The International Trade Blog International Sales & Marketing

Incoterms 2020 DDP: Spotlight on Delivered Duty Paid

On: March 31, 2025 | By:  David Noah |

7 min. read

David Noah |

7 min. read

Incoterms 2020 rules are the latest revision of international terms of trade published by the International Chamber of Commerce (ICC). They are recognized as the authoritative text for determining how costs and risks are allocated to parties conducting international transactions.

Incoterms 2020 rules are the latest revision of international terms of trade published by the International Chamber of Commerce (ICC). They are recognized as the authoritative text for determining how costs and risks are allocated to parties conducting international transactions.

Incoterms 2020 rules outline whether the seller or the buyer is responsible for, and must assume the cost of, specific standard tasks that are part of the international transport of goods. In addition, they identify when the risk or liability of the goods transfers from the seller to the buyer.

In this article, we’re discussing the Incoterm DDP, also known as Delivered Duty Paid.

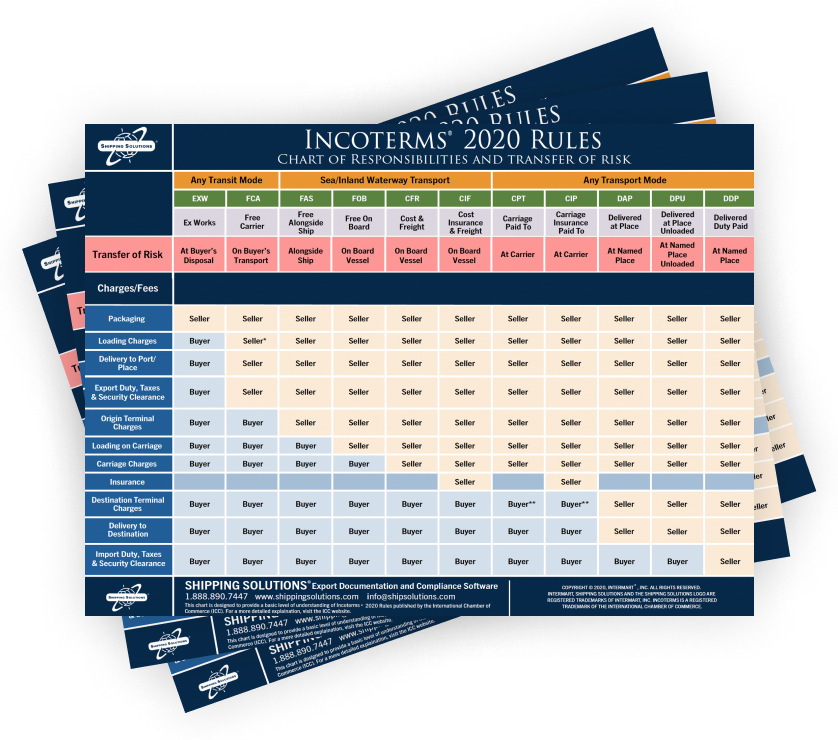

There are 11 trade terms available under the Incoterms 2020 rules that range from Ex Works (EXW), which conveys the least amount of responsibility and risk on the seller, to Delivered Duty Paid (DDP), which places the most responsibility and risk on the seller. The Incoterms 2020 Rules: Chart of Responsibilities and Transfer of Risk summarizes the seller and buyer responsibilities under each of the 11 terms.

For a summary of Incoterms 2020 and a short definition of each of the 11 terms, read An Introduction to Incoterms, or watch the video below.

Delivered Duty Paid (DDP) Responsibilities and Risk

Under the Incoterms 2020 rules, DDP puts the maximum risk and responsibility on the seller. It requires the seller take responsibility for clearing the goods for export, bear all risks and costs associated with delivering the goods, unload goods at the terminal at the named port or place of destination, clear the goods for import clearance and payment, and bring the goods to the place of destination. Risk transfers to the buyer at the destination, so it should be stated clearly and precisely.

Delivered Duty Paid Transportation Options

The ICC has divided the 11 Incoterms into those that can be used for any mode of transportation and those that should only be used for transport by “sea and inland waterway.” Under Incoterms 2020, DDP can be used for any mode of transportation.

Using Delivered Duty Paid

DDP is an extremely risky term for the seller. With DDP, the seller is obliged to clear the goods for both export and import, to pay all import duties as well as required VAT and other taxes, and to execute all customs formalities. If using DDP, the seller may want to consider a slight adjustment to mitigate some of the risk that comes with hard-to-estimate taxes: "DDP (named place of destination) excluding VAT or other taxes."

Sellers may not understand the complex and bureaucratic import clearance procedures that exist in some countries. They may not know how to hire a reputable and competent customs broker in the destination country. They may not know the current import duty rates for their goods or be aware if those duty rates change.

In addition, fulfilling the obligations under DDP may make the seller’s company register in the country of import and may require them to pay corporate income tax. However, not all countries (Mexico, for example) allow non-resident importers. In this case, DDP can be especially difficult to use because the seller will need to determine who will be the importer of record—maybe a trading company or the actual buyer.

When using DDP, it's important for the seller to closely control payment terms. The seller may need to outlay money for duties and taxes and could then be stuck waiting to recover those costs.

DDP also has questionable value to importers, since the likelihood of timely delivery of goods depends on the seller successfully navigating the intricacies of the destination country. Exceptions that might make DDP an acceptable Incoterms 2020 rule to use include shipments of replacement parts, low-value shipments, free samples, product literature or other marketing materials, and other instances when the buyer is not an experienced importer.

- If you're considering DDP, read our article, Incoterms Comparison: DDP vs. DAP—What's the Difference? It explains what you need to understand about these two very similar Incoterms.

DDP Frequently Asked Questions (FAQs)

-

What are the risks for sellers when using DDP?

The primary risk for sellers who use DDP is the complexity of import clearance procedures. Finding reliable customs brokers in destination countries can be difficult, and sellers may not have a good understanding of import duties.

-

Can sellers choose DAP instead of DDP to reduce risks?

Yes, sellers who want more control over the shipment and to avoid the complexities and risks associated with import duties and taxes often prefer DAP over DDP. By selecting DAP, sellers can still oversee the transportation process while shifting the responsibility for import clearance to the buyer.

-

Who is responsible for insurance under DDP?Under DDP, the seller is not obligated to provide insurance coverage for the goods. However, it is recommended for both parties to agree on insurance coverage to protect against loss or damage during transit.

-

Is DDP suitable for all types of shipments?DDP can be used for any mode of transportation, but it may not be suitable for every situation. Consider the nature of the goods, the destination country's customs regulations, and the parties' capabilities and preferences when choosing an Incoterm.

-

How is DDP different from DAP (Delivered At Place)?

While both DDP and DAP require the seller to manage the transportation and delivery of goods, DDP also requires the seller to cover import duties, taxes and customs clearance in the buyer’s country. With DAP, however, the buyer is responsible for these import-related expenses and processes. This makes DAP a lower-risk choice for the seller compared to DDP.

-

Why might some countries restrict the use of DDP?Some countries, like Mexico, don’t permit non-resident companies to act as importers of record, making DDP challenging or impossible to use unless the seller partners with a local entity. Additionally, certain import restrictions or high tax requirements can complicate DDP arrangements.

-

When should an exporter consider using DDP?Exporters may find DDP useful for shipments of replacement parts, free samples, low-value shipments, or goods intended for non-experienced importers. It can also be beneficial when delivering marketing materials or product literature, where handling import duties and taxes streamlines the process for the buyer.

-

Is it common to use DDP in international transactions?DDP is less common than other Incoterms due to its high level of risk for the seller. Many exporters prefer terms like DAP or CPT, which offer similar benefits without requiring the seller to manage import taxes and customs duties. However, DDP can be an attractive option for buyers who want a hands-off import process.

-

How can sellers minimize their risk when using DDP?Sellers can specify "DDP (named place of destination) excluding VAT or other taxes" to reduce their tax exposure. Establishing clear payment terms with the buyer also helps ensure that costs paid by the seller, such as import taxes, are recoverable. Partnering with a trusted customs broker in the buyer’s country can also mitigate some risks related to customs and import processes.

Learn More about Incoterms 2020 Rules

If you are regularly involved in international trade, you need to understand the risks and responsibilities as defined by Incoterms 2020 rules, not just pick the term you always use. Start by getting a copy of ICC's Incoterms® 2020 Rules book.

For a more detailed understanding of which term or terms make the most sense for your company, register for an Incoterms® 2020 Rules seminar or webinar offered by International Business Training. If you don't want to attend a half-day class, you can get the book provided at these seminars and webinars: Incoterms® 2020 for Importers and Exporters.

Read our articles about all of the other Incoterms 2020 rules here:

- EXW (Ex Works)

- FCA (Free Carrier)

- FAS (Free Alongside Ship)

- FOB (Free On Board)

- CFR (Cost and Freight)

- CIF (Cost, Insurance and Freight)

- CPT (Carriage Paid To)

- CIP (Carriage and Insurance Paid To)

- DAP (Delivered At Place)

- DPU (Delivered At Place Unloaded)

Like what you read? Subscribe today to the International Trade Blog to get the latest news and tips for exporters and importers delivered to your inbox.

This article was first published in June 2016 and has been updated and revised based on the changes made with the release of the Incoterms 2020 rules.

About the Author: David Noah

As president of Shipping Solutions, I've helped thousands of exporters more efficiently create accurate export documents and stay compliant with import-export regulations. Our Shipping Solutions software eliminates redundant data entry, which allows you to create your export paperwork up to five-times faster than using templates and reduces the chances of making the types of errors that could slow down your shipments and make it more difficult to get paid. I frequently write and speak on export documentation, regulations and compliance issues.