The International Trade Blog International Sales & Marketing

Exporting to Mexico: What You Need to Know

On: August 21, 2023 | By:  David Noah |

13 min. read

David Noah |

13 min. read

The relationship between Mexico and the United States continues to be highly publicized, specifically in regard to immigration, and in February 2025, the Trump Administration’s 25% tariff on Mexican imports (which was walked back shortly thereafter).

But despite the sometimes contentious relationship between the two countries and an unpredictable future, U.S. exporters should still consider Mexico an exciting growth opportunity. The countries share a 2,000-mile border with 47 active land ports of entry, and as of 2025, more than 200 years of diplomatic relations.

This article looks at the history of U.S. trade with Mexico; how the USMCA has altered trade with that country; the process of exporting to Mexico, including documentation and compliance requirements; and the benefits and considerations for U.S. companies looking to break into the Mexican market.

The United States-Mexico-Canada Agreement (USMCA) and Exporting to Mexico

The USMCA modernized and rebalanced U.S. trade relations with Mexico (and Canada) and reduced incentives to outsource by providing labor and environmental protections, innovative rules of origin, and revised investment provisions. The agreement also brought labor and environment obligations into the core text of the agreement and made them fully enforceable. (USMCA replaced NAFTA, the previous trade agreement, as of July 1, 2020. This means that companies that utilized the benefits of NAFTA when exporting to Mexico must review their products to make sure they qualify under the terms of USMCA; while many products don’t have significant changes, certain key industries in Mexico, like agriculture and automobiles, do have significant changes.)

However, with a new U.S. administration, the future of USMCA remains uncertain. While the agreement is still in force, any shifts in trade policy or political priorities could lead to changes in its implementation or potential renegotiation. This is particularly relevant as the agreement is set for its first formal review in 2026, when all three countries will have the opportunity to assess its impact and propose modifications. Businesses that rely on USMCA’s provisions should stay informed and be prepared for possible adjustments in the coming years.

Here are some of the USMCA's highlights:

- USMCA includes strong enforcement provisions against counterfeiting and piracy to ensure the protection of trade secrets, and ex officio authority for law enforcement officials to stop suspected in-transit counterfeit goods.

- It contains the strongest rules on digital trade of any international trade agreement, including those to ensure that data can be transferred cross-border and minimizing limits on where data can be stored and processed.

- The agreement requires parties to adopt and maintain labor rights recognized by the International Labor Organization, an Annex on Worker Representation in Collective Bargaining in Mexico, and new provisions prohibiting the importation of goods produced by forced labor as well as violence against workers exercising their labor rights.

- The USMCA also supports Mexico’s historic labor reform that creates a whole new labor justice system.

- It stimulates North American auto production by increasing the regional value content for passenger vehicles and light trucks from 62.5% to 75%.

Under USMCA, importers are now the party to make the claim to the appropriate customs authority for preferential duty rates under the agreement based on certification that the goods qualify from the producer, exporter or importer. Under NAFTA, the exporter made those claims.

While there is no longer an official certificate of origin form, whichever party is certifying that the goods meet the rules of origin must provide, at minimum, certain data elements as outlined in the agreement to support the claim. That information can be provided on the invoice or on a separate attached document—a certification of origin. That document can be a hard copy or digital.

History, Trade and Exporting to Mexico

As of 2024, Mexico is the United States’ second-largest goods trading partner after Canada. (CIA World Factbook)

Mexico's $1.4 trillion economy became increasingly oriented toward manufacturing when the North American Free Trade Agreement (NAFTA) entered into force in 1994; USMCA has buttressed the manufacturing sector despite the disruption of the COVID-19 pandemic (CIA World Factbook). More than 90% of the country’s trade is governed by various free trade agreements, which it has with 46 countries. Mexico is the first-, second- or third-largest destination for merchandise exports from 32 U.S. states. The top U.S. export categories to Mexico are:

- Electronics

- Vehicles

- Fuels

- Minerals

- Plastics

- Machinery

- Agriculture and agricultural products, including corn, soybeans, dairy, pork and poultry meat

Exporting to Mexico: The Challenges

U.S. exporters must be aware of certain barriers when exporting to Mexico; however, none are insurmountable. With careful planning and assistance from agencies like the U.S. Commercial Service, exporters of all sizes can be successful in the Mexican market. According to the Mexico Country Commercial Guide, challenges include:

- Ongoing frictions in the supply chain for key industrial components and high prices for certain manufacturing inputs and logistics services, all of which continue to negatively impact the outlook of Mexican companies in certain key sectors

- The country’s size and diversity, which may make it difficult to find a single distributor or agent to cover this vast market

- The Mexican legal system, which differs in fundamental ways from the U.S. system (U.S. firms should consult with competent legal counsel before entering into any business agreements in Mexico)

- The banking system in Mexico, which has comparatively high interest rates but shows signs of growth (Small- and medium-sized enterprises may find it difficult to obtain financing at affordable rates despite the Mexican government’s efforts to increase access to capital)

- Mexican customs regulations, product standards and labor laws may present challenges for U.S. companies.

- Continued violence involving criminal groups has created heightened insecurity in some parts of Mexico, including some border areas.

U.S. companies need to conduct thorough due diligence on who they partner with, and should be conservative in extending credit and be alert to payment delays. (The U.S. Commercial Service offices in Mexico can conduct background checks on potential Mexican partners to help in this process.)

Exporting to Mexico: The Opportunities

In many situations, the potential rewards of exporting to Mexico outweigh any challenges exporters may face. Exporters should identify and cultivate business opportunities while building a strategy to minimize the risks.

The positive impacts of the USMCA mean that Mexico may be a better option for exporting than other countries, as Mexican companies, government agencies, and entire industries are deeply familiar with and receptive to U.S. products and services. U.S. producers often find marketing and selling products and services there to be a straightforward process.

The USMCA improves market access for U.S. companies in several important ways, specifically through intellectual property rights, digital trade, labor obligations, environmental obligations, and automotive manufacturing.

Mexico’s most promising sectors include the following:

- Advanced manufacturing

- Agriculture

- Agribusiness

- Auto parts and services

- Aerospace

- Consumer products

- Education services

- Energy

- Environmental technology

- Franchising

- Healthcare

- Housing and construction

- Information technology equipment and services

- Internet and digital economy

- Packaging equipment

- Plastics and resins

- Security and safety equipment and services

- Transportation infrastructure equipment and services

- Travel and tourism services

Export Assistance

The best thing about exploring the opportunities to export to Mexico is knowing you don’t need to go it alone. If you’re wondering how to export to Mexico, you can rely on assistance from your in-country allies, including the U.S. Commercial Service office, trade missions and chambers of commerce.

U.S. Commercial Service Offices in Mexico

One of the first places to consider are your local and in-country U.S. Commercial Service offices. The Commercial Service in-country offices offer U.S. exporters business partners in Mexico—boots on the ground in the country—and include representation by an agent, distributor or partner who can provide essential local knowledge and contacts critical for your success. You can learn more about in-country offices in our article, Tapping into the U.S. Commercial Service's In-Country Offices.

District Export Councils (DECs)

DECs across the U.S. help exporters by supporting trade and services that strengthen individual companies, stimulate U.S. economic growth and create jobs. DEC members also serve as mentors to new exporters and provide advice to small companies interested in exporting to Mexico.

Trade Missions

Sponsored by state and local trade offices as well as commercial service offices, trade missions are a great way to meet new business contacts and network. Check into them.

International Trade Administration (ITA)

The ITA is an excellent resource to help you combat problems. Staff at the ITA are resident experts in advocating for U.S. businesses of all sizes, customizing their services to help solve trade dilemmas as efficiently as possible. The ITA makes it easy to report a trade barrier, even allowing you to submit your report online.

U.S.-Mexico Chambers of Commerce

Chambers of commerce may be a way to help you when exporting to Mexico. You can learn more about various chambers and how they can help smooth the way for your export activities in our article, The Chamber of Commerce Role in Exporting.

Export Document Requirements for Mexico

Export documentation and procedures for Mexico are as critical as they are for any other country. Mexico is not subject to any special U.S. export control regulations, and it is designated as a Category I country (the least restrictive) for receipt of U.S. high-technology products. The documents you need to export to Mexico from the U.S. will vary depending on your products, but may include:

- Bill of lading

- Commercial invoice

- USMCA certificate of origin

- Packing list

- Sales contract

- Proforma invoice

- AES filing

- Customs declaration

- Insurance policy

Export Compliance Issues When Exporting to Mexico

It’s important to understand the regulations covering what the U.S. exports to Mexico. You must be concerned with complying with export regulations no matter where you ship, but, fortunately, understanding regulations in Mexico is easier to do than, say, if you were exporting to China. However, this doesn’t mean you can take export compliance lightly. You need to understand what is required of you and what’s at risk if you don’t do your job in complying with those regulations.

Product Classification for Export Controls

The first step in ensuring export compliance is determining who has jurisdiction over your goods: the U.S. Department of Commerce under the Export Administration Regulations (EAR) or the State Department's Directorate of Defense Trade Controls (DDTC).

If they fall under the jurisdiction of the Commerce Department, which most products do, you must determine if your export requires authorization from the Bureau of Industry and Security (BIS), which is part of the Commerce Department, you need to answer the following questions:

- What is the ECCN of the item?

- Where is it going?

- Who is the end user?

- What is the end use?

To do that, you must know how to determine the correct classification of your item, also known as determining the Export Control Classification Number (ECCN). The ECCN is different from the HTS or Schedule B classification of your goods. We explain these differences in our article, Export Codes: ECCN vs. HS, HTS and Schedule B.

By making sure your product is classified correctly, you’ll be protecting the U.S. from threats abroad and protecting yourself from severe fines, penalties and even jail time.

Export License Determination

There are several reasons the U.S. government prevents certain exports to China without an export license. Companies must use the ECCN codes and reasons for control described above to determine whether or not there are any restrictions for exporting their products to specific countries. Once they know why their products are controlled, exporters should refer to the Commerce Country Chart in the EAR to determine if a license is required.

Although a relatively small percentage of all U.S. exports and reexports require a BIS license, virtually all exports and many reexports to embargoed destinations and countries designated as supporting terrorist activities require a license. These countries include Cuba, Iran and North Korea. In addition, there are more nuanced restrictions like those against certain Russian industries and the Crimean region of Ukraine.

Part 746 of the EAR describes embargoed destinations and refers to certain additional controls imposed by the Office of Foreign Assets Control (OFAC) of the Treasury Department.

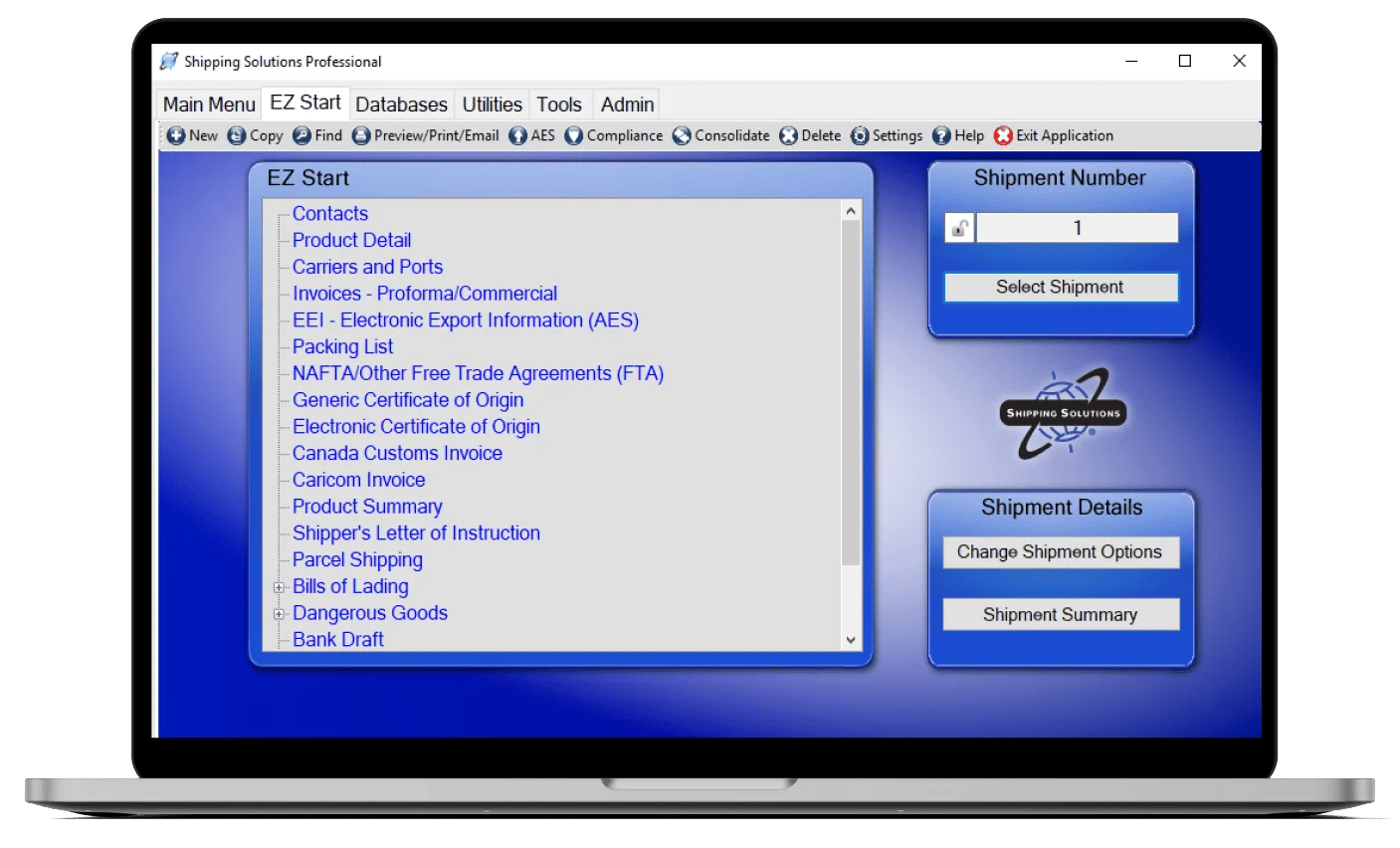

The Shipping Solutions Professional export documentation and compliance software includes an Export Compliance Module that will use the ECCN code for your product(s) and the destination country and tell you if an export license is required. If indicated, you must apply to BIS for an export license through the online Simplified Network Application Process Redesign (SNAP-R) before you can export their products.

There are export license exceptions, like low-value or temporary exports, that allow you to export or reexport, under stated conditions, items subject to the Export Administration Regulations (EAR) that would otherwise require a license. These license exceptions cover items that fall under the jurisdiction of the Department of Commerce and not items that are controlled by the State Department or some other agency.

Deemed Exports

Surprise! You May Be an Exporter without Even Knowing It! A sometimes overlooked compliance issue for exporting to Mexico is deemed exports, or exporting without shipping a product. A deemed export occurs when technology or source code (except encryption and object source code, which is separately addressed in the EAR under 734.2(b)(9)), is released to a foreign national within the United States.

Sharing technology, reviewing blueprints, conducting tours of facilities, and other information disclosures are considered potential exports under the deemed export rule and should be handled accordingly. You can learn how to apply this principle here.

Restricted Party Screenings

Restricted party lists (also called denied party lists) are lists of organizations, companies or individuals that various U.S. agencies—and other foreign governments—have identified as parties that one can’t do business with.

There are several reasons why a person or company may be added to a restricted party list. For example, they may be a terrorist organization or affiliated with such an organization, they may have a history of corrupt business practices, or they may otherwise pose a threat to national security.

Restricted party screening refers to the process in which a company checks a potential customer or business partner against one or more restricted party lists to ensure they are not doing business with a restricted party.

The primary restricted party lists in the United States are published by the Department of Commerce, Department of State and Department of Treasury. However, several other agencies produce lists as well. These agencies recommend that companies perform restricted party screening periodically and repeatedly throughout the movement of goods in the supply chain.

When exporting to Mexico, it’s imperative you check every restricted party list every time you export.

- Fines for export violations can reach up to $1 million per violation in criminal cases.

- Administrative cases can result in a penalty amounting to $300,000 or twice the value of the transaction, whichever is greater.

- Criminal violators may be sentenced to prison for up to 20 years, and administrative penalties may include denial of export privileges.

Export Documentation and Compliance Software

If you’re considering exporting to Mexico, consider this: Shipping Solutions export documentation software can help you quickly create the necessary documents and stay compliant with export regulations. Register here for a free online demo of the software.

This is one in a series of articles exploring exporting to specific countries across the globe—we previously featured ASEAN countries, Australia, Belgium, Brazil, Canada, China, the EU, France, Germany, India, Israel, Japan, the Netherlands, Russia, Singapore, South Korea, Taiwan and the United Kingdom.

This article was first published in 2017 and has been updated to include current information, links and formatting. It is one in a series of articles exploring exporting to specific countries across the globe, including China, Canada, India, Japan, Mexico and the United Kingdom.

About the Author: David Noah

As president of Shipping Solutions, I've helped thousands of exporters more efficiently create accurate export documents and stay compliant with import-export regulations. Our Shipping Solutions software eliminates redundant data entry, which allows you to create your export paperwork up to five-times faster than using templates and reduces the chances of making the types of errors that could slow down your shipments and make it more difficult to get paid. I frequently write and speak on export documentation, regulations and compliance issues.