The International Trade Blog Export Compliance

What's the Difference between a Schedule B Code and an HS Number?

On: April 23, 2025 | By:  David Noah |

8 min. read

David Noah |

8 min. read

“All squares are rectangles, but not all rectangles are squares.”

“All squares are rectangles, but not all rectangles are squares.”

As a child learning geometry, that concept really confounded me. How could one belong to another, yet the inverse not be true? As my teacher explained, the difference lies in specificity.

The same logic applies to export classification codes.

If you’re new to exporting, the difference between Harmonized System (HS) numbers and Schedule B codes may be vexing. Are they the same? Can they be used interchangeably? Which one should you be using—and when?

In casual conversations, exporters tend to use Schedule B code, HS code and HTS code interchangeably. After all, they're all used to classify products for customs. But in practice, the differences matter. Here’s how you can distinguish between HS numbers and Schedule B codes so you can make sure you’re using the right code at the right time.

What Are HS Numbers?

The Harmonized System classification is a six-digit standard, called a subheading, for classifying traded products. HS numbers (also known as HS codes) are used by customs authorities around the world to identify products for duties and taxes.

For exporters, HS numbers simplify international trade. Instead of learning hundreds of different product classification systems, exporters can rely on this globally recognized six-digit code (upon which HTS codes and Schedule B codes are built) as the foundation of customs documentation in nearly every country.

Because HS numbers are consistent across borders, you should include the six-digit HS code on any export documents that are used by both the exporter and the importer. That typically includes the proforma and commercial invoices and certificates of origin.

Here’s a summary of HS numbers:

- There are six digits in an HS number;

- HS numbers are uniform across the globe;

- HS numbers are administered by the World Customs Organization and serve as the foundation for the import and export classification systems used in the United States.

What Are Schedule B Codes?

The Schedule B code is a U.S.-specific coding system administered by the International Trade Management Division of the U.S. Census Bureau to monitor U.S. exports. These codes take the same form as HS codes for the first six digits, but include four additional digits for a total of 10 numbers. These additional numbers provide a more detailed product classification.

While similar in structure, Schedule B codes are not the same as Harmonized Tariff Schedule (HTS) codes, which are used for imports. Exporters should prioritize identifying the correct Schedule B code for their products, and it’s the classification used for Electronic Export Information (EEI) that you submit to AESDirect.

Here’s when you’re required to report a Schedule B code through AESDirect:

- When the value of your goods per Schedule B number exceeds $2,500

- When your product requires an export license

- When exporting a used vehicle

- When exporting to China, Russia, or Venezuela, regardless of value (as of Sept. 27, 2020)

If you pay your freight forwarder or some other third party to file on your behalf, you should include the Schedule B code on your Shipper’s Letter of Instruction (SLI) that you give them.

Here’s a summary of Schedule B codes:

- Contain 10 digits

- Used exclusively in the United States and exclusively for exports

- May differ from the HTS codes used for imports

Properly Classifying Your Products

Not only is it important to understand when to use the six- or 10-digit classification on your export paperwork, it's important to identify the correct classification of your goods. Since the HS number is the same first six digits of the Schedule B code, you don't have to do a separate search for both.

The Census Bureau provides a Schedule B Search Engine that allows you to search for the proper code using a product description. Because the differences between classifications can be quite technical, it's important that someone who understands the technical specifications of your products conducts the search.

Shipping Solutions also offers a standalone Product Classification Software tool. It helps you quickly identify the correct Schedule B, HTS and ECCN codes for your products. Sign up for a free trial.

Finding the Correct Schedule B: An Example

The Schedule B has three pieces of information that you need: the number, the description and the unit of quantity (or unit of measure).

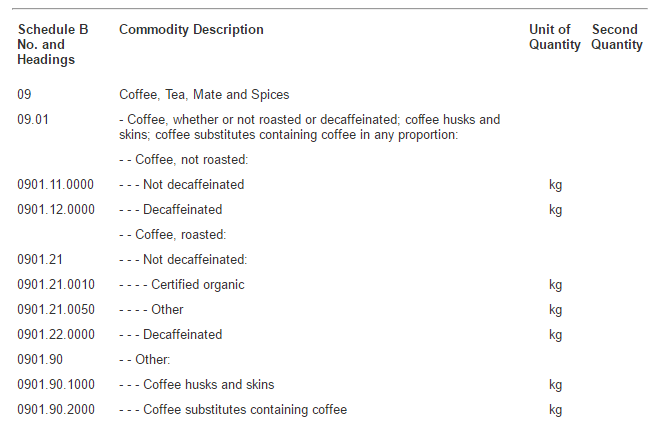

Below is a page from Chapter 9 of the Schedule B. When you look at the first column, you’ll see examples of two-, four-, six- and 10-digit numbers. The two-, four- and six-digit numbers are headings—not actual Schedule B codes.

So using the example, the first Schedule B number that is listed is 0901.11.0000. The 09 and 09.01 preceding it are only headings.

Once you have found the correct Schedule B number, you must decide what to use for your Commodity Description. You must provide a detailed-enough description of the item being exported so that the Schedule B number can be verified. Sometimes that means you can use the description listed right next to the number.

For example, the description, “Coffee husks and skins,” is sufficient for Schedule B number 0901.90.1000. However, the description next to Schedule B number 0901.11.0000, which is “Not decaffeinated,” is not a clear-enough description. So instead, you could build a description using the heading description plus the number description such as, “Coffee, not roasted, not decaffeinated.”

The next column is Unit of Quantity, which also means unit of measure. When you submit your EEI filing through AESDirect or complete an SLI for your freight forwarder so they can file on your behalf, you must report the quantity for this product using this unit of measure. This may be a different unit of measure than how you sell the product and how you include it on your commercial invoice.

For example, you might sell your coffee by the can. Or, because you are a successful wholesaler, by the gross (144 cans). You can, and should, list your product this way on your commercial invoice. If I buy 10 gross of coffee from you, the invoice quantity is 10 and the unit of measure is gross.

However, the Census Bureau doesn’t care about the number of cans you are exporting. Based on your Schedule B number—0901.11.0000—your EEI filing needs to report the quantity in kilograms. If each of your cans contains one pound of coffee, the quantity to report is 65.3 kilograms.

But you may not be done yet. The final column in the Schedule B chart shown above is called Second Quantity.

Under the Schedule B, the Census Bureau sometime requires that you report two quantities and two units of measure for your product. The example above does not show any of those items, but if you look in Chapter 32, you will see that certain kinds of paint need to be reported in liters and kgs (see Schedule B number 3208.10.0000).

Whether there are one or two quantities of measure listed, this AES reporting requirement trips up way too many exporters who default to using the same unit of measure as they use on their invoice whether or not it’s appropriate for their Schedule B code. This can cause an immediate problem by delaying their current shipment or more serious concerns in the future if an audit reveals a pattern of incorrect filings.

Changes to Classification Codes

Just because you’ve found the correct Schedule B or HTS code today doesn’t mean it will stay the same forever.

Both the Schedule B and Harmonized Tariff Schedule (HTS) are updated regularly, typically:

- At the beginning of each calendar year

- Occasionally mid-year, depending on regulatory changes

While many of these updates are minor, they can affect your product classification—and therefore your export documentation and compliance obligations. That’s why it’s important to review your codes at least annually to make sure your filings remain accurate.

The World Customs Organization (WCO) updates the international Harmonized System (HS) every five to six years. These are major structural changes that impact the global classification of goods and trickle down into both the Schedule B and HTS codes. When those updates occur, exporters and importers should expect more substantial revisions that may require reclassifying multiple products.

Properly Preparing Your Export Paperwork

As you've seen, there are a lot of variables to account for when preparing your export paperwork. Here's a summary of what exporters need to keep in mind:

- First, you must properly classify your products using their 10-digit Schedule B code and understand the proper unit of measure.

- Then, make sure the six-digit HS code is included on your documents shared by both the exporter and the importer (because the HS code will be the same for both).

- Include the full Schedule B code on your EEI filing through AESDirect or on your SLI if your forwarder is filing on your behalf.

- And don't forget: while your proforma and commercial invoices may use one set of quantities and units of measure, your EEI and SLI may need a different set.

Whew—that’s a lot to track!

An Easier Way to Manage It All

That's where Shipping Solutions export documentation software can help.

With Shipping Solutions, you can:

- Store product data—including Schedule B codes, prices, and correct units of measure

- Automatically generate export forms like commercial invoices, SLIs, and certificates of origin

- Avoid redundant data entry by selecting products from a dropdown list and entering shipment quantities

- Submit your Electronic Export Information (EEI) directly to AESDirect on the ACE platform—no need to pay a forwarder or third party

Shipping Solutions helps you stay compliant and work faster, without the stress of managing it all manually.

To learn more, watch this quick Getting Started video:

Or sign up for a free online demo to see how it works in action.

Like what you read? Join thousands of exporters and importers and subscribe to the International Trade Blog to get the latest news and tips delivered to your inbox.

This article was first published in January 2015 and has been updated to include current information, links and formatting.

About the Author: David Noah

As president of Shipping Solutions, I've helped thousands of exporters more efficiently create accurate export documents and stay compliant with import-export regulations. Our Shipping Solutions software eliminates redundant data entry, which allows you to create your export paperwork up to five-times faster than using templates and reduces the chances of making the types of errors that could slow down your shipments and make it more difficult to get paid. I frequently write and speak on export documentation, regulations and compliance issues.