The International Trade Blog Export Forms

Getting Paid for Your Exports: Required Documents

On: February 8, 2021 | By:  Catherine J. Petersen |

3 min. read

Catherine J. Petersen |

3 min. read

What's the point of exporting if you don't get paid for your goods? Providing the correct export documents will help ensure you get paid in a timely manner.

What's the point of exporting if you don't get paid for your goods? Providing the correct export documents will help ensure you get paid in a timely manner.

The export quotation is often the first document you'll need to prepare.

An Export Quote

Whether the terms of your international sale require payment by cash in advance, open account, documentary collection/cash against documents or letter of credit, the quotation process is the same.

The quotation should follow a standard format that includes the terms of payment, the international trade term under Incoterms 2020 rules, terms and conditions of the transaction, where ownership will transfer, value of the goods, country of origin, expiration date of the quotation and other details that are specific to your product or transaction.

The quotation is the offer, and the purchase order is the confirmation of order acceptance. When providing a quote to a customer, you'll need to consider the customer’s credit history. You will also need to determine what documents are required for customs clearance in your customer’s country.

It's during this exchange of information, along with your knowledge about a potential customer’s credit history and political and financial risk, that you will determine what documents are required to clear customs in the buyer’s country.

Alternately, you might be asked to provide a proforma invoice. The proforma invoice acts like a quote and looks like a commercial invoice.

Additional Export Documents

You will typically be required to provide the following documents in order to clear customs in your customer’s country:

- Commercial invoice

- Packing list

- International bill of lading (air waybill, ocean bill of lading, rail bill of lading or truck bill of lading)

- Certificates of origin, as needed

- Other documentation, as specified

Find out what documents and other information you need to provide from:

- The buyer

- The freight forwarder handling the transaction

- The U.S. Department of Commerce at the U.S. Export Assistance Center offices

- Courier companies, such as FedEx and UPS, that have lists of documentary requirements by country posted on their websites

- Export software programs such as Shipping Solutions Professional

- The embassy of the buyer’s country

For example, if you have a customer in Saudi Arabia, there are additional documents that are needed by your customer. The Saudi Embassy posts documentation requirements on its website.

In this example, all commercial documents, e.g. shipment of goods certificates, certificates of origin, invoices, vessel navigation certificates, bills of lading, insurance certificates and market price certificates, must be authenticated by a chamber of commerce and also, in some cases, by the Consulate Section of the Royal Embassy of Saudi Arabia. Other countries will have different document requirements and procedures.

This authorization process can be streamlined by applying for a chamberized certificate of origin and other documents through the electronic certificate of origin (eCO) portal on the Shipping Solutions website. You can register for free for the service.

The Purpose of Each Export Form

Regardless of what country you are exporting to, the documentation prepared by the seller for the customer is critical to the buyer’s ability to easily clear customs when the goods arrive at the agreed delivery point in the buyer’s country.

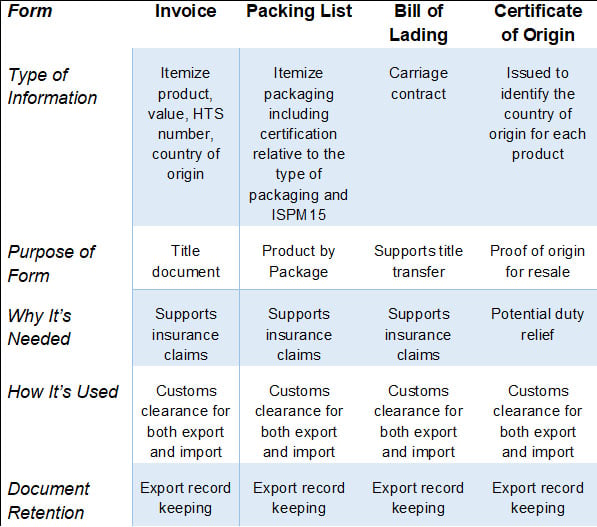

The table below summarizes commercial and regulatory uses of the documentation that companies prepare to support international commercial transactions. Each document requested by the foreign purchaser of goods is usually needed to meet government or financial institution requests or requirements.

If the documentary request or requirement seems unlikely or unusual, qualify the requirement by seeking information from reliable sources, such as the U.S. Export Assistance Center or the Commercial Attaché for the country in question.

In my next article, I’ll describe payment options for international transactions.

This post was originally published in January 2007 and has been updated to include current information, links and formatting.

About the Author: Catherine J. Petersen

In 1992, Catherine Petersen founded C J Petersen & Associates, LLC, a research, instruction and consulting firm located in St. Paul, Minnesota, USA. She has designed documentation and procedure manuals for exporters and has authored/co-authored five books.

Ms. Petersen has had day-to-day practical experience at a freight forwarder, a trading company, and an ocean carrier; she has been active in international business since 1980. Her background led her to develop C J Petersen & Associates, LLC, which is a collaborative consultancy that works with clients to identify compliance gaps and to resolve them. Ms. Petersen retired in 2022.