The International Trade Blog International Sales & Marketing

What's a Letter of Credit? (Infographic)

On: December 14, 2015 | By:  David Noah |

4 min. read

David Noah |

4 min. read

If you’ve been exporting goods for more than a month you’ve probably stumbled upon the term Letter of Credit. Most of the time, you’ll see letter of credit abbreviated as LC, L/C or LOC.

|

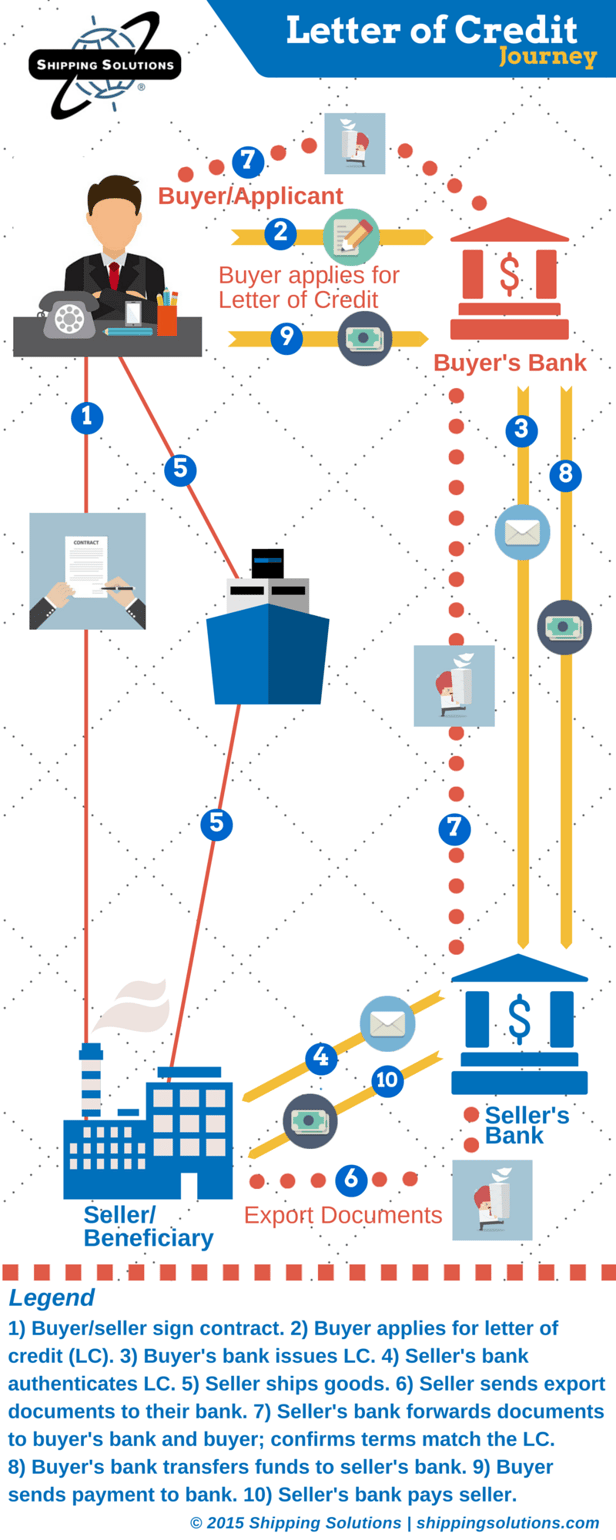

| (Click infographic to enlarge) |

A Legal Document

A letter of credit has nothing in common with how most of us define credit; credit ratings, credit line, and credit score, for instance.

An LC, in fact, is a legal document passed between banks, and buyers and sellers. Basically, it’s a promise to pay the holder if they fulfill specific requirements, which are spelled out in the LC.

LCs are used most of the time when buyers and sellers don’t know each other. That’s why the letter of credit is so popular in international transactions—when buyers and sellers are usually separated by thousands of miles, multiple time zones, and a common language. It’s common for banks to act as intermediaries, and the instrument for managing this complex transaction is the LC. Letters of credit lower risk for both buyers and sellers.

According to the online resource Investopedia, here are the advantages of using the LC in an international transaction.

- For the Seller: Reduced production risk in case the order is changed or canceled; protection in case the buyer doesn’t pay.

- For the Buyer: A buyer is certain to receive the goods stipulated in the letter of credit, and the LC shows solvency for the buyer and allows them to reduce or eliminate an initial payment.

LCs can be complicated, but to help explain the process, we’ve created the infographic shown here. It’s indicative of a typical LC transaction, although details could vary depending on a host of factors. See also the article, 7 Common Mistakes When Preparing Letters of Credit.

Let’s Talk Jargon

First, let’s talk jargon. Here’s a list of terms you’ll encounter during the letter of credit journey. You’ll see most of these used on the infographic.- Applicant: Refers to the buyer.

- Beneficiary: Refers to the seller.

- Issuing Bank: Bank (buyer’s bank) that promises to pay.

- Advising Bank: Bank (seller’s bank) that issues the letter of credit

- Irrevocable: The letter of credit can’t be changed or canceled without permission from everybody involved.

The Letter of Credit Journey

- Buyer/Seller Sign Contract: The journey begins with a contract or purchase agreement signed between the buyer and seller. They agree on a price, quantity and other terms, including a shipping schedule. Let’s assume our seller wants a Letter of Credit (LC), which gives them the confidence that they’ll get paid by the buyer’s bank. Note that the contract or purchase agreement is not linked at all to the LC. Banks don’t care about the agreement between the buyer and seller. In some cases they never see it.

- Buyer Applies for Letter of Credit: Our buyer (applicant) applies for a letter of credit with his or her bank (issuing bank). The LC is a detailed document specifying the seller’s (beneficiary) name and address, ship dates, arrival dates, ship-to address, mode of transportation, and other data. Note, the beneficiary is paid after completing specific actions and meeting the LC’s requirements.

- Buyer’s Bank Issues LC: The issuing (buyer’s) bank sends the LC to the seller’s (beneficiary) bank. In most cases, the seller and its bank are in the same country. In more complex overseas transactions, there may be other banks involved—called intermediaries. Banks insist that every detail of the LC is specific and very clear because it’s legally binding. The slightest mistake, such as a misspelled name or wrong shipping date, will prevent the bank from paying, or asking for a new LC.

- Seller’s Bank Reviews Documents, Forwards to Seller: Following a review of the documents, the seller’s bank forwards the LC to the seller. He or she makes sure its details match the original agreement. Can the seller still meet the terms laid out in the LC?

- Seller Ships Its Products to the Buyer: The seller ships its cargo to comply with the terms expressed in the LC.

- Seller Sends Export Documents to Its Bank: The seller forwards their shipping and export documents to the seller’s bank. The documents required to accompany the shipment of goods are spelled out in the original LC. The bank verifies the documents meet the terms and conditions of the letter of credit. If anything is amiss—misspellings for instance—the bank can refuse to pay. Reviews can take up to several days and, once complete, the documents are passed on to the buyer’s bank.

- Seller’s Bank Forwards Documents to Buyer’s Bank: The buyer’s bank performs the same due diligence on the export documents. If everything looks good, payment is sent to the seller’s bank. The buyer’s bank also forwards the documents to the buyer.

- Buyer’s Bank Sends Payment: Following a successful review of the documents, our buyer’s bank sends payment to the seller’s bank.

- Buyer Takes Possession of Goods, Pays Bank: Assuming the export documents checked out in step seven, the buyer uses the documents to take possession of the goods. Finally, the buyer pays its bank according to the terms of the letter of credit.

- Seller’s Bank Pays Seller: In the 10th and final step of the letter of credit journey, our seller gets paid.

About the Author: David Noah

As president of Shipping Solutions, I've helped thousands of exporters more efficiently create accurate export documents and stay compliant with import-export regulations. Our Shipping Solutions software eliminates redundant data entry, which allows you to create your export paperwork up to five-times faster than using templates and reduces the chances of making the types of errors that could slow down your shipments and make it more difficult to get paid. I frequently write and speak on export documentation, regulations and compliance issues.