The International Trade Blog Export Compliance

Who Is Responsible for Filing the Electronic Export Information (EEI)?

On: September 26, 2022 | By:  Arnesh Roy |

4 min. read

Arnesh Roy |

4 min. read

As an exporter, you will no doubt become familiar with the Automated Export System (AES) if you aren’t already. This is the system that the United States uses to collect data on exports out of the country as outlined in the Foreign Trade Regulations (FTR).

As an exporter, you will no doubt become familiar with the Automated Export System (AES) if you aren’t already. This is the system that the United States uses to collect data on exports out of the country as outlined in the Foreign Trade Regulations (FTR).

The U.S. Census Bureau uses this data, which they call Electronic Export Information (EEI), to compile statistics on economic indicators and the Gross Domestic Product (GDP) of the United States. U.S. Customs and Border Protection (CBP) uses this data to ensure that exporters are following regulations and that exports do not end up in the hands of restricted parties who may pose a threat to the national security of the United States.

All exporters should know if, how and when they are expected to file their export information through AES.

Who Can File the EEI?

There are three parties that can file the EEI data with AES: the U.S. Principal Party in Interest (USPPI), the USPPI’s authorized agent or the authorized agent of the Foreign Principal Party in Interest (FPPI). The USPPI is typically the U.S. exporter, and the FPPI is typically the foreign buyer. Freight forwarders are the primary type of agent that can be authorized to file through AES on behalf of the exporter or the FPPI.

If authorizing an outside agent to file through AES, the USPPI must provide a written power of attorney or other written authorization. This often comes in the form of a Shipper’s Letter of Instruction, a document produced by the exporter and given to the freight forwarder that outlines what is expected of the freight forwarder.

In a routed export transaction, the FPPI can provide the power of attorney or other written authorization to the freight forwarder or the USPPI. You’ll find an in-depth discussion of these options in the blog post Standard vs. Routed Export Shipment: What's the Difference?

When to File the EEI

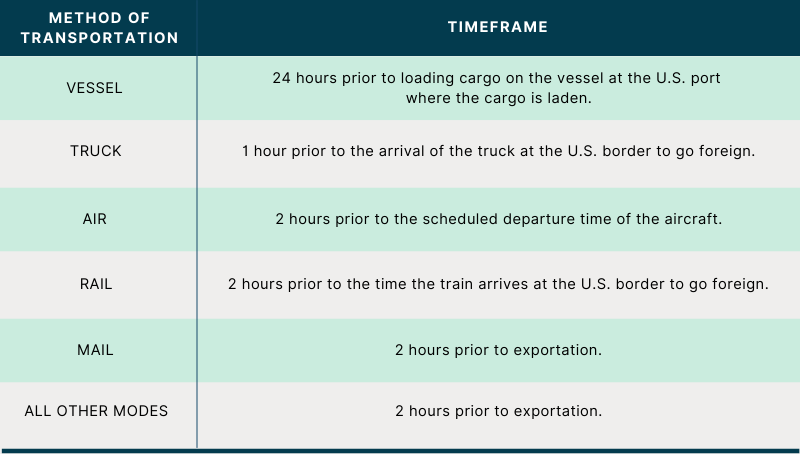

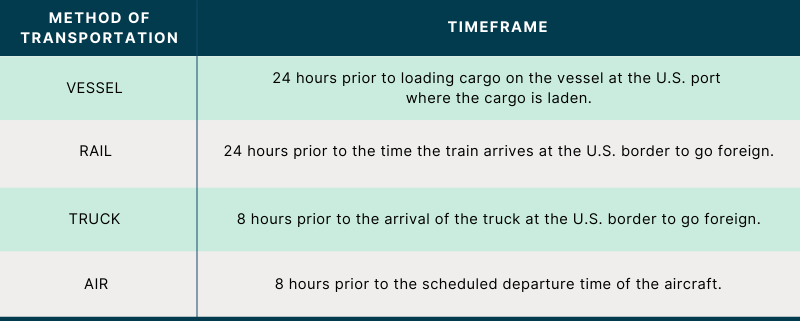

By default, exporters typically have to file their shipment information through AES from one to 24 hours prior to the actual export of the shipment, depending on the mode of transport. Items found on the U.S. Munitions List (USML) under the International Traffic in Arms Regulations may have to be filed earlier than items not on the USML.

Non-USML Shipments

USML Shipments

Note: For USML shipments, refer to the International Traffic in Arms Regulations Parts 120 through 130.

Note: For USML shipments, refer to the International Traffic in Arms Regulations Parts 120 through 130.

The FTR recognize certain criteria that allow exporters to claim exemption from filing, and these criteria are represented by exemption codes. For example, shipments valued under $2,500 by Schedule B number that do not require an export license are exempt from AES filing, and this exemption is represented by the exemption code NOEEI 30.37(a). Shipments to Canada are also exempt (unless they require an export license) and are represented by the exemption code NOEEI 30.36.

Exporters must file through AES for all exports of used self-propelled vehicles, as well as all exports of rough or uncut diamonds (classified under HS subheadings 7102.10, 7102.21 and 7102.31) regardless of value or destination.

How to File the EEI

To file through AES, you will first have to create an account on the Automated Commercial Environment (ACE), the online interface that AES uses to facilitate the collection of shipment information. Once your account has been approved, you can access the ACE portal directly on the U.S. Customs and Border Protection (CBP) website. You will then have to type your shipment information on the AESDirect screens.

Alternatively, exporters can use an AESDirect-certified software such as Shipping Solutions to do their AES filing. The ACE portal is embedded into Shipping Solutions, allowing your EEI to be uploaded directly from the software using the information you’ve already entered for your export documents. This feature prevents you from having to re-type all the export information for AES, which can save time and reduce the chance of making a mistake.

If AES accepts your filing, it will send you an Internal Transaction Number (ITN) that provides proof that you have successfully filed your export information. You should include the ITN on certain export documents to notify your freight forwarder, shipping company and CBP that you have filed through AES. If an AES filing is not required, you should provide the exemption statement instead.

Though you can outsource the responsibility for filing through AES to a freight forwarder or another authorized party, you are still liable for the filing. Failing to file through AES when required or filing incorrect information can lead to civil and criminal penalties up to a maximum of $10,000 per violation. The Office of Export Enforcement (OEE) within the U.S. Department of Commerce, and U.S. Customs and Border Protection within the Department of Homeland Security, are the two agencies tasked with enforcing these rules.

For a more in-depth description of this process, download our free white paper Filing Your Export Shipments through the Automated Export System (AES).

Like what you read? Subscribe today to the International Trade Blog to get the latest news and tips for exporters and importers delivered to your inbox.

This article was originally published in September 2022 and has been updated to include current information, links and formatting.

About the Author: Arnesh Roy

Arnesh Roy was a Senior Inside Sales Representative at Shipping Solutions.