The International Trade Blog Export Forms

Proforma vs. Commercial Invoice: What’s the Difference?

On: April 16, 2025 | By:  David Noah |

6 min. read

David Noah |

6 min. read

A typical export process includes the use of both the proforma and commercial invoices (they're among the 12 most common export documents exporters need to understand and two of the dozens of documents you can complete using Shipping Solutions). Shippers who don’t know better may think the two forms are interchangeable—but they’re not. In this article, we’ll examine the differences, and we'll look at the role each form plays in an export shipment.

A typical export process includes the use of both the proforma and commercial invoices (they're among the 12 most common export documents exporters need to understand and two of the dozens of documents you can complete using Shipping Solutions). Shippers who don’t know better may think the two forms are interchangeable—but they’re not. In this article, we’ll examine the differences, and we'll look at the role each form plays in an export shipment.

The Proforma Invoice

A proforma invoice is simply a quote prepared by the exporter that closely resembles a commercial invoice. An international sale often begins with a letter of inquiry from a potential buyer expressing interest in one or more of your products, outlining the terms of their interest, and requesting either an informal or formal quote.

As discussed in the article How Does the Proforma Invoice Fit in the Export Process?, a buyer may request a quote in the form of a proforma invoice in order to arrange a letter of credit to pay for the goods or to secure financing for the purchase. In addition, certain countries may require a proforma invoice if they tightly control their currency exchange rate, require import permits or use import quotas to protect local industries.

A proforma invoice should be valid for a specific period. Because you're often quoting both the product cost and transportation costs, it's important to give the buyer a reasonable amount of time to respond. After that period, the proforma invoice is no longer valid.

Download a free proforma invoice template here.

The Commercial Invoice

Once the buyer and the seller agree upon the terms of the sale—and the buyer has accepted the terms of the proforma invoice, typically by submitting a purchase order that the seller has accepted—the transaction is ready to proceed. When the goods are ready to ship, the seller issues a commercial invoice.

In addition to listing the amount owed by the buyer to the seller, including when and how payment must be made, the commercial invoice plays an important role in the export process. The commercial invoice is the primary shipping document used by customs authorities worldwide for commodity control and valuation, providing important instructions and information to:

- The freight forwarder

- U.S. and foreign customs

- The import broker

- The marine insurance company

- Both your bank and the buyer’s bank

Because of its importance, the commercial invoice must include all the necessary information to successfully complete the export shipment. 10 Items That Belong on Your Export Commercial Invoice provides a checklist of those items, or this video explains what must be included:

You can download a free commercial invoice template here. (Note: Certain localities, such as Canada and countries in the Caribbean, may require specific invoices instead of, or in addition to, the standard commercial invoice form.)

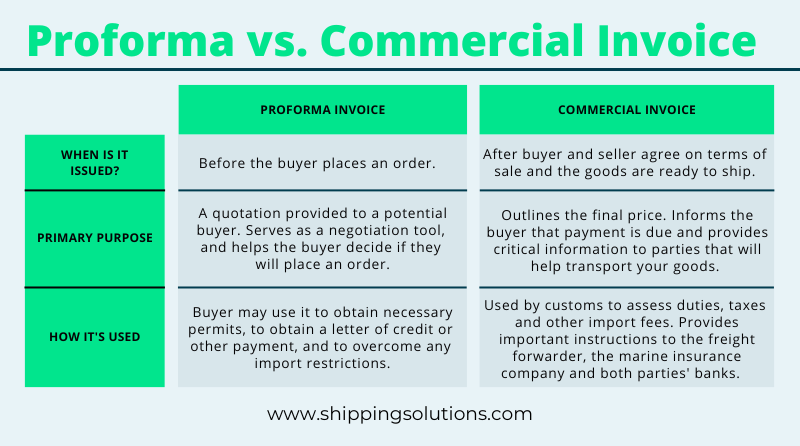

Proforma vs. Commercial Invoice: 3 Key Differences

In summary, although a proforma and commercial invoice may look very similar, there are three key differences between the two documents:

1. When They Are Issued

After a company receives an inquiry about one or more of its products from a potential international customer, it issues a proforma invoice as a quote not only outlining the cost of the goods but also the terms of the sale. The potential buyer can accept the price and terms outlined in the proforma invoice or make a counteroffer in an attempt to negotiate.

2. What They Include

While the kind of information that appears on both types of invoices may be similar, the commercial invoice should represent the final, agreed-upon details of the transaction including any necessary additional export or import control information.

In the absence of a formally negotiated and agreed upon sales contract, the proforma and commercial invoices are part of the paper trail that encompass the contract between the buyer and the seller. Check out the free webinar, Creating an International Sales Contract, for more details about the “battle of the forms.”

3. How They Are Used

As outlined above, the proforma invoice is used by the buyer and the seller to negotiate the price and the terms of the sale. It may also be used by the buyer to obtain any necessary import permits, overcome any potential import restrictions and arrange for a letter of credit or another form of payment.

The commercial invoice is not only an instrument for collecting payment; it is also used by customs agencies to identify appropriate duties, taxes and other import fees, and to ensure compliance with export requirements. It also provides the information needed to move the goods from the seller to the buyer.

The Bottom Line: Commercial vs. Proforma Invoices

If you create the proforma correctly, the difference between a proforma and commercial invoice may be minimal. Both are important to your exporting process, and both are among the dozens of export documents that you can create quickly and easily using Shipping Solutions export documentation and compliance software. This short video shows you how to get started with Shipping Solutions:

Like what you read? Join thousands of exporters and importers who subscribe to Passages: The International Trade Blog. You'll get the latest news and tips for exporters and importers delivered right to your inbox.

This article was first published in April 2021 and has been updated to include current information, links and formatting.

About the Author: David Noah

As president of Shipping Solutions, I've helped thousands of exporters more efficiently create accurate export documents and stay compliant with import-export regulations. Our Shipping Solutions software eliminates redundant data entry, which allows you to create your export paperwork up to five-times faster than using templates and reduces the chances of making the types of errors that could slow down your shipments and make it more difficult to get paid. I frequently write and speak on export documentation, regulations and compliance issues.