On: May 20, 2019 By: Chris Lidberg

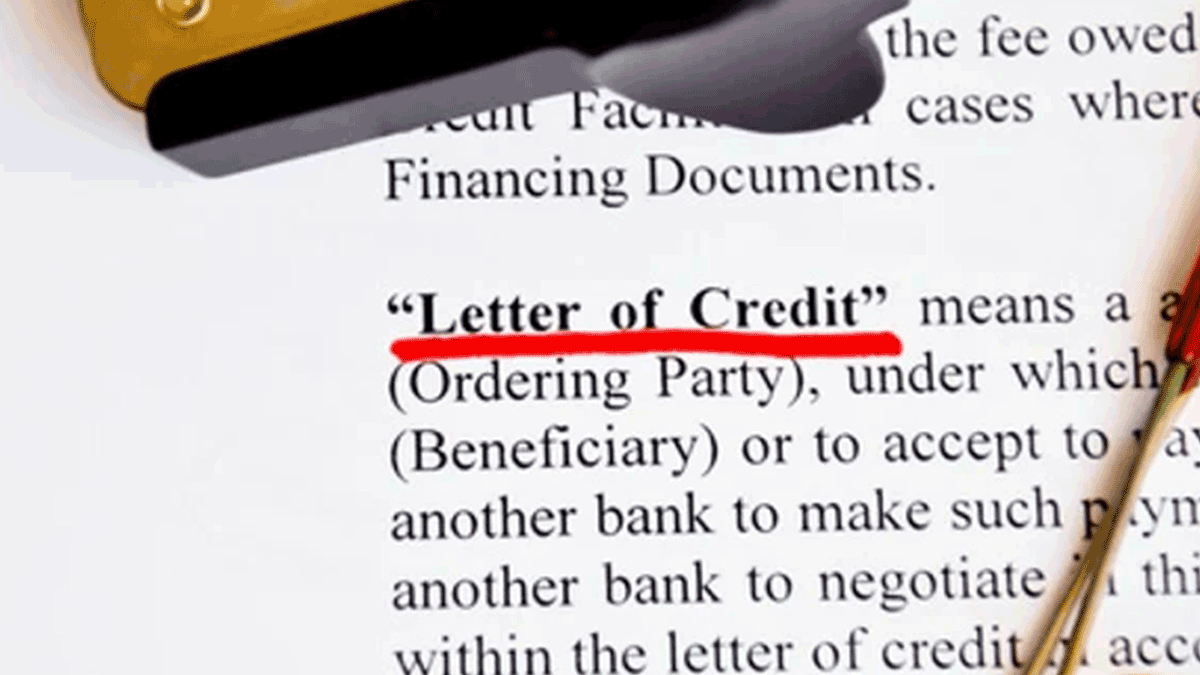

Letter of Credit Basics: Don't Grant Access to Your Goods Before You Get Paid

Too often sellers don’t give much thought to the actual terms and conditions in their letters of credit. This is a mistake, since it can cause all sorts of problems including granting buyers access to their goods before you even get paid.