The International Trade Blog International Sales & Marketing

Methods of Payment in International Trade: An Introduction

On: June 17, 2019 | By:  David Noah |

5 min. read

David Noah |

5 min. read

To succeed in international trade and win sales against foreign competitors, exporters must offer their customers attractive sales terms supported by the appropriate payment methods.

To succeed in international trade and win sales against foreign competitors, exporters must offer their customers attractive sales terms supported by the appropriate payment methods.

Since getting paid in full and on time is the ultimate goal for each export sale, you need to choose the appropriate payment method that minimizes payment risk while also accommodating the needs of the buyer.

There are five primary methods of payment for international transactions. During or before contract negotiations, you should consider which method is mutually desirable for you and your customer.

The Competing Needs of Exporters and Importers

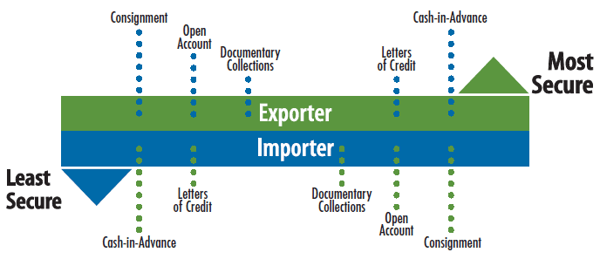

International trade presents a spectrum of risk, which causes uncertainty over the timing of payments between the exporter (seller) and importer (foreign buyer).

For exporters, any sale is a gift until payment is received. Therefore, exporters want to receive payment as soon as possible, preferably as soon as an order is place or before the goods are sent to the importer.

For importers, any payment is a donation until the goods are received. Therefore, importers want to receive the goods as soon as possible but to delay the payment as long as possible, preferably until after the goods are resold to generate enough income to pay the exporter.

International Trade Payment Options

There are five primary methods of payment for international sales. We'll explain each of these payment options in subsequent blog posts.

Cash-in-Advance

With cash-in-advance payment terms, an exporter can avoid credit risk because payment is received before the ownership of the goods is transferred. For international sales, wire transfers and credit cards are the most commonly used cash-in-advance options available to exporters. With the advancement of the Internet, escrow services are becoming another cash-in-advance option for small export transactions.

Requiring payment in advance is the least attractive option for the buyer, because it creates unfavorable cash flow. Foreign buyers are also concerned that the goods may not be sent if payment is made in advance. Thus, exporters who insist on this payment method as their sole manner of doing business may lose to competitors who offer more attractive payment terms.

Letters of Credit

Letters of credit (LCs) are one of the most secure instruments available to international traders. An LC is a commitment by a bank on behalf of the buyer that payment will be made to the exporter, provided that the terms and conditions stated in the LC have been met, as verified through the presentation of all required documents. The buyer establishes credit and pays his or her bank to render this service.

An LC is useful when reliable credit information about a foreign buyer is difficult to obtain, but the exporter is satisfied with the creditworthiness of the buyer’s foreign bank. An LC also protects the buyer since no payment obligation arises until the goods have been shipped as promised.

Documentary Collections

A documentary collection (D/C) is a transaction whereby the exporter entrusts the collection of the payment for a sale to its bank (remitting bank), which sends the documents that its buyer needs to the importer’s bank (collecting bank), with instructions to release the documents to the buyer for payment. Funds are received from the importer and remitted to the exporter through the banks involved in the collection in exchange for those documents.

D/Cs involve using a draft that requires the importer to pay the face amount either at sight (document against payment) or on a specified date (document against acceptance). The collection letter gives instructions that specify the documents required for the transfer of title to the goods.

Although banks do act as facilitators for their clients, D/Cs offer no verification process and limited recourse in the event of non-payment. D/Cs are generally less expensive than LCs.

Open Account

An open account transaction is a sale where the goods are shipped and delivered before payment is due, which in international sales is typically in 30, 60 or 90 days. Obviously, this is one of the most advantageous options to the importer in terms of cash flow and cost, but it is consequently one of the highest risk options for an exporter.

Because of intense competition in export markets, foreign buyers often press exporters for open account terms since the extension of credit by the seller to the buyer is more common abroad. Therefore, exporters who are reluctant to extend credit may lose a sale to their competitors.

Exporters can offer competitive open account terms while substantially mitigating the risk of non-payment by using one or more of the appropriate trade finance techniques covered in a later article in this series. When offering open account terms, the exporter can seek extra protection using export credit insurance.

Consignment

Consignment in international trade is a variation of open account in which payment is sent to the exporter only after the goods have been sold by the foreign distributor to the end customer.

An international consignment transaction is based on a contractual arrangement in which the foreign distributor receives, manages and sells the goods for the exporter who retains title to the goods until they are sold. Clearly, exporting on consignment is very risky as the exporter is not guaranteed any payment and its goods are in a foreign country in the hands of an independent distributor or agent.

Consignment helps exporters become more competitive on the basis of better availability and faster delivery of goods. Selling on consignment can also help exporters reduce the direct costs of storing and managing inventory.

The key to success in exporting on consignment is to partner with a reputable and trustworthy foreign distributor or a third-party logistics provider. Appropriate insurance should be in place to cover consigned goods in transit or in possession of a foreign distributor as well as to mitigate the risk of non-payment.

- Cash in Advance

- Letters of Credit

- Documentary Collection

- Open Account

- Consignment

- Learn about all five options in the free whitepaper, Trade Finance Guide: A Quick Reference for U.S. Exporters

Like what you read? Subscribe today to the International Trade Blog to get the latest news and tips for exporters and importers delivered to your inbox.

This article is taken in large part from the Trade Finance Guide: A Quick Reference for U.S. Exporters, which you can download for free by clicking the link below.

About the Author: David Noah

As president of Shipping Solutions, I've helped thousands of exporters more efficiently create accurate export documents and stay compliant with import-export regulations. Our Shipping Solutions software eliminates redundant data entry, which allows you to create your export paperwork up to five-times faster than using templates and reduces the chances of making the types of errors that could slow down your shipments and make it more difficult to get paid. I frequently write and speak on export documentation, regulations and compliance issues.