The International Trade Blog International Sales & Marketing

An Introduction to Incoterms

On: March 13, 2024 | By:  David Noah |

14 min. read

David Noah |

14 min. read

When planning for an overseas shipment, successful importers and exporters must clearly identify how their goods will get from point A to point B, who will pay for which portions of the journey, and who is responsible if goods are damaged or lost along the way. This is done through Incoterms, a standardized set of rules that help facilitate trade between countries.

The 11 Incoterms define the amount of risk and liability buyers and sellers take on during an international transaction, but choosing the best term to use isn't a clear-cut decision. In this article, we’ll look in-depth at Incoterms 2020—what they are and how they originated, how to apply them, how exporters and importers benefit from them and why they matter.

What Are Incoterms?

Incoterms 2020 rules are the official commercial terms published by the International Chamber of Commerce (ICC). They are a voluntary, authoritative, globally-accepted and adhered-to text for determining the responsibilities of buyers and sellers for the delivery of goods under sales contracts for international trade. Incoterms closely correspond to the U.N. Convention on Contracts for the International Sales of Goods. Incoterms are known and implemented by all major trading nations.

Incoterms are only part of the whole export contract. They don’t say anything about the price to be paid, when payment will be made or the method of payment that will be used in the transaction. Furthermore, Incoterms 2020 rules don’t deal with the transfer of ownership of the goods, breach of contract or product liability; all of these issues need to be considered in the contract of sale. Also, Incoterms 2020 rules can’t override any local country laws.

These are the 11 Incoterms 2020 rules:

- EXW (Ex Works)—insert place of delivery

- FCA (Free Carrier)—insert named place of delivery

- CPT (Carriage Paid To)—insert place of destination

- CIP (Carriage and Insurance Paid To)—insert place of destination

- DAP (Delivered at Place)—insert named place of destination

- DPU (Delivered at Place Unloaded)—insert of place of destination

- DDP (Delivered Duty Paid)—insert place of destination

- FAS (Free Alongside Ship)—insert name of port of loading

- FOB (Free on Board)—insert named port of loading

- CFR (Cost and Freight)—insert named port of destination

- CIF (Cost Insurance and Freight)—insert named port of destination

Incoterms 2020 Definitions

Because each of the different Incoterms identifies the responsibilities of the seller and the buyer in the transaction at different points in the shipping journey, certain Incoterms work better for certain modes of transportation.

Each of the 11 Incoterms is summarized below based on the mode of transport. For a more complete list of the responsibilities for each of the terms, you should get a copy of ICC's Incoterms® 2020 book.

Incoterms for Any Mode of Transport

EXW (Ex Works)

The seller fulfills its obligations by having the goods available for the buyer to pick up at its premises or another named place (i.e. factory, warehouse, etc.) on a date agreed upon by both parties or within an agreed-upon timeframe. The seller needs to provide the buyer with the information they need to take delivery of the goods at that time.

With Ex Works, the buyer bears all risk and costs starting when the goods are made available to the buyer at the seller’s location or other named place until the products are delivered to its location. The seller has no obligation to load the goods or clear them for export.

While Ex Works is the only Incoterm that makes export clearance the responsibility of the buyer, keep in mind that under the U.S. Export Administration Regulations and the Foreign Trade Regulations, the seller does not escape responsibility for export compliance. Even under Ex Works, the seller is required to provide certain data elements about the transaction to the buyer’s freight forwarder or some other designated party that has been authorized to submit the electronic export information through AESDirect.

For more information about these requirements, read the article, Who Is Responsible for Filing the Electronic Export Information?

FCA (Free Carrier)

The seller is responsible for either making the goods available at its own premises or at a named place. In either case, the seller is responsible for loading the goods on the buyer's transport and is responsible for delivery to the port and export clearance including security requirements. Risk transfers once the goods are loaded on the buyer’s transport.

This term has changed the most in the Incoterms 2020 rules. Previously, problems occurred with this term when the seller was responsible for loading the goods on a truck or some other transport hired by the buyer and not directly on the international carrier. If the seller and buyer had agreed on using a letter of credit as the payment method for this transaction, banks often require the seller to present a bill of lading with an on-board notation before they can get paid.

An international carrier won't typically provide a seller who did not present the goods directly to them with a bill of lading. Under the new Incoterms 2020 rules, FCA allows the parties to agree in the sales contract that the buyer should instruct its carrier to issue a bill of lading with the on-board notation to the seller.

CPT (Carriage Paid To)

The seller clears the goods for export and delivers them to the carrier or another person stipulated by the seller at a named place of shipment. The seller is responsible for the international transportation costs associated with delivering goods to the named foreign place of destination.

The transfer of risk, on the other hand, transfers from the seller to the buyer as soon as the goods are delivered to the international carrier. That means the buyer assumes the risk of loading the goods on the carrier and during the international transport of the goods.

CIP (Carriage and Insurance Paid To)

The seller clears the goods for export and delivers them to the carrier or another person stipulated by the seller at a named place of shipment, at which point risk transfers to the buyer. The seller is responsible for the transportation costs associated with delivering goods and procuring insurance coverage to the named place.

The amount of insurance that the seller must purchase has increased under Incoterms 2020 rules for CIP. The seller must purchase a broader level of insurance coverage than under the old Incoterms 2010 CIP rule. It must be at least 110% of the value of the goods and transportation expenses as detailed in Clause A of the Institute Cargo Clauses.

DAP (Delivered at Place)

The seller clears the goods for export and bears all risks and costs associated with delivering the goods to the named foreign destination not unloaded. DAP means the buyer is responsible for all costs and risks associated with unloading the goods and clearing customs to import the goods into the named country of destination.

The named place under this term can be a port, the buyer's location or any named place that is agreed upon. In that regard, DAP provides a lot of flexibility to both parties.

DPU (Delivered at Place Unloaded)

Previously named Delivered at Terminal (DAT), this Incoterm has been renamed Delivered at Place Unloaded (DPU) because the buyer and/or seller may want the delivery of goods to occur somewhere other than a terminal. This term is often used for consolidated containers with multiple consignees.

DPU is very similar to DAP except that the seller must pay for unlading the goods. Like DAP, the seller clears the goods for export and bears all risks and costs associated with delivering the goods to the named place, which can be a port or other named location in the foreign destination. Buyer is responsible for all costs and risks from this point forward including clearing the goods for import at the named country of destination.

DDP (Delivered Duty Paid)

DDP Incoterms 2020 means the seller bears all risks and costs associated with delivering the goods to the named place of destination ready for unloading and cleared for import.

DDP is a risky term for the seller, because they may not be fully aware of the import clearance procedures in the country of import or how to find a competent local customs broker. The seller must also deal in a foreign currency, which means they are responsible for the currency exchange and its associated risks. In addition, not all countries allow for non-resident importers, which means the seller must determine how to establish an importer of record.

Because of all these hurdles that the seller must overcome, DDP may also have questionable value to importers, since they must depend on the seller to successfully navigate these challenges.

Incoterms for Sea and Inland Waterway Transport

FAS (Free Alongside Ship)

The seller clears the goods for export and delivers them when they are placed alongside the vessel at the named port of shipment. Buyer assumes all risks/costs for goods from this point forward. This is not a commonly used term except for goods that may be difficult to load.

FOB (Free on Board)

The seller clears the goods for export and delivers them when they are on board the vessel at the named port of shipment. Buyer assumes all risks and costs for goods from this moment forward. This term is also not commonly used except, perhaps, by U.S. companies that misuse the term because they confuse it with the domestic term FOB.

CFR (Cost and Freight)

The seller clears the goods for export and delivers them when they are on board the vessel at the port of shipment. The seller bears the cost of freight to the named port of destination. Buyer assumes all risks for the goods from the time the goods have been delivered on board the vessel at the port of shipment.

This term sounds a lot like the Incoterm CPT, but it can only be used for sea and inland waterway transport, and the buyer only assumes risk once the goods are loaded on the vessel.

CIF (Cost, Insurance and Freight)

The seller clears the goods for export and delivers them when they are on board the vessel at the port of shipment. Seller bears the cost of freight and insurance to the named port of destination. The seller is required to purchase the minimum level of insurance under Clause C of the Institute Cargo Clauses. This requirement is unchanged from Incoterms 2010.

The buyer is responsible for all costs associated with unloading the goods at the named port of destination and clearing goods for import. Risk passes from seller to buyer once the goods are on board the vessel at the port of shipment.

Indicating Incoterms 2020 Rule Usage

When the seller and the buyer agree upon the appropriate Incoterms 2020 rule they wish to use for their transaction, it's important they include the chosen term in their sales contract, purchase order, proforma and commercial invoices, and other documents. The documents should state the chosen Incoterm followed by the named port, place or point and which set of Incoterms rules they are using.

Here are two examples:

- CIF, Shanghai, Based on Incoterms® 2020 Rules.

- DAP, No. 123, ABC Street, Importland, Based on Incoterms® 2020 Rules.

Using Incoterms for Domestic Sales

Because they use Incoterms for international sales, some companies have started using Incoterms for their domestic sales as well, instead of using the Uniform Commercial Code (UCC) terms. This is perfectly acceptable as long as their contracts identify what set of terms they’re using.

The Importance of Incoterms 2020

Everyone in your organization who has a role in your international transactions should be familiar with the terms. If you are an exporter, that includes your international sales force. If you are an importer, that means your purchasing agents and buyers. Regardless if you are a seller or a buyer, that also includes your accounting department, logistics and transportation departments, senior managers and others.

When a seller and a buyer agree to employ a particular Incoterm, each accepts the corresponding obligations and responsibilities as clearly set forth and defined under that particular Incoterm. Incoterms reduce the risk of legal complications by giving buyers and sellers a single home base from which to reference trade practices.

By correctly using Incoterms, you’ll be able to partner more harmoniously, transport and deliver your goods more easily and get paid more quickly. And who doesn’t want that?

The Origin of Incoterms

Differences in trading practices and legal interpretations between traders of different countries necessitated a common set of rules. These rules needed to be easy for all participants to prevent misunderstandings, disputes and litigation.

Incoterms were first conceived by the ICC in 1921, and the first Incoterms rules were created in 1936. They were officially designated as Incoterms in 1936. Since then, Incoterms have evolved into a codified worldwide contractual standard. They are periodically updated when international trade events require attention. Amendments and additions were made in 1953, 1967, 1976, 1980, 2000, 2010 and 2020.

Who Decides Incoterms Rules?

It’s no small task to be in charge of an international standard. These international trade terms are decided upon by 13 ICC commissions made up of private-sector experts from across the world. These individuals specialize in everything from fields of immediate concern to international business.

How Are Incoterms Rules Revised?

The Incoterms 2020 drafting group, led by co-chairs Christoph Martin Radtke and David Lowe, was in charge of revising the Incoterms rules. According to the ICC, “The group is formed by experts from various nationalities chosen for their extraordinary contribution to international commercial law and to the International Chamber of Commerce along the years.”

Here’s a look at the process followed to revise Incoterms rules:

- After the drafting group made its revisions, the revised drafts were circulated broadly and internationally through ICC National Committees, with the resulting comments and suggestions channeled back to the drafting group.

- The final draft, once approved by the ICC Commission on Commercial Law and Practice, was submitted for adoption by the ICC Executive Board.

- This broad, international consultation aimed to ensure that official ICC products possess an authority, representing the true consensus of the world business community.

Incoterms 2020 Rules

The most current revision of the terms, Incoterms 2020, went into effect Jan. 1, 2020, and consists of 11 Incoterms explained above.

The latest revision’s changes from Incoterms 2010 include the following:

- The most obvious change from Incoterms 2010 is renaming the term Delivered at Terminal (DAT) to Delivered at Place Unloaded (DPU).

- The most significant change from the 2010 rules relates to the term Free Carrier (FCA). Under this term, the buyer can now instruct its carrier to issue a bill of lading with an on-board notation to the seller so that they may satisfy the terms of a letter of credit.

- Under the revised term CIP, the seller is now responsible for purchasing a higher level of insurance coverage—at least 110% of the value of the goods as detailed in Clause A of the Institute Cargo Clauses. The insurance requirement hasn't changed for CIF.

- Incoterms 2020 rules recognize sellers who may use their own transport to deliver the goods. The terms now expressly state that sellers can make a contract for carriage or simply arrange for the necessary transportation.

- Incoterms 2020 rules now specifically call out the import and export security requirements and identify whether the buyer or seller is responsible for meeting those requirements.

You'll find a detailed discussion of what’s new with Incoterms 2020 rules and how to use them in my blog post, Incoterms 2020: Here's What's New.

While you can still use previous versions of Incoterms rules, like Incoterms 2010, it’s not preferred; if you’re not using Incoterms 2020 rules, you must clearly state which version you’re using and make sure your documentation is correct throughout the transaction. If you’re looking to streamline the export documentation process, Shipping Solutions export documentation and compliance software can help.

More Information about Incoterms

Incoterms play too important of a role in international transactions to leave their usage up to chance. Here are some additional resources for learning more:

For more information about each specific Incoterms 2020 rule, download the free white paper: An Introduction to Incoterms® 2020 Rules.

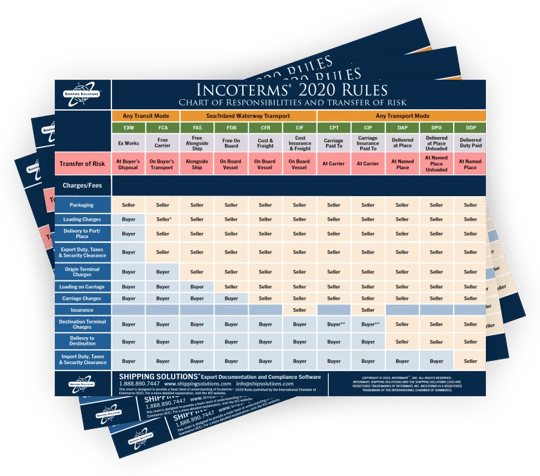

For more information about each specific Incoterms 2020 rule, download the free white paper: An Introduction to Incoterms® 2020 Rules.- For a summary of seller and buyer responsibilities under each of the terms, download the free wall chart: Incoterms® 2020 Chart of Responsibilities and Transfer of Risk.

- For a more detailed explanation of when to use the 11 Incoterms 2020 rules, register for the free 80-minute webinar: Incoterms® 2020 In Practice.

- You can purchase the official Incoterms® 2020 Rules book at the International Chamber of Commerce website.

- To ensure you are properly using Incoterms on your export paperwork, see how Shipping Solutions export documentation and compliance software can help you quickly prepare accurate export documents. Register for a free online demo.

Incoterms Frequently Asked Questions (FAQs)

-

Why are Incoterms important?

Using Incoterms in your contracts minimizes misunderstandings and disputes by clearly outlining each party's obligations. This saves time, money and avoids potential legal issues.

-

Which Incoterm should I use?

The best Incoterm depends on several factors, including the type of goods, mode of transport and desired level of control by each party.

-

Are Incoterms legally binding?

Incoterms themselves are not laws, but they become legally binding when incorporated into a sales contract. Make sure both parties agree on the chosen Incoterm and clearly mention it in your contract.

-

Can I modify Incoterms rules?

Yes, you can add specific terms to an Incoterm as long as both parties agree and clearly document the changes.

-

Do Incoterms cover payment terms?

No, Incoterms deal solely with delivery responsibilities. Payment terms, such as letters of credit, are separate agreements.

-

Are Incoterms updated regularly?

Yes, the ICC reviews and updates Incoterms periodically to reflect changes in international trade practices.

Like what you read? Subscribe today to the International Trade Blog to get the latest news and tips for exporters and importers delivered to your inbox.

This article was first published in two parts in October and November 2014 and has been updated to include current information including the Incoterms 2020 rules, new links and subtle formatting changes.

About the Author: David Noah

As president of Shipping Solutions, I've helped thousands of exporters more efficiently create accurate export documents and stay compliant with import-export regulations. Our Shipping Solutions software eliminates redundant data entry, which allows you to create your export paperwork up to five-times faster than using templates and reduces the chances of making the types of errors that could slow down your shipments and make it more difficult to get paid. I frequently write and speak on export documentation, regulations and compliance issues.