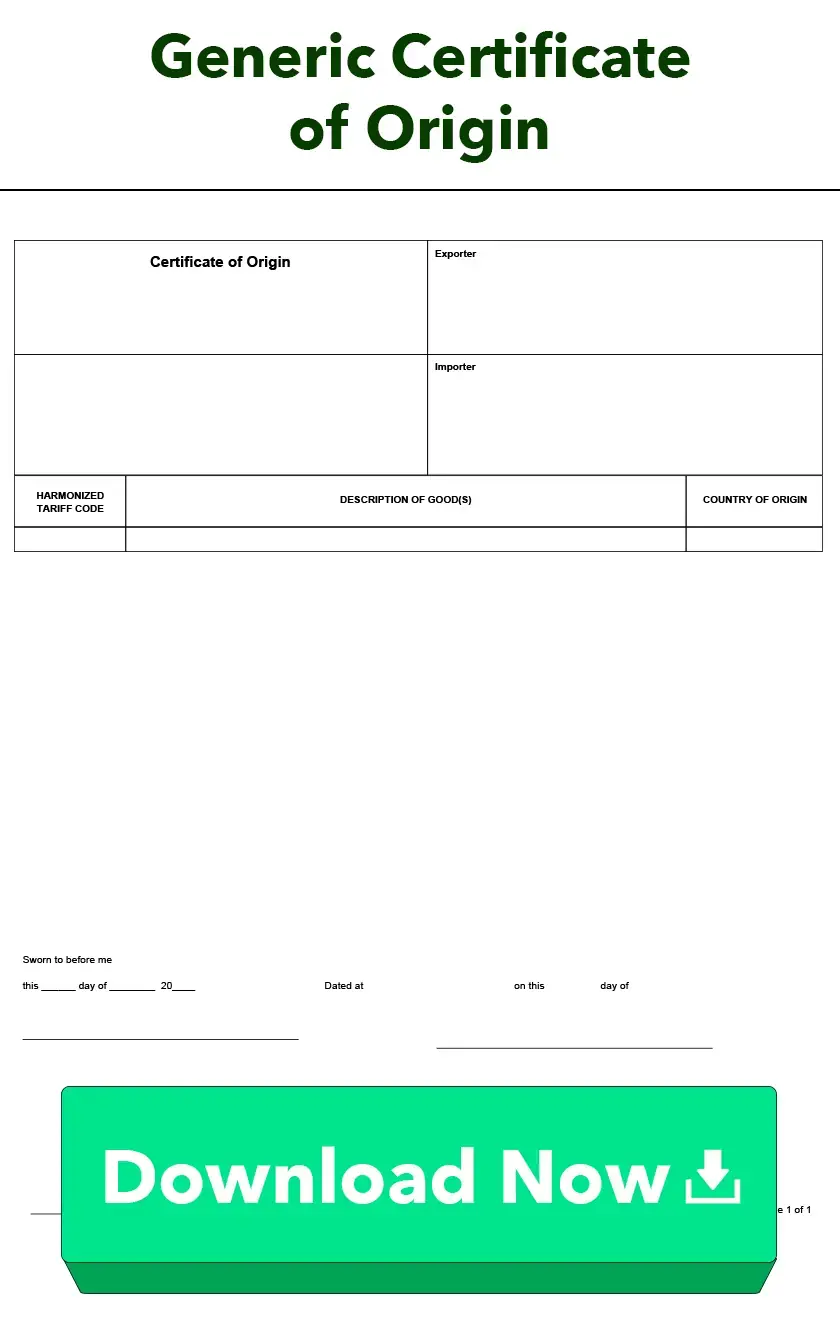

Export Form Templates

Popular

Our most frequently requested export forms.

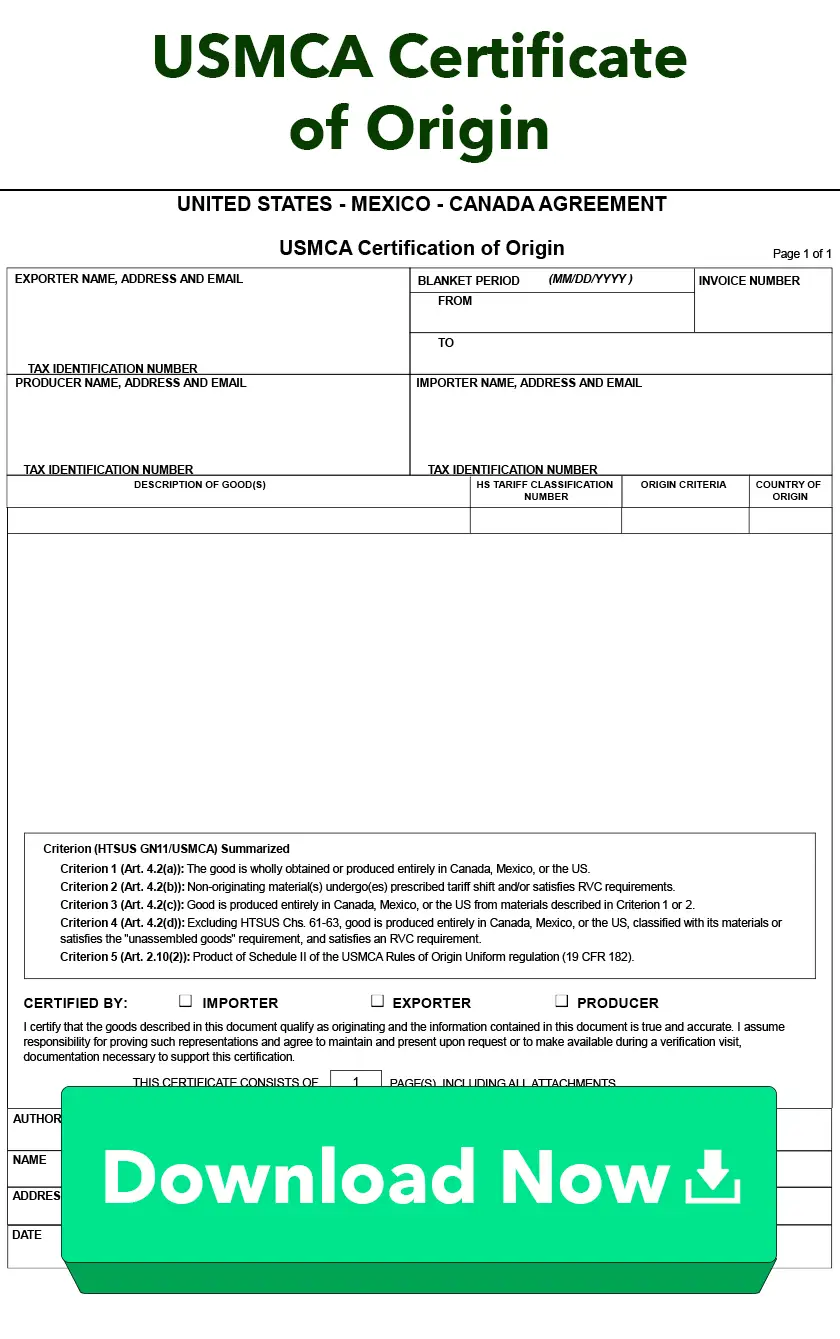

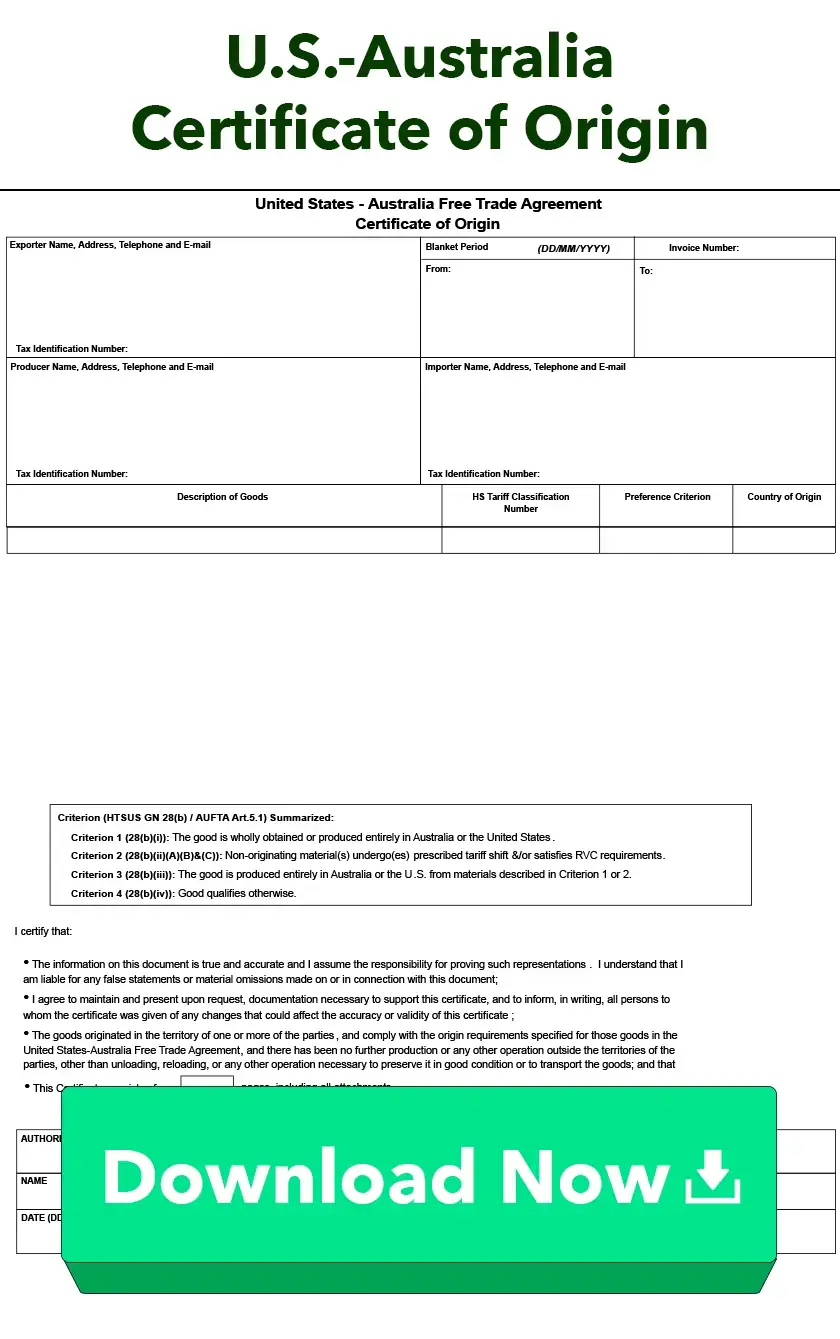

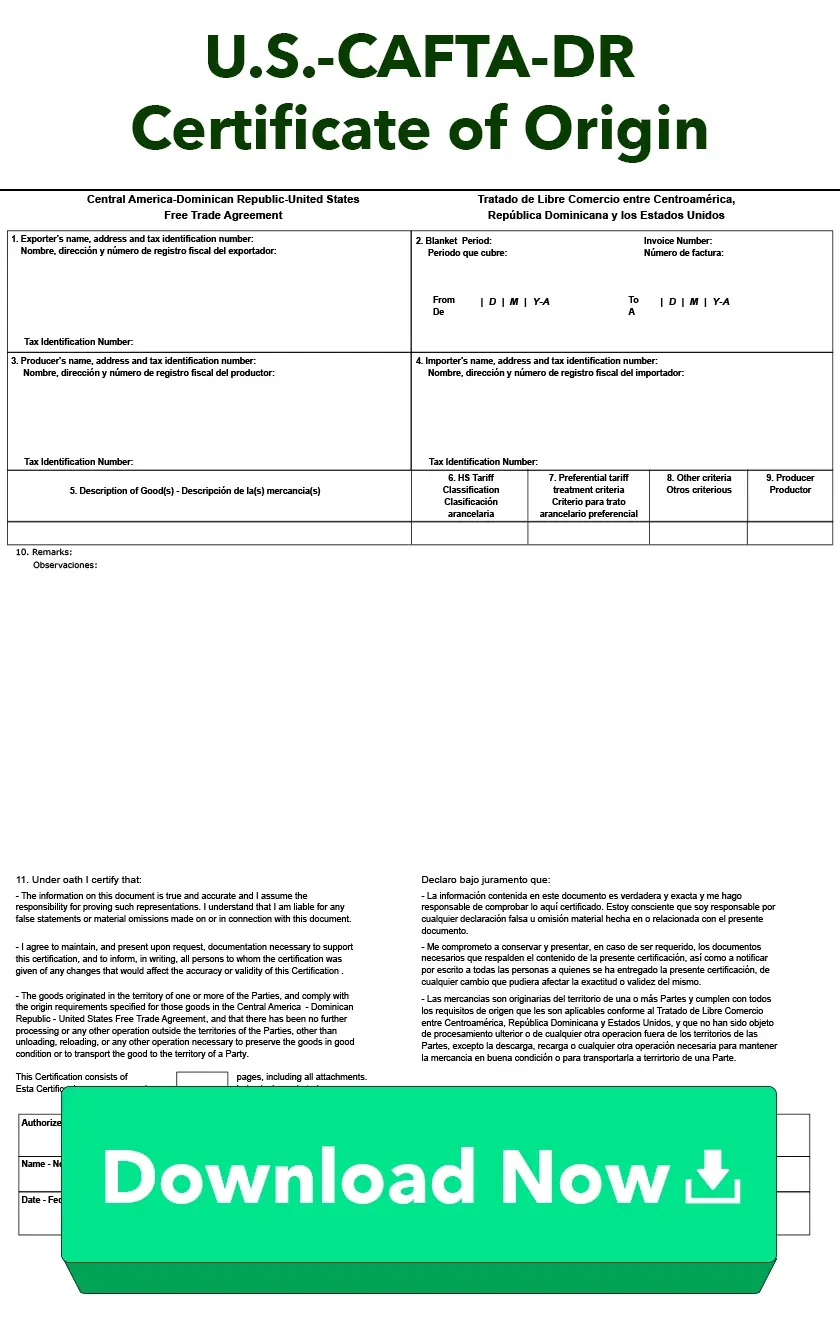

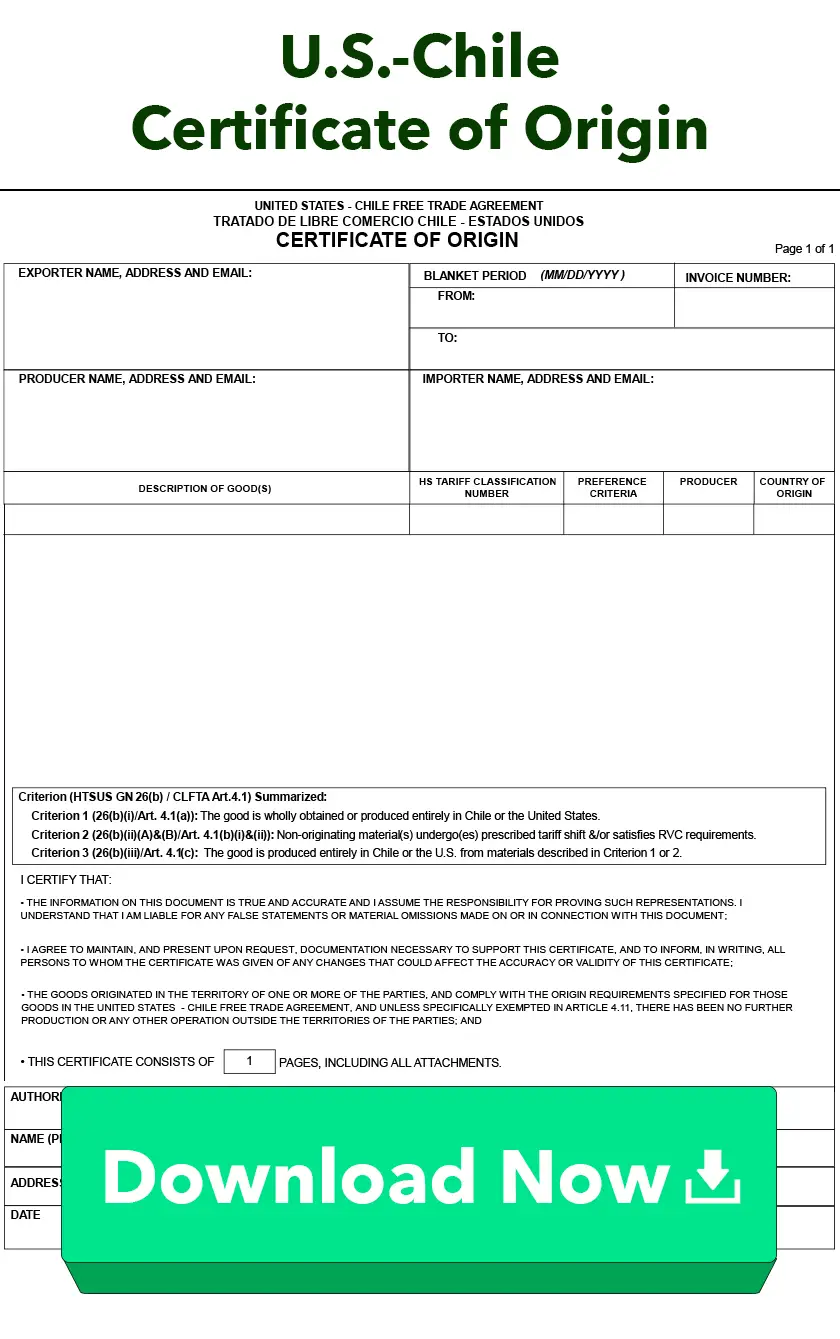

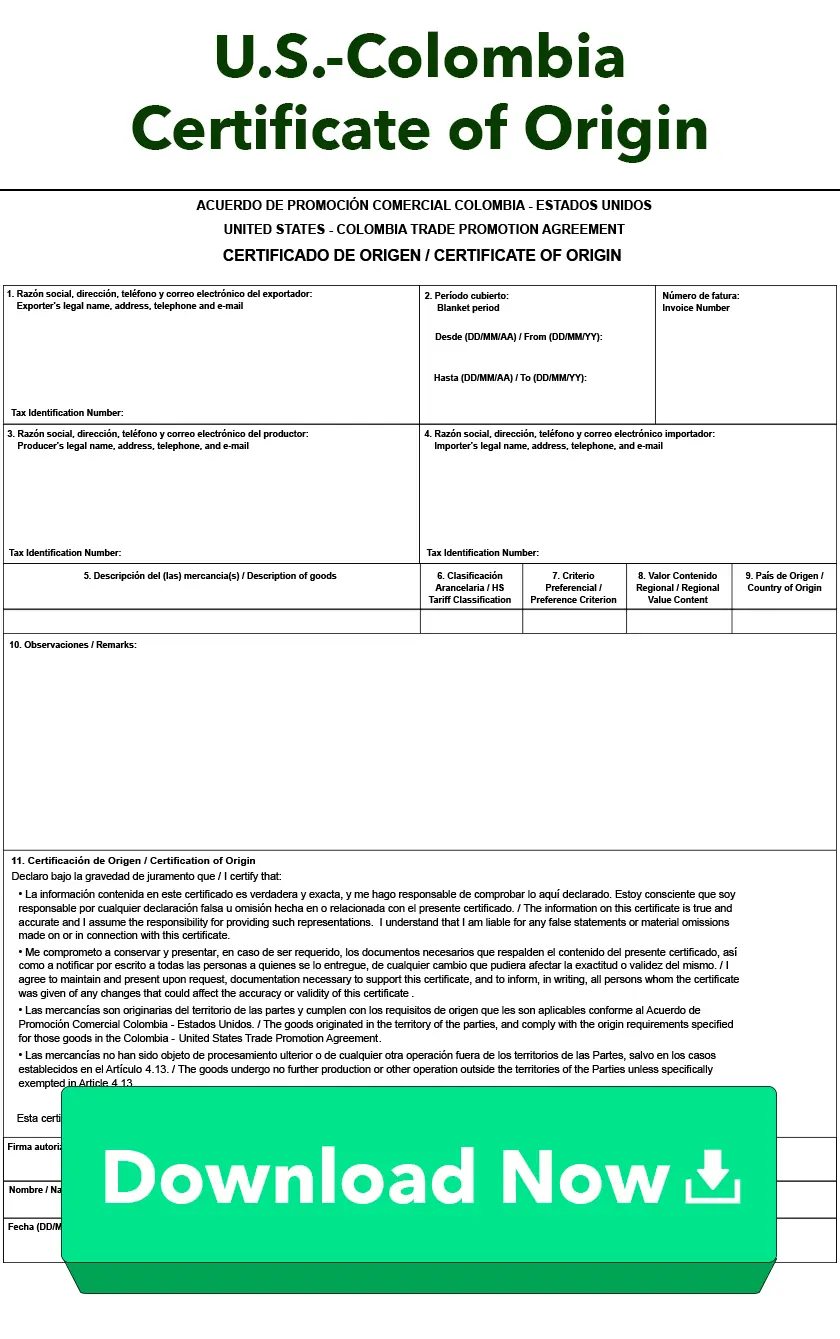

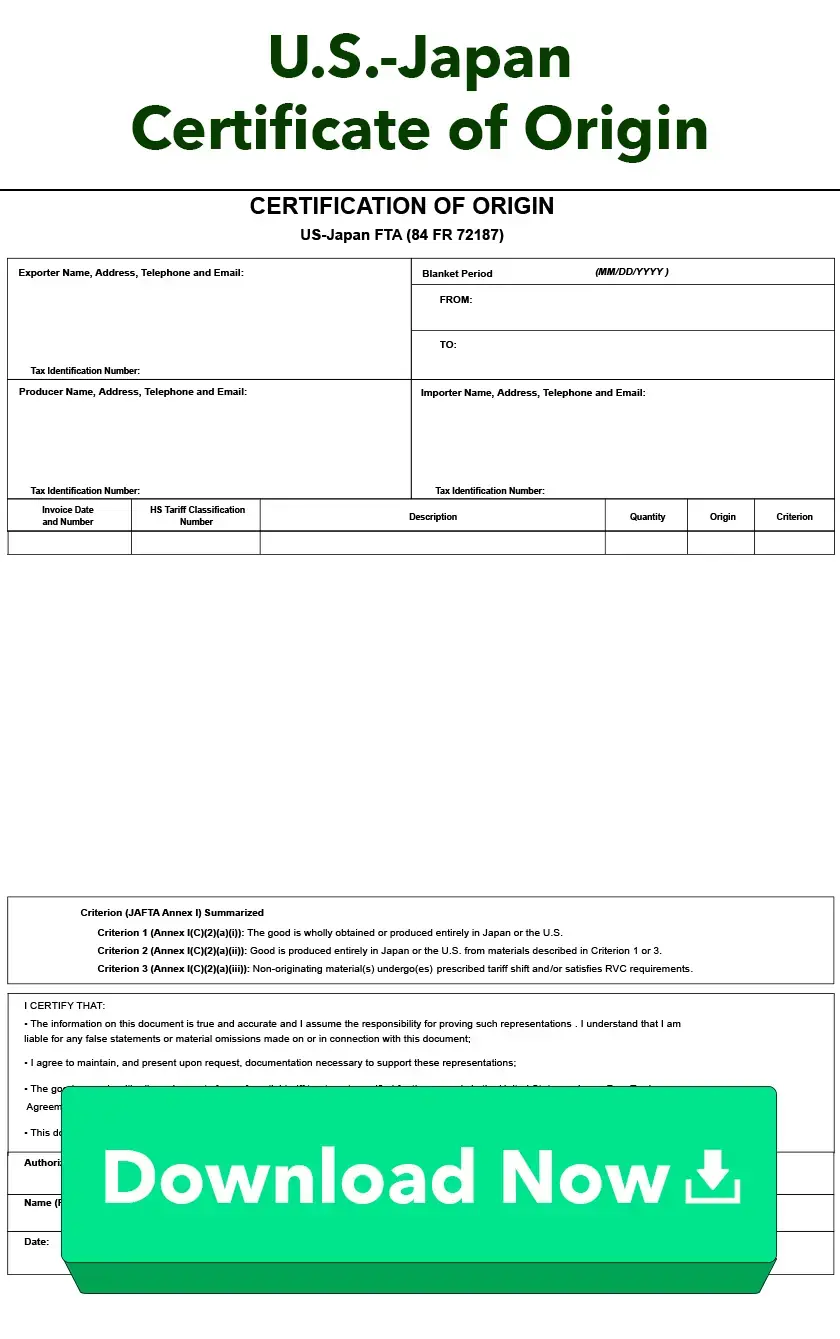

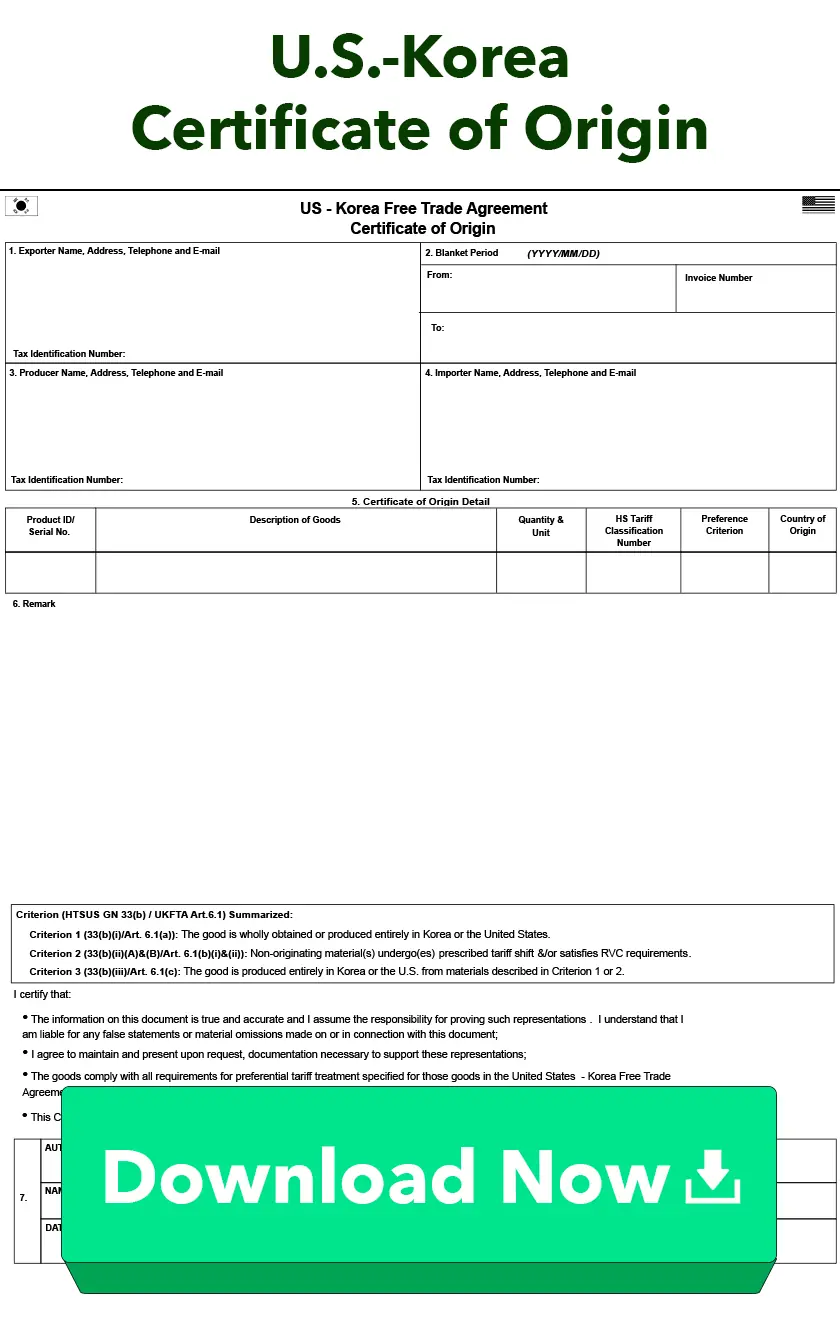

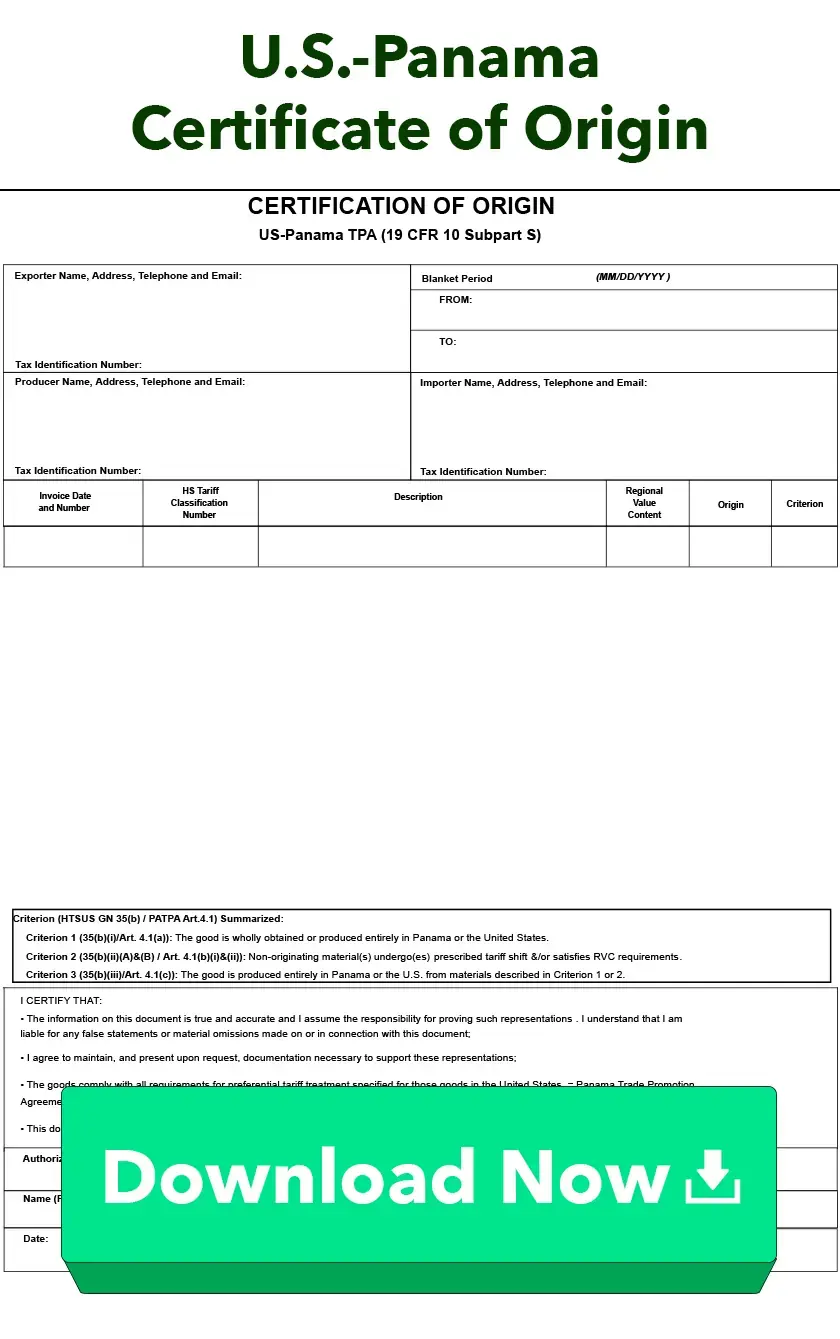

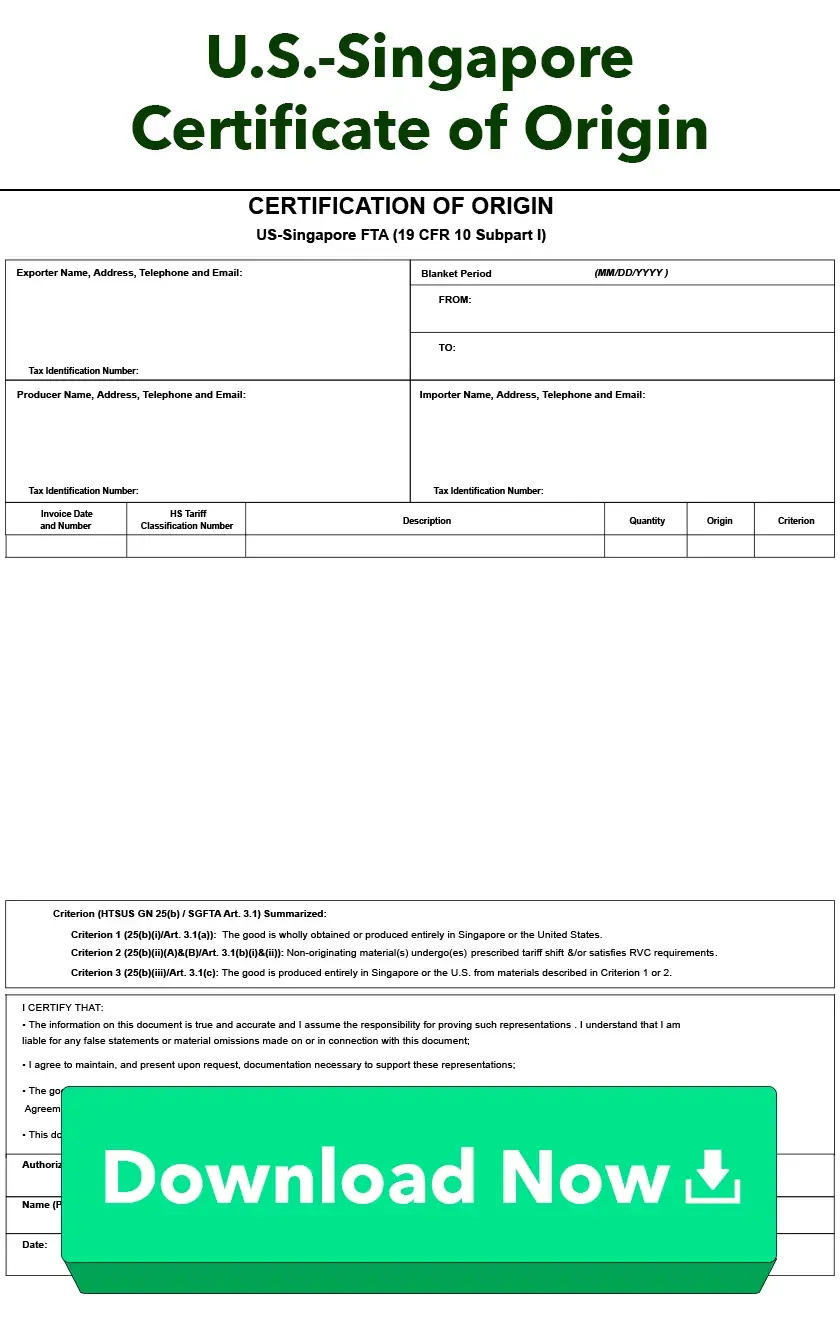

U.S. Certificates of Origin

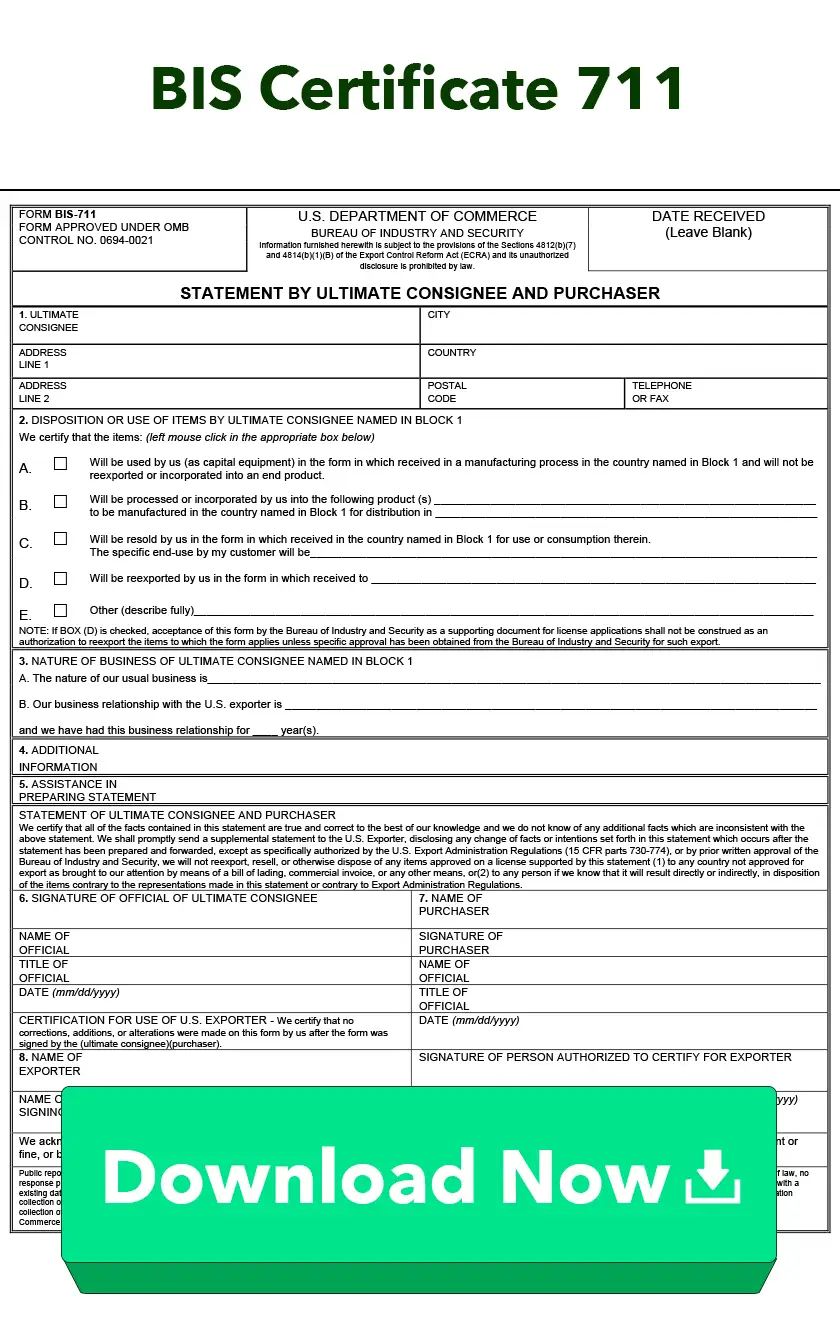

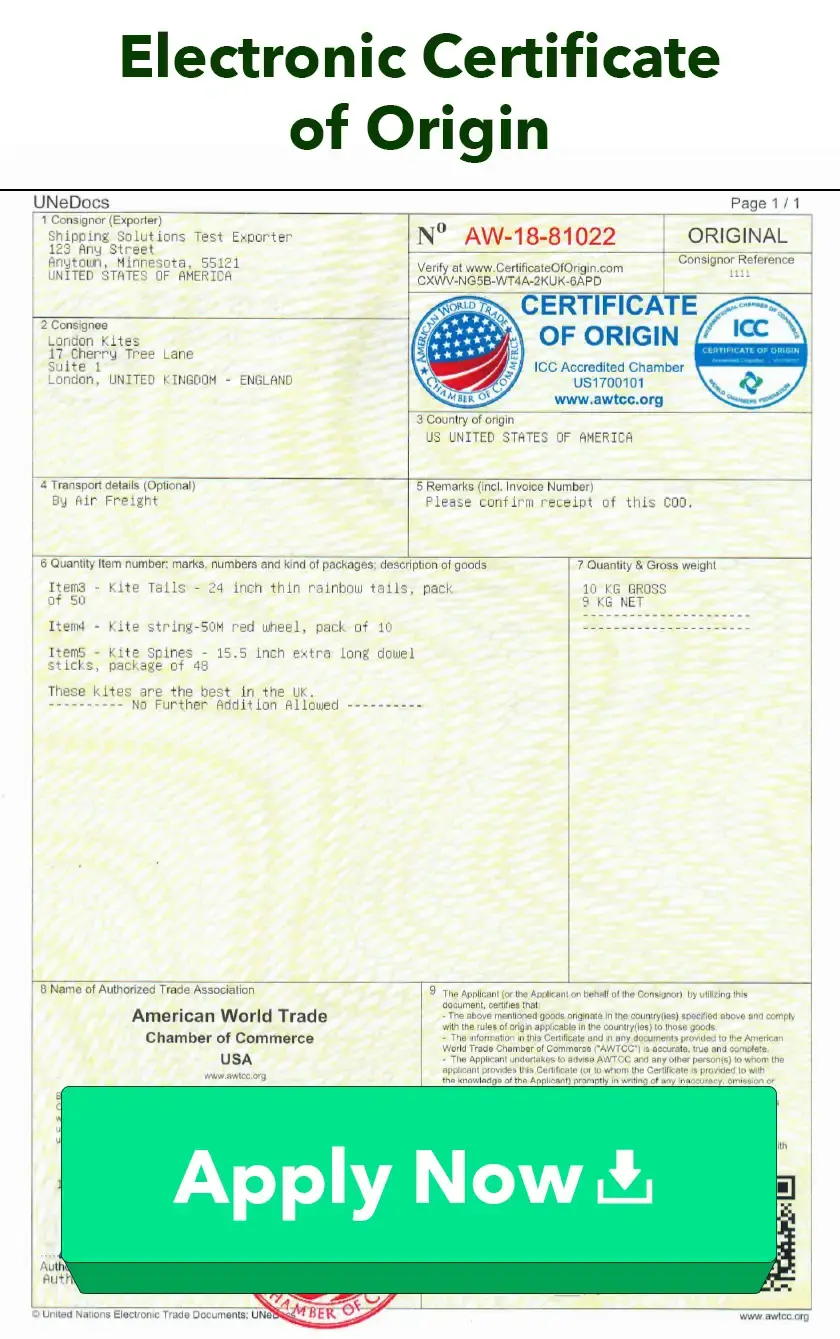

Learn More About U.S. Certificates of OriginThese forms certify the origin of the goods, which may determine the amount of duty to be paid.

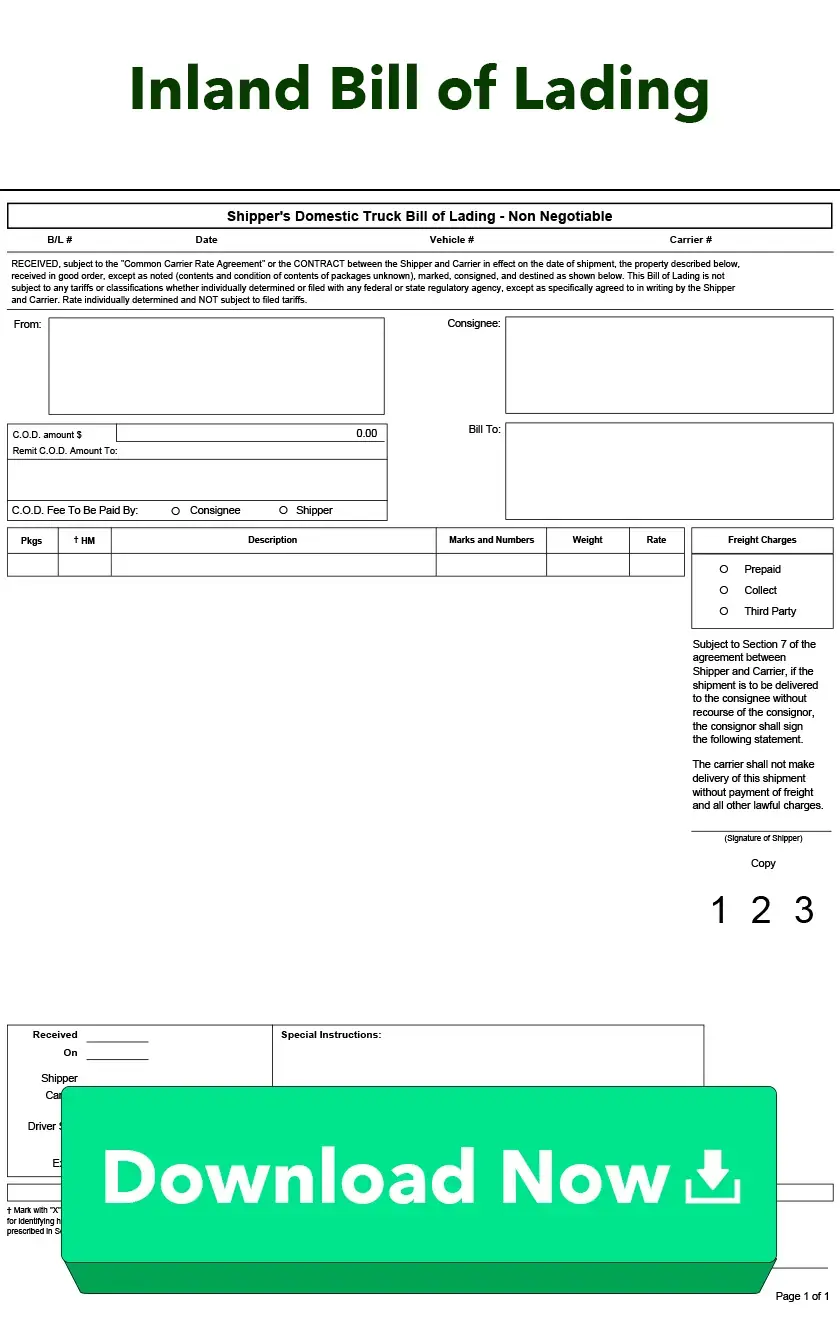

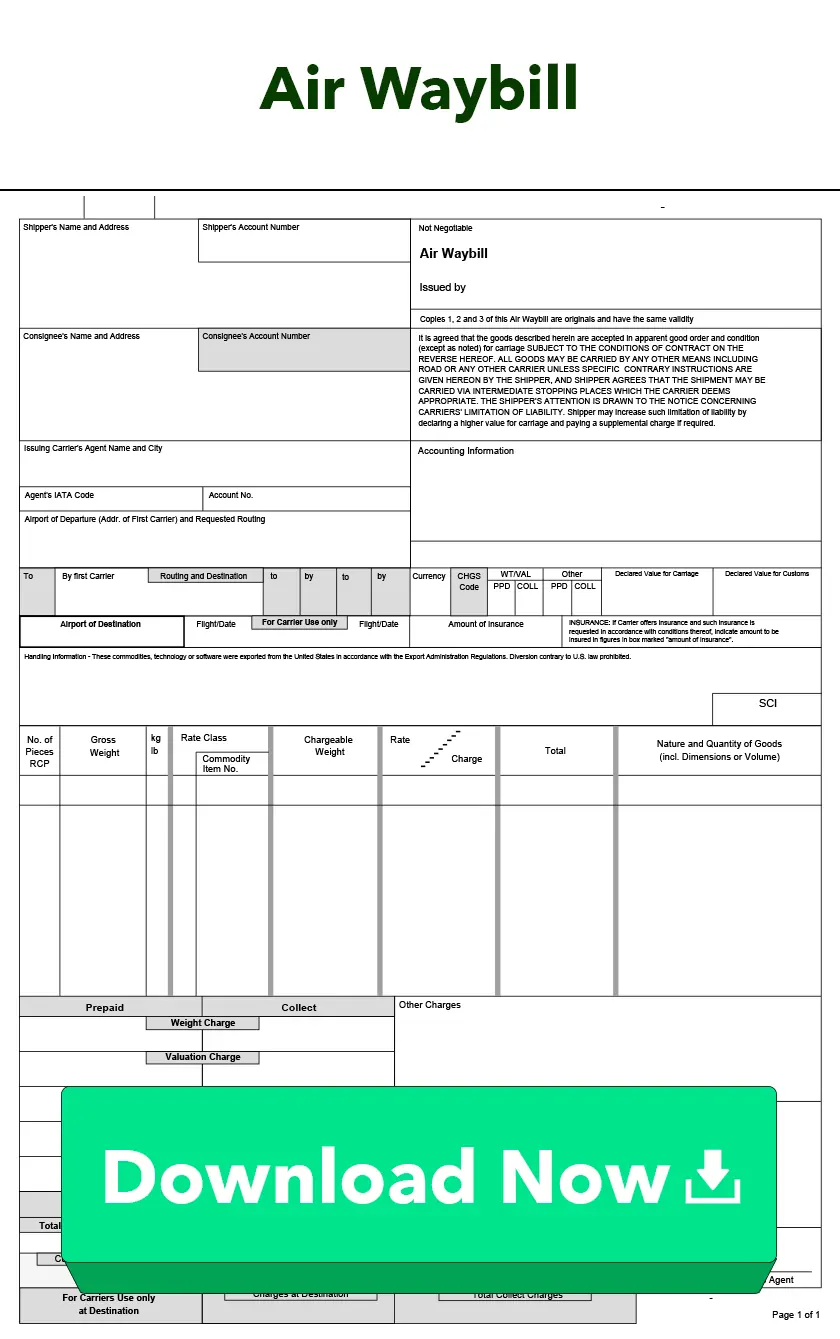

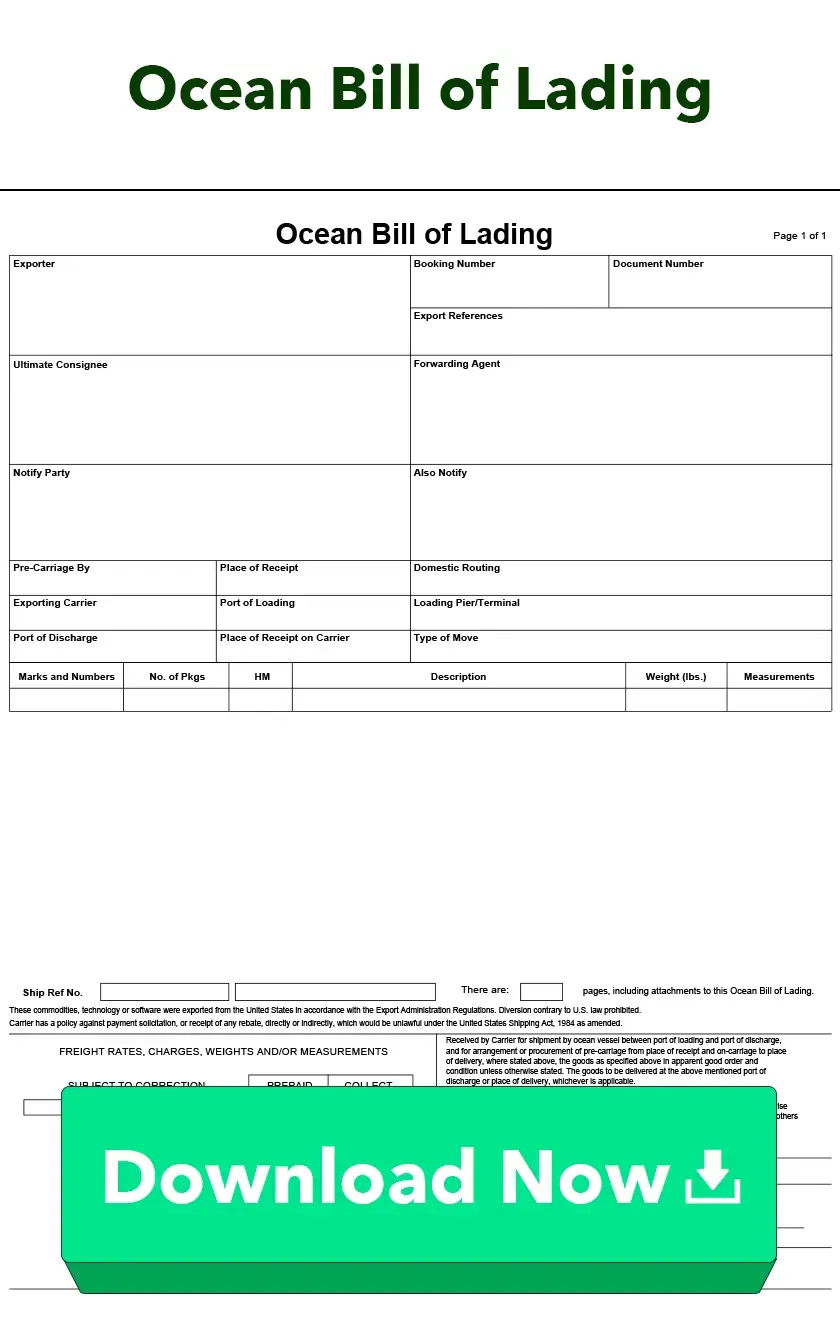

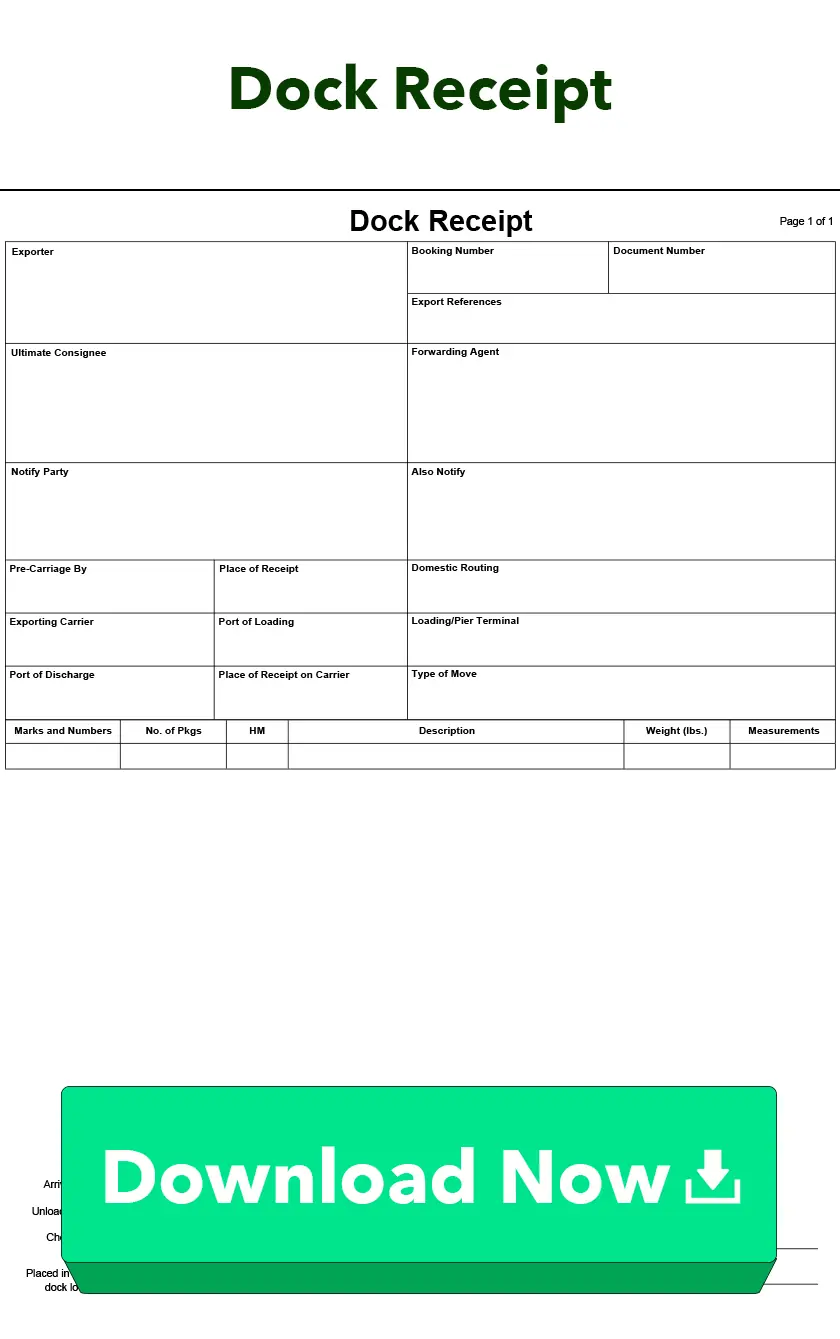

Bills of Lading

Learn More About Bills of LadingA bill of lading is a contract of carriage, a receipt from the carrier, and may be a document of title.

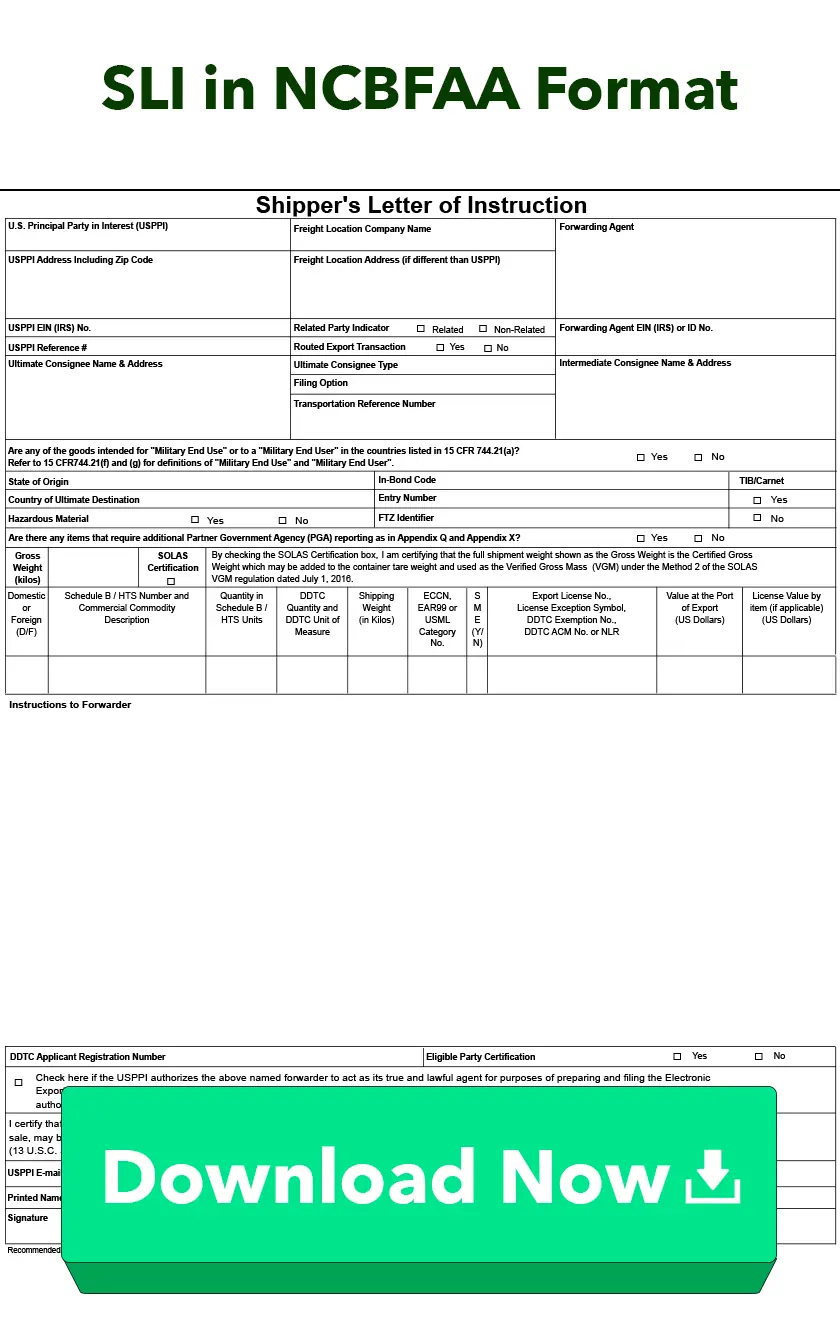

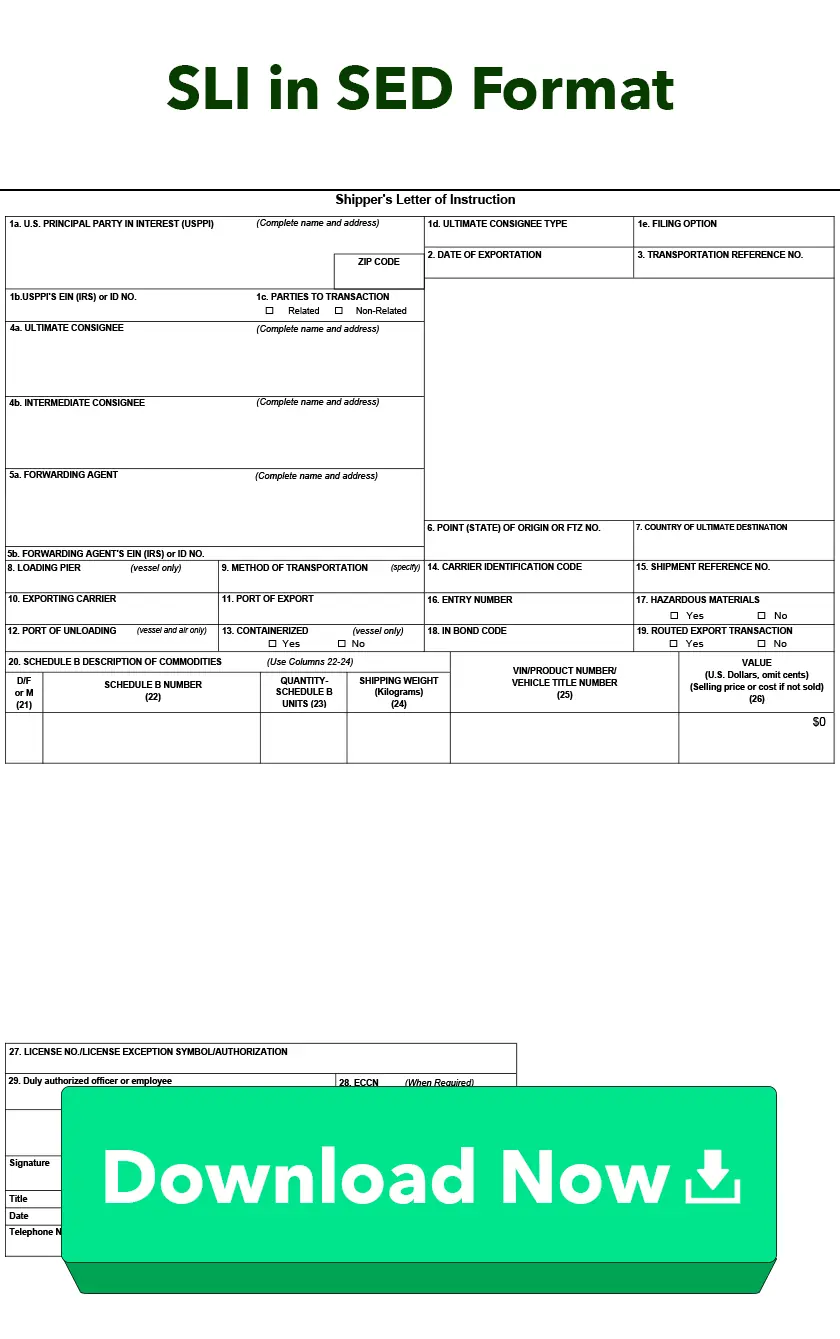

Shipper's Letter of Instruction (SLI)

Learn More About Shipper's Letter of Instruction (SLI)The Shipper's Letter of Instruction (SLI) conveys instructions from the exporter to the carrier or forwarder.

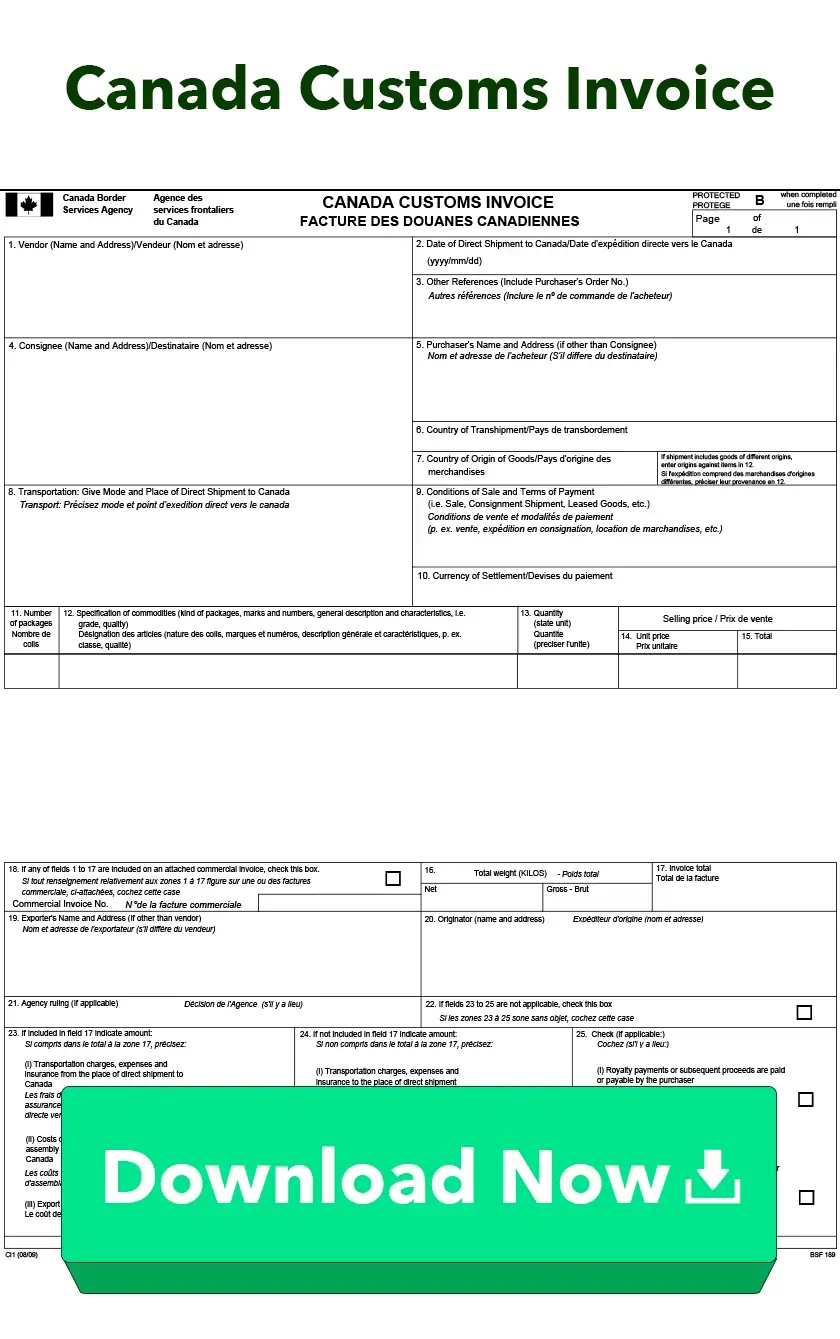

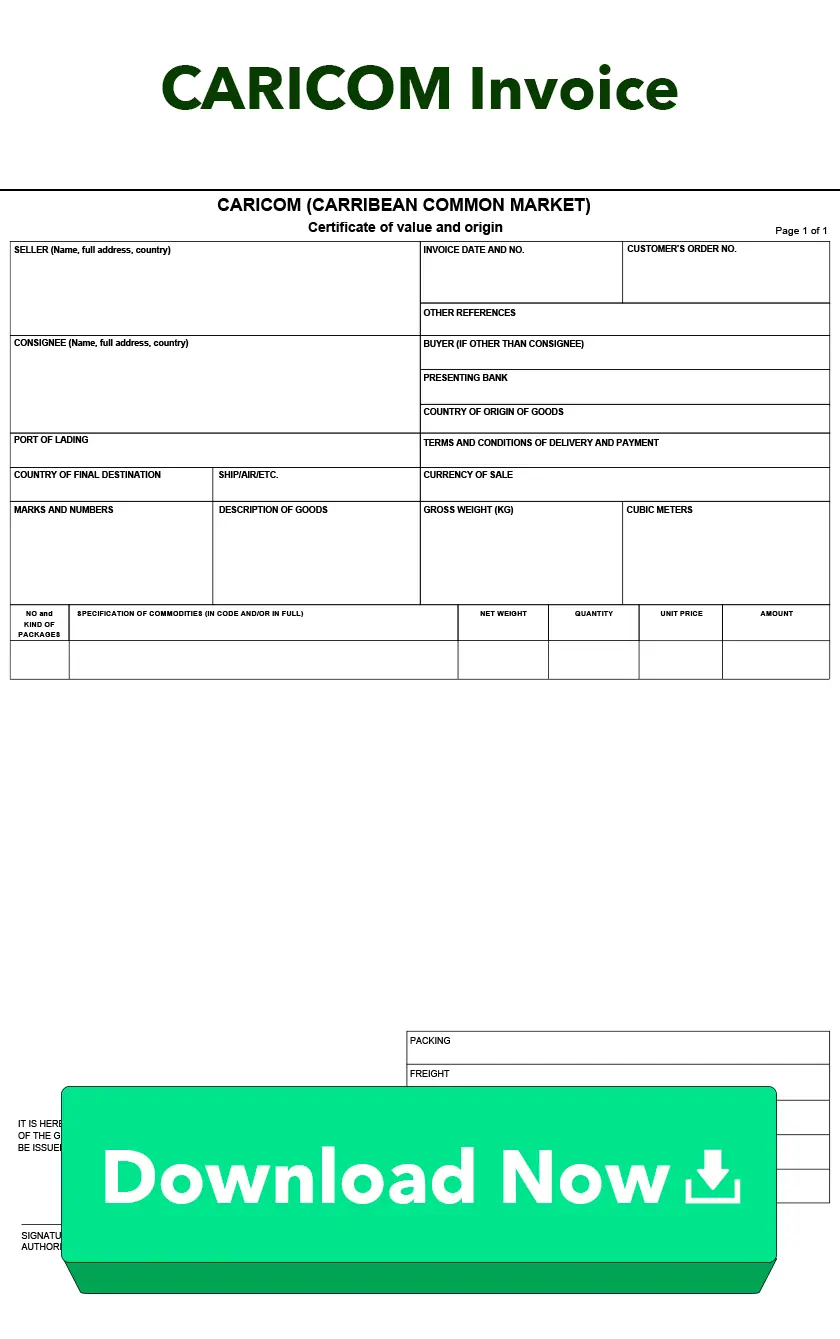

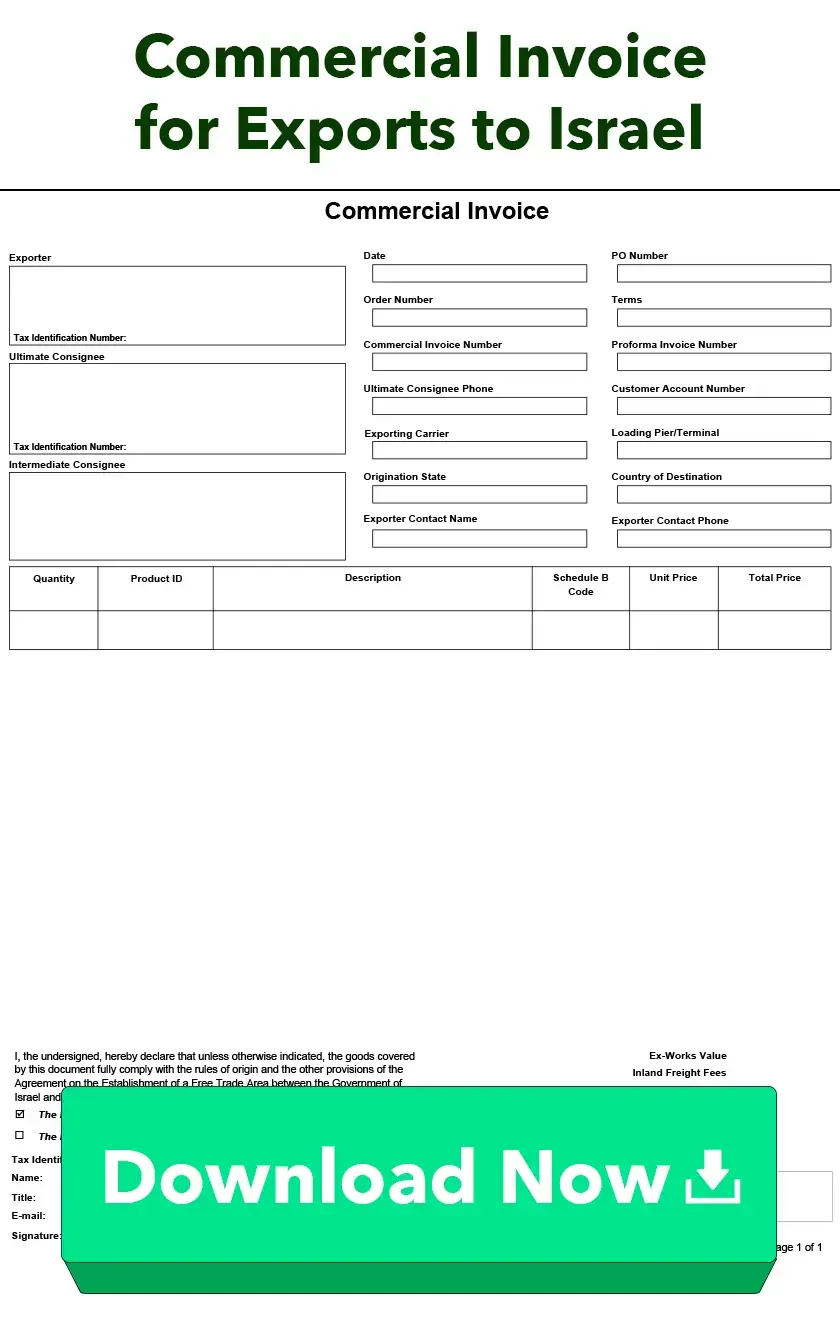

Invoices

Learn More About InvoicesInvoices are one of the most important export documents describing everything included in the shipment and its cost.

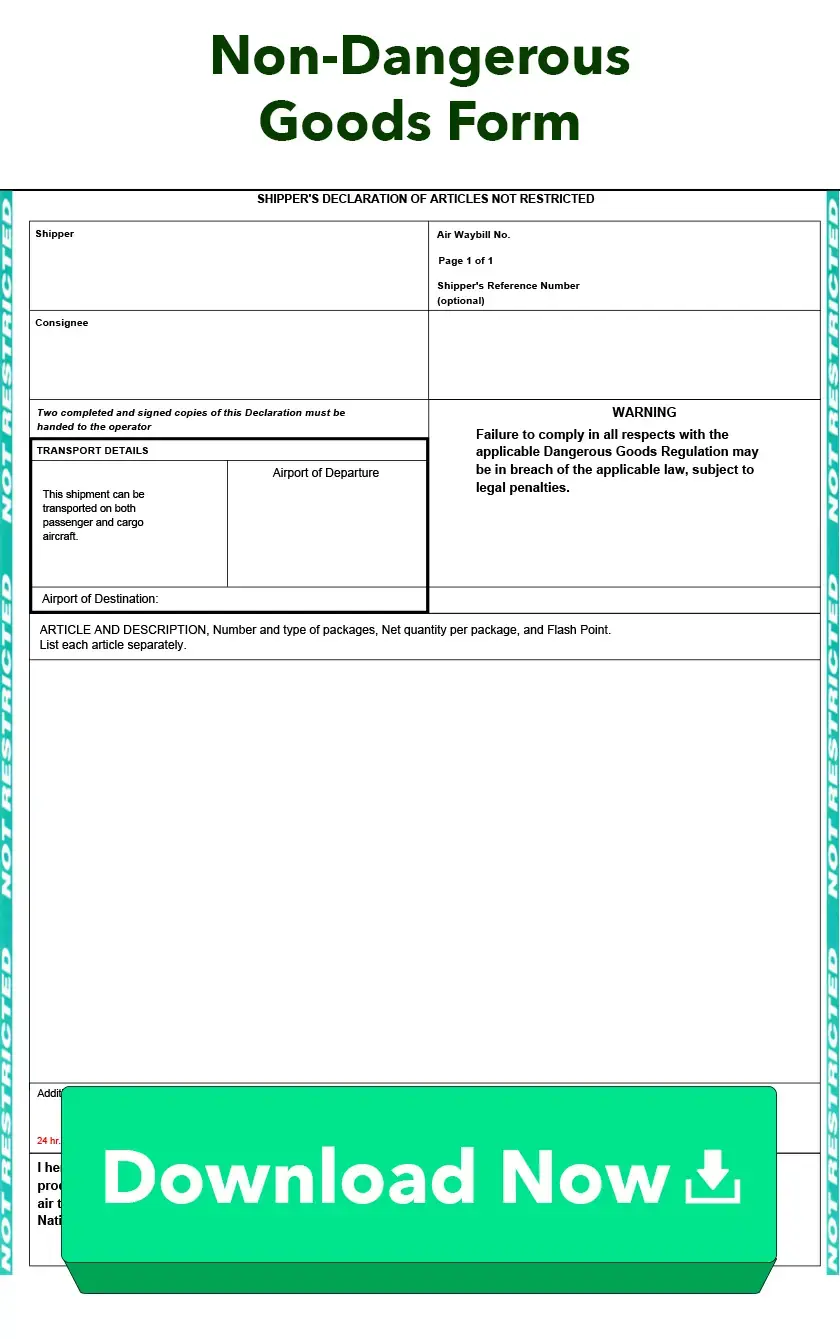

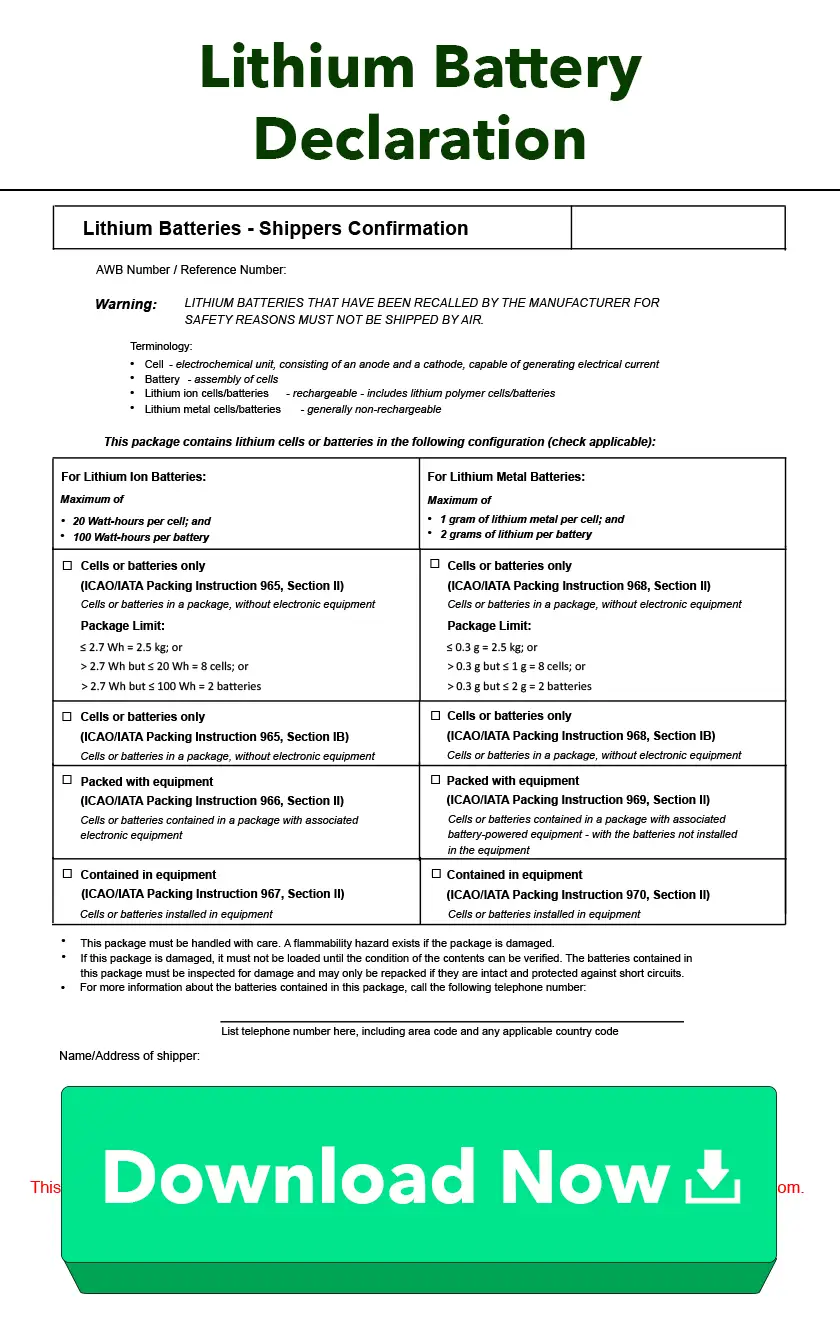

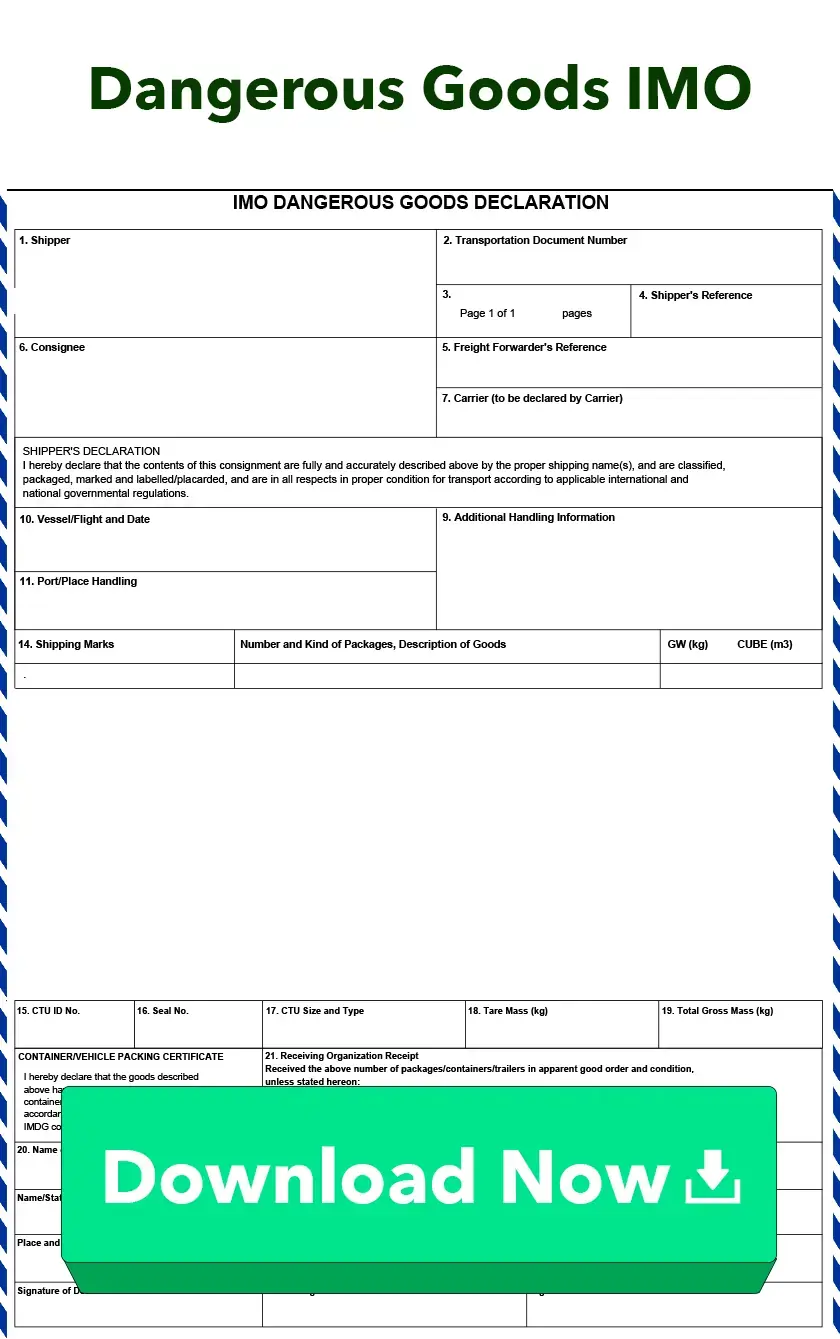

Dangerous Goods Forms

Learn More About Dangerous Goods FormsDangerous Goods (DG) forms are required for transporting dangerous or hazardous items.

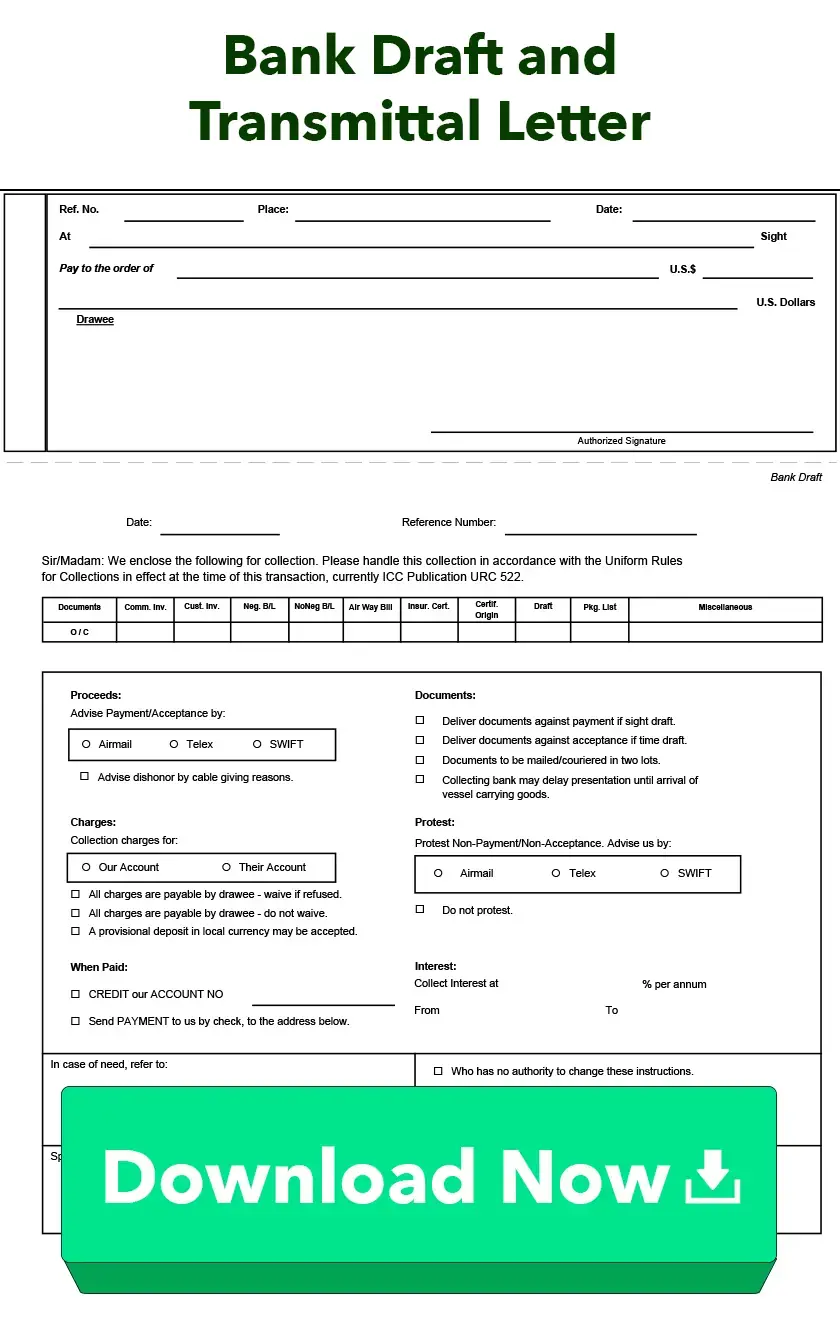

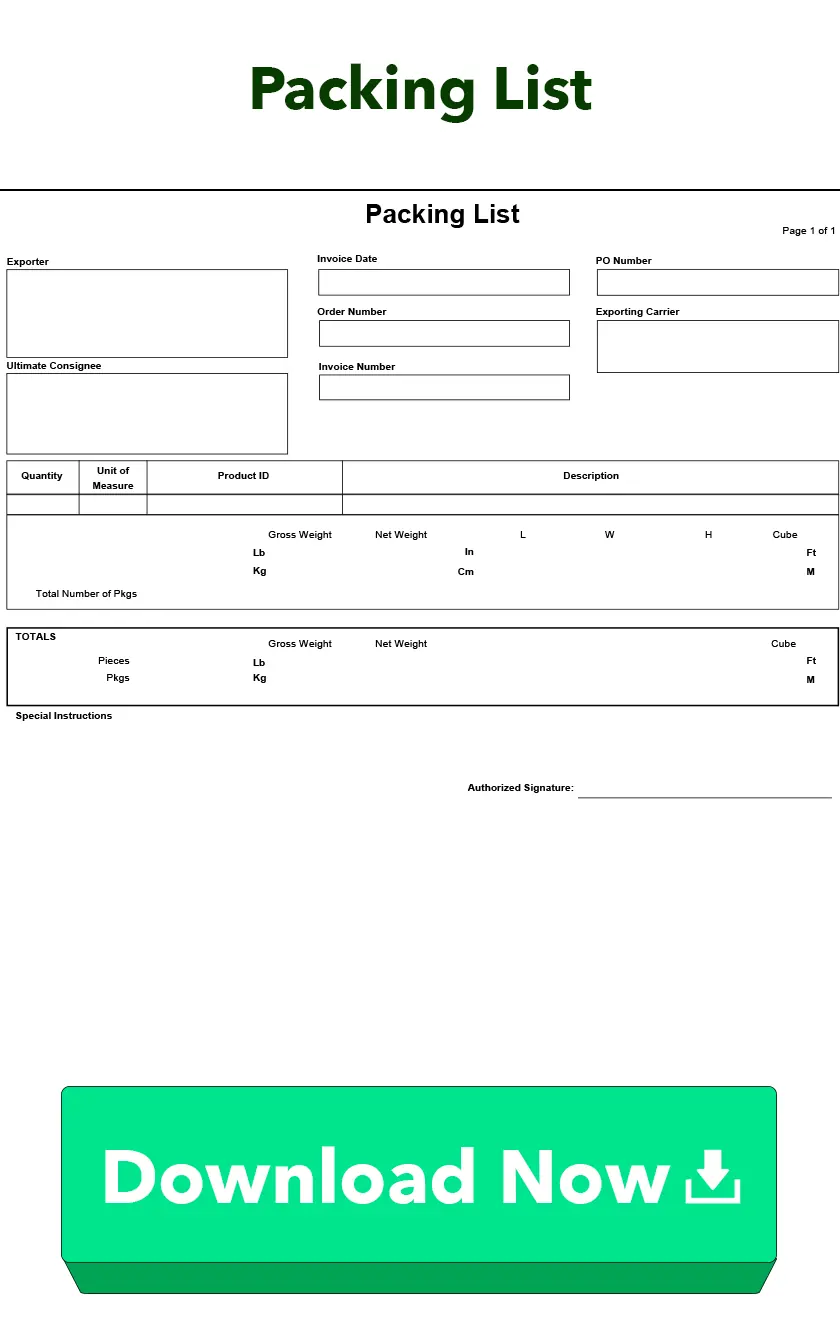

Other

Additional forms required for exporting.

-23_101024.webp)

-26_101024.webp)

-13_101024.webp)

-14_101024.webp)

-20_101024.webp)

-24_101024.webp)

-25_101024.webp)

-27_101024.webp)

-28_101024.webp)

-32_101024.webp)

-33_101024.webp)