The International Trade Blog International Sales & Marketing

Methods of Payment in International Trade: Letters of Credit

On: October 14, 2024 | By:  David Noah |

12 min. read

David Noah |

12 min. read

One of the most important considerations when it comes to international trade is how you are going to get paid for your exports. While relying on cash upfront may eliminate the risk of non-payment, it limits your universe of potential customers as it can cause cash flow and other problems for buyers.

There are five primary methods of payment in international trade that range from most to least secure: cash in advance, letter of credit, documentary collection or draft, open account and consignment. Of course, the most secure method for the exporter is the least secure for the importer and vice versa. The key is to strike the right balance for both sides. This article focuses on letters of credit (LCs).

What Is a Letter of Credit in Global Trade?

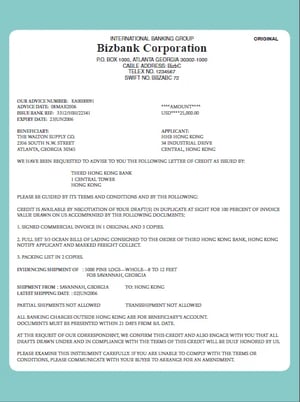

A letter of credit, also referred to as a documentary credit, is a contractual agreement whereby the issuing bank (importer's bank), acting on behalf of the customer (the importer or buyer), promises to make payment to the beneficiary or exporter against the receipt of complying stipulated documents. The issuing bank will typically use intermediary banks to facilitate the transaction and make payment to the exporter.

Understanding a Letter of Credit

Understanding a Letter of Credit

The LC is a separate contract from the sales contract on which it is based; therefore, banks are not concerned with the quality of the underlying goods or whether each party fulfills the terms of the sales contract.

The bank's obligation to pay is solely conditioned upon the seller's compliance with the terms and conditions of the LC. In LC transactions, banks deal in documents only, not goods.

LCs can be arranged easily for one-time transactions between the exporter and importer or used for an ongoing series of transactions.

A letter of credit may be irrevocable, which means that it cannot change unless both parties agree; or, it can be revocable, in which case either party may unilaterally make changes. Unless the conditions of the LC state otherwise, it is always irrevocable, which means the document may not be changed or canceled unless the importer, banks and exporter agree. A revocable LC is inadvisable, as it carries many risks for the exporter.

The Advantages of a Letter of Credit

LCs are one of the most versatile and secure instruments available to international traders. Since LCs are credit instruments, the importer's credit with their bank is used to obtain an LC. The importer pays the bank a fee to render this service. An LC is useful when reliable credit information about a foreign buyer is difficult to obtain or if the foreign buyer's credit is unacceptable, but the exporter is satisfied with the creditworthiness of the importer's bank.

This method also protects the importer because the documents required to trigger payment provide evidence that goods have been shipped as agreed. However, because LCs open up the potential for discrepancies, which may negate payment to the exporter, documents should be prepared by trained professionals.

Discrepant documents—literally not having an "i dotted and t crossed"—may negate the bank's payment obligation. That's why many export companies use export documentation and compliance software like Shipping Solutions to ensure their export paperwork is accurate and complete.

Confirmed Letter of Credit

A greater degree of protection is afforded to the exporter when an LC issued by a foreign bank (the importer's issuing bank) is confirmed by a U.S. bank.

The exporter asks its customer to have the issuing bank authorize a bank in the exporter's country to confirm (this bank is typically the advising bank, which then becomes the confirming bank). Confirmation means that the U.S. bank adds its engagement to pay the exporter to that of the foreign bank. If an LC is not confirmed, the exporter is subject to the payment risk of the foreign bank and the political risk of the importing country.

Exporters should consider getting confirmed LCs if they are concerned about the credit standing of the foreign bank or when they are operating in a high-risk market where political upheaval, economic collapse, devaluation or exchange controls could put the payment at risk. Exporters should also consider getting confirmed LCs when importers are asking for extended payment terms.

The Letter of Credit Process

There are typically seven steps that occur to get paid using a letter of credit:

- The importer arranges for the issuing bank to open an LC in favor of the exporter.

- The issuing bank transmits the LC to the nominated bank, which forwards it to the exporter.

- The exporter forwards the goods and documents to a freight forwarder.

- The freight forwarder dispatches the goods and either the dispatcher or the exporter submits documents to the nominated bank.

- The nominated bank checks documents for compliance with the LC and collects payments from the issuing bank for the exporter.

- The importer's account at the issuing bank is debited.

- The issuing bank releases documents to the importer to claim the goods from the carrier and to clear them at customs.

Parties to a Letter of Credit

While an LC usually involves the exporter, importer and both parties' banks, these four principals can be referred to by different names:

- Applicant—The importer (foreign buyer).

- Beneficiary—The exporter (seller).

- Issuing Bank—Importer's bank that opens the LC in favor of the exporter.

- Nominating Bank—Exporter's bank that facilitates the eventual payment from the importer's bank.

- Advising Bank—Exporter's bank that informs the beneficiary of the opening of the LC and verifies its authenticity.

- Confirming Bank—Exporter's bank that adds its own guarantee to pay if the importer's bank fails to do so.

- Exporter's Bank—Generally the exporter will ask that their own bank be used by the importer's bank as (1) an advising bank and (2) a confirming bank. The advising bank is normally also given the nominated bank's role.

Special Letters of Credit

Letters of credit can take many forms. When an LC is made transferable, the payment obligation under the original LC can be transferred to one or more second beneficiaries. With a revolving LC, the issuing bank restores the credit to its original amount each time it is drawn down.

A standby LC is not intended to serve as the means of payment for goods but can be drawn in the event of a contractual default, including the failure of an importer to pay invoices when due. Similarly, standby LCs are often posted by exporters in favor of an importer because they can serve as bid bonds, performance bonds and advance payment guarantees. In addition, standby LCs are often used as counter guarantees against the provision of down payments and progress payments on the part of foreign buyers.

Tips For Exporters on Using Letters of Credit

If you’re considering letters of credit for your exports, keep these things in mind:

- Banks pay only the amount specified in the LC, even if higher charges for shipping, insurance or other factors are incurred and documented.

- Consult with your bank before the importer applies for an LC to determine if an LC is appropriate for the transaction, what the costs will be and how disputes are resolved.

- Consider whether a confirmed LC is needed.

- Upon receiving an LC, carefully compare the letter’s terms with the terms of the proforma invoice. This is extremely important because the terms must be precisely met or the LC may be invalid (and you may not get paid). If meeting the terms is impossible, or any documented information is even slightly incorrect, contact the customer immediately and ask for an amendment.

- Negotiate with the buyer and agree on detailed terms to be incorporated into the LC. You may request that the LC specify that partial shipments and trans-shipment will be allowed. Specification can prevent unforeseen problems.

- Determine if all LC terms can be met within the prescribed time limits. Provide documentation showing goods were shipped by the date specified in the LC.

- Ensure all documents are consistent with the terms and conditions of the LC.

- Be cautious of discrepancy opportunities that may delay or cause non-payment.

- Cash in Advance

- Open Account

- Documentary Collection

- Consignment

- Learn about all five options in the free whitepaper, Trade Finance Guide: A Quick Reference for U.S. Exporters

Frequently Asked Questions (FAQs): Letters of Credit

-

What is a letter of credit (LC)?

A letter of credit is a financial instrument issued by a bank that guarantees payment to the exporter once the exporter meets specific conditions stipulated in the letter. It provides security to both the exporter and the importer in international trade transactions.

-

How does a letter of credit work?

When an importer and exporter agree on a trade deal, the importer's bank issues a letter of credit on behalf of the importer. In some cases, the exporter may request confirmation from their own bank. Once the LC is in place, the exporter ships the goods and presents the required documents. The bank verifies the accuracy of the export documents and their consistency with the terms of the LC. If the presented documents meet the LC requirements, the bank will arrange for payment to the exporter as per the agreed terms.

-

Why should exporters and importers use letters of credit?

Letters of credit provide security for both parties involved in an international trade transaction. Exporters can ensure they receive payment if they meet the terms and conditions outlined in the LC. Importers can have confidence that they will receive the goods as specified in the agreement before making payment. It reduces the risk of non-payment or non-delivery.

-

What are the different types of letters of credit?

- Revocable: This type of LC can be modified or canceled by the issuing bank without notice to the exporter. It offers minimal protection and is rarely used in international trade.

- Irrevocable: This type of LC cannot be modified or canceled without the agreement of all parties involved. It provides greater protection for exporters and is widely used in international trade.

- Confirmed: An LC is confirmed when the exporter asks its customer to have the issuing bank authorize a bank in the exporter's country to confirm. Confirmation means that the U.S. bank adds its engagement to pay the exporter to that of the foreign bank.

- Transferable: The payment obligation under the original LC can be transferred to one or more second beneficiaries when an LC is transferable.

- Revolving: The issuing bank restores the credit to its original amount each time it is drawn down when using a revolving LC.

- Standby: This type of LC is not intended to serve as the means of payment for goods but can be drawn in the event of a contractual default, including the failure of an importer to pay invoices when due.

-

What are the common documents required in a letter of credit transaction?

The required documents may vary based on the specific LC terms, but common documents include:

- Proforma invoice

- Commercial invoice

- Bill of lading or air waybill

- Packing list

- Certificate of origin

-

How long does it take to process a letter of credit?

The processing time for a letter of credit can vary depending on the complexity of the transaction and the efficiency of the banks involved. Allow ample time for the issuance, review and approval of the LC, as well as the shipment of goods and document preparation. Typically, the process can take anywhere from a few days to a few weeks.

-

Are there any risks associated with using letters of credit?

While letters of credit offer a level of security, there are still risks involved. Non-compliance with the terms and conditions specified in the LC can result in non-payment or delays. Additionally, fraudulent or forged documents can lead to payment disputes. It is crucial for both exporters and importers to thoroughly review and understand the terms of the LC to minimize these risks.

-

Can letters of credit be transferred or assigned to another party?

Letters of credit can be transferred or assigned to another party with the consent of all parties involved. This transfer allows the initial beneficiary to transfer their rights to a third party, such as a supplier or financier. It is important to review the terms and conditions of the LC to determine if transferability is permitted.

-

How much does it cost to use a letter of credit?

The cost of using a letter of credit varies depending on the banks involved, the complexity of the transaction and the amount of risk associated with the trade. Common fees include issuance fees, amendment fees (for changes to the LC), confirmation fees (if the LC is confirmed by a bank other than the issuing bank), and negotiation fees (charged by the bank for handling the documents).

-

What happens if there is a dispute regarding the letter of credit?

If a dispute arises regarding the letter of credit, it is advisable to seek legal counsel. It is important to maintain clear communication with the banks involved and provide all necessary documentation to support your case.

Like what you read? Join thousands of exporters and importers who subscribe to Passages: The International Trade Blog. You'll get the latest news and tips for exporters and importers delivered right to your inbox.

This article is taken in large part from the Trade Finance Guide: A Quick Reference for U.S. Exporters, which you can download for free by clicking the link below.

About the Author: David Noah

As president of Shipping Solutions, I've helped thousands of exporters more efficiently create accurate export documents and stay compliant with import-export regulations. Our Shipping Solutions software eliminates redundant data entry, which allows you to create your export paperwork up to five-times faster than using templates and reduces the chances of making the types of errors that could slow down your shipments and make it more difficult to get paid. I frequently write and speak on export documentation, regulations and compliance issues.