The International Trade Blog International Logistics

Trade Agreements—FTAs, TPAs, Unilateral, Bilateral, Multilateral: How Do They Differ?

On: September 12, 2022 | By:  Kristine Race |

5 min. read

Kristine Race |

5 min. read

Trade Agreements (TAs) are agreements between two or more counties, where the governments have agreed on certain rules and obligations that must be followed in order for a company to claim preferential treatment. Preferential treatment is the term used for the elimination or reduction of duties paid on qualifying goods.

Trade Agreements (TAs) are agreements between two or more counties, where the governments have agreed on certain rules and obligations that must be followed in order for a company to claim preferential treatment. Preferential treatment is the term used for the elimination or reduction of duties paid on qualifying goods.

The U.S. currently has 11 Free Trade Agreements (FTAs) and three Trade Promotion Agreements (TPAs). Both FTAs and TPAs are trade agreements, but FTAs provide extensive reduction or elimination of tariffs on almost all traded goods, while TPAs are limited in scope and depth of tariff reduction between the customs territories.

The 14 agreements that the U.S. currently has in place are with the the following 20 countries:

- Australia

- Bahrain

- Chile

- Colombia

- CAFTA-DR: Costa Rica, Dominican Republic, El Salvador, Guatemala, Honduras and Nicaragua

- Israel

- Jordan

- Korea

- Morocco

- USMCA: Canada and Mexico

- Oman

- Panama

- Peru

- Singapore

Types of Trade Agreements

There are three different types of trade agreements:

- Unilateral trade agreements are one-sided trade arrangements that benefit only one country. They allow countries to decrease the amount of trade restrictions with another country, often offering developing nations trade benefits to help spur development. Other countries have no choice in the matter, and the agreement is not open to negotiation. The United States has unilateral trade policies under the Generalized System of Preferences (GSP). Duties are eliminated on thousands of products when imported from one of 119 designated beneficiary countries and territories, with the goal of promoting economic growth in some of the world’s poorest countries.

- Bilateral trade agreements are between two countries or customs territories. They are easier to negotiate than the multilateral trade agreements. Many of the agreements with the countries listed above are bilateral agreements.

- Multilateral trade agreements are between more than two countries, the United States-Mexico-Canada Agreement (USMCA), for example. These are the most powerful but also have the most obstacles as it’s harder to reach mutual satisfaction.

Differences to Consider

Many people think that all TAs are the same. You might think that what is good for one TA is good for another, but each agreement has its own rules and regulations. Many are similar, sometimes identical, but each good imported and exported under a TA must be looked at individually in relation to the specific rules and regulations for each TA.

Some of the differences between trade agreements to consider include:

Are there drawback restrictions?

Drawback is the refund of certain duties, internal revenue taxes and certain fees collected upon the importation of goods and refunded when the merchandise is later exported or destroyed. Restrictions vary between TAs, and some do not have any restrictions.

How is Regional Value Content (RVC) calculated?

USMCA uses the Transaction Value or Net Cost Methods. Others use the Build-Up, Build-Down and Net Cost Methods, or materials plus direct cost of processing must at least equal a percentage of appraised value method.

These methods calculate the percentage of originating content of the final goods when a TA rule specifies that RVC must be used to qualify goods. It is totally the manufacturer’s choice which method is used as specified for each TA if there is more than one method. This can be beneficial, because a good may not qualify by one method but could qualify by using another.

Can you make a reconciliation claim?

Sometimes a TA certificate or declaration is not available at the time of import for certain reasons. For USMCA, Chile FTA, CAFTA-DR, Colombia TPA, Korea FTA, Oman FTA, Panama TPA and Peru TPA, an importer can submit the certificate at a later date and a reconciliation is filed to provide the final and correct information. The reconciliation claim is due within 12 months of the earliest entry import date.

Documentation Requirements

Most FTAs and TPAs do not require a formal or standard form to show proof of origin and will accept any documentation that a company chooses as long as certain data elements are included to prove goods qualify for preferential treatment. Companies may choose to use a certificate of origin or some other document such as the commercial invoice, as long as it contains all the data elements that are required for the FTA.

You can download sample FTA Certificates of Origin in PDF format here.

The data elements that must be included vary between the FTAs. For example, USMCA has nine data elements that must be on a certificate type form, whereas Australia-United States Free Trade Agreement (AUSFTA) has 10 data elements and Israel Free Trade Agreement (ILFTA) does not require a certificate—the goods only need to be marked as qualifying, along with a statement printed on the commercial invoice. To find which data elements are required for each FTA, check the Documenting Origin section on U.S. Trade Information Center website.

Most FTAs use specific letter codes to identify the Preference Criteria, but these also differ depending on which FTA you’re using. For example, you would not write Preference Criterion B on the AUSFTA form just because this was the letter criterion used for a USMCA shipment.

All preferential claims must be signed and dated, whether the claim is made in the form of a certificate such as a USMCA certificate or a declaration statement on the commercial invoice for ILFTA.

Comparing Agreements

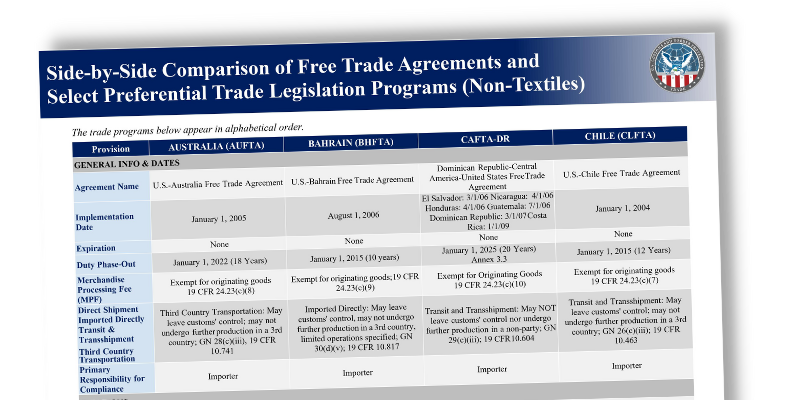

A side-by-side comparison of all of the U.S. trade agreements is available at the U.S. Customs and Border Protection website.

Like what you read? Subscribe today to the International Trade Blog to get the latest news and tips for exporters and importers delivered to your inbox.

About the Author: Kristine Race

Kristine Race has 17 years of experience in Global Trade Compliance. She began her career with Tyco Fire Products (Tyco) as a Trade Compliance Administrator. After earning her B.A. in Global Business Management, she was promoted to Trade Compliance Specialist. In 2018, Tyco was purchased by Johnson Controls Inc. (JCI), where she then specialized in Free Trade Agreements for all JCI and former Tyco business units in the U.S. and Canada.

During her career she developed organizational methods and policies; provided training; established procedures; determined HTS classification, ITAR and ECCN for products; and specialized in Free Trade Agreements.

Kristine currently lives in Northeast Wisconsin where she enjoys spending time with her family, crafts, photography and writing.

.webp?width=763&height=852&name=CTA%20-%20How%20to%20Qualify%20for%20a%20Free%20Trade%20Agreement%20(FTA).webp)