The International Trade Blog International Sales & Marketing

Incoterms 2020 CIP: Spotlight on Carriage and Insurance Paid To

On: June 25, 2025 | By:  David Noah |

7 min. read

David Noah |

7 min. read

Incoterms 2020 rules are the latest revision of international terms of trade published by the International Chamber of Commerce (ICC). They are recognized as the authoritative text for determining how costs and risks are allocated to parties conducting international transactions.

Incoterms 2020 rules are the latest revision of international terms of trade published by the International Chamber of Commerce (ICC). They are recognized as the authoritative text for determining how costs and risks are allocated to parties conducting international transactions.

Incoterms 2020 rules outline whether the seller or the buyer is responsible for, and must assume the cost of, specific standard tasks that are part of the international transport of goods. In addition, they identify when the risk or liability of the goods transfers from the seller to the buyer.

In this article, we’re discussing the Incoterm CIP, also known as Carriage and Insurance Paid To.

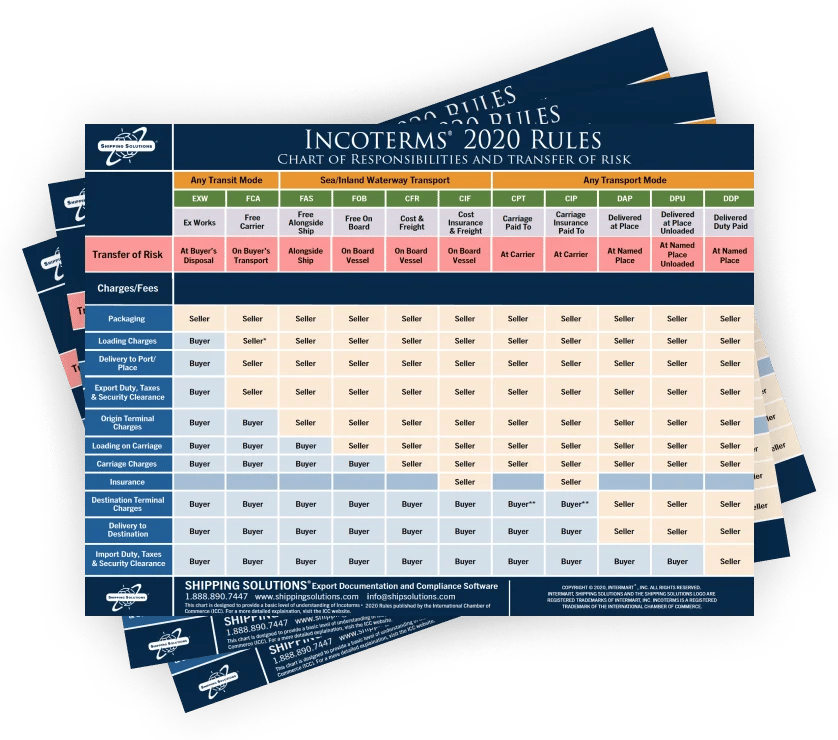

There are 11 trade terms available under the Incoterms 2020 rules that range from Ex Works (EXW), which conveys the least amount of responsibility and risk on the seller, to Delivered Duty Paid (DDP), which places the most responsibility and risk on the seller. The Incoterms 2020 Rules: Chart of Responsibilities and Transfer of Risk summarizes the seller and buyer responsibilities under each of the 11 terms.

For a summary of Incoterms 2020 and a short definition of each of the 11 terms, read An Introduction to Incoterms, or watch the video below.

Carriage and Insurance Paid To Responsibilities and Risk

Under the Incoterms 2020 rules, CIP means the seller is responsible for delivering goods to the first carrier or another person stipulated by the seller at a named place of shipment, at which point risk transfers to the buyer. The seller is responsible for the transportation costs and insurance associated with delivering goods at least to the named place of destination.

CIP is one of only two Incoterms 2020 rules that identify which of the parties must purchase insurance (the other being CIF—Cost, Insurance and Freight).

With the release of the Incoterms 2020 rules, the amount of insurance required under CIP has increased to at least 110% of the value of the goods as detailed in Clause A of the Institute Cargo Clauses rather than the lower level provided under Clause C, which is what was required for CIP in the 2010 rules and still is required for CIF. This is because CIP is most commonly used for manufactured goods with higher value than the commodity goods more typically shipped under CIF. The insurance underwriter must be able to settle in the destination country.

Since this is a standard export transaction, the seller or its agent is responsible for submitting the Electronic Export Information (EEI) through AESDirect on the ACE portal.

Carriage and Insurance Paid To Transportation Options

The ICC has divided the 11 Incoterms into those that can be used for any mode of transportation and those that should only be used for transport by “sea and inland waterway.” Under Incoterms 2020, CIP can be used for any mode of transportation.

Using Carriage and Insurance Paid To

With all of the C-group terms, including CPT, the seller is responsible for contracting international transportation and purchasing insurance. The named place where the transfer of responsibility occurs is always on the buyer’s side.

What is the difference between CPT and CIP? CIP accounts for some of the risk the buyer is taking on when the seller arranges transportation. Under CIP, the seller is obligated to insure the goods in favor of the buyer to cover the buyer's risk.

FAQs: Incoterms 2020 CIP

-

What does CIP mean in Incoterms 2020?CIP (Carriage and Insurance Paid To) is one of the 11 Incoterms 2020 rules defined by the International Chamber of Commerce (ICC). It means the seller is responsible for arranging and paying for transportation and insurance to a named place of destination. Risk transfers from the seller to the buyer once the goods are handed over to the first carrier.

-

Who pays for insurance under CIP Incoterms?Under CIP, the seller is obligated to purchase insurance for the goods in favor of the buyer. The insurance must cover at least 110% of the goods’ value, as specified in Clause A of the Institute Cargo Clauses, and the underwriter must be able to settle claims in the destination country.

-

When does risk transfer from seller to buyer in CIP?Risk transfers to the buyer once the seller hands over the goods to the first carrier at the agreed place of shipment—not upon delivery at the final destination.

-

Is CIP used for all modes of transport?Yes. CIP can be used for any mode of transportation, including multimodal shipments. It is not limited to sea or inland waterway transport.

-

What’s the difference between CPT and CIP?

Both CPT (Carriage Paid To) and CIP require the seller to pay for transportation. The key difference is insurance:

- CPT does not require the seller to provide insurance.

- CIP requires the seller to insure the goods on the buyer’s behalf.

-

What is the seller responsible for under CIP?

Under CIP, the seller must:

- Arrange and pay for transportation to the named place of destination

- Purchase insurance covering at least 110% of the goods’ value

- Deliver the goods to the first carrier

- File the Electronic Export Information (EEI) through AESDirect on the ACE portal

-

What should exporters know before using CIP?

Exporters should ensure:

- Insurance coverage complies with Clause A (not Clause C)

- The named destination is clearly defined in the contract

- They understand the point where risk transfers

- They submit required export documentation like EEI

Learn More about Incoterms 2020 Rules

If you are regularly involved in international trade, you need to understand the risks and responsibilities as defined by Incoterms 2020 rules, not just pick the term you always use. Start by getting a copy of ICC's Incoterms® 2020 Rules book.

For a more detailed understanding of which term or terms make the most sense for your company, register for an Incoterms® 2020 Rules seminar or webinar offered by International Business Training.

Read our articles about all of the other Incoterms 2020 rules here:

- EXW (Ex Works)

- FCA (Free Carrier)

- FAS (Free Alongside Ship)

- FOB (Free On Board)

- CFR (Cost and Freight)

- CIF (Cost, Insurance and Freight)

- CPT (Carriage Paid To)

- CIP (Carriage and Insurance Paid To)

- DAP (Delivered At Place)

- DPU (Delivered At Place Unloaded)

- DDP (Delivered Duty Paid)

If history is any indication, the Incoterms 2020 rules will be around for at least a decade. Now seems like the perfect time to make sure you understand each of the terms, so you can make sure you’re speaking the same language as your international trading partner.

Like what you read? Subscribe today to the International Trade Blog to get the latest news and tips for exporters and importers delivered to your inbox.

This article was first published in March 2017 and has been updated and revised based on the changes made with the release of the Incoterms 2020 rules.

About the Author: David Noah

As president of Shipping Solutions, I've helped thousands of exporters more efficiently create accurate export documents and stay compliant with import-export regulations. Our Shipping Solutions software eliminates redundant data entry, which allows you to create your export paperwork up to five-times faster than using templates and reduces the chances of making the types of errors that could slow down your shipments and make it more difficult to get paid. I frequently write and speak on export documentation, regulations and compliance issues.