The International Trade Blog Export Compliance

What Is the Destination Control Statement and Why Should It Be on Your Commercial Invoice?

On: January 16, 2023 | By:  David Noah |

4 min. read

David Noah |

4 min. read

The Destination Control Statement is a legal statement required by the Export Administration Regulations (EAR) and the International Traffic in Arms Regulations (ITAR) stating that the goods you are exporting are destined to the country indicated in all the shipping documents. It is a necessary legal boundary clarifying what happens to shipments, and it essentially states that the buyer isn’t going to take the goods and forward them to another country.

The Destination Control Statement is a legal statement required by the Export Administration Regulations (EAR) and the International Traffic in Arms Regulations (ITAR) stating that the goods you are exporting are destined to the country indicated in all the shipping documents. It is a necessary legal boundary clarifying what happens to shipments, and it essentially states that the buyer isn’t going to take the goods and forward them to another country.

At one time the statement required by the Bureau of Industry and Security (BIS) under the EAR was different than the statement required by the State Department under the ITAR, but that changed in 2016 when both agencies began accepting a single, harmonized statement regardless of whether the goods fell under the jurisdiction of BIS or State.

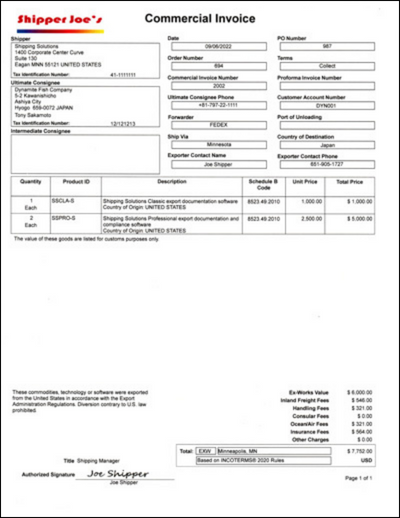

Both the EAR and ITAR regulations require that the Destination Control Statement appear only on the commercial invoice and not on other export documents that accompany the merchandise from the U.S. to its ultimate destination abroad. However, the ITAR regulations also require that this new statement, or a reference to this statement, be included within licensing, manufacturing and distribution agreements.

When Is the Destination Control Statement Required?

According to BIS, all exported items listed on the Commerce Control List that are not classified as EAR99 or are eligible for license exception BAG or GFT require a Destination Control Statement. Exceptions to the Destination Control Statement are listed in Part 758.6 of the EAR, and you can contact the U.S. Department of Commerce, an attorney or your freight forwarder to learn more.

While it’s not a requirement for all transactions, including a Destination Control Statement on every transaction is a good precaution to protect yourself in the event that merchandise you sold to a domestic purchaser is unexpectedly exported from the United States.

The Destination Control Statement must include the following statements at an absolute minimum:

These items are controlled by the U.S. Government and authorized for export only to the country of ultimate destination for use by the ultimate consignee or end-user(s) herein identified. They may not be resold, transferred, or otherwise disposed of, to any other country or to any person other than the authorized ultimate consignee or end-user(s), either in their original form or after being incorporated into other items, without first obtaining approval from the U.S. government or as otherwise authorized by U.S. law and regulations.

The Export Administration Regulations require you to take the following actions when exporting under the authority of this license.

- Record the Export Control Classification Number in the block provided in the Automated Export System (AES).

- Record your validated license number in the block provided in AES.

- Place a Destination Control Statement on all commercial invoices for shipments of items on the Commerce Control List.

Preventing Potential Export Violations

Preventing Potential Export Violations

Imagine you’re exporting controlled goods to the UAE. From there, without your knowledge, the goods are forwarded to Iran. There are no restrictions between those countries, and the Iranian company has a division in the UAE. In this case, you are breaking the law (whether you mean to or not).

It’s up to you to do your due diligence so a situation like this doesn’t occur. If a buyer is telling you they won’t transfer, but you have reason to believe the goods will get forwarded, you have to act accordingly.

- Be aware of compliance regulations.

- Familiarize yourself with laws and regulations that may impact your area of exporting.

- Know your customers.

- Know what penalties you face for breaking the law.

What happens if you don’t include a Destination Control Statement when required?

Quite simply, you’re breaking the law. You could face civil and criminal fines and penalties, including denial of export privileges, exclusion from practice and even jail time. It’s not worth it to risk it, especially when it’s relatively simple to get help with your exports.

More Information

To learn more about the Destination Control Statement and general export compliance regulations, check out the following resources:

- Check out our comprehensive resource for all exporters: Export Procedures and Documentation: An In-Depth Guide.

- Download the free Shipping Solutions whitepaper: What You Need to Know about Export Compliance.

- Read more information about using the Destination Control Statement on your domestic paperwork: Avoid Export Violations on Your Domestic Sales.

- Speak with a BIS counselor who can provide some guidance on the Export Administration Regulations.

Like what you read? Subscribe today to the International Trade Blog to get the latest news and tips for exporters and importers delivered to your inbox.

This article was first published in December 2014 and has been updated to include current information, links and formatting.

About the Author: David Noah

As president of Shipping Solutions, I've helped thousands of exporters more efficiently create accurate export documents and stay compliant with import-export regulations. Our Shipping Solutions software eliminates redundant data entry, which allows you to create your export paperwork up to five-times faster than using templates and reduces the chances of making the types of errors that could slow down your shipments and make it more difficult to get paid. I frequently write and speak on export documentation, regulations and compliance issues.