The International Trade Blog Free Trade Agreements

Verification of Origin: FTA Certification and Documentation

On: March 25, 2024 | By:  Kari Crane |

5 min. read

Kari Crane |

5 min. read

Once you have determined that your product originates and qualifies for a free trade agreement (FTA), you will need to certify and document that qualification. This is one of the last steps in the process of claiming preferential treatment under an FTA. In previous articles, we explained the other steps: determining tariff rates, reading rules of origin and using the three primary methods of qualification.

Once you have determined that your product originates and qualifies for a free trade agreement (FTA), you will need to certify and document that qualification. This is one of the last steps in the process of claiming preferential treatment under an FTA. In previous articles, we explained the other steps: determining tariff rates, reading rules of origin and using the three primary methods of qualification.

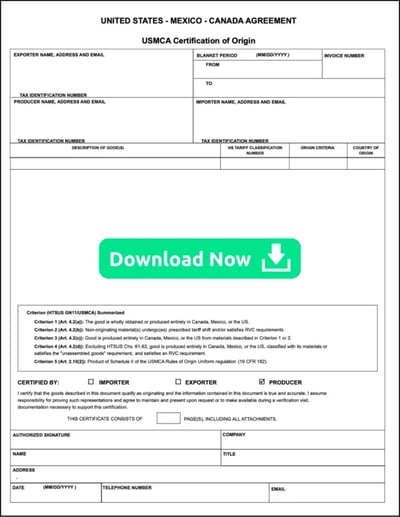

Certification of origin can be done through a statement on company letterhead, information on the commercial invoice or with a certificate of origin, generic or tailored to the specific FTA you’re using. A certificate of origin is the most structured way to present the information and it ensures you include all required data elements.

What to Include on an FTA Certificate of Origin

While the importer is responsible for claiming preferential duty rates, the producer or exporter of the goods is the one most likely to know whether or not the goods qualify. Therefore, they are often the party that completes the certificate of origin.

Some of the data elements that are typically included:

Some of the data elements that are typically included:

- Exporter, importer and producer details

- Description of goods

- HS number

- Origin criteria

- Country of origin

- Who is certifying the information—the importer, exporter or producer

The importing country has the right to audit, visit, review and even assess civil or criminal penalties on the party that certified the goods as eligible if a false declaration of origin is made. So it’s important to document how you’ve determined that the goods qualify.

Certification requirements are found in the rules of origin of each U.S. FTA. To ensure you’re including all of the required information, Shipping Solutions has free certificate of origin templates available to download for most of the U.S. FTAs, including the following:

- USMCA: Canada and Mexico

- Australia

- CAFTA-DR: Costa Rica, Dominican Republic, El Salvador, Guatemala, Honduras and Nicaragua

- Chile

- Colombia

- Japan

- Korea

- Panama

- Peru

- Singapore

- Commercial Invoice for Exports to Israel

The Easier Way to Complete FTA Export Documents

As you can see, the correct documentation is vital to claiming preference through an FTA. But completing this paperwork (along with all of the other documents required for your export transaction) can be a hassle if you don’t have the right tool to complete them in a timely, efficient manner.

That’s where Shipping Solutions export documentation software fits in. Thousands of successful exporters use Shipping Solutions to complete their FTA certificates of origin and other export forms up to five times faster than preparing them by hand or by using Excel or Word templates. The more advanced version of the software—Shipping Solutions Professional—can save even more time by linking to your company’s accounting or ERP system and helping ensure compliance with export regulations.

Let us show you how Shipping Solutions software can help your company. Schedule a free online demo of the software today.

Recordkeeping

Documentation related to the importation and certification of origin must typically be kept for five years from the latest date of importation of the good. All records used to demonstrate that the good is originating need to be kept, including the certificate of origin. If you have a complex product and are using the regional value content (RVC) method to show qualification, you will want to keep a worksheet to prove how that calculation was made. (Learn what a worksheet should include and download a sample in our article, How to Determine Free Trade Agreement (FTA) Qualification.

Conclusion

Proper recordkeeping and documentation ensure that your business not only benefits from preferential FTA treatment but that it is also prepared for potential audits. Documentation is part of your compliance responsibilities, and doing it correctly is important if you hope to avoid potential shipping delays and fines.

Like what you read? Join thousands of exporters and importers who subscribe to Passages: The International Trade Blog. You'll get the latest news and tips for exporters and importers delivered right to your inbox.

About the Author: Kari Crane

Kari Crane is the editor of Passages: The International Trade Blog. Kari joined Shipping Solutions after working as an editor, writer and designer at a major market newspaper in Texas. Kari has spent her career finding different ways to tell stories and make complex topics easy-to-understand, so she loves helping importers and exporters understand how to navigate the complex world of international trade.

.webp?width=763&height=852&name=CTA%20-%20How%20to%20Qualify%20for%20a%20Free%20Trade%20Agreement%20(FTA).webp)